Lithium price forecast: Will the price keep its bull run?

Lithium prices have been on a downward trend, but is there a rebound in store?

The battery-grade lithium prices have eased in the past weeks despite ongoing supply shortage and robust global electric vehicle sales.

The weekly prices for lithium hydroxide (a minimum of 56.5% LiOH2O battery grade) averaged $75,000 per tonne ($75 a kilogram) cost, insurance and freight (CIF) basis on 7 July, down from $81,500 on 7 May, according to the London Metal Exchange (LME) and price reporting agency Fastmarkets.

Lithium carbonate prices in China retreated to CNY475,500/tonne ($70,905.61) in late June, from a record high of CNY500,000 in March, according to economic data provider Trading Economics.

However, prices of lithium carbonate and lithium hydroxide – raw materials for making electric vehicle (EV) batteries – are still double from the prices in early January.

Is the downtrend only a temporary blip? In this article we examine the latest market news and supply-demand data that shape lithium price forecasts.

Lithium market overview

Lithium does not have a futures market as it is a relatively small metal market in terms of trading volume. However, derivatives market place CME Group has lithium hydroxide futures, which use lithium hydroxide price assessment published by Fastmarkets. In 2019, the LME in partnership with Fastmarkets launched a reference price based on the weekly physical spot trade index on a CIF China, Japan and Korea basis.

China, Japan and Korea are the three largest markets for seaborne lithium. The lithium spot price in those countries is considered the industry benchmark for battery grade lithium.

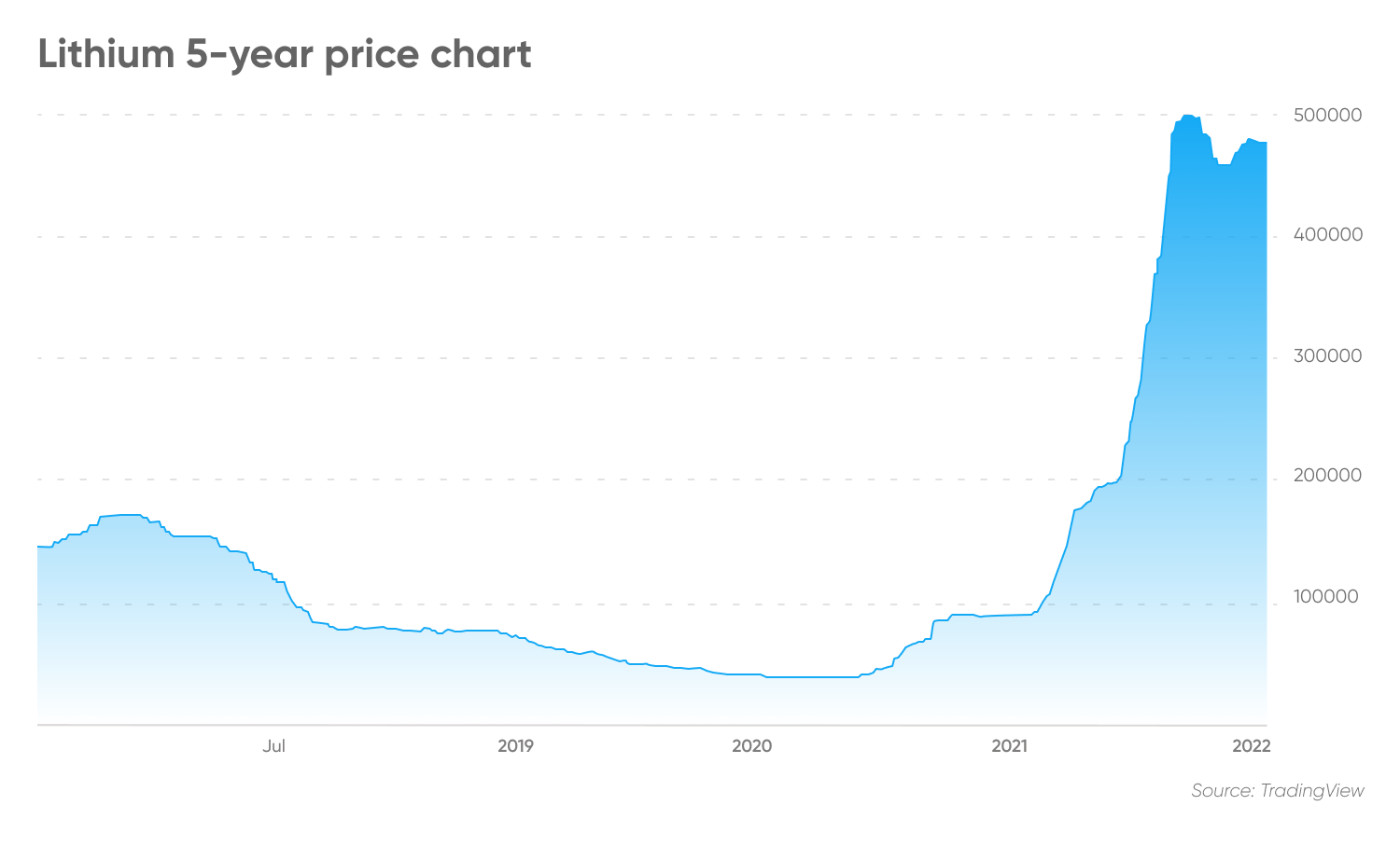

According to historical data, lithium prices fell between 2018 to 2020 due to supply glut as miners, such as Pilbara Minerals and Altura Mining, increased production.

The price of lithium hydroxide dropped to $9 a kilogram on 30 December 2020, from $20.5/kg on 4 January 2018. Lithium carbonate traded at $6.75/kg on 30 December 2020, down from $19.25 on 4 January 2018.

Prices started to climb early 2021 due to robust EV growth as the global economy rebounded from the effects of the Covid-19 pandemic. The lithium carbonate price has risen ninefold to date from $6.75/kg in early January 2021, while the lithium hydroxide has increased more than seven-fold from $9.

In the Global EV Outlook 2022 published in May, International Energy Agency (IEA)

reported sales of EVs doubled in 2021 from the previous year to a new record of 6.6m units. The total number of electric cars on the roads globally reached 16.5m, tripled from the amount in 2018.

In the first quarter of this year, 2 million EV cars were sold, up 75% year-over-year (YOY).

However, lithium carbonate spot prices in the Asia-Pacific market eased in the second quarter as fresh outbreaks of Covid-19 in China, which prompted the government to impose lockdowns, affected the raw material supply chain.

According to chemical market and pricing intelligence, Chemanalyst, lithium carbonate price was assessed at $72,155/tonne or $72.15/kg in the second quarter ended June 2022, down from $74,750/tonne in the first quarter ended in March.

The lithium hydroxide price in the Asia-Pacific, however, rose $73,190/tonne in the second quarter, from $68,900/tonne in the first quarter, said Chemanalyst.

Supply-demand outlook suggest tight market

In March, the Australian government forecast that global demand for lithium could rise to 636,000 tonnes of lithium carbonate equivalent (LCE) in 2022, from 526,000 tonnes in 2021. Demand is expected to more than double to 1.5 million tonnes by 2027 as global EV adoption continues to rise.

It estimated global lithium output to increase slightly above demand to 650,000 tonnes LCE in 2022 and 1.47 million tonnes in 2027.

The increase in lithium output, however, may not be able to catch up with demand from battery producers.

Research company Wood Mackenzie forecast in March that global cumulative lithium-ion battery capacity could rise over five-fold to 5,500 gigawatt-hour (GWh) by 2030 from 2021 to respond to EV massive expansion plans.

In 2021, the Asia Pacific region, led by China, accounted for 90% of global battery manufacturing. However, this was expected to fall to 69% by the end of the decade, according to Wood Mackenzie.

North America’s battery capacity could double by 2030, though it still lags behind Europe, which is on track to surpass North America by 2022. Through faster expansion, Europe is expected to account for more than 20% of global capacity by 2030.

Find out more about Lithium Americas share price forecast.

Automakers step up mine investment

In a research note from 4 July, Fitch Solutions found that there had been an increase in the number of battery-metals mining investments by carmakers to secure enough battery metals.

The firm’s data showed a total of 21 investments made over the past 18 months from 2021 to 2022, compared to just two prior to 2021. Of those projects, 16 were investments into lithium mining and the rest nickel.

The lithium mining investment projects included a supply deal between China’s Ganfeng Lithium Co. and US EV producer Tesla (TSLA) in November 2021 and a BMW Group (BMW) investment in Lilac Solutions, which provides technology for sustainable lithium extraction.

Lithium price forecast: Analysts’ predictions

Fitch Solutions in its lithium price forecast for 2022 estimated battery-grade lithium carbonate’s price in China to average $21,000 per tonne this year, easing to average $19,000 per tonne in 2023.

The firm was in the process of updating the lithium price forecast given the current high prices and changes in the economic context, Trickett said.

Fitch Solutions forecast global lithium carbonate supply to increase by 219kilotonnes (kt) between 2022 and 2023 and another increase of 194.4 kt between 2023 and 2024, Trickett said.

In a lithium price forecast for 2022 from economic data provider Trading Economics expected lithium carbonate in China to trade at CNY482,204.55/tonne by the end Q3 2022 and CNY502,888.80 in 12 months.

Because of the volatility and uncertainty on supply and demand, analysts can only provide short-term forecasts. They did not provide a lithium price forecast for 2025 or a lithium price forecast for 2030.

When looking into lithium price predictions, bear in mind that analysts’ forecasts can be and have been wrong. If you would like to invest in lithium, you should do your own research first. Your investment decision should be based on your attitude to risk, your expertise in this market, the spread of your portfolio and how comfortable you feel about losing money. And never invest more than you can afford to lose.

FAQs

Is lithium a good investment?

Rising lithium-ion battery demand driven by EVs is expected to push lithium consumption higher in the next decade. While analysts widely expect this rising demand to support prices, forecasts can be wrong.

Whether it’s a good investment for you or not depends on your investing goals and portfolio composition. You should do your own research and never invest what you cannot afford to lose

Will lithium prices go up or down?

The price forecasts for lithium carbonate are mixed. Fitch Solutions suggested lithium prices to ease in 2023, while Trading Economics’ forecast indicating prices may rise.

Remember that analysts’ lithium price predictions can be inaccurate. You should do your own research. Past price performance never guarantees current results.

Should I invest in lithium?

Whether you should invest in lithium depends on your risk tolerance, investing goals and portfolio composition. You should do your own research. And never trade more money than you can afford to lose.