GM stock forecast: Can EV ramp-up boost the carmaker’s outlook?

The General Motors (GM) stock prices fell over the past month as industry growth remained constrained by supply chain disruption and higher production costs. Brands under the Detroit-based GM group include Chevrolet, Buick, GMC, Cadillac, Baojun and Chinese joint-venture Wuling.

The continuing global semiconductor shortage and rising raw material costs hit the GM stock performance, despite rising revenue in the first quarter this year.

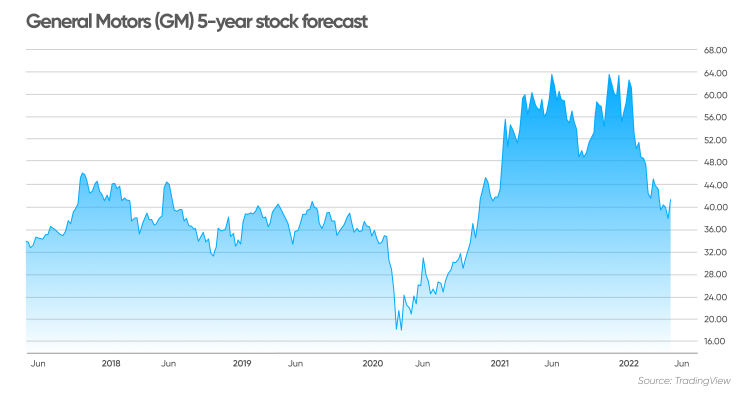

The US automaker’s shares are listed on the New York Stock Exchange (NYSE). They hit an all-time high at $65.74 on 4 January 2022. However, by 4 May the GM stock market price had fallen to a 20-month low at $40.20, down 38.8% from that January high and 30.2% below the same time in 2021.

According to General Motors CEO Mary Barra, the global semiconductor shortage is still having an impact on the automaker, and the supply shortage is expected to last into 2023. As a result, GM’s vehicle sales in the first quarter fell compared with Q1 2021.

In addition, higher metal prices, which are a key material in vehicles and lithium-ion batteries, have pushed manufacturing costs higher, weighing on GM’s profit margin.

Are you interested in learning more about the GM stock outlook? Read on for our analysis for the latest analysts’ forecast and the latest GM stock news.

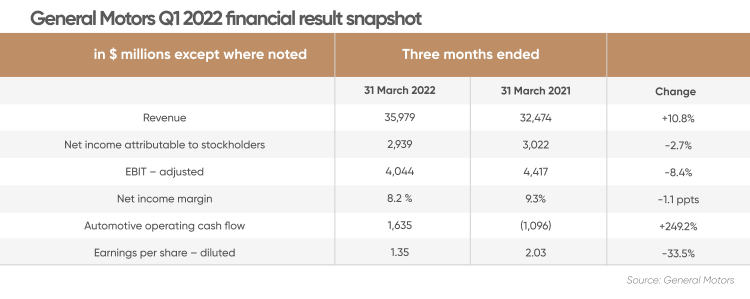

Spiralling raw material costs offset rising revenue in Q1

General Motors’ Q1 revenue rose to $36bn, up 10.8% on the same quarter last year, but net income fell by 2.7% year-on-year (YoY) to $2.9bn. As a result of higher production costs, the company’s adjusted earnings before interest and tax (EBIT) fell 8.4% YoY to $4bn. According to GM, operating costs:

GM has reaffirmed its full-year 2022 net income forecast in a range of $9.6bn to $11.2bn, and earnings guidance of EBIT-adjusted in a range of $13bn to $15bn.

With GM prioritising electric vehicle (EV) development and reinvesting cash flow, the company might not reinstate a dividend in 2022. The last GM stock dividend declared was in March 2020.

Strong demand and pricing offset falling car sales

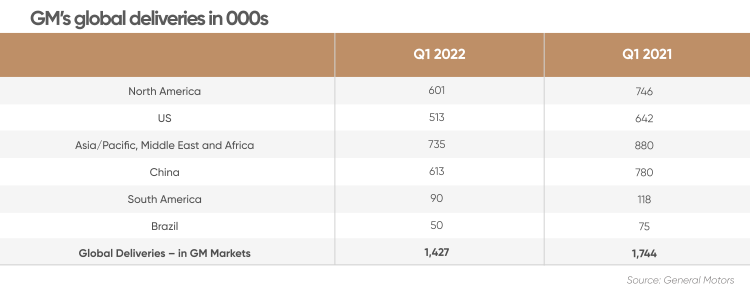

Semiconductor supply tightness has hit GM’s vehicle sales in Q1. The number of cars sold globally fell to 1.43 million units, down 18.2% from the same period last year.

Deliveries across all regions fell along with GM’s global market share, which dropped to 9.1% in Q1 from 9.9% in the same quarter last year. In North America and the US, GM sold 601,000 cars and 513,000, respectively, accounting for 14.8% and 15.2% of the domestic market share.

According to GM, its Chinese joint-venture, Wuling MINI Electric Vehicle, continued to be the top-selling EV in China. The company delivered 613,000 cars in China in Q1, accounting for 10.6% of the Chinese market share.

Despite lower sales, revenue was boosted by “strong pricing on [its] crossovers and trucks in a tight inventory environment”.

GM raises stake in driverless technology Cruise

GM has increased its ownership of automaker Cruise to 80%. Cruise focuses on developing electric, self-driving technology. It operates in 70% of San Francisco, California, with plans to expand its operation across the entire city later this year.

Cruise began offering driverless rides in January 2022. It “has travelled in driverless mode about 40 times the distance from San Francisco to New York City”, according to GM CEO Mary Barra in her Q1 2022 letter to shareholders. Cruise could start charging for rides in San Francisco should it complete the permitting process this year.

GM’s Q1 financial report notes that Cruise’s EBIT-adjusted deepened to a $0.3bn loss, up from $0.2bn in Q1 2021.

GM to accelerate EV production

GM plans to accelerate its EV capacity to 1 million units a year by the end of 2025. In North America, the company is targeting production of 400,000 all-EVs between 2022 and 2023.

GM also expects to deliver record sales for its Bolt EV and electric utility vehicle (EUV) in 2022 in North America, even though Q1 sales only accounted for 0.3% of the US EV market.

Production and deliveries of the Bolt EV and EUV resumed in April after faulty EV battery modules were recalled in the third quarter of 2021. According to GM, dealers continue to repair customers’ vehicles with the default battery modules.

The carmaker also plans to rapidly scale production of the below six Ultium-based vehicles:

The GMC HUMMER EV Pickup, which began production in late 2021, followed by the SUV model, which goes into production in 2023.

The Cadillac LYRIQ, which began production last month.

The Chevrolet Silverado EV, which begins production in early 2023.

The all-electric Chevrolet Blazer SS, which enters production in mid-2023, followed by Equinox EV, which launches just after the all-electric Blazer SS.

In March 2020, GM announced it had developed a new EV battery cell and platform called the ‘Ultium batteries’, which could enable a GM-estimated range of up to 400 miles or more on a full charge, with 0 to 60 miles per hour acceleration in as little as three seconds.

GM has also announced a global expansion of its affordable EV strategy in collaboration with Japanese carmaker Honda, using the Ultium battery technology.

General Motors stock forecast

According to Market Beat, at the time of writing on 4 May, 17 of 22 Wall Street analysts surveyed had a ‘buy’ consensus rating for GM stock, while five recommended ‘hold’.

The average 12-month GM stock price target was $65.90, with a 66.5% upside potential. Analysts forecast that the GM share price could reach $98 or fall to $44.

Algorithm-based forecaster Wallet Investor predicted that the price could reach $46.97 in the next 12 months. Its GM stock forecast 2025 had it at $82.85, above the all-time high of $65.74 achieved 4 January 2022.

In contrast, AIPickup’s GM share price forecast was bearish for the next 10 years, suggesting that the group share price could fluctuate, with the average below $42.

AIPickup expected the average GM future stock price to hit $39.91 in 2022, falling to $38.82 in 2023, $38.35 in 2024 and $34.48 in 2025. The forecaster predicted that the price could rebound to $41.59 in 2026, before falling to $36.47 in 2027, $41.33 in 2028, $39.30 in 2029 and $38.75 in 2030.

When considering whether to invest in General Motors company stock, you should always do your own research, considering the outlook and relevant market conditions. A number of factors dictate whether stock prices rise or fall, including the company’s fundamentals and broader macro-economic factors. There are no guarantees. Markets are volatile. You should conduct your own analysis, taking in such things as the environment in which it trades and your risk tolerance. And never invest money that you cannot afford to lose.

FAQs

General Motors stock buy, sell or hold?

As of 5 May, 17 of 22 Wall Street analysts surveyed by Market Beat had a ‘buy’ consensus rating for GM stock, while five recommended ‘hold’.

Whether GM is a good investment for you will depend on your portfolio composition, investment goals and risk profile. Different trading strategies will suit different investment goals with short or long-term focus. You should do your own research. Keep in mind that past performance is no guarantee of future returns. And never invest more than you can afford to lose.

Is General Motors stock a good buy?

Whether the stock is a good buy or not will depend on your investing goals, portfolio composition and risk profile. You should do your own research before investing in GM stock. And never invest what you cannot afford to lose.

Why has the General Motors stock price been going down/up?

GM stock fell in the first quarter as the automaker’s performance was constrained by rising commodity prices and the global semiconductor shortage, leading to lower investor confidence over the company’s outlook.

Will General Motors stock go up or down?

Analysts were mixed on their GM stock price predictions at the time of writing (5 May). AI Pickup forecast that the share price could fluctuate in the next decade, with the average price below $42. Wallet Investor thought GM stock could rise to $82.85 in the next five years. Predictions can be wrong. You should do your own research. And never invest what you cannot afford to lose.

How high can GM stock go?

The share price hit an all-time high at $65.74 on 4 January 2022. Wallet Investor had a GM projected stock price of $82.85 for 2027.

Analysts’ GM stock analysis could be wrong. Their predictions have been inaccurate in the past. Always do your own research before investing. And remember to never invest more money than you can afford to lose.

Related topics