What is oil trading and how does it work?

Oil trading gives you access to one of the world’s most heavily traded commodities. This guide explains how it works, including key benchmarks, trading hours, and strategies used by traders.

What is oil trading?

Oil trading involves speculating on the price of crude oil – typically benchmarks like Brent or WTI – using financial instruments such as contracts for difference (CFDs). This allows traders to gain exposure without owning or storing physical oil.

Crude oil prices respond to global supply and demand shifts, including OPEC+ decisions, geopolitical events, inventory levels, and broader economic trends. Traders may use oil markets to hedge risk, diversify portfolios, or seek short-term opportunities in the energy sector.

How does oil trading work?

Oil trading lets you take a position on oil prices without owning physical barrels, typically through derivatives such as contracts for difference (CFDs) or spread bets. You can go long if you expect the price to rise, or short if you think it will fall – based on the underlying value of Brent or US crude.

Spot and futures markets

When trading crude oil, you choose between two main pricing methods: spot and futures.

-

Spot markets use prices based on immediate supply and demand, and these positions typically reflect the front-month futures contract rather than physical oil delivery. Spot CFDs roll over and do not have fixed expiry dates.

-

Futures markets reference contracts with clearly defined expiry dates.

The crude oil spot price is the current market price for immediate settlement, typically based on the nearest expiring futures contract in CFD oil trading. Meanwhile, the crude oil futures price is the market-agreed price for settlement on a specified date in the future, reflecting expected changes in supply and demand.

When trading crude oil futures, you'll see each contract listed alongside an expiry date, indicating precisely when the position settles. In contrast, oil spot CFDs are continuously priced and rolled, with no fixed expiry.

Learn more in our commodity futures guide.

Long and short positions

You can open a long (buy) CFD position if you expect oil prices to rise, or a short (sell) position if you think they will fall. For example, traders might short Brent crude if OPEC announces increased production, anticipating this could lead to oversupply and potential downward pressure on prices.

Price drivers

Oil prices move in response to key market influences, including OPEC production decisions, geopolitical events in oil-producing regions, global economic growth indicators, and inventory reports from major economies. These factors can cause volatility in oil markets.

Speculation and hedging

Oil traders might aim to speculate on short-term price movements or hedge existing market risks. For example, an airline might hedge fuel costs using derivatives such as swaps or options, while a retail trader could speculate on oil price movements through CFDs.

Trading access

Using our online oil trading platform, traders can electronically access global oil markets, such as Brent crude and US crude. CFD trading lets you gain exposure to oil markets without physically handling or storing the underlying asset.

Past performance isn’t a reliable indicator of future results.

Which oil markets can I trade?

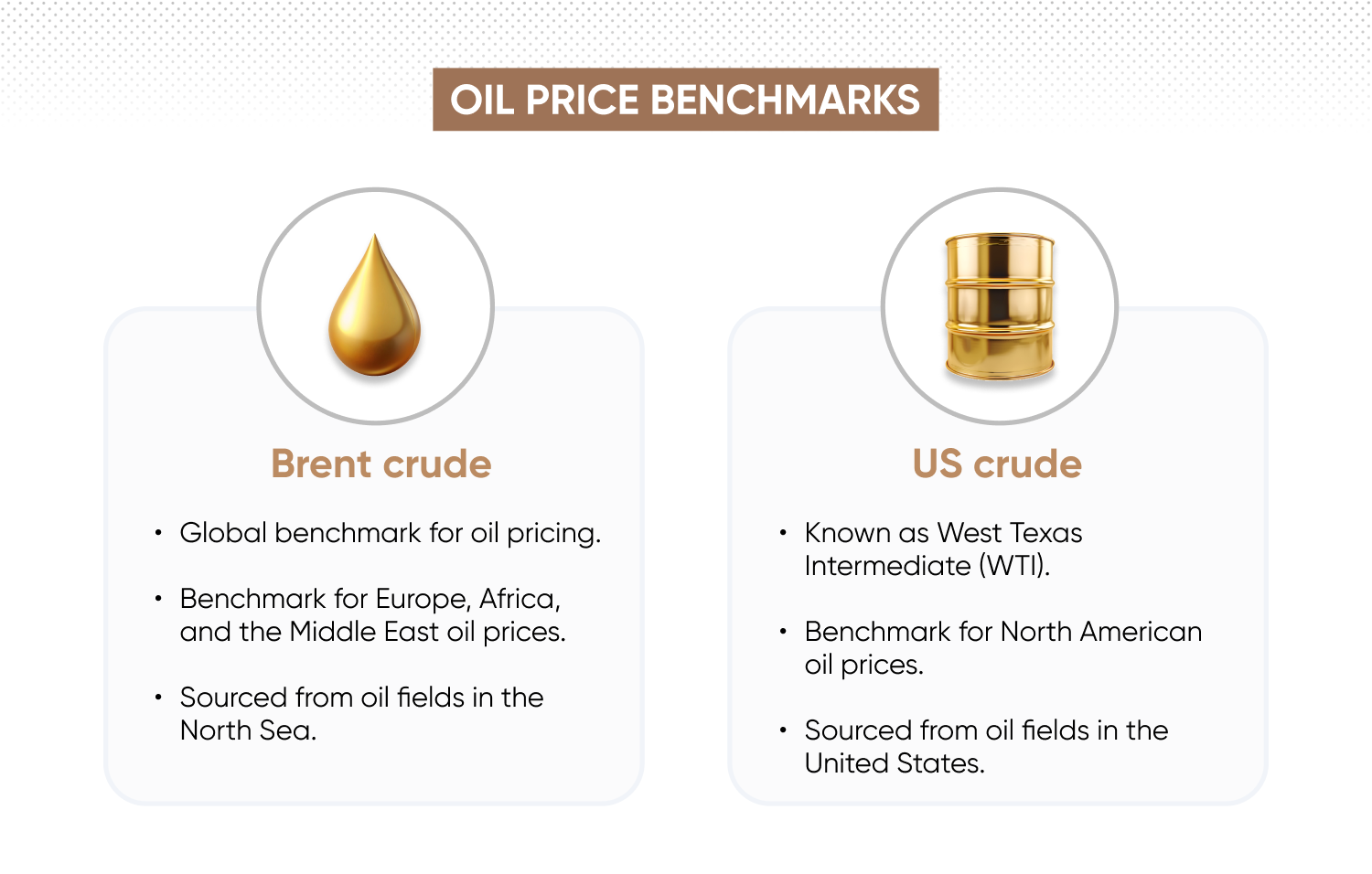

The majority of oil trading revolves around Brent crude and US crude. When you trade oil online, these benchmarks underpin most pricing and liquidity.

-

Brent crude is a major global benchmark for oil pricing. It’s produced in the North Sea and widely used to price oil from Europe, Africa, and the Middle East.

-

US crude, also called West Texas Intermediate (WTI) is sourced from several US states and used as the benchmark for North American oil prices.

Learn more in our how to trade Brent crude and how to trade US crude trading guides.

What is an example of oil trading?

Trade Brent crude CFD – long position

Let’s say Brent crude is trading at $82.00 per barrel.

You expect prices to rise after news of reduced output from OPEC, so you open a long CFD at £10 per point. With each $1 movement equal to 100 points, this means a £1,000 gain or loss for every $1 price change. At 10% margin, your initial deposit is £820 (excluding costs).

Later that day, Brent rises to $83.00. That’s a 100-point move in your favour, resulting in a gross profit of £1,000 (100 × £10), before the spread and any overnight funding fees if applicable.

Had the price fallen to $81.00 instead, you’d have lost 100 points – resulting in a £1,000 gross loss, plus any associated costs.

Trade Brent crude CFD – short position

Now let’s say Brent crude is still trading at $82.00, but this time you expect the price to fall due to rising US stockpiles. You open a short CFD at £10 per point, with the same £1,000 per $1 price movement.

The price drops to $81.00 and you close the trade.

You’ve made a profit of £1,000 (100 × £10), before costs such as the spread and any overnight funding fees.

However, if the price had risen to $83.00 instead, you’d face a £1,000 loss (100 × £10), plus trading costs.

Where can you trade oil?

Crude oil trading takes place on major global exchanges and in over-the-counter (OTC) markets. Retail traders can trade oil via CFDs offered by regulated brokers, without needing to own or store physical oil.

Our oil CFDs reference key benchmarks traded on leading exchanges, including:

-

Intercontinental Exchange (ICE): trades Brent crude, which is based on supply from the North Sea and is used to price oil exports from Europe, Africa, and the Middle East – electronic trading conducted on ICE Futures Europe.

-

New York Mercantile Exchange (NYMEX) – trades US crude (West Texas Intermediate), the benchmark for US oil pricing. It’s operated by CME Group – electronic trading available through CME Globex.

Traders can speculate on the price of Brent and US crude with our CFD trading web platform and mobile apps, which provide live price charts, flexible position sizes, and margin options.

Learn more about CFDs in our contracts for difference (CFD) trading guide.

What are the oil market trading hours?

Oil trading is available nearly 24 hours a day, five days a week. Brent crude and US crude are traded on global exchanges with extended hours.

Here are the oil market trading hours for US and Brent crude in UTC*:

|

Type |

Exchange |

Summer hours |

Winter hours |

|

US crude |

CME Globex |

Sunday 10pm - Friday 9pm (break: 9pm-10pm) |

Sunday 11pm - Friday 10pm (break: 10pm-11pm) |

|

Brent crude |

ICE Futures Europe |

Monday 12am - Friday 10pm (break: 9:05pm-10:25pm) |

Monday 1am - Friday 11pm (break: 10:05pm-11:25pm) |

Meanwhile, Dubai crude is primarily traded via physical contracts and does not follow the same electronic trading hours.

Follow the US crude and Brent crude oil price live in US dollars with our US crude price chart and Brent crude price chart.

*These schedules are subject to change due to factors such as public holidays and exchange-specific maintenance periods.

Oil trading: What are the risks and benefits?

Oil trading lets you gain exposure to global commodity markets, but comes with both potential opportunities and risks, influenced by macroeconomic and sector-specific factors.

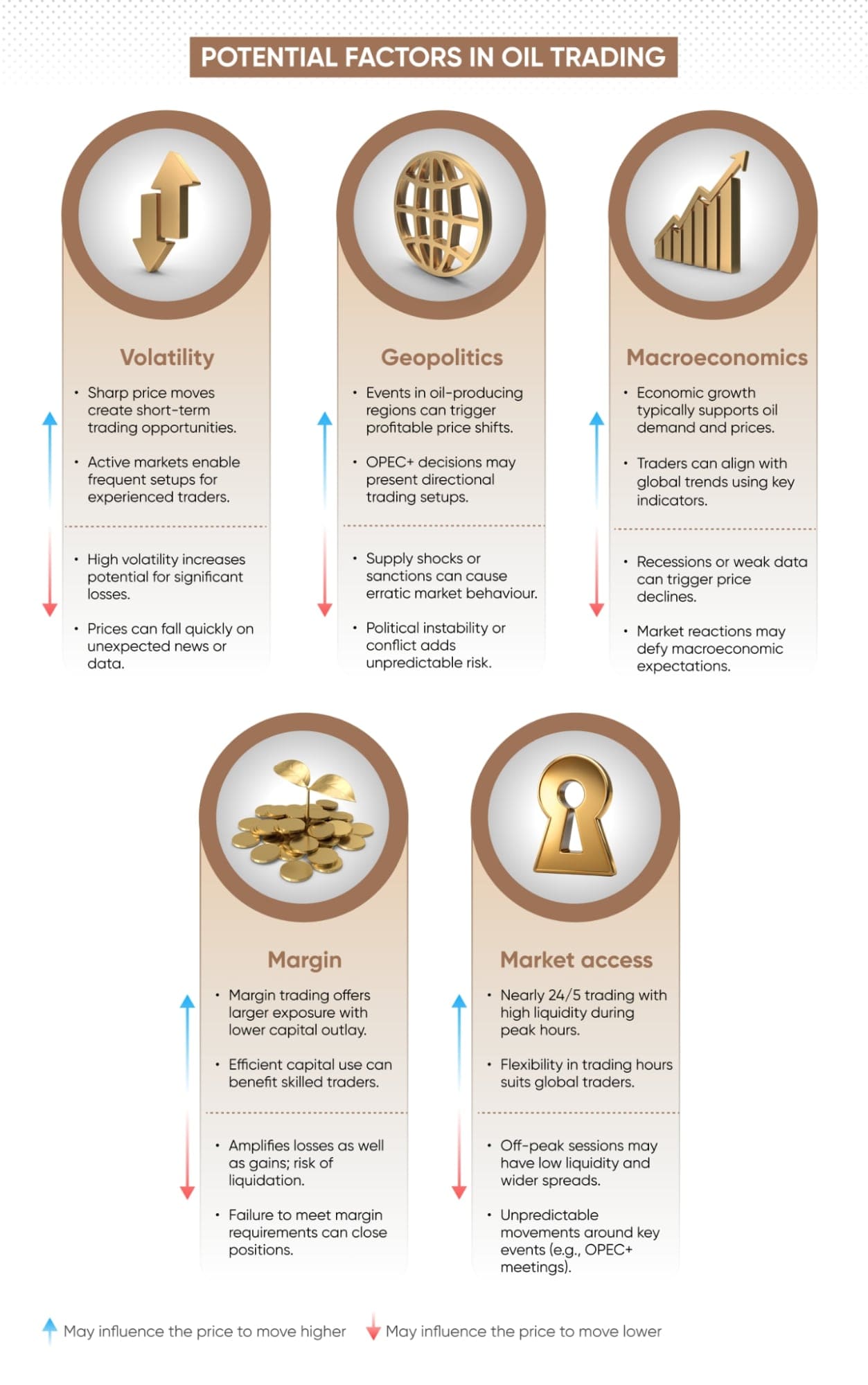

Price volatility

Oil is one of the most actively traded commodities, with prices that can move sharply in response to news and data. This can create opportunities for short-term trades. However, positions can lose value quickly, particularly when markets react to unexpected events.

Geopolitical events

Crude oil prices can respond to geopolitical developments in major oil-producing regions and OPEC+ production decisions. Events such as supply disruptions, sanctions or conflict can cause sudden price spikes or drops. These movements may create trading setups but also introduce added uncertainty.

Macroeconomic data

Rising demand during economic growth may support oil prices, while downturns can weigh on consumption and lead to declines. This historical relationship means oil traders often monitor GDP data, central bank policy and manufacturing indicators.

Margin & leverage

Oil CFDs are traded on margin, which lets you get more exposure with a fraction of the outlay. While this can magnify potential returns, it also increases the scale of potential losses, and leveraged positions may be closed automatically if margin requirements aren’t met.

Market access

Crude oil markets operate nearly 24 hours a day, five days per week, offering flexible trading times and deep liquidity during peak hours. However, reduced liquidity during off-peak periods or around OPEC+ meetings can lead to wider spreads and erratic price movements.

Speculation and hedging

You might trade oil to speculate on short-term price changes or hedge portfolios. Oil trading could be profitable in fast-moving markets but increases exposure to sudden reversals. The energy transition may gradually reduce longer-term demand, adding complexity to strategic positions.

Past performance isn’t a reliable indicator of future results.

Learn more about commodities trading.

Trading oil vs gas: What are the differences?

Oil and gas are commonly traded commodities which share some similarities. However, oil and gas trading differ in key areas.

Here’s how they compare:

|

Oil |

Gas |

|

|

Price benchmarks |

Brent crude; US crude (WTI) |

US natural gas (Henry Hub); EU natural gas (Dutch TTF) |

|

Market structure |

Globally integrated |

More regionally segmented |

|

Storage |

Easier to store and ship globally |

Requires pipelines or LNG-specific infrastructure |

|

Demand |

Travel and industrial |

Heating and electricity |

Oil trading

Oil is a globally traded commodity, with Brent and US crude serving as the main pricing benchmarks. Oil prices are influenced by factors such as OPEC+ production decisions, geopolitical tensions, and global economic indicators. As crude oil is easier to store and ship, prices across regions are more closely aligned than in natural gas markets.

Gas trading

Gas is more regionally segmented. For instance, US natural gas prices are based on the Henry Hub benchmark, while EU natural gas prices refer to Dutch TTF. Gas prices have historically been influenced by seasonal demand, with additional summer impact from electricity generation where air conditioning use is high. Gas is more difficult to move across borders, requiring pipelines or LNG-specific infrastructure, which can lead to supply bottlenecks and sharper price movements.

Discover more in our natural gas trading guide.

What are some oil trading strategies?

You can choose from a range of oil trading strategies designed to take advantage of price movements in Brent and US crude. The following trading strategies demand a solid understanding of technical indicators, fundamental analysis, and effective risk management.

Here are some common approaches:

Range trading

Range traders look to buy near support and sell near resistance, aiming to profit from prices moving within a set range. Indicators like Bollinger Bands or the RSI can help highlight conditions for potential entries. This works best in stable, sideways markets.

Day trading

Day traders open and close oil CFD positions within the same day, avoiding overnight exposure. They typically use short-term charts and technical tools to trade intraday price swings, seeking to respond to volatility while managing risk tightly.

Swing trading

Swing traders hold positions for a few days to a few weeks, aiming to capture medium-term trends. They might use chart patterns, moving averages, or fundamental drivers to identify setups. This strategy suits traders who prefer not to monitor the market constantly.

Position trading

Position traders hold longer-term CFD positions based on broader trends such as supply forecasts, economic data, or geopolitical risks. It’s a slower approach that may involve weekly price charts and wider stop-losses.

Discover more trading strategies on our comprehensive trading strategies page.

FAQs

What is oil trading at today?

Oil prices change throughout the trading day based on global supply and demand. Prices are quoted in US dollars per barrel and are influenced by economic data, inventories, and geopolitical events. You can monitor commodities – such as oil – with our Brent crude and US crude live price charts.

How does oil trading work?

CFD oil trading means that you speculate on the price movements of Brent or WTI crude (US crude) without owning physical barrels. You can go long (buy) if you expect the price to rise or short (sell) if you think it will fall. CFD trading is leveraged, which means you only need to deposit a fraction of the total trade value, but this also increases the potential for losses.

What is oil trading?

Oil trading is the buying and selling of crude oil contracts to profit from price changes. Retail traders use online oil trading platforms to access Brent or US crude via derivatives like CFDs. These markets are driven by global supply, demand, inventories, and macroeconomic trends.

What time does oil start trading?

WTI crude (CME Globex) opens Sunday at 10pm UTC and trades through to Friday, with a daily break from 9pm to 10pm. Brent crude (ICE Futures Europe) opens Sunday at 11pm UTC, with a daily break from 9:05pm to 10:25pm. CFD trading hours typically follow the exchange but are often available nearly 24 hours a day during the trading week, with short breaks depending on the provider.

Curious about trading other assets?

We offer access to the most popular financial markets in the world.Indices trading

Find out more about index trading, a popular way for traders to gain broad exposure to listed companies.

Shares trading

Trade price movements of the biggest companies without needing to own the stock itself.

Forex trading

Learn about the world’s most-liquid market and why so many people trade it.