Shares

For our shares pricing, we take the underlying exchange sell and buy prices of each stock and then apply a markup to these prices. This means you’re trading on the ‘true’ prices from the underlying market with just a small adjustment for our fee. It also means our price will reflect fluctuations in the underlying market spread due to changes in liquidity.

Example

- Let’s say one physical stock in the underlying market has a sell price of $99.95 and a buy price of $100.05.

- When you trade the stock with us as a derivative (EG CFD), we’ll apply a fixed markup to this price of $0.05 either side, making our sell price $99.90 and our buy price $100.10. This means our spread is 0.20.

- If the underlying market widens to 99.80/100.20, our fixed markup of 0.05 makes our price 99.75/100.25. This means our spread is now 0.50.

Forex and spot metals

Unlike the rest of our offerings, spot forex and metals are not traded on a centralised exchange in the underlying market. This means there’s no central reference point for brokers to derive their price from and so typically prices are calculated through a range of OTC (over-the-counter) counterparties. These can range from investment banks to other brokers.

These prices are subject to variable spreads depending on market conditions. At Capital.com, we aggregate them and subsequently add a small additional spread (our transaction fee) depending on the market.

Example

- Let’s look at how we price EUR/USD at a given point.

- We aggregate pricing from three counterparties of 1.12345/1.12355, 1.12350/1.12360, and 1.12348/1.12358, for a consolidated price of 1.12348/1.12358.

- To this price, we apply a spread of (EG), 0.00006 to make the Capital.com price 1.12345/1.12361.

Indices

Our cash index pricing is derived from our price providers’ mid-price and subtracting/adding spread.

We fix our index spreads based on times throughout the day, usually to reflect changes in the underlying liquidity of the market. Our spread will typically be widest when the underlying futures market is closed, and tightest during the main share-trading session.

As cash indices are tradeable in the underlying market.Many price providers, including ours, will derive their cash price by taking the futures price and adjusting for fair value, which is expected dividends of the constituent stocks and the relevant market interest rates.

Fair value represents what the index should be worth in a perfect market without arbitrage opportunities.

Commodities and the VIX index

You can trade on both commodity spot prices (also sometimes called ‘undated commodities’) and commodity futures with us.

How we price commodity futures markets

We price our commodity futures by adding our spread to the underlying market price. The price you trade at already includes the spread.

Spreads can change. Please check individual market details in the app or web platform for the latest figures.

The exchanges that we source our commodity futures prices from are:

- Brent Oil: ICE Futures Europe

- Carbon Emissions: ICE Futures Europe

- Crude Oil: New York Mercantile Exchange (NYMEX)

- Cocoa US: ICE Futures US

- Natural Gas: New York Mercantile Exchange (NYMEX)

All contracts expire at specified future dates and are cash-settled, so you’ll never take delivery of a commodity.

How we price commodity spot markets

We determine prices for our spot commodity markets using the two nearest futures contracts of a commodity, as these are usually the most traded.

Over time, our undated price gradually shifts from the price of the nearest contract to the next one to avoid the need for an expiry date (sometimes called a rollover date).

In our system:

- The ‘front month contract’ (the one that expires soonest) is called ‘A’.

- The ‘back month contract’ (the one that expires second soonest) is called ‘B’.

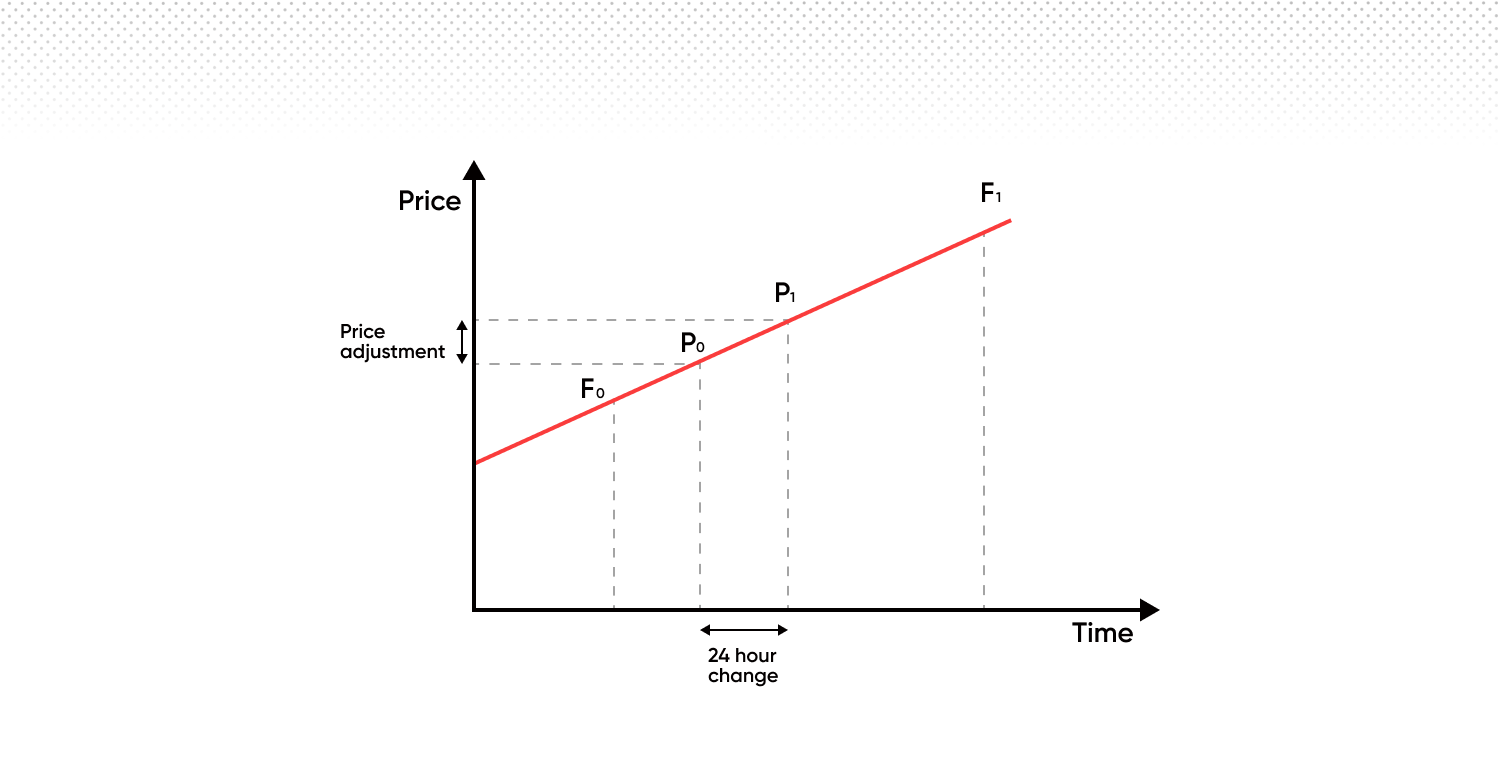

- Our price (P0 and P1 in the diagram below) gradually moves from the price of ‘A’ towards the price of ‘B’ between these two expiry points.

- The price of ‘B’ can be higher or lower than the price of ‘A’, though in the example below, it’s higher.

When the front month contract ‘A’ expires, we transition to the next set of contracts. This means ‘B’ becomes the new ‘A’, and the contract that expires after the new ‘A’ becomes the new ‘B’. This process continues, so there is always a smooth transition from one contract to the next.

This means that when we transition, our pricing will be based 100% on the front month contract, and then move in a linear fashion towards the back month.

When trading these (as with other markets), you’ll pay an overnight holding cost, which has two parts:

- Admin fee: This is a fixed fee of 0.01096% charged daily.

- Daily premium adjustment: This reflects the daily movement of our price from the front month (A) to the back month (B). You will either pay or receive this adjustment, based on the direction of your trade.

When the price difference between A and B is larger, the daily adjustment is also larger.

The price difference between the two contracts can vary greatly depending on the market conditions, most obviously in commodities that are affected by seasonal demand (e.g natural gas).

Daily Premium Adjustment

The Daily Premium Adjustment applied to spot commodity positions has a neutral impact on your profit and loss – it is not a trading fee or charge. Its purpose is to remove the effect of seasonal fluctuations in commodity prices, ensuring that the spot price you trade on remains continuous and never expires.

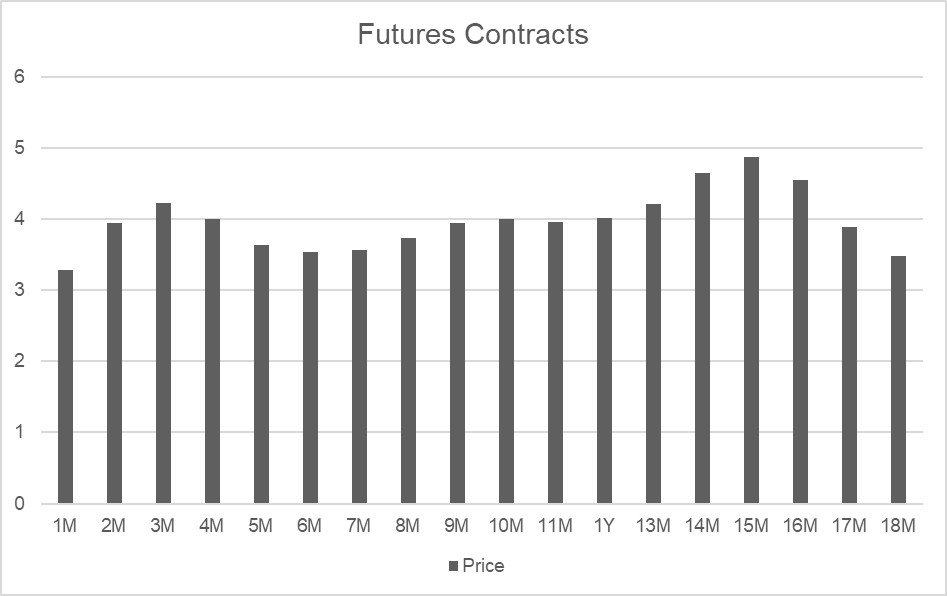

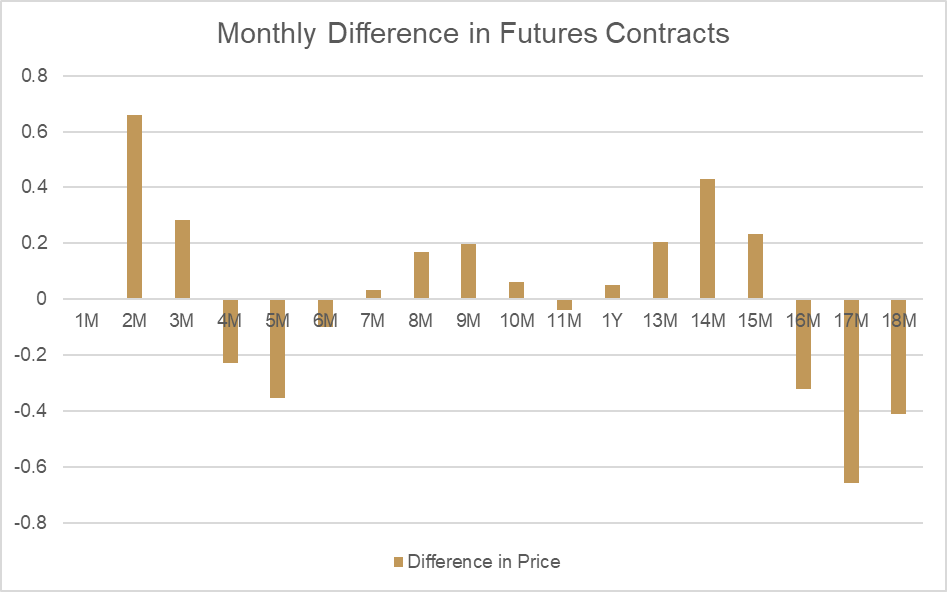

Here’s an example using real prices for Natural Gas, a commodity with different prices for contracts expiring each month in the future. You can see a relative change in the value of each monthly contract in the second chart. These changes are due to seasonal supply and demand, not market expectations of future prices. In other words, Natural Gas typically costs more to buy in winter than in summer.

Comparing Month 2 and Month 3, we can see there is a large difference in prices (known as ‘fair value’):

| Expiry Date | Period | Price |

|---|---|---|

| 30 Days | 2M | 3.938 |

| 64 Days | 3M | 4.221 |

| Difference | 0.283 |

If we look at how this price changes per day between these two points, we can calculate the fair value adjustment that would be applied as a Daily Premium Adjustment. As Month 2 is lower than Month 3, the valuation price of the spot commodity will naturally rise each day in line with the change in fair value.

To offset this impact on open positions, an equivalent adjustment is subtracted from accounts holding long positions. For short positions, the same amount is credited. The overall effect of the fair value adjustment on both the valuation price and the account balance is zero.

| No. of Days | Change per Day |

|---|---|

| 34 | 0.00832 |

| Long Result | Amount |

|---|---|

| P/L | 0.00832 |

| Adjustment | -0.00832 |

| Net effect | 0 |

| Short Result | Amount |

|---|---|

| P/L | -0.00832 |

| Adjustment | 0.00832 |

| Net effect | 0 |

The Daily Premium Adjustment is necessary to reflect changes in fair value, and we apply the updated fair value each day just before the closing time for trading in each commodity. You can see the effect of the new fair value applied to a spot commodity directly on the platform charts, as shown in the example below.

The Daily Premium Adjustment is not a cost or fee – it’s an adjustment that keeps your P&L unaffected by day-to-day changes in fair value for spot commodity positions.