Trading essentials for beginners

This introduction to online trading for beginners will take you through the most important market concepts – from key terms and different types of assets to how to make a trade. Read on and learn how to trade confidently and responsibly.

What is trading?

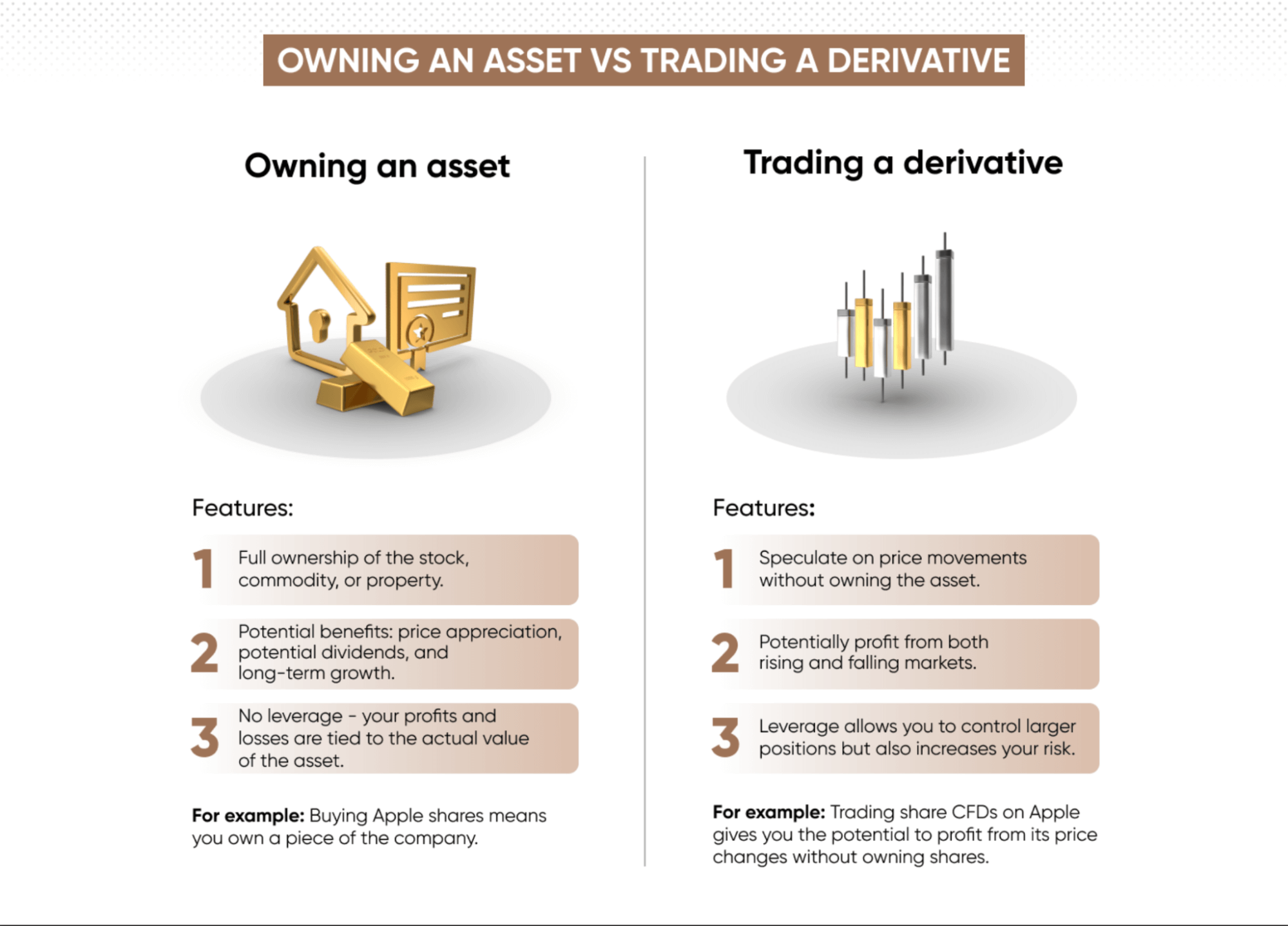

Unlike investing, where you own the asset outright, trading involves speculating on the price of the asset without taking ownership. For example, when you trade a derivative, like a CFD, you're not buying the asset itself but are instead profiting from the difference in its price over time.

With trading, you’ll typically use leverage, or margin trading. This allows you to control larger positions with less initial capital. For example, with 10:1 leverage, you only need $100 to control a $1,000 trade, with the rest effectively lent to you by the broker you’re using.

This means that leverage can increase potential profits, since you’re exposed to the price movements of the whole $1,000 rather than just your $100 outlay. However, on the flipside, it also amplifies potential losses, making risk management a crucial part of trading. Diverse strategies can be employed using tools to predict whether an asset's price will rise or fall, based on factors such as macroeconomic trends or technical analysis like support and resistance levels.

Learn more about trading vs investing.

Key trading terms

When you're starting out with derivatives, understanding the key trading terms is essential for making informed decisions and managing your trades effectively. Familiarising yourself with the basics will help you navigate the markets more confidently and reduce confusion. In this section, we’ll cover the essential trading terms that every beginner should know, providing a solid foundation for your trading journey.

CFDs

- Contracts for difference (CFDs) are a popular way of trading on the price of stocks, indices, commodities, and forex without owning the underlying assets. Instead of buying the asset (as you would when investing), you trade on the rise or fall in its price – usually over a short period of time.

- Essentially, a CFD is a contract between a trader and a counterparty (sometimes a broker, sometimes the market itself), to exchange the difference in value of an underlying security between the opening and closing of a position.

- With CFDs, you can profit on a market by speculating on its price rising (known as going long) or on its price falling (known as going short). And because a CFD enables you to trade using just a fraction of your position’s value – known as trading on margin, or leveraged trading – you can open larger positions than your initial capital may otherwise allow.

- Our CFD calculator helps you understand what you could win or lose on a trade. Adjust your trade size and leverage to see how margin, outlay, and potential returns all work together.

- Learn more about CFD trading.

Spread betting

- Spread betting is a type of derivative trading available primarily in the UK and Ireland, but also in a few other countries worldwide.

- Like CFD trading, spread betting is a popular way to trade on margin. In both cases, you don’t buy or sell any asset physically – you merely speculate on the price direction of the underlying asset.

- But while the two may appear similar, there are key differences between them. For one, spread betting is usually exempt from capital gains tax and stamp duty in the UK, but you should always check with a tax specialist if this is the case for you. Secondly, CFDs are traded as contracts (and fractions of contracts), while spread betting involves staking a unit of currency per point of market movement.

- Learn more about spread betting.

Leverage

- Applying leverage, or trading on margin, means controlling a larger position with a relatively small outlay, by effectively borrowing funds from the broker.

- For example, with a leverage ratio of 10:1, you can control a $10,000 position with just $1,000 of your own capital. This can magnify potential profits, as even small price movements can result in significant returns.

- However, it's important to note that leverage also increases risk – losses are equally magnified. Proper risk management is crucial when using leverage to avoid substantial losses.

- Learn more about margin trading.

Going long/short

- In derivatives trading, you have the flexibility to go long or short, depending on whether you expect the price of an asset to rise or fall. Going long means buying a CFD with the expectation that the price of the asset will increase, allowing you to sell it later at a higher price for a profit.

- On the other hand, going short means selling a CFD when you believe the price will decrease, with the aim of buying it back at a lower price and profiting from the difference.

- This ability to trade both rising and falling markets is one of the key advantages of CFD trading, giving traders the opportunity to benefit from various market conditions.

- Learn more about buying and selling.

Risk

- Risk is a fundamental concept in CFD trading, especially for beginners. It refers to the potential for financial loss when the market moves against your position. In CFD trading, risks are amplified due to factors like leverage, which can increase both profits and losses.

- Market volatility, unexpected news events, and poor risk management can also contribute to significant losses. To manage risk, traders often use tools like stop-loss orders, which automatically close a position if the market moves too far in the wrong direction. Understanding and managing risk is crucial to avoiding excessive losses and protecting your capital.

- Learn more about risk management in trading.

Financial markets for new traders

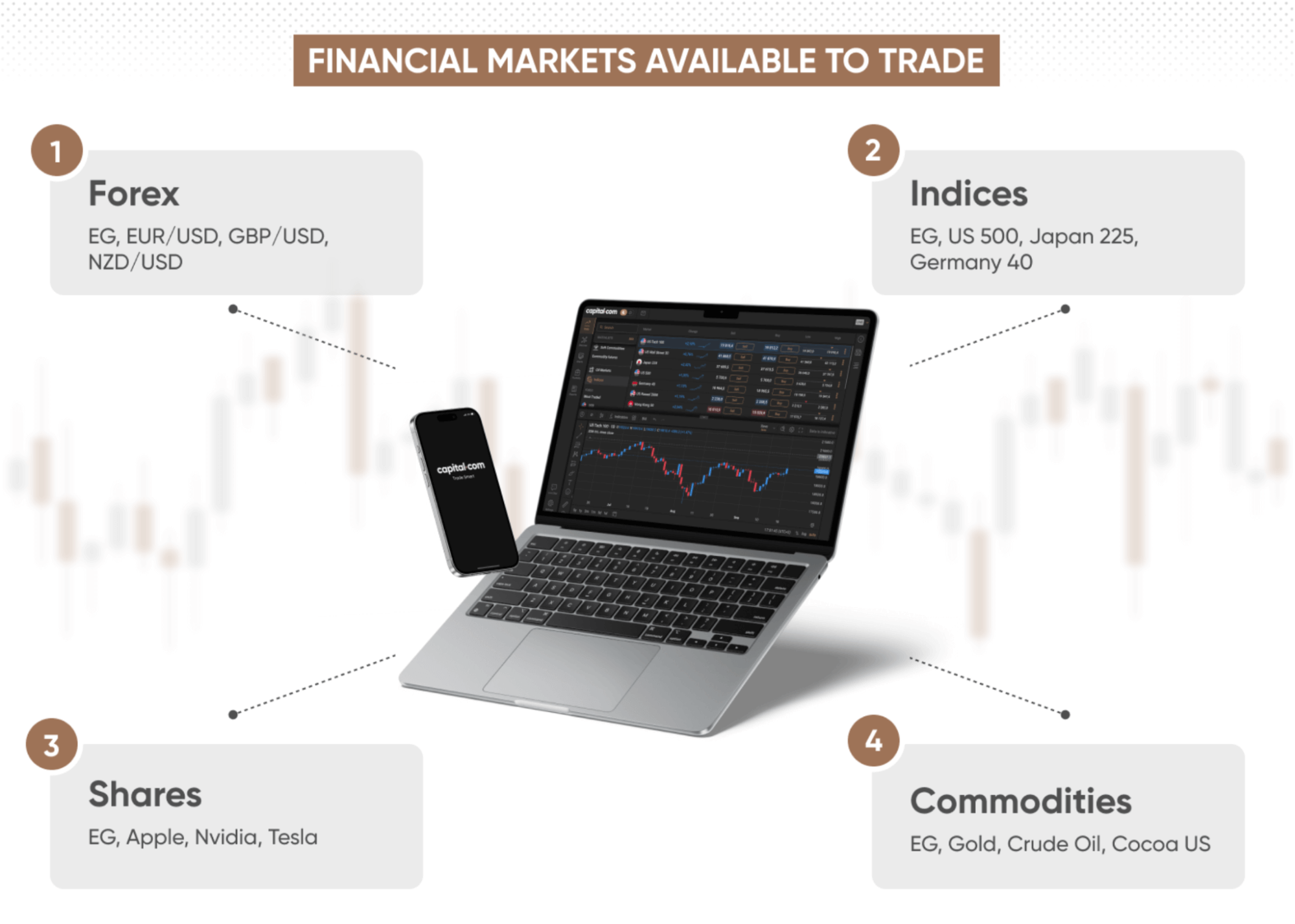

For new traders entering the world of CFDs, the available financial markets can take a variety of forms. The main markets available for CFD trading include shares, commodities, forex (currencies), and indices. Each of these markets offers unique opportunities and risks.

- Stock markets let traders speculate on the price movements of individual listed companies through share trading. Learn more about share trading.

- Commodity markets focus on physical goods like gold, oil, or agricultural products, influenced by global supply and demand. Learn more about commodity trading.

- The forex market is where currencies are traded in pairs, and it's known for high liquidity and 24-hour access, except weekends. Learn more about forex trading.

- Indices allow traders to bet on the performance of a group of stocks, such as the US 500 market, which represents 500 of the leading stocks listed on major American exchanges. Learn more about indices trading.

For beginners, choosing one or two markets to focus on may be a good strategy at first. This allows you to build your knowledge and confidence before branching out into other areas. Understanding how these markets work will give you a strong foundation for CFD trading.

Applying your trading strategy

Once you’ve learned the basics of trading, the available assets, and how the market works, it’s time to develop a trading strategy – your game plan for making trading decisions and managing your positions. Broadly speaking, strategies fall into two categories: technical and fundamental.

A technical strategy focuses on chart patterns, price movements, and technical indicators like moving averages or support and resistance levels. Traders who use technical analysis believe that past market behaviour can help predict future price movements.

A fundamental strategy, on the other hand, is based on evaluating the underlying factors that can affect an asset's price, such as company earnings, economic data, or geopolitical events. Fundamental traders look at the bigger picture to decide when to buy or sell.

The key is to find a strategy that fits your style and risk tolerance, and then refine it over time as you gain experience in the market.

Learn more about trading strategies, and find a broad range of educational content in our learn to trade section and learn how to open a brokerage account.

Learn more about how forex lot sizes work and why they matter in trading.

How to make your first trade

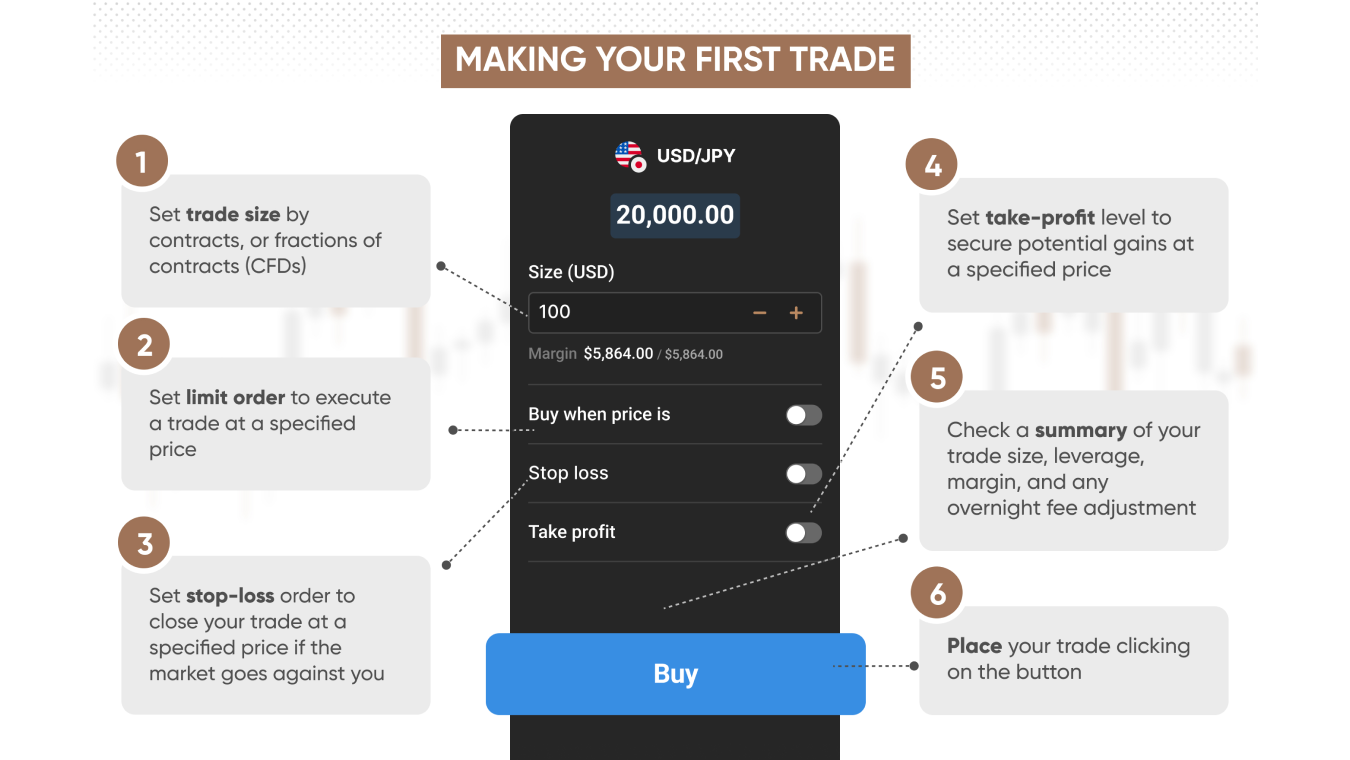

Making your first trade on our live platform is simple with our user-friendly interface. You can trade with us by practising with a demo, and following these steps:

- 1. Choose an asset to trade, based on your trading goals

- 2. Choose whether to trade with a CFD or spread bet

- 3. Decide on your trade size

- 4. Consider applying a stop-loss to manage risk

- 5. Open your position long or short

- 6. Manage your position, monitoring fundamental and/or technical drivers

- 7. Close your position

Risks and benefits of trading

Trading offers both exciting opportunities and significant risks. Understanding both is crucial to becoming a successful trader.

|

Benefits |

Risks |

|

Potential for profit: you can capitalise on price movements and get quick returns. |

Losses can be magnified: while leverage can increase profits, it can also increase losses in kind. |

|

Leverage: you can control larger positions with less capital. |

Market volatility: sudden price swings can be unexpected losses, particularly when risk management strategies aren’t in place. |

|

Flexibility: you can profit from both rising and falling markets. |

Emotional stress: impulsive, rather than rational decisions can lead to poor outcomes. |

|

Diverse assets: you can trade a range of assets from shares to commodities and forex. |

Risk of overtrading: near-constant access to markets can mean overexposure. |

The key is to find a strategy that fits your style and risk tolerance, and then refine it over time as you gain experience in the market.

Learn more about trading strategies, and find a broad range of educational content in our learn to trade section.

FAQs

How to start trading for beginners

To start trading as a beginner, you need to first understand the basics of how markets work and what assets you can trade. It's important to open a demo account to practise without risking real money, choose a reliable online broker, and learn about strategies that fit your risk tolerance. Start with small trades to build confidence and experience.

Which trade is best for beginners

The best trade for beginners typically involves assets that tend to demonstrate lower volatility, such as blue-chip stocks or major currency pairs in forex. These markets often, but not always, move more predictably, making them easier to analyse and trade with smaller risk. Beginners should focus on simple strategies that they can easily manage.

How much should a beginner start with

How much a beginner should start with depends on their financial situation and risk tolerance.

How to choose an online broker

To choose an online broker, beginners should look for a platform that offers competitive fees, a user-friendly interface, and access to comprehensive educational resources. It’s also important to check if the broker is regulated, offers demo accounts, and provides responsive, round-the-clock customer support.

What are the risks of trading

The risks of trading include losing more money than you initially invested, especially if you’re using leverage. Market volatility, sudden price changes, and emotional decision-making can lead to significant losses. Effective risk management, such as using stop-loss orders, can help reduce exposure to these risks.

Where can I learn more about the markets to trade?

You can learn more about the markets to trade by accessing online courses, reading educational materials from reputable brokers, and using demo accounts to practise. Additionally, following financial news, subscribing to market analysis newsletters, and joining trading communities can help you stay informed about market trends and strategies.