Grayscale IPO – how to trade Grayscale shares

When is the Grayscale IPO date?

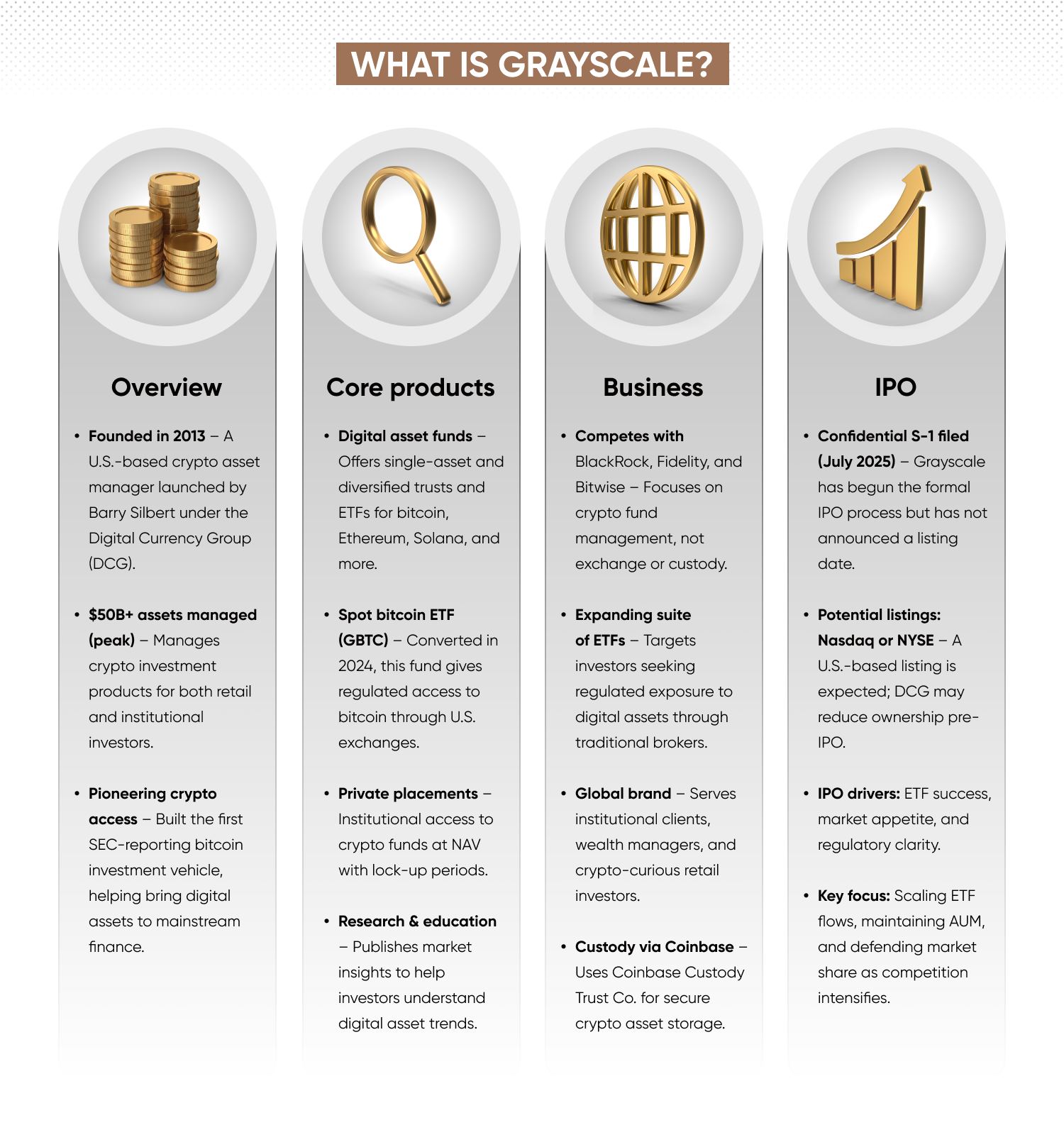

As of July 2025, Grayscale has not officially announced a date for its initial public offering (IPO). However, on 14 July, Grayscale Investments confidentially submitted a draft registration statement (Form S-1) with the US Securities and Exchange Commission, marking an official step toward a potential listing. With the success of the Grayscale Bitcoin Trust (GBTC) and other crypto funds, a public listing could unlock new capital and transparency for the brand.

A public offering could depend on market conditions, crypto regulation in the US, and investor demand for digital asset exposure via traditional equity markets.

Several factors could influence the timing of a Grayscale IPO:

-

Regulatory clarity: the SEC's decision to approve spot bitcoin ETFs in January 2024 set a precedent that may ease Grayscale's path to listing.

-

Market appetite: crypto markets have rebounded in 2024 and 2025, boosting investor interest in digital asset firms.

- Operational readiness: Grayscale has converted GBTC into an ETF and restructured its fee model, which may suggest preparation for further market-facing activity.

What is Grayscale?

Grayscale is a digital asset management firm known for offering crypto investment products to institutional and retail investors. Headquartered in the US and founded in 2013, it operates under the umbrella of Digital Currency Group (DCG).

Its flagship product, the Grayscale Bitcoin Trust (GBTC), provides indirect exposure to bitcoin without requiring direct crypto ownership. Grayscale has expanded its offerings to include trusts and ETFs for Ethereum, Solana, Chainlink and other digital assets, giving investors access to crypto markets via traditional brokerage accounts.

Grayscale played a key role in legitimising crypto as an asset class for traditional investors. Before the rise of crypto ETFs, its trusts were among the few SEC-reporting investment vehicles giving regulated bitcoin exposure, helping hedge funds, pensions, and wealth managers access digital assets compliantly.

Key milestones in Grayscale’s history

-

2013: Grayscale launched its Bitcoin Investment Trust, the first publicly traded bitcoin fund in the US.

-

2015: became a wholly owned subsidiary of DCG.

-

2020: assets under management (AUM) surpassed $10bn amid the crypto bull run.

-

2021: filed to convert GBTC into a spot bitcoin ETF.

-

2023: won a court case against the SEC, clearing a path for GBTC to become an ETF.

-

2024: GBTC officially converted to an ETF in January, trading on NYSE Arca.

-

2025: continues to expand its ETF suite and diversify into multi-asset crypto products. Filed for IPO with the SEC.

Grayscale’s key offerings:

-

Digital asset ETFs and trusts: bitcoin, Ethereum, Solana, Chainlink and more.

-

Institutional-grade custody: offers security infrastructure via Coinbase Custody.

-

Market insights and research: publishes in-depth reports on digital asset trends.

The firm aims to make crypto more accessible to traditional investors and currently manages tens of billions in assets across its product suite.

How does Grayscale make money?

Grayscale earns revenue by charging management fees on its investment products, particularly its ETFs and private placement vehicles. Unlike some crypto exchanges, Grayscale does not facilitate trading directly but packages digital assets into investable products. Here’s a breakdown of Grayscale’s revenue streams.

|

Revenue stream |

Description |

|

Management fees |

Grayscale charges annual fees for managing its crypto funds, ranging from 0.25% to 2.5%, depending on the product. For example, GBTC has a 1.5% fee, which is significant at scale. |

|

ETF conversion |

With the shift of GBTC to an ETF, Grayscale earns via lower but potentially more scalable fees, attracting larger institutional flows. |

|

Private placements |

Institutions can buy into Grayscale products at NAV (net asset value) with a lock-up period, generating initial and recurring income. |

|

Product expansion |

Launching new single-asset and diversified crypto funds expands AUM and broadens Grayscale’s fee base. |

|

Research and sponsorship |

While smaller in scope, Grayscale also partners on educational and promotional initiatives around digital assets. |

Grayscale does not directly profit from trading spreads or leverage. Its business model depends on attracting AUM and retaining investor trust in its crypto exposure products.

Grayscale faced criticism for its higher fees compared to competitors. In response, the firm has started reducing fees on new ETFs to remain competitive as more low-cost crypto products enter the market.

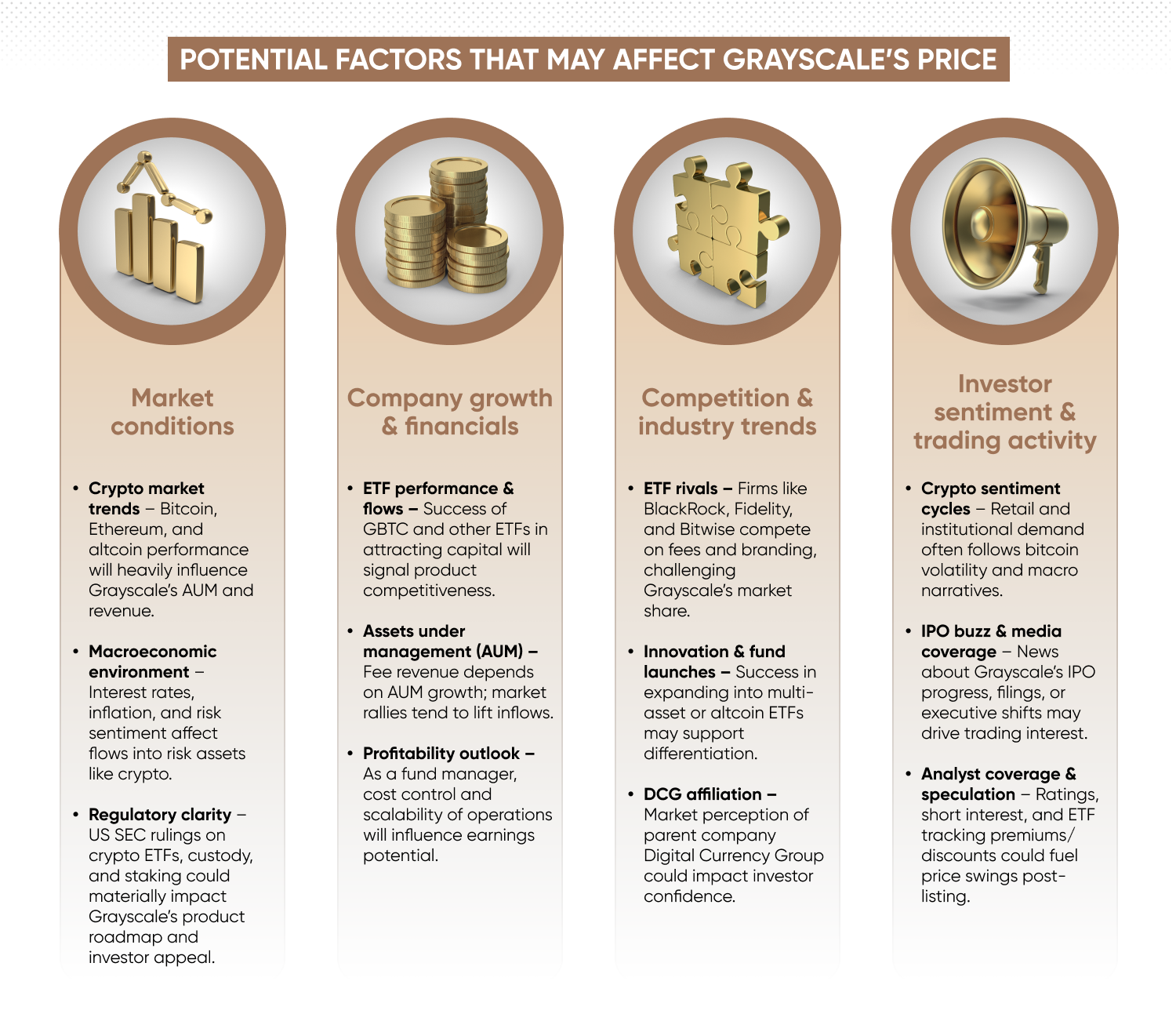

What might influence the Grayscale live stock price?

Should Grayscale go public, its share price will likely respond to several crypto-related and market-wide factors. As a pure-play crypto asset manager, it would be closely tied to the sentiment and volatility of the digital asset class. Here are some of the company’s key drivers.

Crypto market sentiment

Grayscale’s stock would likely correlate with bitcoin and broader altcoin performance. When crypto prices rise, investor interest in exposure products grows, boosting AUM and fees. Conversely, bear markets tend to reduce fund inflows and compress valuations.

ETF flows and performance

If Grayscale’s ETFs perform well and attract capital, this will reflect positively on its business model. ETF outflows or price discounts to NAV may raise concerns about product competitiveness.

Regulatory outlook

The SEC’s stance on new crypto ETFs, staking, and custody rules could influence investor confidence. Clearer regulation may benefit Grayscale, while adverse rulings could limit its future products.

Competition and innovation

Firms like BlackRock, Fidelity, and Bitwise are actively expanding in the crypto ETF space. Grayscale’s ability to retain market share amid fee compression and innovation will be closely watched.

Parent company impact

Grayscale is owned by DCG, which has faced legal and financial scrutiny over the past few years. A clean separation or rebranding ahead of an IPO may ease investor concerns.

How to trade Grayscale stocks via CFDs

If and when Grayscale lists, you could speculate on its share price movements using contracts for difference (CFDs). This means you won’t own the shares directly, but can take long or short positions based on your view of the market.

Here’s how to get started:

- 1. Choose a broker

Select a regulated platform that offers access to Grayscale stock via CFDs. Capital.com provides CFD trading on thousands of shares, including newly listed IPOs where available.

- 2. Open an account

Create a live or demo trading account. You’ll need to verify your identity and provide some financial background information

- 3. Deposit funds

Add money to your account using your preferred payment method. Always trade within your risk tolerance.

-

4. Research the market

Use our platform’s news and analysis to monitor Grayscale’s performance and the broader crypto market. -

5. Place a CFD trade

Go long if you think the stock will rise, or short if you expect it to fall. Set stop-losses and take-profits to manage risk.

Learn more about contracts for difference in our CFDs trading guide.

Which crypto-related stocks can I trade?

Until Grayscale goes public, there are several other listed companies that provide indirect exposure to crypto markets. You can trade these stocks via CFDs on Capital.com:

-

Coinbase (COIN) – a leading crypto exchange platform with over 100 million users and growing institutional custody services.

-

MicroStrategy (MSTR) – holds over 200,000 bitcoin on its balance sheet, with a corporate strategy focused on long-term BTC exposure.

-

Robinhood (HOOD) – offers crypto trading to retail users, alongside stocks and ETFs.

-

Riot Platforms (RIOT) and Marathon Digital (MARA) – major US bitcoin miners whose revenue depends on BTC price and network hash rate.

-

Block (SQ) – formerly Square, offers crypto payments, wallets, and development through its TBD division.

-

Galaxy Digital (GLXY.TO) – a diversified crypto financial firm providing asset management, trading and venture services.

You can also track sector-specific ETFs such as:

-

BITQ – Bitwise Crypto Industry Innovators ETF

-

WGMI – Valkyrie Bitcoin Miners ETF

FAQ

Who owns Grayscale?

Grayscale is owned by Digital Currency Group (DCG), a crypto conglomerate founded by Barry Silbert. DCG previously held a portfolio of crypto-related businesses, including Genesis and CoinDesk. However, CoinDesk was sold in 2023 to a group led by Bullish, a digital asset exchange.

Is Grayscale a public company?

No, Grayscale is a privately held subsidiary of DCG. However, several of its investment products – such as the Grayscale Bitcoin Trust (GBTC) and others – trade publicly on exchanges like NYSE Arca and OTC markets.

What is GBTC?

GBTC is the Grayscale Bitcoin Trust, which was converted into a spot bitcoin ETF in January 2024. It allows investors to gain exposure to bitcoin via a regulated fund structure.

Will Grayscale IPO in 2025?

There is no confirmed IPO date. However, in July 2025, Grayscale confidentially submitted a draft registration statement (Form S-1) with the SEC – marking a formal step toward a potential listing. The IPO timeline will likely depend on market conditions, regulatory developments, and investor demand.

Can I trade Grayscale stock via CFDs?

If Grayscale goes public, many brokers may offer its shares for CFD trading, depending on market demand and regulatory approvals. Capital.com offers CFD trading on hundreds of stocks, including IPOs.

How does Grayscale compare to Coinbase or MicroStrategy?

Grayscale focuses on offering crypto exposure through funds and ETFs, whereas Coinbase runs a trading platform and MicroStrategy uses bitcoin as a treasury asset. All three are closely tied to bitcoin’s price and sentiment.

Will Grayscale IPO in 2025?

Grayscale has remained tight-lipped about a potential 2025 IPO, but several analysts believe the success of its ETF products and favourable regulatory signals could accelerate listing plans.

Discover more IPOs

Stay informed on IPOs, market trends, and the newest trading opportunities

Figma IPO