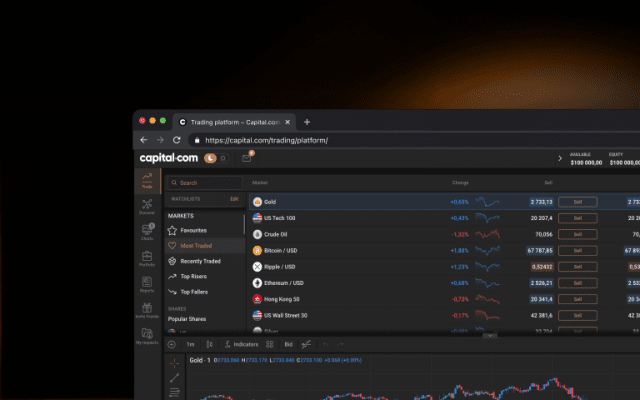

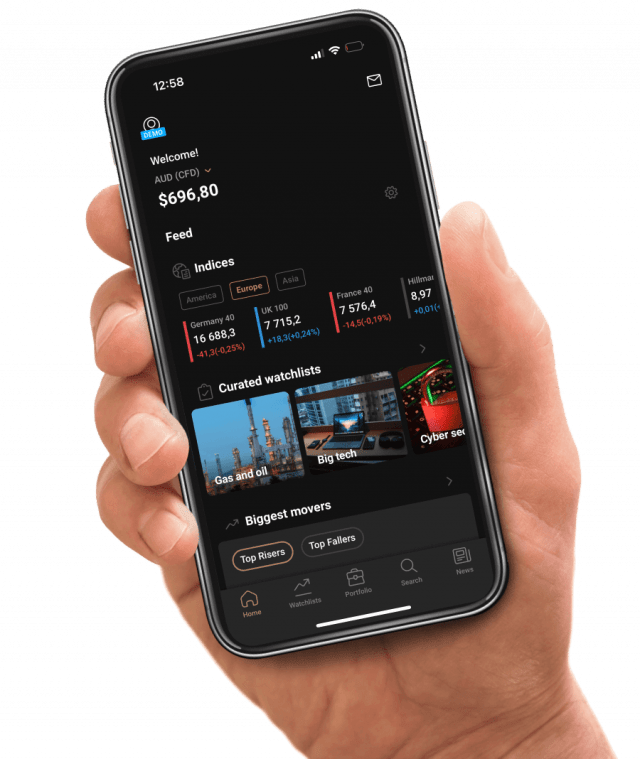

Opera en una plataforma y una aplicación diseñadas para ayudarte a ahorrar tiempo. Gráficos altamente personalizables, noticias con las que hacer trading desde la aplicación, integración con TradingView y MT4, y mucho más.

Autorizada y regulada por la Comisión de Valores de Bahamas (SCB)

El mejor broker que he conocido después de probar con muchos, obviamente para que nombrarlos. Por ejemplo, la primera razón que empecé a usar Capital fue la llegada de mi dinero de inmediato a mi cuenta bancaria, a diferencia de las existentes en el mercado que tardan días o tienen mucha burocracia; y la segunda razón, que te devuelve dinero por el hecho de operar en un mercado determinado, debido a los spread y al volumen existente. Mientras más activo seas, más dinero te reembolsa. Muchas grac

Muy atentos a cada duda o inconveniente que tienes, te responden súper rápido y son muy claros, muy buena aplicación, súper recomendable

Excelente servicio, me ayudaron en tiempo récord en la solución a mi solicitud, es agradable sentir este respaldo. Recomendados totalmente.

El mejor de todos, un excelente servicio y una rápida respuesta y un retiro súper rápido sin comisión

Mi aplicación de cabecera para invertir con información actualizada. Muy satisfecho. Nunca he tenido problemas con Ingresos o Retiros. Muy recomendable. Aplicación segura.

El chat en vivo de capital.com es muy útil y facilita mucha la comunicación con el equipo técnico de esta misma además la atención que se me brindo fue muy buena eficaz y rápida

hasta el momento ha sido muy buena. Es la primera vez que invierto en el trading y todo es muy claro y sencillo

Poder usarlo con Tradingview y que se puede operar con divisas pese a la regulación en España. Comisiones bajas en spread, sobre todo en crypto comparado con otros bróker no especializados en cryptos exclusivamente.

El mejor broker, sin comisiones, mejor spread y gran catalogo de productos

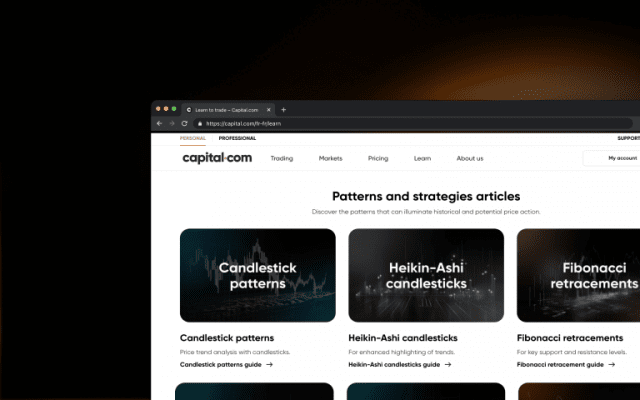

Buena aplicación, encuentro casi todos los mercados, da tutoriales de como operar, solo quisiera que estuvieran en español, pero por lo demás muy completo, puede usarse en tradingview, desde computadora o celular

Me ha parecido muy fácil de operar. Muy bueno que se puede fondear la cuenta con tarjeta porque eso hace más rápido el proceso.

Excelente conjunto de herramientas para trading. Comisiones muy bajas. Muy recomendable.

Conecta con todas las bolsas importantes del mundo y permite información inmediata e instantánea de tu cartera. Excelente

Una aplicación con interfaz amigable para los principiantes, facil de operar. Comisiones justas y acceso a variedad de mercados.

La experiencia en la plataforma es muy buena así como los indicadores dentro del trading y los agentes responden en el momento y te da mucha atención que te hace sentir confiable el broker, muy recomendado

Muy buena aplicación para invertir! El modo prueba y las guías te ayudan a corregir muchos errores antes de hacer tus primeras operaciones, además es muy fácil operar en ella.

Estas son nuestras reseñas de 4 y 5 estrellas. Los datos específicos del usuario se han anonimizado intencionadamente para salvaguardar su privacidad de conformidad con los requisitos del RGPD

El servicio, las herramientas y los recursos ideales para que sigas desarrollando tus habilidades.

Perfecciona tus análisis con una serie de gráficos intuitivos, herramientas de dibujo y más de 100 indicadores.

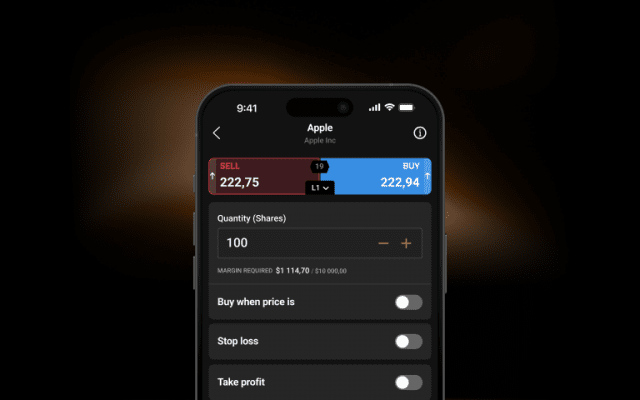

Controla posiciones más grandes con márgenes bajos en mercados seleccionados. El apalancamiento magnifica tanto los beneficios como las pérdidas. Pueden aplicarse límites.

Nuestro equipo de expertos está disponible 24/7 para ayudarte.

Monitorea la evolución del precio de tus activos favoritos y no pierdas de vista tu estrategia.

Según los datos de nuestro servidor interno de 2024, el 99% de los retiros se procesa en 24 horas.

Comienza tu viaje por el mundo del trading con Capital.com.

Prepara tu experiencia de trading con facilidad y sin riesgos.

Aprende conceptos clave mediante cursos accesibles, seminarios web, cuestionarios y videos.

Disfruta un soporte experto y amigable las 24 horas del día.

Siéntente cómodo con tu exposición y opera utilizando tamaños flexibles.

Utiliza órdenes stop-loss1 para limitar tus pérdidas cuando el mercado vaya en tu contra.

1Las órdenes stop-loss pueden no estar garantizadas