DAX 40 continues to push to new all-time highs ahead of the eurozone CPI release

DAX 40 rises to new all-time high as regional inflation readings show smaller price increases

The DAX 40 continues its relentless climb pushing to a new all-time high above 17,700. The German index continues to attract buyers as it seems to take meditated steps higher, with a few sessions of little movement between each new leg higher. The sentiment in the overall equity market remains bullish with indices pushing to new highs on both sides of the Atlantic. Still, the DAX 40 stands out this week as it has failed to pull back and reconsider the move higher like other majors, including the S&P 500 and US Tech 100. The DAX 40 rally looks to be unobstructed in the short term, but the RSI has ventured over the overbought line, suggesting some resistance may be ahead. That said, the last time the RSI surpassed the 70 mark it continued for a few weeks towards 85 before reversing lower, meaning the current move into overbought territory doesn’t necessarily mean immediate pullback.

DAX 40 daily chart

Past performance is not a reliable indicator of future results.

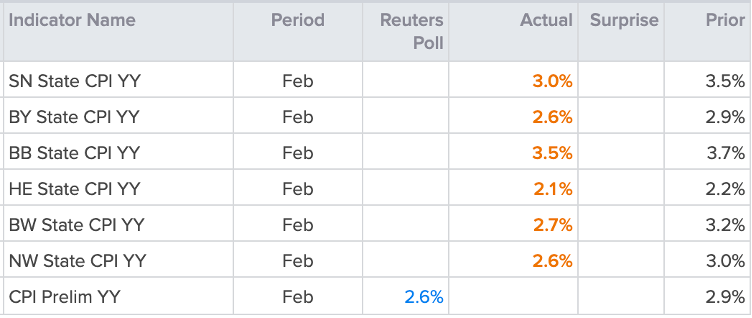

The regional inflation readings released this morning show consumer prices rose at a smaller pace in February after a few months of readings that stepped away from the disinflation process. The national CPI data will be released later this afternoon (1pm GMT), but it could give the DAX another leg higher if it reignites hopes of rate cuts from the European Central Bank. Consumer prices are expected to have risen 2.6% in the year to February, down from 2.9% in January, and the lowest reading since June 2021.

Germany regional CPI releases

This will gear up traders for tomorrow’s Eurozone CPI. The yearly rate is expected to drop to 2.5% from 2.8% in January, which would be the lowest reading since July 2021. Again, this drop would be gladly welcomed by dovish hopefuls as it reinstates the disinflation process that started at the end of 2022.

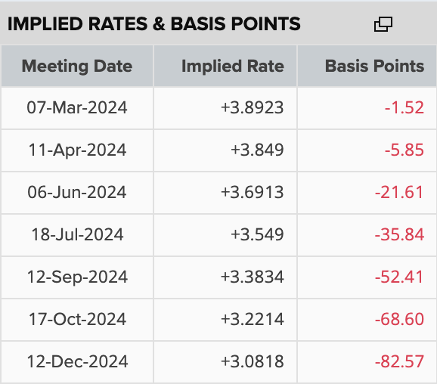

Markets are currently pricing in a 6% chance that the European Central Bank cuts rates at their meeting next week. It seems highly unlikely that they would cut rates as the latest commentary from ECB officials continues to reinforce the notion that rates will not be lowered until inflation has successfully returned to the 2% target in the long term. But Friday’s CPI reading could prompt some further guidance from Lagarde and her team on when rate cuts could be expected, especially if the reading evidence softening inflation. Futures markets are currently pricing in 82bps of cuts priced for the remainder of 2024.

ECB market-implied basis points for 2024