TUI share price forecast: Can it regain consumer confidence?

German travel group TUI (TUI) has endured a miserable few weeks. The TUI stock market price has plunged 26% since the start of this year.

The sharp decline has been mainly triggered by market reaction to a new share placing to repay Covid-19 aid received from the German government.

But confidence in the firm has also been shaken by the chaos and bad publicity caused by the cancellation of flights and holidays.

So, what does this mean for the company? Should investors steer clear until the problems are fixed, or is now the time to invest in TUI shares?

In this TUI share forecast we take a look at its recent results, analyse its prospects for the all-important summer season, and ask analysts to give their predictions.

TUI share price history: What has happened to the share price?

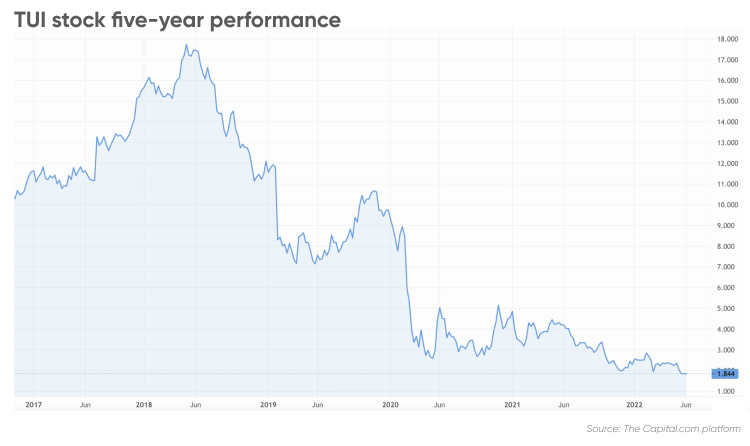

TUI stock has been trading significantly lower since the Covid-19 pandemic caused restrictions to be introduced in March 2020.

The share price stood at more than £17 back in May 2018, but two years later it had plummeted to just over 300p as the travel industry ground to a halt.

Although the widespread relaxation of travel restrictions gave the company’s revenues – and the stock price – a boost, it’s still been on something of a rollercoaster.

Over the past year, the stock has fallen 55% from 420p to 188.8p at market close on 6 June 2022.

TUI stock analysis: New share placing

TUI’s stock price plunged after unveiling a capital increase to pay back some of the German state bailout it received during the Covid-19 pandemic.

The move, which saw the company place 162.3 million new ordinary shares, raised €425m (£363m), but resulted in the stock price falling.

No investor likes to see the value of their stake diluted and that caused the negative reaction, according to Danni Hewson, financial analyst at AJ Bell.

However, she pointed out that if this summer was going to be one to remember for all the right reasons, then shareholders might have been more forgiving.

“The recent scenes at major European airports and warnings that the chaos is unlikely to be over in time for the crucial summer season have added insult to injury,” she said.

The problems have stemmed from airlines and airports facing staff shortages in the wake of the Covid-19 pandemic. This has resulted in them struggling to cope with the increased demand.

TUI’s most recent results

TUI recently reported group revenue of €2.1bn (£1.8bn) for the second quarter – up €1.9bn year-on-year, reflecting a more normalised travel environment.

In a statement, it said March saw the highest monthly revenue in the quarter as “operations ramped up” after a more subdued January and February post Omicron restrictions.

The quarter saw 1.9m customers depart, representing an increase of 1.7m customers versus the prior year. The highest departure volume was achieved in March.

The company also announced that the second quarter underlying EBIT loss almost halved to €-329.9m versus the €-633m loss in the same period last year.

TUI share news: Ongoing disruption

However, the disruption at airports has been making all the headlines. It’s made life a misery for UK families looking to escape abroad for the half-term school holiday.

On 1 June, TUI issued a statement addressing the problems. While acknowledging the disappointment caused by delays, it insisted most flights were operating as planned.

It stated: “We’re incredibly sorry to those customers who have been impacted by the recent disruption to our operations. We understand that last minute delays and cancellations are incredibly disappointing, and we would like to reassure our customers that we are doing everything we can to get them on holiday as planned.

“Whilst every delay and cancellation is regrettable, the vast majority of our flights are operating as planned, with more than 26,000 customers taking off yesterday on holiday.”

Airport situation could deteriorate

The Prospect union, which represents thousands of people working in airports and air traffic control, has warned the situation may get worse before it improves.

According to Garry Graham, Prospect’s deputy general secretary, unions warned the government and aviation employers that “slashing staff” would cause problems post-pandemic.

TUI share price prediction: What the analysts think

The recent airport disruption couldn’t have come at a worse time for a sector that had been starting to recover in the wake of Covid-19, according to Danni Hewson.

“People have missed holidays – but if that summer break comes with added expense, irritation and heartbreak, plenty of would-be-travellers will stow their credit cards until the dust settles,” she told Capital.com. This could put pressure on the operators.

While Hewson believes people know travel companies have had a hard time and accept it will take time to return to normal, their patience won’t last forever.

“With allegations swirling that companies are overselling on what they know they can deliver that understanding will wane quickly and winning back customers will cost considerably more than just getting it right,” she added.

Ivor Jones, an analyst at Peel Hunt, has a ‘hold’ recommendation on TUI stock and recently reduced the target price from 260p to 190p. “Despite excellent trading news from TUI with the interims, we can’t quite get out a ‘buy’ recommendation,” he wrote in a recent note.

In fact, Jones believes he’s been “too optimistic for too long”, particularly in relation to the recovery in the cruise business.

“We have lowered our full year 2022 underlying EBIT (earnings before interest and tax) forecasts from €831m to €612m, remaining towards the top of the range we believe,” he said.

While acknowledging high levels of employment are positive and holiday demand is likely to prove more resilient than for other large purchases, he remains cautious.

TUI share price forecast: Where will the price go next?

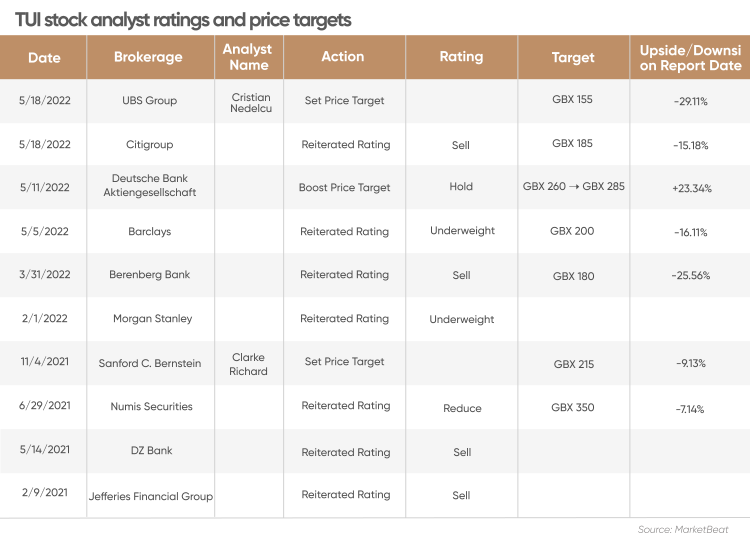

The question is: Are TUI shares a ‘buy’, ‘sell’ or ‘hold’? The stock was a ‘sell’ based on the views of six analysts compiled by MarketBeat (as of 7 June), even though their consensus view was the share price could rise 13% to 213.75p over the coming year.

The highest predicted stock forecast came in at 350p, which would be an 85% premium over the 188.8p closing price on 6 June 2022. The lowest forecast suggested a 26% fall to 140p.

The stock could be a “bad long-term (one year) investment”, according to the algorithmic forecasting of Wallet Investor as of 7 June, which predicted the price could crash to zero over the next 12 months.

According to its TUI stock forecast 2022, the stock could end the year at 87.393p and move down to zero in August 2023. The site had the stock remaining at zero in June 2025 but doesn’t project as far ahead as 2030.

When looking for TUI (TUI) stock predictions, it’s important to bear in mind that analysts’ forecasts and algorithm-based price targets can be wrong. Projections are based on making fundamental and technical studies of the TUI stock’s historical price pattern – but past performance does not guarantee future results.

It is essential to do your own research. Always remember that your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio and how comfortable you feel about losing money. You should never trade money that you cannot afford to lose.

FAQs

Is TUI a good stock to buy?

Whether TUI is a good stock to buy will depend on your view of the stock. Remember, analysts’ predictions are often wrong so it’s important to carry out your own research into the stock. You should never trade money that you cannot afford to lose.

Will TUI stock go up or down?

No-one knows for sure. The consensus view of analysts compiled by MarketBeat (as of 7 June) was that the TUI stock could rise 13% to 213.75p over the coming year. However, the algorithmic forecasting of Wallet Investor suggested the price could crash to zero over the same period.

Why has the TUI share price been dropping?

The stock market reacted negatively to TUI’s new share placing to raise funds to repay the Covid-19 relief it had received from the German government. Investor confidence has also been rocked by the recent disruption at airports.

Related topics