Microsoft stock forecast: Third-party projections

Microsoft was trading at $531.62 as of 1:12pm (UTC) on 27 October 2025, moving within an intraday range of $520.20–$531.90. The share price shows modest strength after the previous week’s slight gains, as investors await the company’s upcoming quarterly results.

Market attention is also on Microsoft’s Q1 FY2026 earnings release, scheduled for 29 October (Microsoft Investor Relations FAQ, 27 October 2025). Broader sentiment across the market remains supported by the resilience of Big Tech ahead of a series of major earnings reports this week (Bloomberg, 26 October 2025).

Microsoft stock forecast: Analyst price target view

Guggenheim (investment note)

Guggenheim issued a new target price of $586, reflecting around 12% potential upside from Microsoft’s previous close. The firm noted that AI monetisation through Azure and Copilot continues to support growth momentum (Yahoo Finance, 27 October 2025).

MarketBeat consensus (analyst poll)

MarketBeat reported that the average 12-month target across 36 analysts is $616.47, within a range of $475 to $710. The data show 35 ‘buy’ ratings and one ‘hold’, indicating confidence in enterprise cloud demand (MarketBeat, 27 October 2025).

UBS (equity research)

UBS maintained its $650 target, citing Azure’s 39% revenue growth and continued AI integration across Microsoft’s services. The bank said enterprise adoption trends appear to offset short-term cost pressures from AI infrastructure investment (Investing.com UK, 22 October 2025).

Wells Fargo (sector update)

Wells Fargo reaffirmed its ‘Overweight’ rating and raised the target to $675 from $650. Analysts highlighted Azure’s growth and Copilot’s wider rollout as key factors supporting confidence despite higher capital expenditure (Yahoo Finance, 8 October 2025).

24/7 Wall St. (outlook update)

24/7 Wall St. set its latest year-end 2025 target at $563.64, noting year-to-date gains of nearly 25% and sustained focus on AI-driven earnings growth (24/7 Wall St., 23 October 2025).

MSFT stock price: Technical overview

Microsoft (MSFT) last traded at $531.62 as of 1:12pm (UTC) on 27 October 2025, holding above its 20-, 50-, 100- and 200-day moving averages at approximately $518, $512, $506 and $458. The 20-over-50 alignment remains intact, with short- and medium-term averages positioned above longer-term levels. The 10- and 30-day simple moving averages (SMAs) around $517–516 reinforce underlying support within the current range.

Momentum indicators are neutral: the 14-day RSI stands at 59.75, within the upper-neutral zone, while the ADX at 14.25 signals a weak directional trend. A daily close above the Classic Pivot R1 at $527.38 could bring the next resistance at $536.80 into focus. Initial support sits at the Classic Pivot (P) near $509.88, with the 100-day SMA at $506 providing the next support level. A move below the 100-day average could expose the S1 level at $500.45 (TradingView, 27 October 2025).

This technical overview is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Microsoft share price history

Microsoft’s share price has risen steadily over the past two years, supported by demand for cloud and AI services. From late-2023 levels near $370, the stock advanced through several quarters of consistent gains, reaching around $420 by the end of 2024 and above $530 by October 2025. This represents an increase of roughly 40% year on year as of 27 October 2025, with Microsoft trading near its highest levels for the period. The trend indicates continued investor confidence amid broader market volatility, highlighting the company’s ongoing strength in enterprise software and AI-related growth areas.

Past performance is not a reliable indicator of future results.

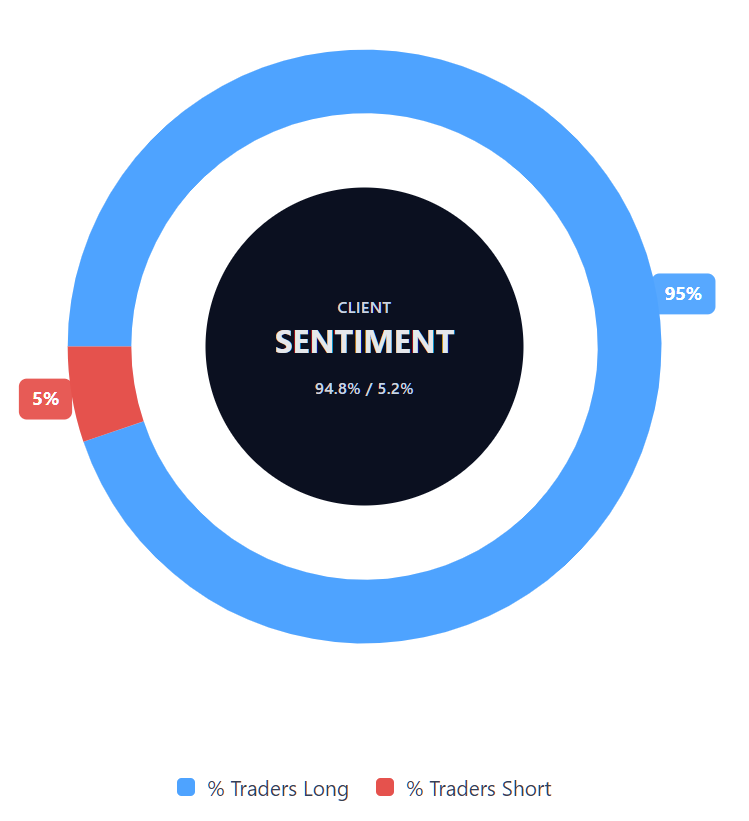

Capital.com’s client sentiment for Microsoft CFDs

As of 27 October 2025, Capital.com client positioning in Microsoft CFDs currently shows a strong buy bias, with 94.8% of positions long and 5.2% short, putting buyers ahead by 89.6 percentage points. This represents a notably one-sided long skew, indicating a preference for upward exposure among clients at this time. Figures reflect open positions on Capital.com and are subject to change.

FAQ

Is Microsoft a good stock to buy?

Microsoft remains one of the world’s largest technology companies, supported by ongoing growth in cloud computing, AI and enterprise software. However, whether it is a good investment depends on individual goals and risk tolerance. The share price and valuation fluctuate with broader market conditions and company performance.

Could Microsoft stock go up or down?

Yes. Microsoft’s share price may move in either direction, influenced by factors such as earnings results, market sentiment, economic data and demand for cloud and AI services. Analyst forecasts from late 2025 indicate a wide range of potential outcomes, reflecting both upside and downside risks. Past performance is not a reliable indicator of future results.

Should I invest in Microsoft stock?

Whether to invest in Microsoft depends on personal circumstances, trading objectives and risk appetite. It is important to note that past performance is not a reliable indicator of future results, and markets can move unpredictably.