What are ETFs and how do you trade them?

What is an exchange-traded fund?

ETF trading is the buying and selling of exchange-traded funds to gain exposure to a broad range of assets and speculate on price fluctuations.

Exchange traded funds (ETFs) are among the most popular financial instruments that investors add to their portfolios for exposure and diversification. Rather than having to research and analyse individual stocks, you can track the performance of a group of stocks or an index, as well as trade commodity funds by investing in ETFs.

Are you new to the market and looking to have ETF trading explained? In this guide, we look at ETF trading in more detail, explaining how you can start ETFs trading and looking at other important information you may need to know.

Why trade ETFS?

Why trade ETFs over, say, mutual funds, which also offer diversified portfolios of constituent assets? Here are some key reasons why many seek exposure to ETFs.

Diversification: ETFs provide exposure to a variety of assets, helping investors diversify their portfolios.

Trading flexibility: ETFs are often traded as CFDs and can be bought and sold throughout the trading day at market prices, unlike mutual funds, which are not typically traded as CFDs and are traded only at the end of the trading day.

Lower costs: ETFs generally have lower expense ratios compared to mutual funds because they are passively managed and aim to replicate the performance of an index.

Transparency: ETFs typically disclose their holdings on a daily basis, allowing investors to see what assets they own.

Tax efficiency: Due to their structure, ETFs can be more tax-efficient compared to mutual funds, potentially resulting in lower capital gains distributions.

Types of ETFs

The types of ETFs available to trade range from equity ETFs to currency ETFs and more.

Equity ETFs track a specific index or sector of stocks, such as the US 500 or technology stocks.

Bond ETFs focus on fixed-income securities, including government bonds, corporate bonds, or municipal bonds.

Commodity ETFs invest in physical commodities like gold, silver, oil, or agricultural products.

Sector and industry ETFs target specific sectors or industries, such as healthcare, finance, or energy.

International ETFs provide exposure to stocks or bonds from markets outside the investor’s home country, such as emerging markets or specific countries like Japan or China.

Real estate ETFs invest in real estate investment trusts (REITs) and other real estate-related assets.

Thematic ETFs focus on specific themes or trends, such as clean energy, technology innovation, or demographic shifts.

Inverse ETFs are designed to profit from a decline in the value of an underlying index or asset. They often use derivatives to achieve their investment goals.

Leveraged ETFs seek to amplify the returns of an underlying index, usually by two or three times, using derivatives and debt.

Dividend ETFs focus on companies that pay high dividends, providing income as well as potential capital appreciation.

Actively managed ETFs have portfolio managers who make decisions about the fund’s investments with the goal of outperforming the market. This is unlike most ETFs, which passively track an index.

How to trade ETFs

When it comes to how to trade ETFs, you can buy and sell them on stock exchanges or trade the derivative as a CFD. Here’s what each approach looks like.

Buying the ETF itself

Through this method, you own a share of the actual ETF through certain brokers. In doing so, you’ll have a direct stake in the underlying assets held by the ETF, such as stocks, bonds, or commodities.

This means you are entitled to receive dividends if the ETF distributes them, which may be paid in cash or reinvested into more shares of the ETF. You may also get voting rights.

Trading ETFs with derivatives

When you trade an ETF using a derivative such as a CFD, you won’t own the underlying ETF or its assets. Instead, you are entering into a contract with the CFD provider to exchange the difference in the price of the ETF between the opening and closing of the contract.

CFDs allow you to trade ETFs on margin, meaning you are employing leverage. This enables you to control a larger position with a smaller amount of capital. Also, CFDs enable short selling, allowing for the potential to profit from falling as well as rising prices. Leverage amplifies both potential gains and losses, making it risky, so make sure you employ sound risk management practices when trading.

However, you can also manage positions risk-free with our demo account and practise before trading with real money.

ETF trading example: Invesco QQQ CFD

Let’s say you’re interested in gaining exposure to the technology sector. You believe it will experience significant growth in the near future due to positive earnings reports and innovative product launches.

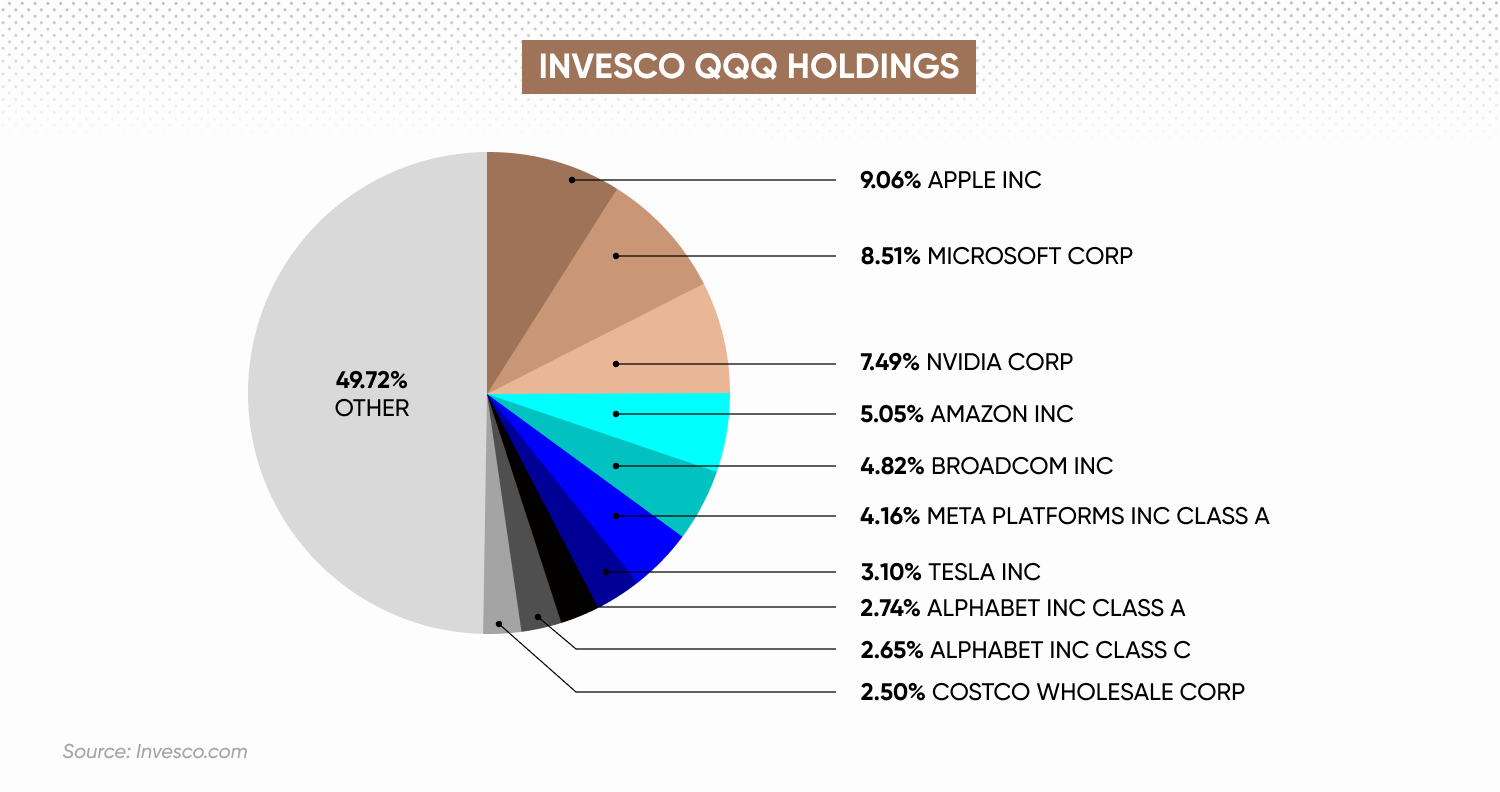

Instead of trading individual technology stocks, you decide to trade the Invesco QQQ ETF (QQQ), which tracks the US Tech 100 index. This ETF includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market, providing broad exposure to the technology sector.

Reasons for choosing QQQ ETF CFD

Let’s apply the general reasons for choosing an ETF to this specific example.

Diversification

Trading individual stocks like Apple (AAPL), Microsoft (MSFT), or Alphabet (GOOGL) can expose you to company-specific risks. For example, negative news items about a single company can significantly impact its stock price.

However, the QQQ ETF includes a wide range of tech companies, reducing the risk associated with any single company's performance. This diversification helps mitigate volatility and provides a more stable investment vehicle.

Greater exposure

Researching and managing multiple individual stocks can be time-consuming and complex. Each stock requires separate analysis, tracking, and trading decisions.

Trading the QQQ ETF allows you to gain exposure to the entire tech sector with a single position. This simplifies your trading strategy and reduces the need for extensive research on multiple companies.

Market access and liquidity

Also, not all tech stocks have the same level of liquidity. Some smaller tech companies might have wider spreads and less trading volume, making it harder to enter and exit positions.

However, the QQQ ETF is highly liquid, with tight spreads and high trading volume. This ensures that you can quickly enter and exit positions without significant slippage, meaning your trade is more likely to be executed at the price you want.

How to manage an ETF CFD position

Let’s say QQQ is currently trading at $350 per CFD contract.

You decide to open a long CFD position for 100 contracts of QQQ.

The standard leverage for this market is 5:1, meaning you only need to put down 20% of the total trade value as margin.

The total value of the trade is $350 x 100 = $35,000. With 5:1 leverage, you need $7,000 as margin.

Over the next few days, the tech sector performs well, and QQQ increases to $380 per contract.

You decide to close your CFD position when QQQ reaches $380.

Profit calculation:

Opening price: $350

Closing price: $380

Price difference: $380 - $350 = $30

Total profit: $30 x 100 shares = $3,000

Result: You made a profit of $3,000 on your CFD trade, minus any broker fees or overnight financing costs.

However, if the price fell by $30 instead of rose, the calculation would be as follows:

Loss calculation:

Opening price: $350

Closing price: $320

Price difference: $320 - $350 = $-30

Total loss: $30 x 100 shares = $3,000

Result: You made a loss of $3,000 on your CFD trade, minus any broker fees or overnight financing costs.

Take a look at our trading guides for more on the strategies to consider in the markets.

Create an account Open a demo account

FAQs

What are ETFs?

ETFs are instruments that comprise a basket of assets, such as commodities, shares or currency pairs. The ETFs themselves can be bought, meaning you can have a stake in the constituent assets and enjoy potential benefits such as dividends. They can also be traded with CFDs, meaning that you can go short on the instrument as well as long. CFDs also typically enable leveraged trading, meaning you can have exposure to a large position with a relatively small outlay. Leveraged trading amplifies both profits and losses, making it risky.

What are the most popular ETFs?

Three of the most popular ETFs to trade are the SPDR S&P 500 ETF (SPY), which tracks the US 500 index, representing 500 of the largest publicly traded companies in the US. In commodities, the SPDR Gold Shares (GLD) tracks the price of gold bullion, offering a way to invest in gold without holding the physical commodity. And iShares MSCI Emerging Markets ETF (EEM) tracks the MSCI Emerging Markets index, providing exposure to a diverse range of emerging market equities.

How do ETFs make money?

ETFs make money through capital appreciation (buy low, sell high), dividends from stocks, and interest from bonds. These earnings are passed to investors. Additionally, authorised participants use arbitrage to keep ETF prices aligned with their net asset value, ensuring fair market pricing.

ETF vs mutual funds, what’s the difference?

ETFs trade on exchanges with fluctuating prices and are usually passively managed. They have lower fees, higher tax efficiency, no minimum investment, and manual dividend reinvestment. Mutual funds trade at day’s end net asset value, can be actively managed, have higher fees, possible minimums, and automatic dividend reinvestment options.