New Zealand dollar forecast: NZD rallies but will Kiwi’s resurgence last?

What’s next for the New Zealand dollar? Read on for some of the latest analyst forecasts.

The New Zealand dollar (NZD) has seen a resurgence since falling to an over two-and-a-half year low against the US dollar (USD) in early October 2022.

On 2 November 2022, NZD was on track to post three straight weeks of gains against the greenback. The currency has also emerged as a top gainer among G10 currencies in recent weeks.

In this article, we look at the factors that have helped the New Zealand currency, also known as the Kiwi, gain against the USD (NZD/USD) and some of the analysts’ latest NZD predictions.

What is the New Zealand dollar?

The New Zealand dollar is the official currency and legal tender of New Zealand. The currency is also used in Cook Islands, Niue, Tokelau and the Pitcairn Islands. It was first issued by the Reserve Bank of New Zealand (RBNZ) in 1967, replacing the New Zealand pounds, shillings and pence system.

It was nicknamed the ‘kiwi’ due to the appearance of the country’s native bird on the nation’s bank notes.

According to the Triennial Central Bank Survey by the Bank for International Settlements (BIS) published in October 2022, the New Zealand dollar is the 14th most-traded currency in the world.

What drives the NZD value?

New Zealand’s interest rate outlook and interest rate differentials between other economies are key drivers for NZD rates on foreign exchange (forex) markets.

According to the RBNZ, the nation has employed nearly every form of exchange rate regime. Between 1973-1984, the NZD followed a fixed exchange rate period when the Kiwi was pegged to the US dollar at a specific rate. Today, the RBNZ uses an inflation-targeting regime to maintain currency stability.

International trade is another important driver for the kiwi, accounting for nearly 25% of New Zealand’s gross domestic product (GDP) between 2019 and 2021. According to the World Trade Organisation (WTO), China ranked as New Zealand’s top export destination, accounting for over 31% of the nation’s exports in 2021, followed by Australia, US, Japan and the European Union (EU).

Agricultural products accounted for 75% of New Zealand’s exports, with milk and cream, meat, butter and fruits among the top exported items. The nation posted a current account deficit in 2021, with automobile and petroleum as its top imported items.

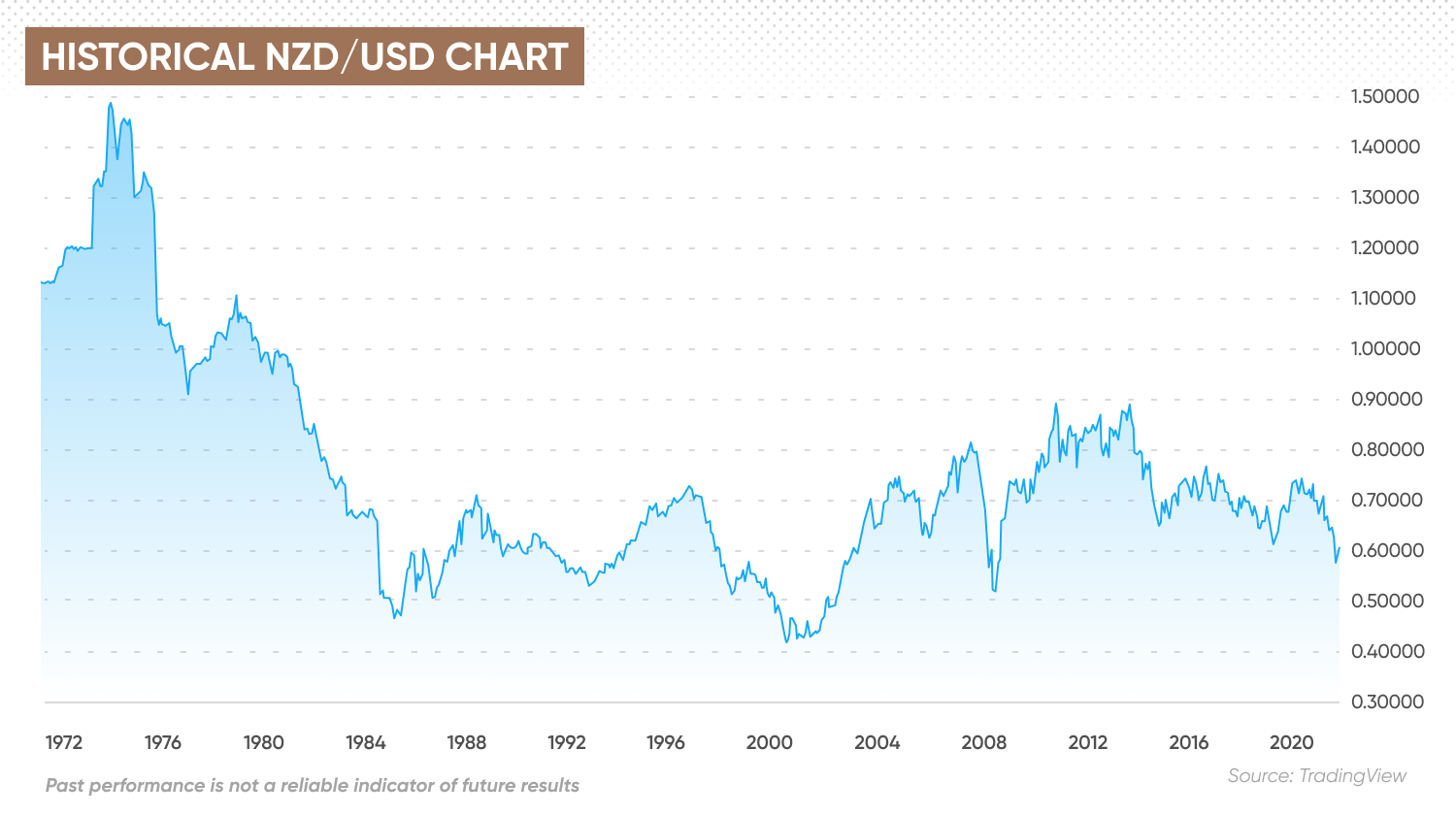

Historical NZD performance: A story of many ups and downs

According to the NZD/USD historical data, the New Zealand dollar was valued higher than the US dollar in the 1970s. It was during a period of economic turmoil in the US when President Richard Nixon broke the Bretton Woods system which ended the US dollar convertibility to gold in 1971. The NZD/USD exchange rate rose to an all-time high of 1.49 in October 1973.

Two years later, the NZD fell to trade close to parity with the USD.

By the turn of the new millennium in October 2000, the kiwi had dropped to an all-time low, hitting 0.39 against the greenback.

Since then, the NZD has experienced cycles of rises and falls against the USD. In March 2009, the NZD/USD rate hit a multi-year low of 0.489. By August 2011, it surged to 0.884, its highest since 1981.

The pair fell to a low of 0.546 during the onset of the Covid-19 pandemic in March 2020, and tested this support level in October 2022.

Recent NZD price action: Rate hike outlook dominates

In 2022, the global monetary tightening cycle has emerged as the biggest driver of foreign exchange rate fluctuations. The NZD has mirrored similar weakness, as showcased by its global peers against USD during the year. On 13 October 2022, NZD/USD rates fell to 0.5512 – its lowest since March 2020.

The US Federal Reserve’s (Fed) aggressive rate hikes and capital flight towards safe-havens like the US dollar has propelled the US Dollar Index (DXY), which tracks the performance of USD against a basket of major currencies, to a 20-year high in September 2022.

More recently, the US dollar has seen “one of its deepest corrections of the year” on bets of a smaller-than-expected rate hike in November and December by the Fed. As a result, the NZD posted its best monthly performance of the year against the USD – the NZD/USD gained 3.9% in October.

The RBNZ’s October rate hike, which lifted interest rates in New Zealand to a seven-year high of 3.5%, has also supported the NZD’s rebound.

The RBNZ is expected to maintain its rate hike pace as inflation in the country trended at a 30-year high of 7.2%. The central bank’s target in the second quarter of 2022 came in above the target range of 1% to 3%.

After conducting its sixth rate hike of the year on 5 October 2022, the RBNZ said:

Daniela Hathorne, senior analyst at Capital.com, noted:

As of 2 November 2022, the NZD/USD was on track to post three straight weeks of gains at 0.586. However, year-to-date, the pair’s rate is still 14% lower.

Year-to-date, the New Zealand dollar has slipped over 1% against the euro (EUR/NZD) and lost about 3% against the Australian dollar (AUD/NZD). It has shown resilience against some other major world currencies, gaining about 9.9% against the Japanese yen (NZD/JPY) and nearly 1% against the British pound (GBP/NZD).

New Zealand dollar forecast for 2022 and beyond: Expert commentary

-

NZD/USD forecast

Hathorne said that the Kiwi is “well-positioned to continue challenging the USD”, adding:

Westpac Institutional Bank forecast NZD/USD rates to trend at 0.58 in December 2022, 0.65 in December 2023 and 0.66 in June 2024.

ASB Economics & Research said in its NZD forecast on 1 November 2022: “With the FOMC (Federal Open Market Committee) in hiking mode, NZD topside is limited, and NZD resistance of 0.5870 is unlikely to be broken given the global risk profile, the weak yuan backdrop”.

Trading Economics saw the kiwi trading at 0.54 against the greenback in 12 months from 2 November 2022. The data firm did not share New Zealand dollar forecast for 2030.

-

NZD/AUD forecast

Multi-national bank HSBC said in a New Zealand dollar forecast that the AUD is expected to strengthen against the NZD as “Australia’s fundamentals look stronger than New Zealand’s on a relative basis, with fewer hard-landing risks and a stronger current account position.”

The National Bank of Australia saw AUD/NZD rates at 1.14 in December 2022. In its New Zealand dollar forecast for 2025, it said the pair could trade at 1.09 by the end of the year.

Finally, economists at ING THINK said New Zealand’s employment data was a key data to watch out for. As noted on 1 November:

The bottom line

If you are looking for a New Zealand dollar forecast to inform your forex trading, it’s important to remember that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions. As such, analysts can and do get their predictions wrong.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Is NZD going up or down?

The direction of the New Zealand dollar will depend on a number of factors, including the outlook for the nation’s economy and the RBNZ’s decisions on the rate hikes.

Will the New Zealand dollar get stronger in 2023?

Whether the New Zealand dollar could get stronger in 2023 will depend on a number of factors, including the outlook for the nation’s economy, international trade and the RBNZ’s decisions on the rate hikes.

Is it a good time to buy New Zealand dollars?

Whether now is the good time to buy NZD depends on your personal circumstances, risk tolerance and how much you intend to invest. You should do your own research to develop a view of the currency as an investment. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.