Wall Street hits record highs ahead of FOMC decision and Magnificent Seven results

Wall Street hits fresh record highs as investors prepare for an FOMC decision and major tech company earnings.

The markets have a massive wall of event risk to scale this week and a flood of news overnight added to the deluge of information market participants have to tackle and discount. To this point though, it's all largely positive. The US has said that the trade deal likely to be signed by it and China tomorrow will include a cut to tariffs, specifically that related to fentanyl, as well as cuts to shipping levies. The boom in the US tech industry also appears to be expanding unabated, with Nvidia CEO Jensen Huang hosing down fears of an AI bubble while also inking agreements with Palantir and Nokia. Microsoft also pledged to take a greater stake in Open AI. The result was another record high on Wall Street, heading into tomorrow's FOMC decision and a big 48 hours of Magnificent Seven earnings.

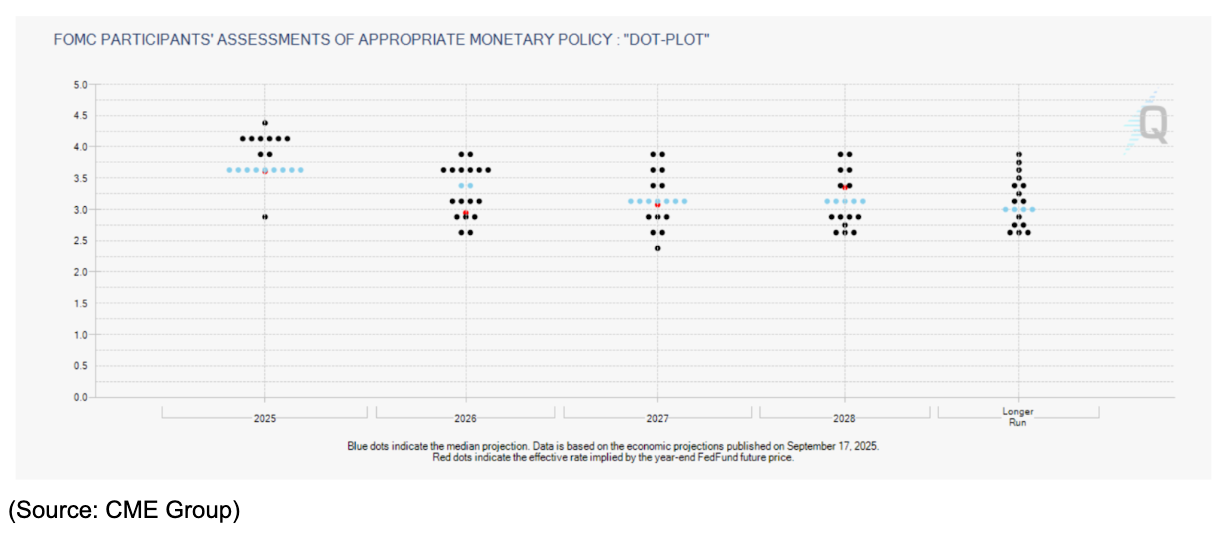

The markets focus on Powell’s presser with rate cut baked-in

The FOMC is all but certain to cut interest rates at this meeting, with the markets pricing in a near 100% implied probability. It's also expected to be a humdrum event, with the implied move for the S&P500 tomorrow barely 1%. That's low for a Fed day but similar to what was discounted and transpired at the central bank's last decision. There's no updated forecasts at this meeting, so the interest is in the guidance provided by Chairperson Jerome Powell at his press conference. A lot of dovishness is baked into the curve, with a cut in December almost fully discounted and a Federal Funds Rate of sub 3% implied for next year. Anything that upsets that pricing could lead to volatility. However, with the Fed focussed on the labour market side of its mandate, despite sticky inflation, not to mention a vacuum of data because of the US Government shut down, Chair Powell may play a straight bat. That means not validating the market's pricing, but not pushing back on it either.

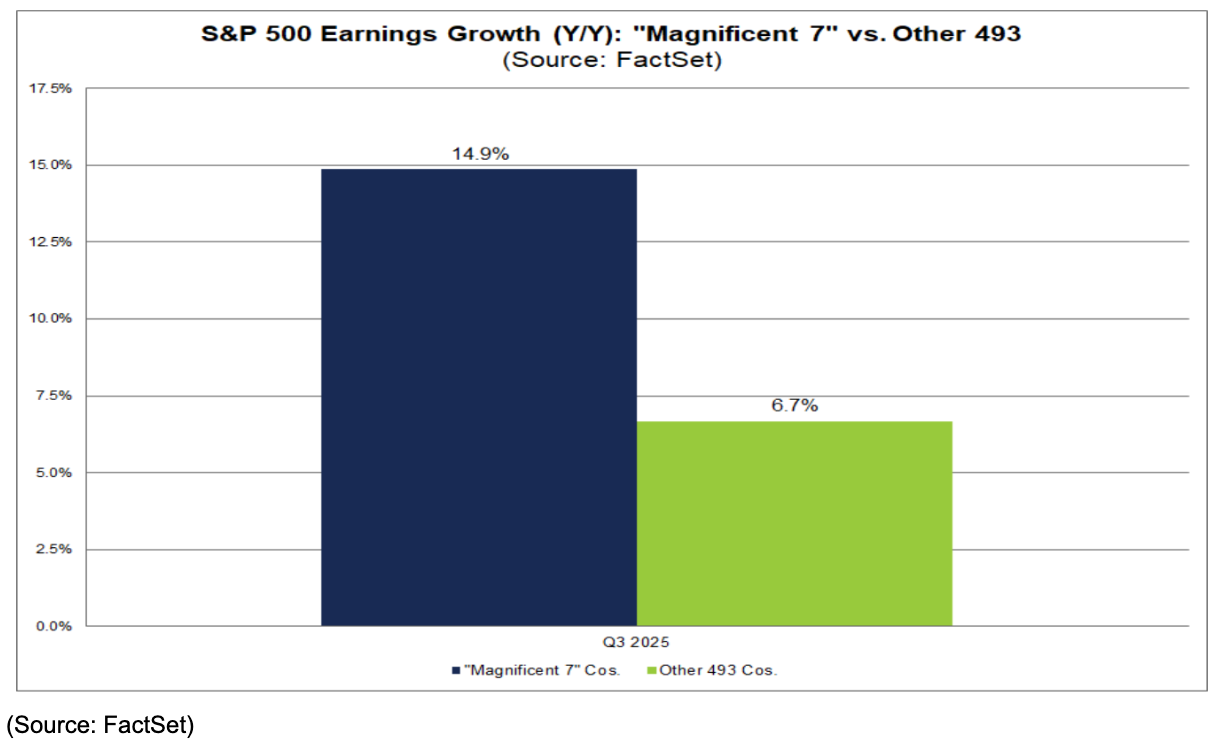

Magnificent Seven stocks surge going into earnings

A gauge of Magnificent Seven stocks lifted 1.3% overnight, with Apple rising to the status of a $US4 trillion company. The cohort confronts a high bar to exceed again this quarter, with analysts projecting earnings growth in the realm of 15%. However, that's a similar estimate to previous quarters, which the group managed to smash: last quarter, the Magnificent Seven delivered earnings growth of about 27%. Alphabet, Microsoft and Meta report tomorrow, with Apple and Amazon the day after. Although each has their own stories to tell and sell, the common thread will be about AI monetisation and future CAPEX plans. Investors are looking at how the firms balance both to sustain earnings and an adequate return on investment going forward.