US Earnings Season : JP Morgan, Citigroup, Wells Fargo

The first major US banks report quarterly earnings on Friday, April 12th, 2024. We preview what to expect from JP Morgan, Citigroup, and Wells Fargo's quarterly numbers.

The price information and economic data in this article are sourced from Bloomberg and nasdaq.com

The first major US banks report quarterly earnings on Friday, April 12th, 2024. We preview what to expect from JP Morgan, Citigroup, and Wells Fargo's quarterly numbers.

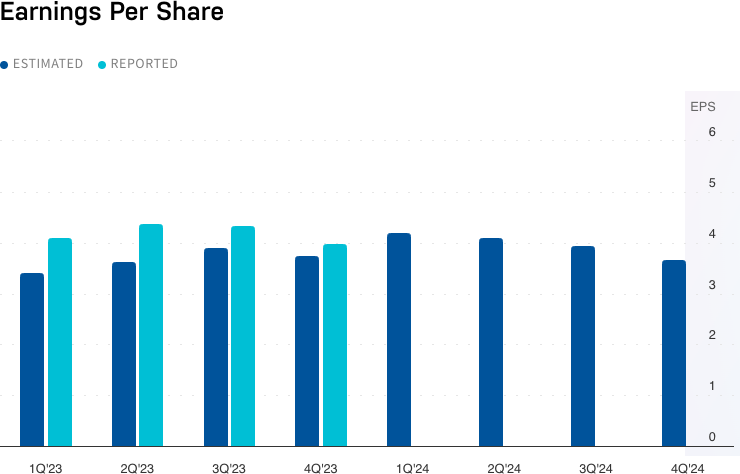

JP Morgan (JPM)

According to Bloomberg data, JP Morgan’s EPS is expected to rise 2% year over year in Q1 to $4.18 per share. The increase in earnings is forecast to be underpinned by a 6% lift in revenues, driven primarily by card growth.

(source: nasdaq)

However, net interest margins are expected to fall, driven by higher costs as operating expenses rise and the diminished impact of strong economic activity and interest rate increases.

Provisions are also tipped to rise due to cyclical and seasonal factors, while exposure to commercial interest rates, both from a cash flow and balance sheet perspective, could be key risks for market participants.

Comments from the bank, especially CEO Jamie Dimon, about the outlook for its financial performance and the US economy might drive expectations for future growth for JP Morgan.

(Past performance is not a reliable indicator of future results)

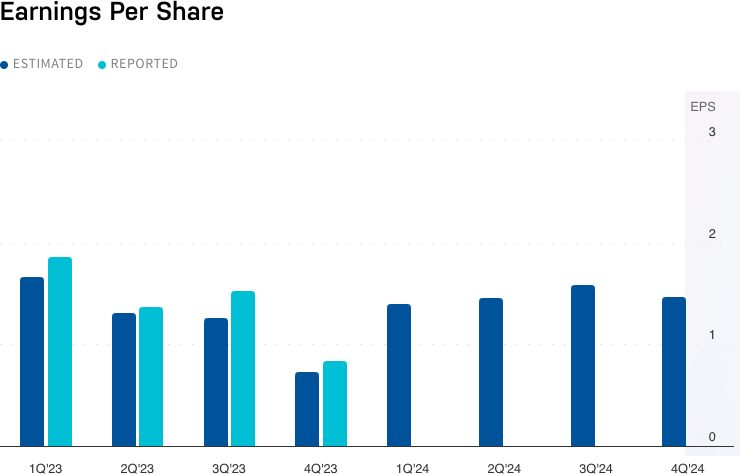

Citigroup (C)

According to Bloomberg data, Citigroup’s Q1 results will be driven by credit card revenue and investment banking fee growth and offset softening in trading revenue. EPS is tipped to fall 32% from the corresponding period a year ago to $1.27 per share.

Higher operating costs related to a restructuring during the quarter are likely to impact profits. However, net interest margins are forecast to show resilience, with NIM only projected to dip by two points to 2.44%.

Higher operating costs related to a restructuring during the quarter are likely to impact profits. However, net interest margins are forecast to show resilience, with NIM only projected to dip by two points to 2.44%.

The quantity of provisions set aside by Citigroup will be closely watched by market participants, with forecasters estimating the sum to reach $2.6 billion.

(Past performance is not a reliable indicator of future results)

(Past performance is not a reliable indicator of future results)

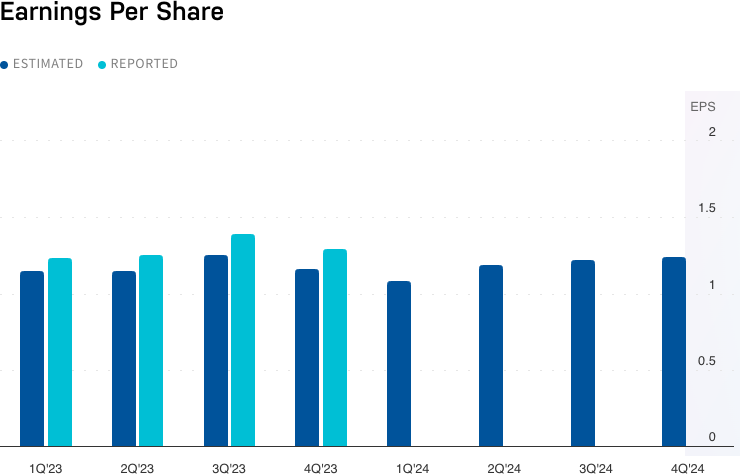

Wells Fargo (WFC)

Wells Fargo is highly sensitive to retail banking and commercial real estate, with the bank’s 1Q earnings expected to be hit by softness in both segments. According to Bloomberg data, analysts expect EPS to decline to $1.08 per share on a 3% drop in revenues.

Loan growth is expected to stall from a quarter ago a dip of 1%, while deposits are projected to remain nominally unchanged. Mortgage income is also expected to decline. Meanwhile, net interest margins are forecast to drop eight basis points to 2.84%.

Loan growth is expected to stall from a quarter ago a dip of 1%, while deposits are projected to remain nominally unchanged. Mortgage income is also expected to decline. Meanwhile, net interest margins are forecast to drop eight basis points to 2.84%.

Market participants will focus on commercial real estate exposure in Wells Fargo’s quarterly results, as heavy exposure to the market risks the health of the bank’s balance sheet. Provisions will also be in focus amid expectations of deteriorating credit conditions. (Past performance is not a reliable indicator of future results)

(Past performance is not a reliable indicator of future results)

The price information and economic data in this article are sourced from Bloomberg