Trade uncertainty caps AUD/USD upside heading into Australian CPI Indicator

AUD/USD Outlook: Trade Uncertainty Limits Gains Ahead of Australian CPI.

The AUD/USD is struggling to gain upward momentum, despite a broadly weaker US Dollar, with trade uncertainty and its expected impact on global growth weighing on the pair. Although it’s of secondary importance in the short-term as markets await the US Department of Commerce’s review into US trade relations, this week’s CPI Indicator will help inform RBA policy expectations and what capacity the central bank may have to cut rates again.

Forecasters do not provide comprehensive estimates for the CPI Indicator. The headline figure is tipped to remain steady from a month earlier at 2.5%. However, there is no consensus estimate published for the more important trimmed mean CPI, which strips out volatility items and is the RBA’s preferred measure of underlying inflation. Last month’s CPI indicator revealed that inflation likely dropped to 2.8% and within the RBA’s target band, raising the prospect of further rate cuts from the central bank.

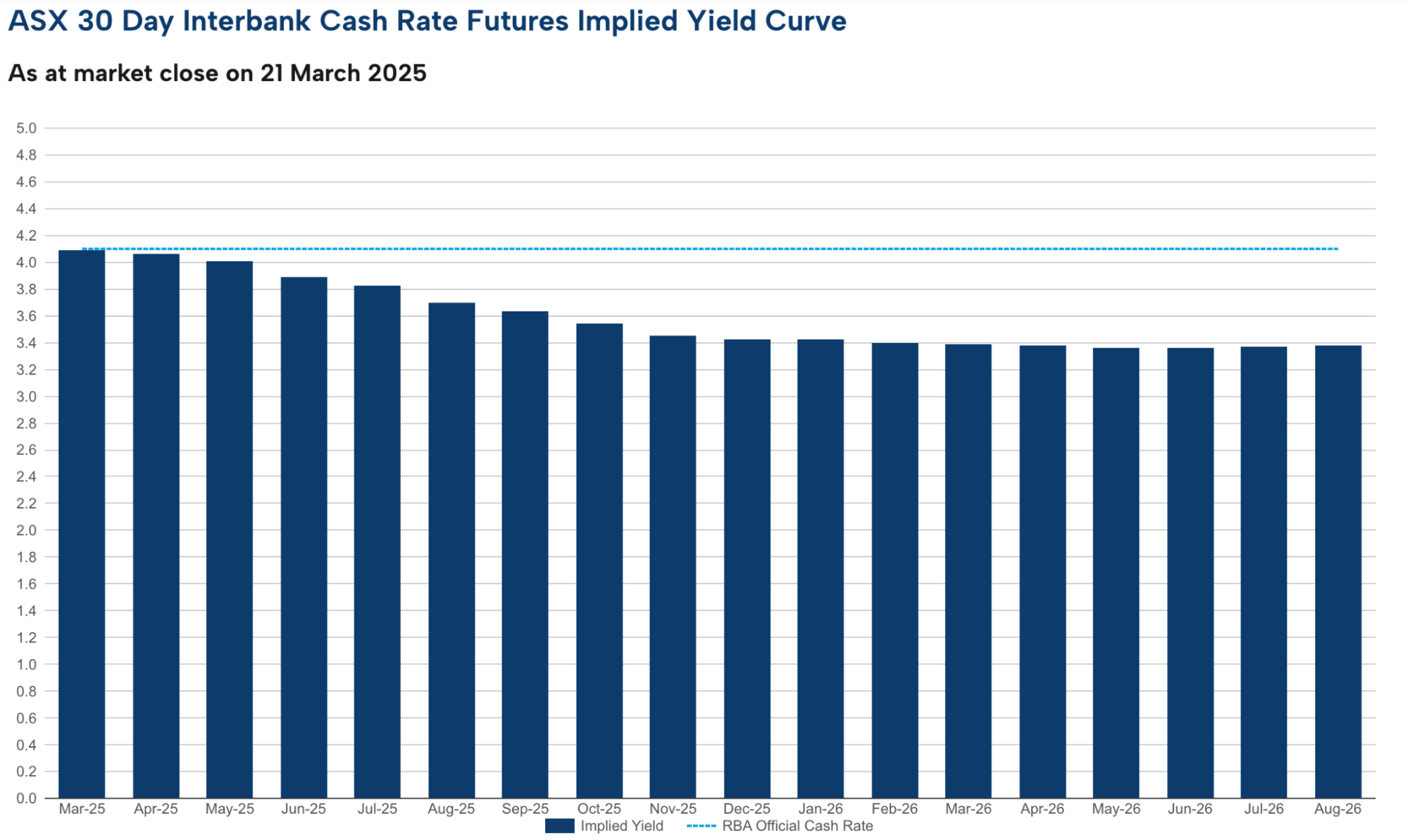

The markets continue to bet that the RBA will probably cut interest rates again in May – interest rate markets imply a cut is a roughly 75% chance. However, it relies on the official quarterly CPI data, which is released at the end April, showing inflation is within the target range and continuing the trajectory forecast in the RBA’s February Statement on Monetary Policy. The markets will be assessing the CPI indicator for signals that prices are trending in this direction.

(Source: ASX)

The AUD/USD remains in a primary downtrend with its next move primarily dependent on developments in US trade policy. The pair could experience some volatility around the CPI indicator, with an upside surprise potentially strengthening the pair and a downside surprise weakening it. The 20-DMA stands out as the most immediate level of technical resistance. Meanwhile, minor support appears to be between 0.6260 and 0.6270.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)