RBNZ tipped to cut rates by 50bp in first meeting of 2025

The Reserve Bank of New Zealand meets for the first time in 2025 on Wednesday 19th of February, with market pricing suggesting it is all but certain the central bank cuts rates.

Joblessness rises as New Zealand economy falls into recession

New Zealand's GDP decreased by 1.0% in the third quarter of 2024, marking the second consecutive quarter of negative growth and signaling a technical recession. On an annual basis, GDP growth was a modest 0.1% for the year ending September 2024, underscoring the broader economic slowdown.

The labor market has also experienced a downturn, with the unemployment rate increasing to 5.1% in the December 2024 quarter, up from 4.8% in the previous quarter. This marks the highest unemployment rate since September 2020.

New Zealand Inflation remains within target band, markets imply 50 basis point cut

Inflationary pressures have eased in New Zealand, with headline CPI increasing by 2.2% in the fourth quarter of 2024. This rate falls within the RBNZ's target range of 1–3% and suggests that previous inflationary risks are subsiding. The moderation in both headline and core inflation provides the central bank scope to ease policy as it looks to buffer the economy from weaker growth.

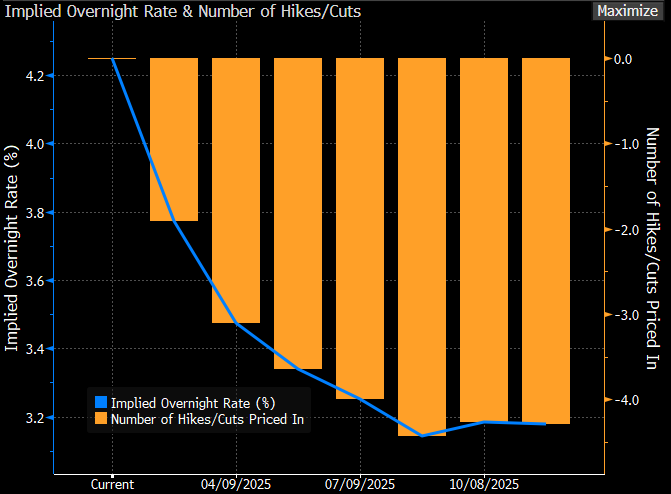

Financial markets are responding to these economic developments by adjusting their expectations for monetary policy. Current swap market pricing indicates a high probability of a 50 basis point reduction in the Official Cash Rate (OCR), potentially lowering it from 4.25% to 3.75%. The central bank’s last projections forecast 100 basis points by the end of 2025, with the 110 basis points of cuts baked into the swaps curve suggesting markets expect a downward revision to this guidance.

(Source: Bloomberg)

NZD/USD rising despite looming RBNZ rate cut

The NZD/USD is drifting higher despite the prospect of a 50 basis point rate cut from the RBNZ. Softer US economic data along with hopes the globe will avoid an all out trade war has seen the pair drift to year-to-date highs. The RBNZ has a history of shocking the markets. Although it’s unlikely to hold rates steady, a smaller 25 basis point move could see the NZD/USD surge higher, while unchanged guidance could also see the pair edge higher. The 0.5750 level looms as a critical point of resistance.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)