Market Analysis: UK economy rebounds in November – how does that impact rate cut expectations?

Market Analysis: UK economy rebounds in November – how does that impact rate cut expectations?

The UK economy recovered in November as evidenced by the 0.3% growth in GDP in the month. The reading came in higher than the 0.2% expected but it doesn’t remove the risk of a technical recession in the last quarter of 2023 as October saw a 0.3% contraction in GDP, following a marginal contraction in the third quarter. Grant Fitzner, chief economist at the ONS, said the rebound in GDP had been “led by services with retail, car leasing and computer games companies all having a buoyant month”.

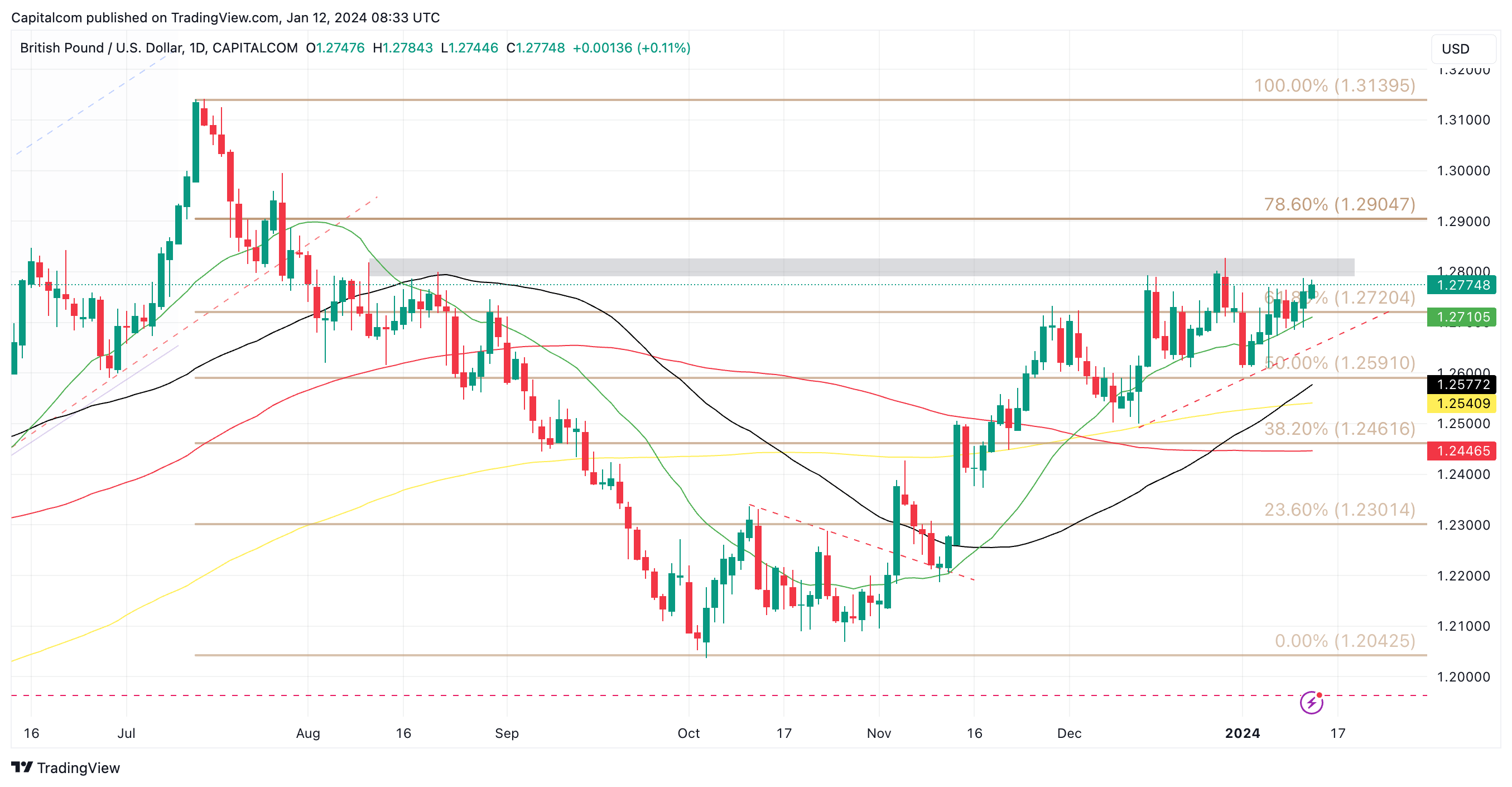

The upbeat data has kept the bullish momentum going in the pound but has failed to induce any significant moves. GBP/USD is slowly building higher in an attempt to gather the strength to break above 1.28. the pair has been showing good resilience in recent weeks despite the US dollar’s rebound on the back of markets unwinding some of the odds of a rate cut in March. Thursday’s stronger US CPI data has failed to reignite a bullish rally in USD as a deviation of the recent downtrend was already expected, and the prior stronger-than-forecasted US jobs data has already done its part in pricing out some of the rate cut expectations. Technically, GBP/USD has a good amount of support within its current uptrend so it seems likely that the bullish bias will remain in the short term. Increased resistance is likely to appear between 1.2792 and 1.2827.

GBP/USD daily chart

Past Performance is not a reliable indicator of future results.

Past Performance is not a reliable indicator of future results.

-

Expectations regarding rate cuts continue to shift

In a similar fashion to what is happening in the US and the UK, the latest economic data seems to be causing more confusion than providing clarity. The market mentality around monetary policy shifted noticeably in the last quarter of 2023 as central banks started to acknowledge that their policies had become sufficiently restrictive and were working effectively to reduce inflation. At this point, all of the attention shifted towards attempting to decipher when each central bank would start cutting rates, and by how much. Growth and inflation had been softening conveniently over the past few months, feeding into the “rate cut rhetoric” meaning most market expectations were aligned.

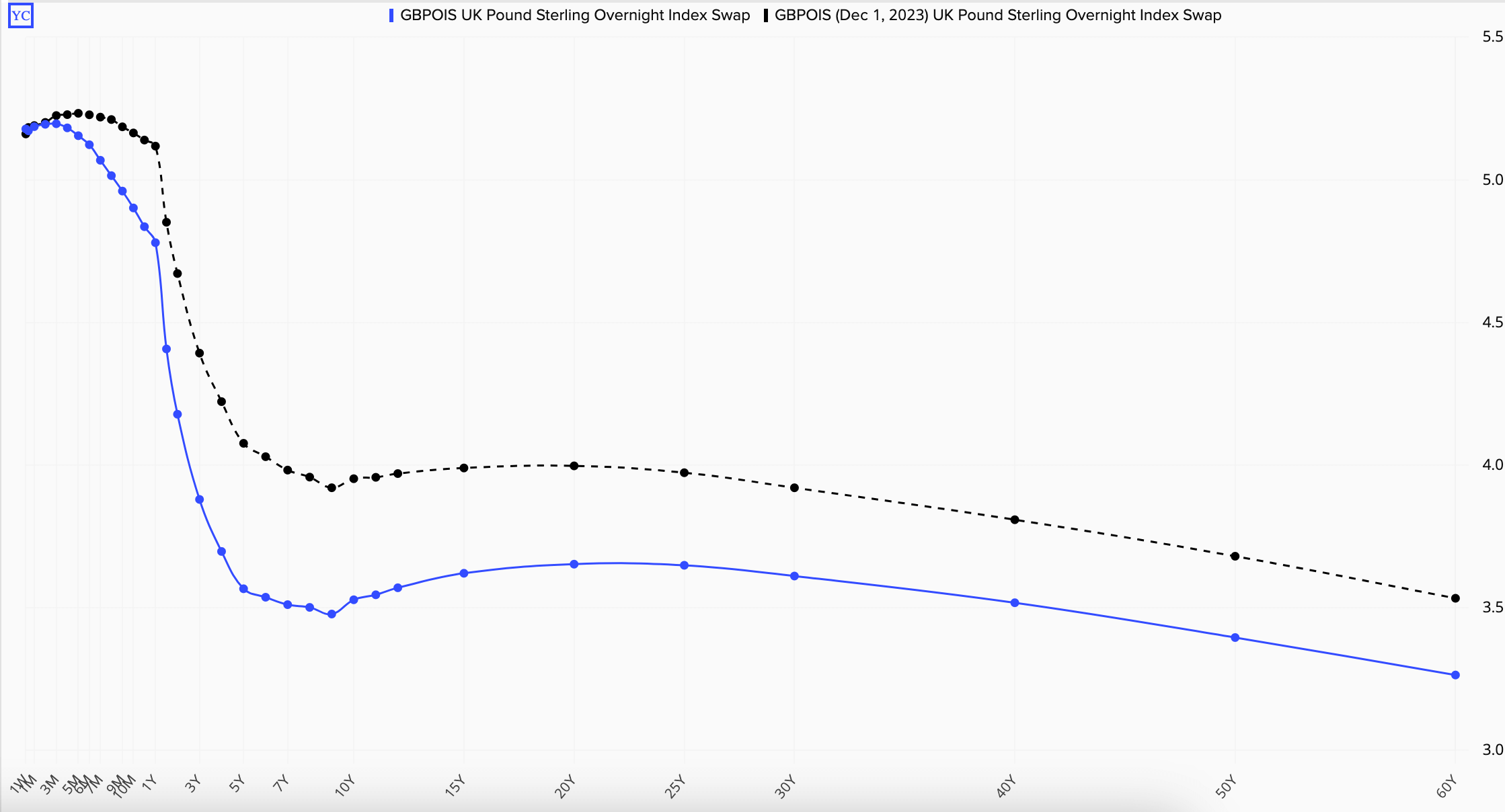

The chart below shows how the overnight swaps have changed since December 1st highlighting the shift in expectations towards a looser monetary policy starting this quarter.

GBPOIS current (blue line) vs 1st December (black line)

Source: refinitiv

Source: refinitiv

Past Performance is not a reliable indicator of future results.

But the latest data across the US, UK and Eurozone has thrown a spanner in the works of the dovish hopefuls. This is not uncommon – after all, we know that economies hardly ever follow a straight line – but traders seem to be slightly unsure as to how to position themselves going forward. Consumer prices have risen in December in both the euro area and the US, highlighting the non-linearity of the disinflation process. We’ll have to wait until next Wednesday to get the latest CPI reading in the UK, but so far data provided by Reuters suggests expectations are for the downward trend in consumer prices to continue in the UK, dropping from 3.9% in November to 3.8% in December. If so, the markets could start to price in higher chances of a rate cut in March from the BoE, which could weigh on the pound as it worsens its carry trade potential. Regardless, markets will likely be cautious until further insight from BoE speakers can be obtained.