Japanese markets shudder ahead of BOJ decision and upcoming election

A looming election and a BOJ decision has rattled Japanese financial markets

Bank of Japan monetary policy and Japanese political uncertainty ripple through Japanese and global financial markets.

Interest rate and fiscal policy uncertainty lifts volatility

Japanese markets have experienced a triple whammy this week. Rising geopolitical and trade tensions between the US and European Union has shaken market sentiment globally. Meanwhile, a Bank of Japan decision on the 23rd of January looms and the Japanese parliament will also be dissolved on the same day heading into a snap election next month. The dynamic is stoking uncertainty about monetary and fiscal policy settings and reverberating through stocks, bonds and the Japanese Yen.

The political uncertainty in Japan is currently the largest risk. Japan’s Prime Minister Sanae Takaichi, riding a wave of popularity, has called an election to secure a strong public mandate for her fiscal and defence strategies. The policies would entail significant deficit spending, adding to Japan’s hefty public debt burden and putting upward pressure on inflation at a time where price growth remains above the Bank of Japan’s target.

To this point, the Bank of Japan has been permissive of above target inflation. Although it has lifted rates, by its own admission, it has kept policy in accommodative territory. It has also avoided taking a more hawkish stance on policy even as upside risks to prices from loose fiscal policy build. Recent communications suggest that the central bank is trying to guide the market to an earlier than expected hike, potentially in April. For now, the markets are baking-in the next move won’t come until July.

This week’s Bank of Japan meeting is all but certain to see policy kept unchanged. However, the markets will be focussing on the guidance regarding future policy and an updated set of economic forecasts. There’s a building expectation that the BOJ will revise higher growth and inflation projections, a move that would help build the case for sooner rate hikes.

Nikkei, bonds and Yen fall as policy uncertainty increases

Heightened political uncertainty compounded by the prospect of even greater deficit spending in Japan and accommodative Bank of Japan policy has rattled Japanese markets. The greater inflationary risks stemming from more fiscal stimulus and low interest rates coupled with the subsequent higher JGB issuance to fund the spending has pushed down bond prices and the Yen. Meanwhile, the Nikkei, which had benefitted from the prospect of very loose policy settings, has fallen amid the political uncertainty, higher bond yields and rising global trade tensions.

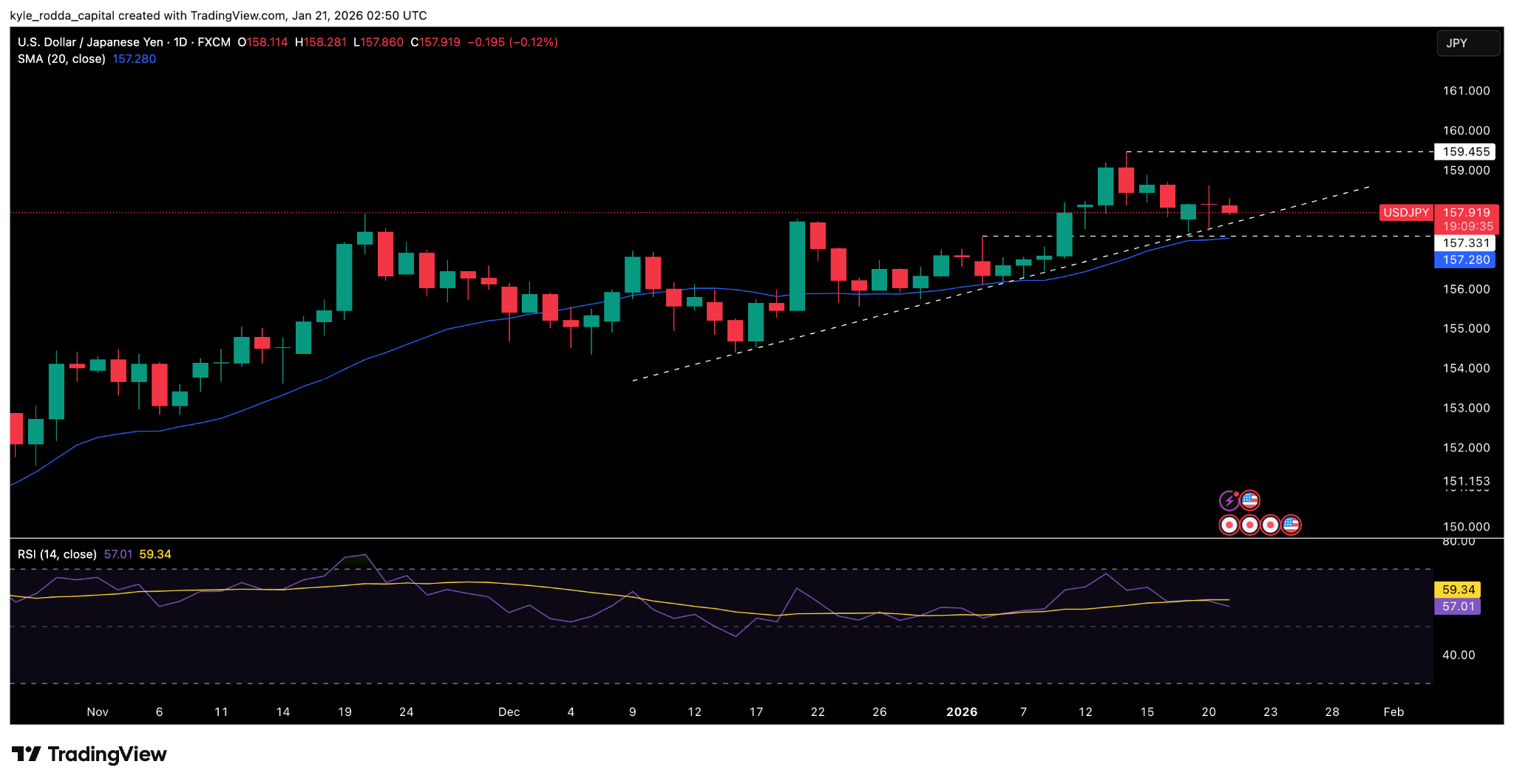

The depreciation in the Yen is increasing speculation about possible intervention in the currency markets by the Ministry of Finance. The urgency has diminished with a broad-based weakening of the US Dollar following tariff threats made by the US against some European economies. The uptrend for the USDJPY remains intact, however. Short-term resistance appears to be around 159.45, while a confluence of support levels has emerged around 157.30. Short-term upward sloping trendline support will also be closely watched by traders to determine the pair’s directional bias in the immediate future.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)