GBP/USD drops to five-month low as dovish BoE and weak retail sales weigh on GBP

Weak economic data and dovish comments from BoE speakers weigh on GBP/USD as geopolitical risks continue to favour USD

Investors have been flocking to safe assets recently as tensions in the Middle East have escalated with two-way retaliatory attacks between Israel and Iran in the past few weeks. This has meant the bullish momentum has been building in the US dollar, weighing on most other major currencies.

GBP/USD has been caught in the crossfire but the weakening fundamentals in the UK have also helped increase the downside pressure on the pair. Last Friday’s UK retail sales were the latest in a lengthy list of indicators highlighting the weakness in the economy. There was no growth in sales numbers in March, and when excluding fuel sales, the number was down 0.3% from the previous month.

Meanwhile, wages continue to grow, putting upside pressure on domestic inflation. This combination of weaker growth and stubborn inflation is causing investors to become concerned about the Bank of England’s ability to adjust its monetary policy successfully over the coming months. Markets are currently pricing in two 25bps rate cuts in 2024, 10 basis points more than Friday before the retail sales data was released and several BoE speakers offered their latest insights. The first cut is now fully priced in for August, up from September a few days ago.

This highlights that investors remain focused on the latest economic data to try and determine when the BoE may be forced to start easing its restrictive policy. The rate differentials between different central banks continue to be a key driver of FX markets, and markets are currently pricing in a higher chance that the BoE will cut rates before the Federal Reserve, which will likely continue to exert bearish pressure on GBP/USD.

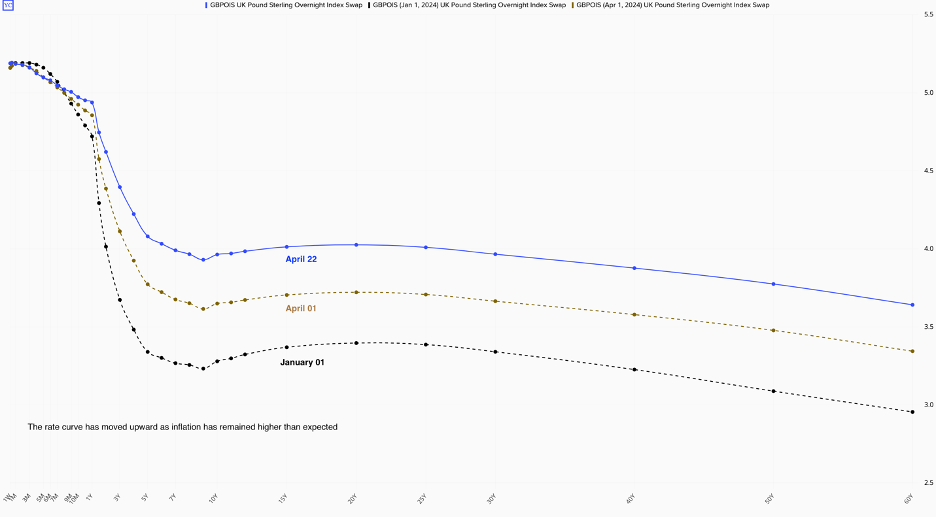

It seems like even the most hawkish members of the BoE are starting to turn. MPC member Dave Ramsden said on Friday that whilst there were expected to be bumps in the disinflation process, the balance of domestic risks to the outlook for UK inflation is now tilted to the downside. He added that he has become more confident in the evidence that risks to persistence in domestic inflation pressures are receding, forecasting that CPI in April will drop sharply, close to the 2% target. When talking about market pricing, he said the bank would consider the forex implications for inflation. Still, he highlighted that markets seemed to be more worried about the persistence of UK inflation given the curve had moved upward in recent weeks.

GBP OIS shift between January 1st and April 22nd

Source: refinitiv - Past performance is not a reliable indicator of future results.

Source: refinitiv - Past performance is not a reliable indicator of future results.

Technically, GBP/USD looked primed for a reversal in March as it broke through a key technical range around the 1.28 mark. But the pullback has intensified as geopolitical risks have favoured the dollar, helped by stronger US fundamentals when compared to the UK. Ramsden’s comments alongside the weak retail sales data on Friday have led markets to price a 25bps cut in June as a coin flip, weakening the case for GBP even further.

Further downside in GBP/USD is easier to sell than upside right now, so the short-term bias seems set to continue lower for now. The next immediate level of support could be seen as the 1.23 mark, which coincides with the 23.6% Fibonacci from 1.3139 to 1.2036 pullback in the summer of last year. Beyond this level, the space looks open for further downside pressure towards 1.22, at which point there has been increased buying pressure in the past, specifically around 1.2160.

GBP/USD daily chart

Past performance is not a reliable indicator of future results.

Past performance is not a reliable indicator of future results.