GBP latest: UK CPI fails to drop in December, pushing back expectations for rate cuts

GBP latest: UK CPI fails to drop in December, pushing back expectations for rate cuts

By Daniela Sabin Hathorn, senior market analyst at Capital.com

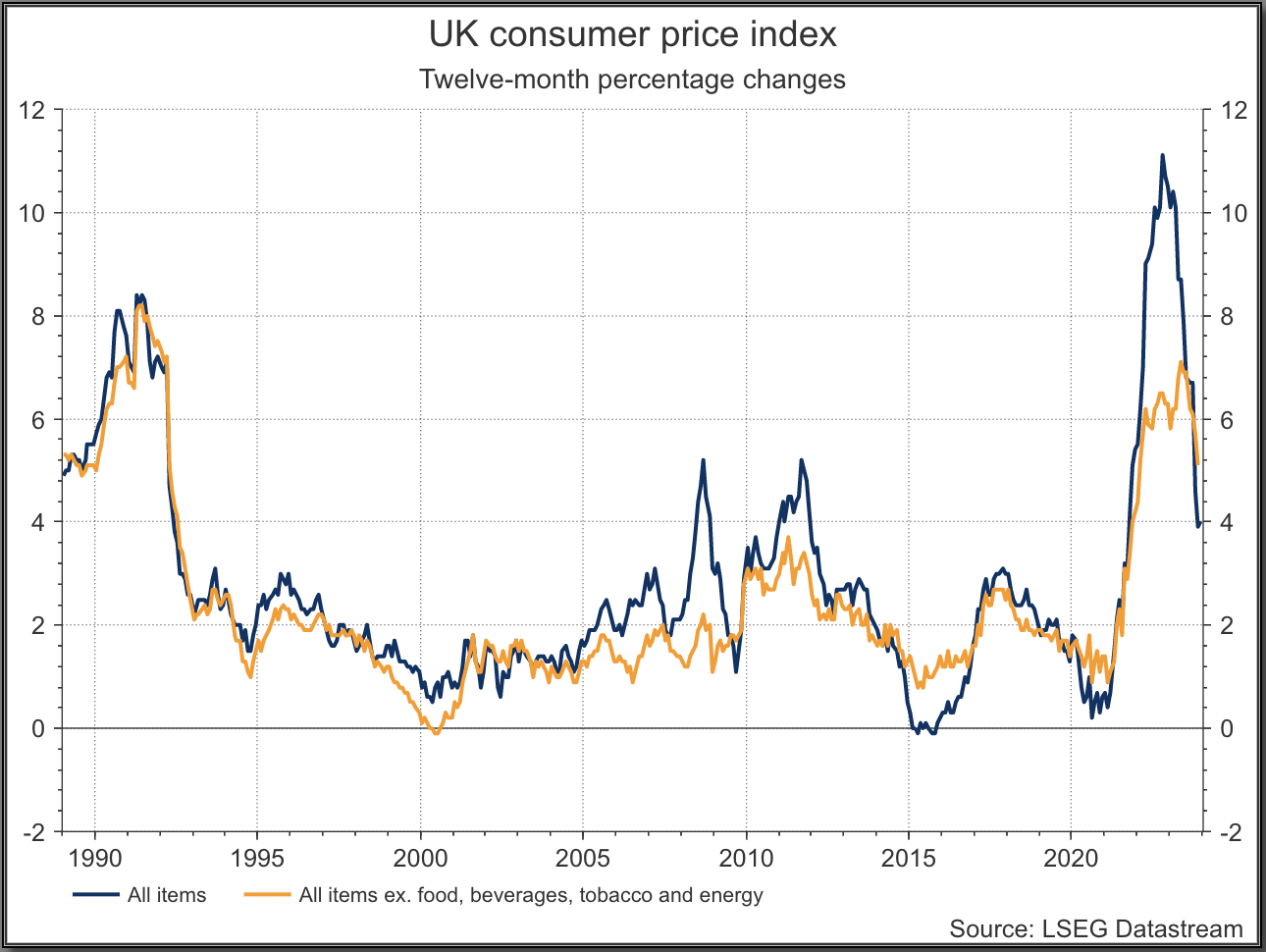

UK consumer prices rose more than expected in December. Headline CPI rose 0.4% in the last month of the year, higher than the 0.2% anticipated. The annual rate rose to 4% from 3.9%, when analysts were hoping for the disinflation process to have continued and dropped to 3.8%. This is the first time the CPI data has come in higher than the previous month since February. Core CPI – which excludes volatile prices like energy and food – rose 0.6% in December, with the annual rate unchanged from the month prior at 5.1%.

Source: refintiv - Past Performance is not a reliable indicator of future results.

As stated on the ONS website, the largest upward contribution to the monthly change in CPI annual rates came from alcohol and tobacco while the largest downward contribution came from food and non-alcoholic beverages. The largest upward contributions in core prices came from travel and transport services.

The rise in prices wasn’t completely unexpected as previous releases from the US and Euro area had shown the same pattern. The reality is that the disinflation process is never linear so it’s not uncommon to see a few months where prices deviate from the downward trend. Comparing the current data to where inflation was a year ago speaks volumes about the progress that has been made in controlling price pressures by controlling borrowing costs. But the last leg of the race is always the hardest, and the same happens with inflation. Achieving the last mile and getting prices back down to the long-term 2% target is going to be challenging, especially for the Bank of England.

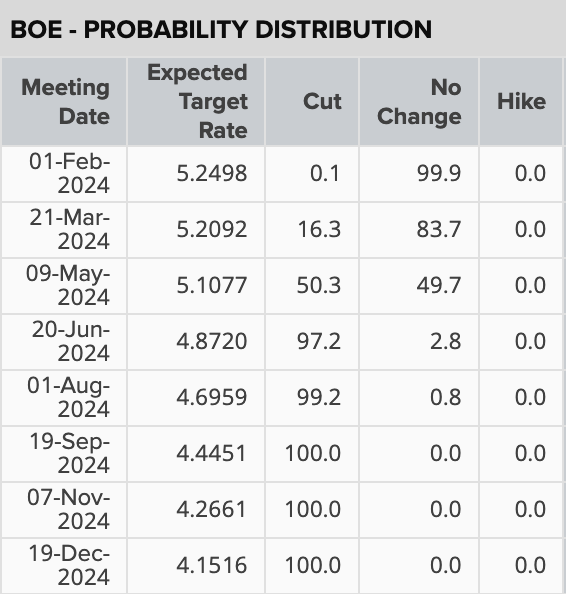

Markets have been focused on trying to price in the next steps in monetary policy and the CPI data released this morning has shifted expectations of rate cuts in 2024, down to 112bps from 130bps, as per data from Reuters. This suggests investors believe the BoE will likely hold off on cutting rates in the immediate future and will likely do so at a slower pace than previously anticipated. Markets are currently pricing in a 50% chance that the first cut will happen in May.

Source: refinitiv

The firmer CPI reading strengthened the Pound on Wednesday morning, allowing GBP/USD to reverse higher after finding support at the 50-day SMA (1.2598). The RSI remains in negative territory and the bullish momentum remains capped by the recent rebound in the US dollar on the back of the Fed’s Waller pushing back on imminent rate cuts. The pair now faces the ascending trend line which was acting as support until Tuesday’s pullback and so far, buyers have been priced out at this level. The softer risk environment favours the dollar but the pound is likely to remain supported in the short term as investors re-price their expectations of a more hawkish BoE after the firmer data.

GBP/USD daily chart

Past Performance is not a reliable indicator of future results.

Meanwhile, away from the influence of the dollar, GBP/JPY continues to break higher. The pair is trading at a seven-week high above 187 as traders favour the pound over the yen in the carry trade. The policy divergence between the BoJ and the BoE is the main driver of the strength in GBP/JPY and this momentum could be expected to continue if both central banks remain on their current course – the BoJ unwilling to firm its monetary policy and the BoE pushing back on the need to loosen theirs just yet.

GBP/JPY daily chart

Past Performance is not a reliable indicator of future results.