EUR/USD, EUR/GBP turn bullish as EU CPI rises in May, but rate cut expectations remain unfazed

Consumer inflation ticked up in May in the Eurozone but markets remain convinced a rate cut is coming on June 6th.

The euro picked up some bids on Friday morning as the preliminary consumer prices reading for May showed hotter-than-expected inflation. EUR/USD has taken advantage of Thursday’s reversal on the back of a weaker dollar to consolidate some further momentum towards 1.0850. Meanwhile, EUR/GBP took the stronger reading as an opportunity to break away from the bearish pattern that had been dominating for the past few days, bouncing from 0.8500 towards 0.8530.

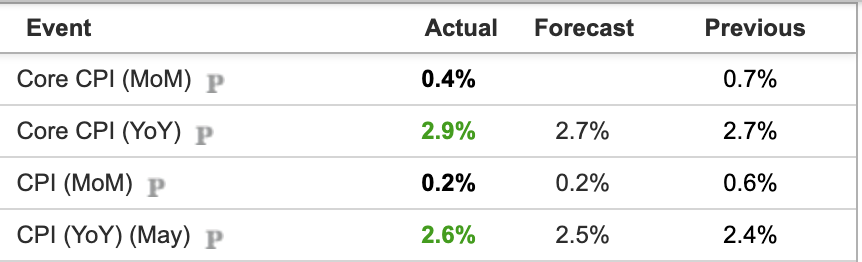

The preliminary data shows both headline and consumer inflation rising from the previous month. Markets had already anticipated a hotter reading but the data actually came in higher than expected. The rise from the month prior shows the disinflation process has stalled, which will likely lead to questions as to whether this is the start of a change in trend or an outlier. The worry will be whether the CPI gets closer to 3% rather than 2% over the coming months.

Source: investing.com

Source: investing.com

The higher reading comes at a time when markets are all but convinced that the European Central Bank will cut rates by 25 basis points at their meeting next Thursday. Funnily enough, the stronger CPI doesn’t seem to have derailed these expectations. In fact, money markets are now pricing in a 94% chance of a cut according to data from Reuters, versus 91% on Thursday.

Commentary from the ECB’s Panetta on Friday morning seemed to give a green light for a rate cut in June. She said that the bank should avoid policy being too restrictive as that could push inflation below the ECB’s symmetrical target but also highlighted that policy would remain restrictive even after a few cuts. This gives the feeling that she is justifying cutting rates in order to avoid economic damage if held for too long at current levels, but also by suggesting that cutting once or twice in the coming months will not make that much of a difference.

It will be interesting to see if we get any further commentary from ECB members before the meeting next week. I believe they have gone somewhat into a blackout phase so we may not get their view on the latest CPI data before the meeting takes place, but if markets are to be taken as a reference, a 25 bps cut is very much likely to happen.

On the charts, both EUR/USD and EUR/GBP are attempting to build the gains after the data release. There seems to be some reluctance in EUR/USD as the pair remains trapped below the high from Thursday. EUR/GBP does have more room to go further given it has been heavily sold off in May. The fact markets expectations about a rate cut in June haven’t really changed despite the higher CPI reading the upside seems to be slightly capped for the euro. The rate differential will be playing against the European currency when compared to the US and the UK.

EUR/GBP daily chart

(Past performance is not a reliable indicator of future results)

(Past performance is not a reliable indicator of future results)