ECB preview: A cut, but how many more?

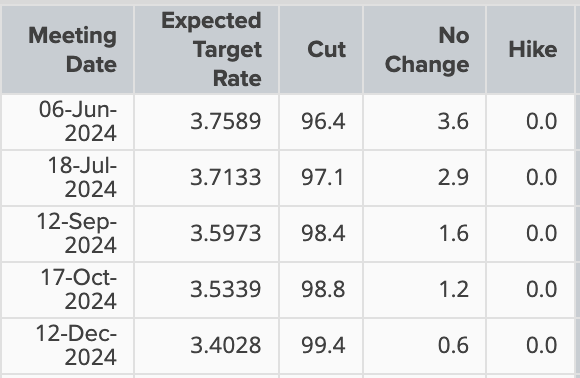

After months of waiting, a rate cut from the ECB on Thursday looks like a done deal. Data from Reuters shows markets pricing in a 96% chance of a 25-basis point cut from the European Central Bank following Thursday’s policy meeting.

All price information and forecast data in this article is sourced from Reuters, FX Street

After months of waiting, a rate cut from the ECB on Thursday looks like a done deal. Data from Reuters shows markets pricing in a 96% chance of a 25-basis point cut from the European Central Bank following Thursday’s policy meeting. The current rate of 4% has been in place since September last year after a 14-month hiking cycle that took rates from -0.5% to the current level.

Market-implied probabilities of a rate cut from the ECB

Source: refinitiv

Markets had been hoping for rate cuts to start earlier in the year, with up to six 25 bps cuts priced in for 2024 at the end of last year. But while resilient economic data and stubborn inflation forced central banks to push back on rate cuts and markets to re-price their expectations, it now seems like the wait is over. Despite higher-than-expected CPI data released on Friday, markets are still banking on a cut from the ECB this week.

Realistically, ECB Governing Council members have talked up a rate cut too much for it not to happen on Thursday. Anything but a cut would be a massive surprise and likely damage the bank’s reputation. In the past, rate cuts have been triggered by a recession but the playing field is very different this time around. The incoming data continues to show resilience in the eurozone economy, with a tight labour market and stable growth. The ECB has no real need to cut rates just yet – the decision is more likely to be driven by a desire to start easing financing conditions in a very gradual manner. This would allow the bank to take its time rather than having to rush into cutting because the data has started to turn significantly worse. Therefore, it’s likely there won’t be a successive cutting cycle starting this week, but more of a gradual dragged-out approach.

There is a real risk of overtightening and keeping rates restrictive for too long. As with the start of the hiking cycle we may find that, in hindsight, central banks are seen as having been too slow to act. In the current cycle, it led to runaway inflation, but in the upcoming cutting cycle it may lead to economic distress. It’s hard to know at this point, but it seems the ECB may be trying to get ahead of these accusations, becoming a forward-looking bank rather than just reactive to the latest data.

ECB members have highlighted in their recent commentary that a rate cut will not make that much difference. Commentary from the ECB’s Fabio Panetta on Friday morning seemed to give a green light for a rate cut in June. He said the bank should avoid policy being too restrictive as that could push inflation below the ECB’s symmetrical target, but also highlighted that policy would remain restrictive even after a few cuts. This gives the feeling that he is justifying cutting rates to avoid economic damage if held for too long at current levels, but also suggests that cutting once or twice in the coming months won’t make that much of a difference.

So the key focus at this meeting will likely be trying to figure out how many cuts are in the pipeline. Data from Reuters suggests there are two 25 bps cuts fully priced in for the remainder of the year, but this may well change over the coming months. For now, it looks like the second cut could come between October and December, which would be appropriate for a ‘taking it slow’ approach. Commentary from ECB President Christine Lagarde after the meeting on Thursday is likely to be heavily scrutinised for any hints and reporters will try and force the information out of her in the press conference. Based on previous reactions, Lagarde will likely play her cards close to her chest and try and give as little as possible away, but any future guidance could reshape expectations in markets, affecting European equities and FX pairs.

On the charts, EUR/USD is attempting to hold on to the momentum behind the reversal last week but the downside pressure is mounting. A rate cut from the ECB could weigh further on the euro as the rate differential would play against it versus other currencies like the US dollar and the British pound. One positive is that the US dollar has been struggling to keep hold of any bullish momentum despite the more hawkish Federal Reserve. The positive risk appetite has been allowing EUR/USD to advance in recent months, but further momentum will likely be impacted by the forward guidance from the ECB. If the bank is seen as more dovish than expected, further bearish momentum could take the pair back down below 1.08.

Meanwhile, European equities have been regaining their footing in recent days with both the DAX 40 and EU STOXX 50 bouncing off support last week. A rate cut is likely to ignite further buying appetite and a dovish takeaway from the meeting could support the indices in their attempt to break above the recent highs.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.

All price information and forecast data in this article is sourced from Reuters, FXStreet