DEUTZ stock forecast: Third-party price targets

Explore DEZ’s recent price action, third-party price targets and technical analysis.

DEUTZ AG (DEZ) is trading around €10.529 as of 4:08pm UTC on 12 January 2026, moving within an intraday range of €9.625–€10.559 on Capital.com’s price feed. The session high leaves the stock trading close to the top of its stated intraday range. Past performance is not a reliable indicator of future results.

The move comes amid a relatively firm backdrop for German equities, with Germany’s main stock market benchmark (DE40/DAX) having advanced to the mid-25,000 area and extending gains from late 2025 (Trading Economics, 2 January 2026). Company-specific developments have highlighted DEUTZ’s ongoing strategic measures, including a planned new organisational structure with five business units from 1 January 2026 and acquisitions in electrification and emergency power systems (Deutz, 17 December 2025).

DEUTZ stock forecast 2026–2030: Third-party price targets

As of 12 January 2026, third-party DEUTZ stock predictions show a cluster of 12-month objectives in the high single- to low double-digit euro range as of late 2025, based on coverage from seven banks. These targets reflect individual institutional estimates and represent indicative 12-month views rather than guarantees of future performance, with DEUTZ noting that it does not endorse these external projections.

Berenberg (broker research)

Berenberg applies a €10 target price to DEUTZ shares, alongside a Buy rating. The bank points to DEUTZ’s transformation initiatives and anticipated margin progression versus the wider capital-goods universe as factors underpinning its target (Berenberg, 19 November 2025).

Investing.com (multi‑broker 12‑month target)

Investing.com reports that the average 12-month target price for DEUTZ AG is €10.73, with individual analyst estimates ranging from €10 to €12. The site notes that these projections reflect analysts’ views on earnings, margins and sector conditions, set against uncertainty around economic growth and capital-goods demand (Inveting.com, 12 January 2026).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

DEZ stock price: Technical overview

The DEZ stock price is currently around €10.529 as of 4:08pm UTC on 12 January 2026, holding above its recent intraday pivot at €8.337 on the Classic framework. On the daily chart, price remains well above the 20-, 50-, 100- and 200-day simple moving-average cluster at roughly €8.80, €8.32, €8.76 and €8.04 respectively, indicating that the prevailing trend remains constructive, with shorter-term averages positioned above longer-term baselines.

Momentum indicators suggest conditions are stretched, with the 14-day RSI near 80.8 and within overbought territory, while the ADX at around 34.6 points to an established trend rather than a range-bound market. On the upside, the immediate area to watch is the Classic R1 near €9.013, with R2 around €9.527 becoming relevant on any sustained daily close above the first resistance level. On pullbacks, initial support is marked by the Classic pivot around €8.337, followed by the 200-day SMA near €8.04 as a deeper moving-average support zone. A break below that area would bring the Classic S1 level around €7.823 into focus (TradingView, 12 January 2026).

This technical analysis is provided for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

DEUTZ share price history (2024–2026)

DEZ’s stock price has spent much of the past two years trending higher from the mid-€6 area. The stock traded near €7.33 in late March 2025 before advancing steadily through the second half of the year. By early August 2025, the price dipped briefly below €7.50, but this was followed by a rebound, with DEUTZ moving into a higher trading band between roughly €8 and €9.50 through autumn, as daily ranges widened around key sessions in October.

Toward year-end, the share price largely held above €7.80 and finished December 2025 near €8.48. It then accelerated at the start of 2026 as buying interest increased. As of 12 January 2026, DEUTZ AG is trading around €10.58, placing it well above levels seen in mid-2025 and marking a sharp early-year extension of the prior uptrend.

Past performance is not a reliable indicator of future results.

DEUTZ (DEZ): Capital.com analyst view

The DEZ stock price has risen sharply into early 2026, moving from the mid-€7–€8 area in mid-2025 to trade above €10.50 by 12 January 2026. Recent sessions have marked fresh two-year highs on this dataset. This advance follows an extended period of range-bound trading between approximately €6.50 and €9.50, suggesting improved sentiment around the stock, while also increasing exposure to sharper pullbacks should momentum weaken.

From a broader perspective, DEUTZ AG is exposed to cyclical influences such as industrial demand, capital-goods spending and infrastructure trends. These factors can support prices when activity levels are strong, but may weigh on the share price if growth slows or order intake underperforms. Company-specific initiatives related to strategy, profitability and balance-sheet management may help underpin confidence if execution remains on track. Conversely, execution risks, cost pressures or weaker-than-expected earnings updates could challenge the recent strength in the share price. Past performance is not a reliable indicator of future results.

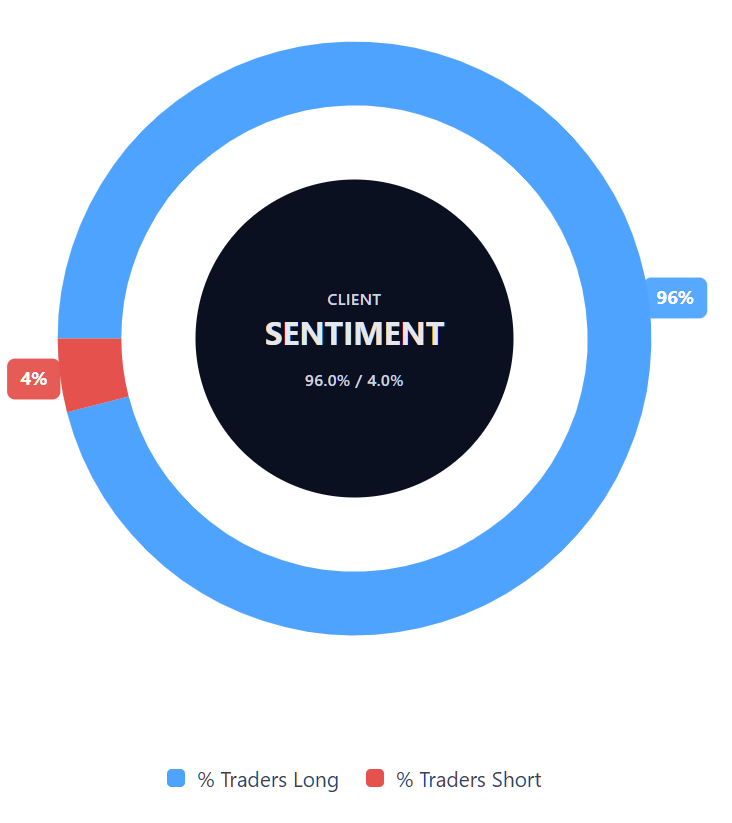

Capital.com’s client sentiment for DEUTZ CFDs

As of 12 January 2026, Capital.com client positioning in DEUTZ CFDs shows 96% buyers versus 4% sellers, a one-sided skew that places buyers ahead by 92 percentage points. This configuration keeps sentiment in heavy-buy territory, although shifts in positioning over time could see this imbalance narrow or reverse. This snapshot reflects open positions on Capital.com and can change.

Summary – DEUTZ stock price

- DEUTZ AG traded mostly between approximately €6.50 and €9.50 through 2025, with the price trending higher over the year from the mid-€6 area in spring to the high-€8s by December.

- The share closed December 2025 near €8.48 before extending gains into early 2026 to trade above €10.50 on 12 January 2026, marking a strong start to the new year on this dataset.

- Technical indicators for late 2025 and early 2026 show price holding above key daily moving averages, alongside a stretched RSI and an established trend backdrop.

Past performance is not a reliable indicator of future results.

FAQ

Who owns the most DEUTZ stock?

DEUTZ AG has a diversified shareholder base that includes institutional investors, asset managers and private shareholders. No single investor is publicly disclosed as holding a controlling stake. Ownership levels can change over time as shares are traded on the open market, and reported holdings typically reflect regulatory disclosure thresholds rather than a complete real-time picture. For the most up-to-date breakdown, investors generally refer to DEUTZ AG’s investor relations disclosures and regulatory filings.

What is the five-year DEUTZ share price forecast?

There is no reliable or agreed five-year share price forecast for DEUTZ AG. Longer-term projections are inherently uncertain, as they depend on variables such as economic cycles, industrial demand, company execution and broader market conditions. Most publicly available forecasts focus on shorter horizons, typically around 12 months, rather than multi-year outcomes. Any longer-term expectations should be viewed as speculative scenarios rather than predictions, and past price behaviour does not provide a dependable guide to future performance.

Is DEUTZ a good stock to buy?

Whether DEUTZ is considered a good stock to buy depends on individual circumstances, objectives and risk tolerance. The company operates in cyclical industrial markets, which can offer periods of growth but also expose shareholders to economic slowdowns and earnings volatility. While recent price movements and analyst commentary may point to potential positives, valuation considerations, execution risks and broader market conditions remain relevant. This information is not investment advice and does not assess suitability for any individual.

Could DEUTZ stock go up or down?

Yes, DEUTZ AG’s share price can move both higher and lower. Like other listed equities, it is influenced by factors such as company results, order intake, costs, strategic execution, sector trends and overall market sentiment. Short-term movements may also reflect technical factors and changes in investor positioning. As with any equity investment, price gains are not guaranteed, and declines are possible at any time, particularly during periods of heightened volatility or weaker economic conditions.

Should I invest in DEUTZ stock?

Deciding whether to invest in DEUTZ AG is a personal decision that depends on financial goals, time horizon and appetite for risk. Shares in industrial companies can experience significant price swings linked to economic cycles and company performance. Before making any investment decision, it is important to consider the risks involved, review publicly available information and, where appropriate, seek independent professional advice. Nothing here should be interpreted as a recommendation to invest.

Can I trade DEUTZ CFDs on Capital.com?

Yes, you can trade DEUTZ CFDs on Capital.com. Trading share CFDs lets you speculate on price movements without owning the underlying asset and to take long or short positions. However, contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses. You should ensure you understand how CFD trading works, assess your risk tolerance, and recognise that losses can occur quickly.