CAC 40 struggles to reverse higher after worst week in over two years

Political turmoil in France causes European stocks to tumble

The CAC 40 suffered its worst performance in over two years last week. The political turmoil stemming from the European elections caused the French stock index to drop over 6.5% from the open last Monday as French president Emmanuel Macron called a snap election after the bad results in Sunday’s polls.

The index fell 2.7% on Friday alone as polls showed Marine Le Pen’s far-right Rassemblement National or a left-wing coalition could leave Macron’s centrist alliance out of the running. It seems like the surge in right-wing support has left Macron’s party without most of its centre-left and centre-right support.

Current ministers have warned that if Rassemblement National were to win it could lead to a debt crisis like the one seen in the UK under Liz Truss, with a lack of fiscal responsibility and a clash with Brussels. But even if Le Pen’s party doesn’t win, there is likely to be political instability up ahead, which has led to turmoil in markets.

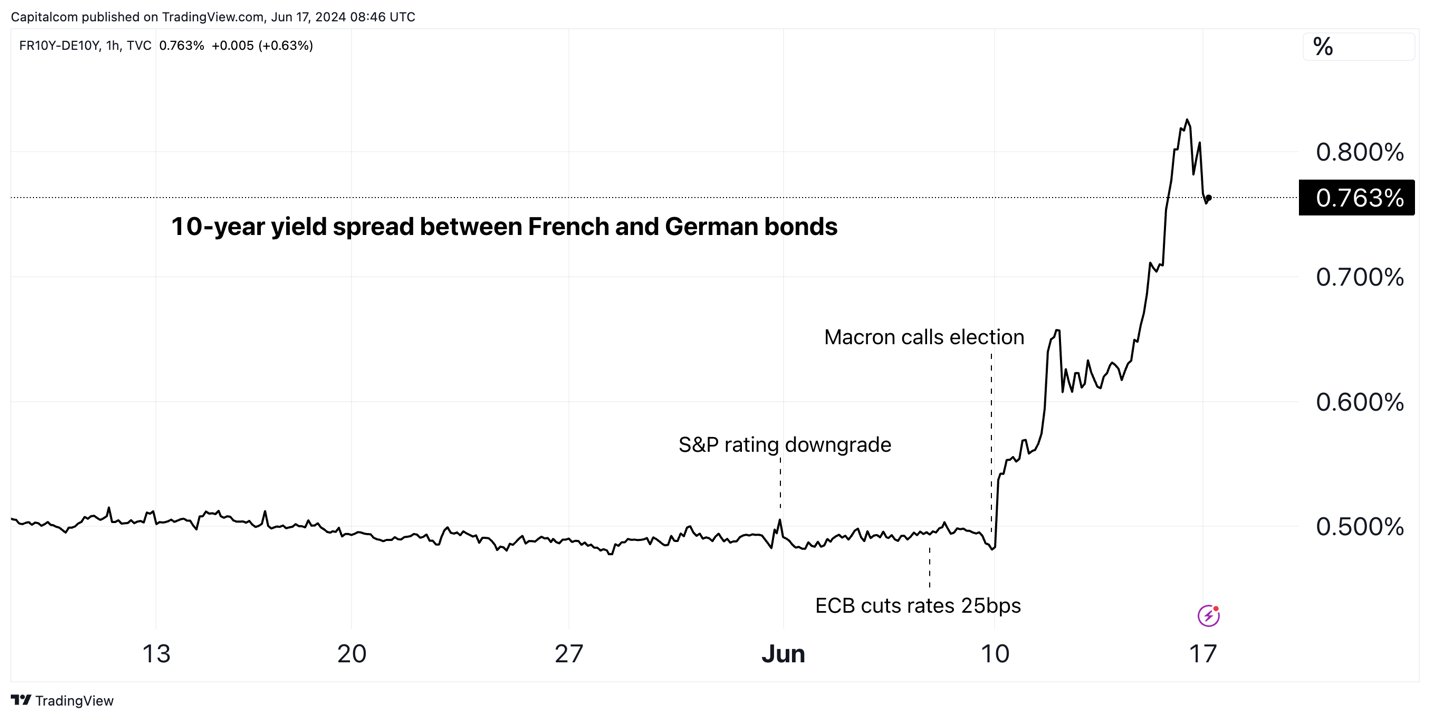

French – German 10-year yield spread (FR10Y – DE10Y) 1-hour chart

(Past performance is not a reliable indicator of future results.)

Yields on French bonds spiked last week with the 10-year yield spread with German bonds shooting up to 0.82%, the highest level in over a decade. But yields on French bonds had already been rising as the S&P S&P Global rating agency downgraded French debt at the close of markets on May 31. The spread between German and French bonds recovered slightly the following week as markets focused on the ECB cutting rates, but Macron’s announced snap legislative elections caused the spread to spike. The timing has been unfortunate as the rating downgrade has added to the perception of financial risks in the French economy.

Concerns about the levels of French corporate debt are starting to come to light and markets are worrying about the impact this can have on the French economy and the Euro bloc as a whole. Stock markets in Spain, Italy and Germany all took a tumble last week as a knock-on effect as the Eurozone debt crisis just over a decade ago no longer seems so far away.

For now, European stocks are attempting a rebound on Monday morning. The DAX 40, EURO STOXX 50 and CAC 40 are all attempting a rebound after bouncing off Friday’s lows, but the momentum seems fragile. Banks, which hold substantial government debt, have been among the worst-performing French stocks.

Last week’s moves have pushed the CAC 40 into oversold territory but it doesn’t seem like this will be enough to stop the bearish momentum. In the last four weeks, the index has dropped below its four key moving averages and therefore there is a lack of immediate support. If the selloff continues, the 7,400 mark has provided support in the past and could offer a chance for new buyers to come in if we see some profit taking this week.

CAC 40 daily chart

(Past performance is not a reliable indicator of future results.)