GBP forecast: Sunak policy U-turn closes crisis chapter, but headwinds for sterling remain

With Rishi Sunak's work cut out as the UK reels from Trussonomics, where next for sterling? Read on for the latest GBP analysis and forecasts round-up

The British pound (GBP) has fallen in value this year amid rising inflation, the prospect of the economy entering recession by the end of the year, political uncertainty, and persistent strength in the value of the US dollar (USD).

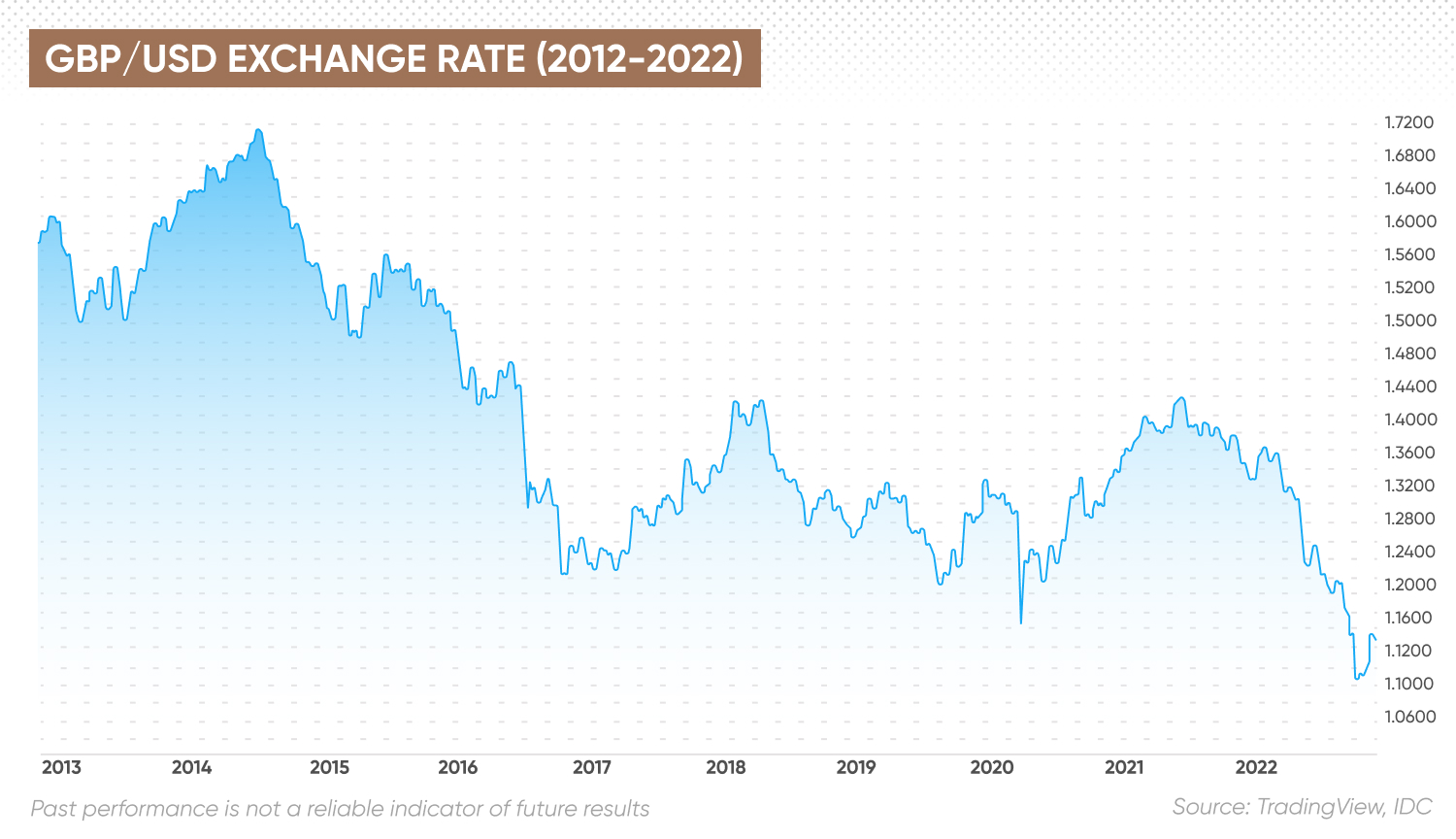

As of 2 November 2022, GBP/USD – the cable, as it is known across currency-trading desks – is down over 15% year-to-date (YTD), despite a recent rise on the back of the UK’s budget U-turn and the formation of a new Conservative government led by Rishi Sunak.

Sterling has risen over 11% as the USD has softened on expectations the US Federal Reserve (Fed) could slow its pace of monetary tightening, and as turbulence in British politics appears to have subsided.

GBP/USD Live Exchange Rate Charts

Will the pound find support or continue to shed value?

In this article, we look at GBP’s recent performance and the long-term outlook for the currency based on foreign exchange (forex, FX) analysts’ forecasts.

What drives the value of sterling?

The British pound sterling is the former global reserve currency and one of the world’s strongest by value. GBP is the fourth most-traded currency on the forex markets, which reflects the UK’s role as the world’s fifth-largest economy and a major financial centre.

The value of the pound is driven by macroeconomic indicators, including gross domestic product (GDP), inflation, interest rates, services and manufacturing activity, and the UK unemployment rate.

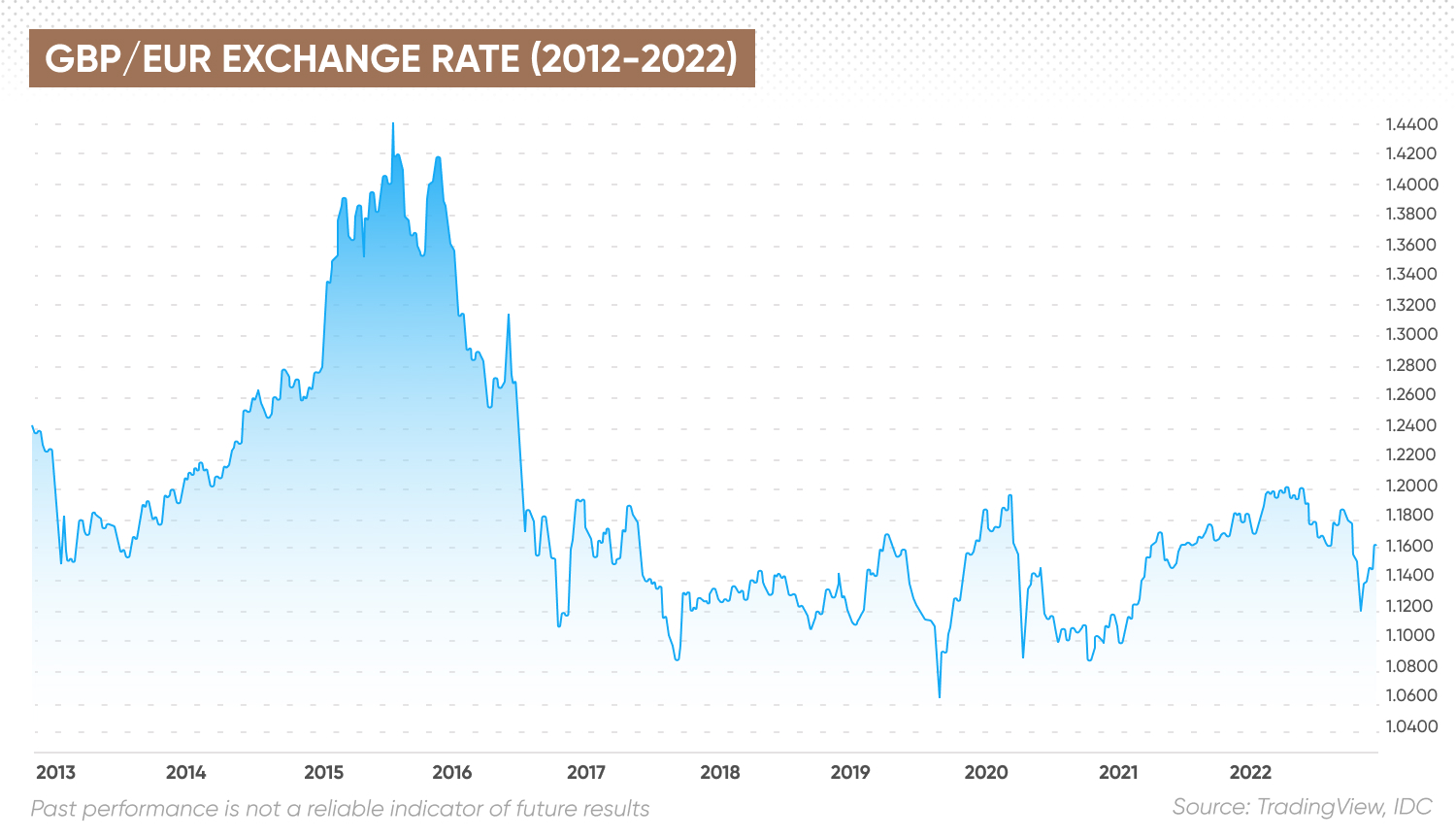

Sentiment has been a key driver in recent years, as uncertainty surrounding the UK’s exit from the EU has weighed on sterling’s value since the 2016 Brexit referendum.

More recently, concerns over the impact of the Russia-Ukraine war on inflation in the UK, the appointment of the country’s fourth prime minister in six years, and recent spending plans have added further downward pressure.

That has outweighed the effect of the Bank of England (BoE) raising interest rates from 0.10% in December 2021 to 2.25% in September 2022.

Trussonomics push GBP to 37-year low vs USD

The pound has been in a long-term decline against the US dollar since 2014, when it traded up to $1.70. The pair fell to $1.50 at the start of 2015. After the UK held its Brexit referendum in 2016, it dropped to the $1.23 level in 2016 as investors sold the pound on uncertainty surrounding the vote’s impact on UK trade.

GBP/USD rose to $1.40 in 2018, but slid to $1.21 in mid-2019 when Boris Johnson took office as prime minister, increasing the likelihood of a ‘hard Brexit’ with no European trade deal.

The pair moved up to $1.33 in December 2019 but dropped to $1.145 on 19 March 2020 as investors sought safe haven in the dollar at the start of Covid-19 lockdowns.

GBP/USD climbed to $1.4190 in May 2021 as sterling gained after the Scottish National Party failed to secure an absolute majority in elections, reducing the likelihood of a Scottish independence referendum. The economy also reopened after Covid-19 lockdowns, raising hopes for a strong recovery.

The exchange rate dropped from the $1.35 level at the end of 2021 to dip below March 2020’s low in the first week of September. The GBP/USD rate hovered in the $1.14–$1.16 range as the UK appointed Liz Truss as its new prime minister on 6 September.

The UK’s then-chancellor Kwasi Kwarteng unveiled a spending plan, dubbed the “mini-budget”, on 23 September, cutting taxes and boosting borrowing in an attempt to shock the economy out of low growth and fund the country’s response to the energy crisis. Kwarteng’s plan, christened “Trussonomics”, pushed sterling over the edge as markets roiled in response to the decision.

Capital.com’s chief market analyst Piero Cingari weighed in on the mini-budget:

“Investors are uncertain about the government’s fiscal plan because it differs significantly from the Bank of England’s monetary policy. The latter also ignored expectations for a larger rate hike in September.”

The pound shed 3.5% of its value after the announcement of the mini-budget on Friday 23 September and tanked further still as markets reopened, eventually hitting a record low of $1.0327.

With Liz Truss replaced by Rishi Sunak in late October 2022, the UK has U-turned on its economic plan and is currently looking to across-the-board tax rises to fund the £50bn hole in public finances.

While the pound has strengthened as UK politics finally finds some stability, rising 11% against the US dollar over the past month, Britain’s economic fundamentals remain bleak, signalling potential further turmoil for GBP.

Data from the flash October Purchasing Managers’ Index (PMI) confirmed that the UK economy has lost its momentum. The reading came in at 46.2 for October, down from 48.4 in September – the lowest point in 29 months. The index has come in below 50 – the mark separating contraction and expansion – for the third straight month.

Inflation, as measured by the Consumer Price Index (CPI), was up to 10.1% year-over-year (YoY) in September, according to the UK’s Office of National Statistics (ONS) – up from 9.9% in August.

Producer Price Inflation (PPI), which measures inflation at the factory gate level, came in at 20% in the year to September 2022 – down from 20.9% in August and a record high of 24.1% in June. PPI is often considered a lead indicator for consumer prices, suggesting a higher CPI going forwards. The Bank of England has stated that UK inflation could peak at more than 13% this year.

The data points to the pound’s precarious position, as the UK appears to be on the brink of a recession.

As George Vessey, UK currency strategist at Western Union Business Solutions, recently told Reuters:

Vasileios Gkionakis, EMEA Head of CitiFX G10 Strategy, commented that the GBP is in a highly fragile state, given the health of the economy:

What is the outlook for the pound for the remainder of the year, and over the long term?

GBP forecast: How will the pound trade against USD and EUR?

Bloomberg recently cited Deutsche Bank strategist Shreyas Gopal as saying the pound’s “crisis chapter” has drawn to a close. Gopal wrote in a note to clients:

“The recent newsflow has been more positive for the current account, but is unlikely to stop the external deficits remaining wider than usual and wider than other developed market peers over coming quarters.”

Analysts at UK-based currency exchange firm Monex were bearish in their GBP prediction against the US dollar and the euro:

“Despite the recent rebound in the pound towards the end of September, which we assign to technical factors such as portfolio adjustment due to liquidation efforts and month-end/quarter-end flows, foreign investor sentiment on GBP assets and the UK’s fundamentals remains weak. In this regard, we expect the recent GBP rally to prove transitory and the UK’s deteriorating fundamentals – higher core inflation, more restrictive monetary policy, lower growth and a widening of the current account deficit – to come to the fore for FX traders over the course of Q4.

“Risks to our GBPUSD forecast over the coming two quarters are plentiful due to intervention measures taken by the Bank of England, the unstable fiscal and political backdrop, and the open-ended nature of the government’s upcoming liabilities.”

GBP/USD forecast: Has sterling bottomed out?

As the differences between the UK and US economies become clearer, and with Britain’s new government attempting to prop up the economy and strengthen the pound, let’s take a look at analysts’ recent GBP/USD forecasts.

In a recent G10 FX Daily Update issued on 28 October 2022, Scotiabank analyst Shaun Osborne said:

“We still rather think the GBP has seen the worst of the recent turmoil and restoring credibility to government finances could help the pound regain the $1.20 zone after its recovery through the $1.14 area. But the delayed fiscal update is still a long way off, leaving the GBP subject to swings in the broader USD tone in the meantime.”

Technically, Osborne was also bearish on the short-term GBP/USD rate, saying: “The GBP is consolidating gains from earlier in the week but the late week stall in the mid 1.16 zone may develop into more persistent resistance unless GBP gains resume in short order. We are bullish on the broader outlook for the GBP above the 1.14 level and expect firm support on dips to the low/mid 1.14 area from here. Intraday gains through 1.1610 should cue renewed GBP gains.”

Analysts at ING were of a similar opinion to Monex, while pointing to the impact of the BoE’s upcoming interest rate decision on the GBP:

“Sterling continues to trade with high volatility in the FX options market, which prices a 150 pip GBP/USD range for Thursday... we believe the disappointment of a 50bp rate hike would send GBP/USD back down to the 1.1400 region this week.

“Providing some backing to this view is the external environment, where we think the balance of risks favour a stronger dollar. Plus, tighter liquidity conditions around the world will typically weigh on currencies like sterling, with large external funding needs.

“A GBP/USD rally from here requires a soft dollar environment, the Sunak government credibly filling the £35bn funding gap at the 17 November Autumn statement, and the BoE pushing ahead with a more aggressive tightening cycle. We think the combination of all three is unlikely.”

ING FX analyst Francesco Pesole was mildly bearish on the pound in a piece on 2 November 2022, stressing the importance of the upcoming BoE meeting:

In their latest FX Snapshot on 31 October 2022, analysts at Citibank’s Hong Kong office changed their forecast for GBP/USD to “tactically neutral”:

“As a result, GBP is likely to underperform pretty much across the board (especially vs Commodity Bloc, CHF and SGD) while likely locked in a 1.05–1.15 trading range vs USD for much of this year.”

In her latest video on the currency pair, Capital.com analyst Daniela Hathorn outlined the following support and resistance levels to watch in upcoming weeks:

Resistance

1.1540 (Confluence from the beginning of September)

1.15 (5 October high)

1.1380 (13 October high)

Support

1.1055 (13 October low)

1.0765 (12 October low)

1.0514 (28 September low)

GBP/EUR forecast: How will the pound fare against the euro?

Monex Europe updated its GBP/EUR forecasts in early September and has yet to change them in light of recent fiscal events.

The forex firm said:

According to Monex, the currency pair could rise to 1.12 in six months – by 31 March 2023 – but fall again to 1.10 in a year’s time.

Economics data provider TradingEconomics forecast that GBP/EUR could be priced at 1.16207 by the end of this quarter and at 1.15227 in one year’s time.

As of 2 November 2022, algorithm-based forecast website WalletInvestor considered the pair to be a “not so good long-term (1-year) investment”.

The platform’s GBP forecast for 2022 in relation to the euro had the pair finishing the year at an average of 1.16. WalletInvestor’s GBP forecast for 2025 against the EUR was a steeper average of 1.212 by December that year. According to the website, the pair could rise to an average of 1.244 by September 2027. There was no GBP forecast for 2030.

When looking at any pound forecast, it’s important to remember that currency markets are highly volatile, making it difficult for analysts to make accurate long-term predictions. We recommend that you always do your own research, looking at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision.

FAQs

Why has the GBP been rising?

Since hitting a record low in September, GBP has risen over 11% as USD has softened on expectations the Fed may slow its pace of policy tightening, and as turbulence in British politics died down with the formation of a new Conservative government.

Will the GBP go up or down?

The direction of the pound against other currencies could depend on the UK’s economic performance, monetary policy and the new UK government, among other factors.

When is the best time to trade GBP?

The busiest time for the GBP market is typically during European trading hours between 07:00-16:00 GMT. Releases of major macroeconomic data and monetary policy statements tend to drive volatility on currency markets, increasing liquidity and creating opportunities for traders to profit.

However, you should keep in mind that high volatility increases risks of losses.

Is GBP a buy, hold or sell?

The trading position you take on GBP is a personal decision you should make based on your risk tolerance, investing strategy and portfolio composition, after researching the market to understand the latest trends, news and analysis.

Keep in mind that past performance is no guarantee of future returns, and never invest money you cannot afford to lose.