The Bank of Japan is expected to keep policy unchanged but markets at risk from a hawkish pivot

The Bank of Japan is expected to keep policy unchanged but may deliver hawkish guidance

The Bank of Japan (BOJ) will announce its latest monetary policy decision this week, and while no change to interest rates is expected, markets will be paying close attention to the central bank’s tone and forward guidance. With political uncertainty brewing at home, fresh trade agreements reached abroad, and inflation still running above target, expectations are building for the BOJ to offer more hawkish commentary about its next steps.

Policy likely on hold – but tone may shift

The BOJ is widely anticipated to keep its benchmark policy rate unchanged at 0.5%. However, policymakers are coming under increasing pressure to tighten policy further, with inflation remaining above the BOJ’s 2% target and real interest rates still deep in negative territory.

Despite the status quo on rates, the tone of the meeting could shift. Markets are looking for a stronger signal about the timing and conditions under which the BOJ might tighten policy again. While firm commitments may be lacking, any suggestion of growing concern about persistent inflation could be taken as a sign that the central bank is preparing to act. The markets are edging toward pricing in further hikes this year. However, a full hike isn’t baked in, yet.

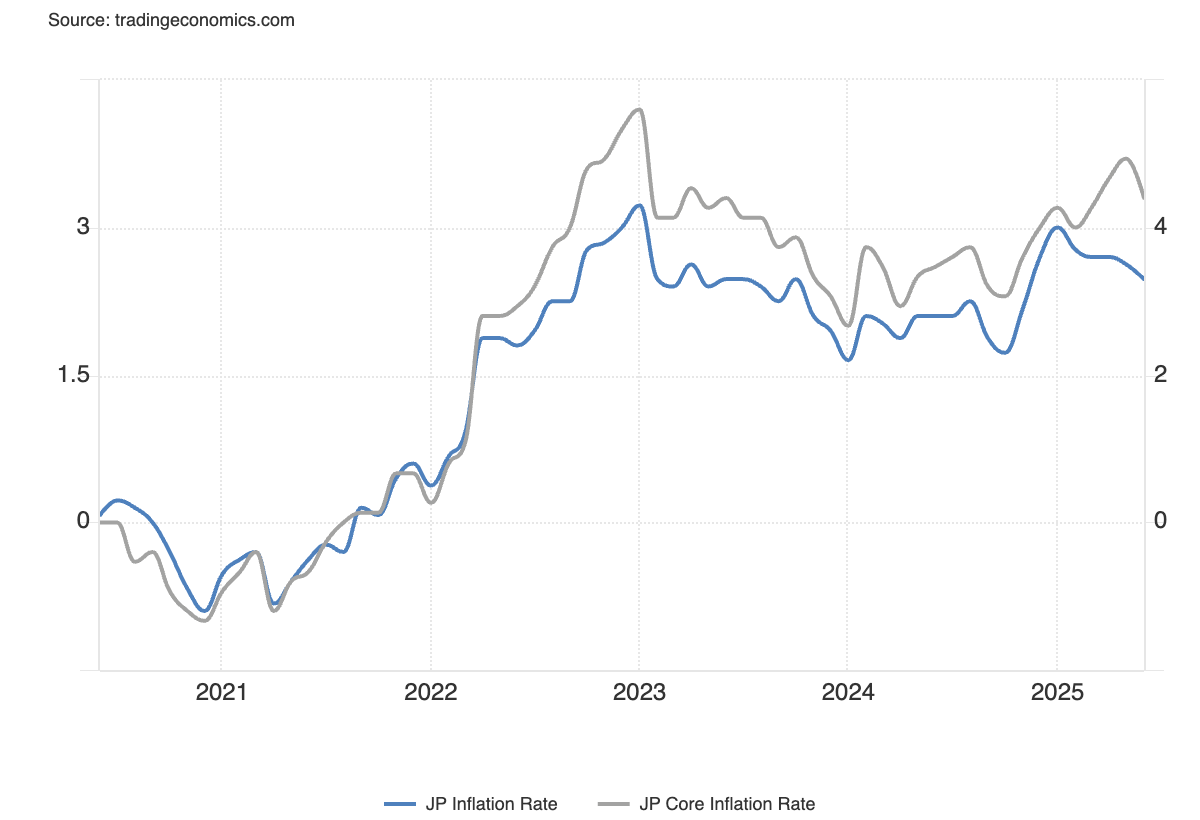

Inflation still elevated as policy remains loose

Japan’s inflation dynamics remain a concern for policymakers. Core inflation (excluding fresh food) has consistently printed above 2%, with the latest data showing a year-on-year increase of 3.3% in June. At the same time, the BOJ’s policy remains among the loosest in the developed world. Real interest rates remain negative, and the central bank has eased its quantitative tapering program amid signs of dysfunction in the JGB market.

(Source: Trading Economics)

Complicating matters is the fiscal backdrop. Following recent Upper House elections, there is renewed focus on the sustainability of Japan’s public finances. Fiscal policy is unlikely to be restrictive, and if anything, could lean expansionary in the months ahead. That leaves more of the inflation-fighting burden on the BOJ, raising the prospect of tighter monetary conditions down the track.

Political instability adds a layer of uncertainty

While economic fundamentals point to the need for policy adjustment, political uncertainty may temper the BOJ’s rhetoric. The ruling Liberal Democratic Party (LDP) lost its Upper House majority in the latest elections, raising questions about the stability of Prime Minister Shigeru Ishiba’s leadership. Speculation is building that Ishiba could step down, creating further political volatility.

That risk could lead the BOJ to err on the side of caution, avoiding aggressive hawkish signals that might stoke financial market volatility during a politically sensitive period. Nonetheless, with the domestic economy overheating slightly and real rates too low, the pressure on the central bank to lay the groundwork for further tightening is mounting.

Yen could rally and Nikkei fall on hawkish pivot

For financial markets, the key takeaway from the meeting will be the BOJ’s forward guidance. Even subtle shifts in rhetoric could have meaningful impacts on the Japanese Yen and Nikkei 225 index.

The Yen has scope to appreciate over the longer term. In the US, the Federal Reserve is moving into an easing cycle, and while inflation risks remain, they are seen as transitory. Policy remains relatively restrictive. In contrast, the BOJ is behind the curve, with inflation still well above target and policy settings highly accommodative in real terms. That divergence suggests room for yen strength, especially if the BOJ signals more tightening ahead.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)

Conversely, the Nikkei may come under pressure. Any hawkish hints could undermine the tailwinds that loose monetary policy has provided to Japanese equities. While broader risk sentiment and external drivers also matter, markets may begin to reassess their positioning if BOJ tightening becomes a more imminent prospect.