AUD/USD hits a 15-month high ahead of Australian inflation data

The AUD/USD rises to new highs as the chances of an RBA hike in February rise.

The Australian Dollar has climbed to its highest level against the US Dollar since October, 2024 going into monthly CPI data.

Australian inflation tipped to edge higher

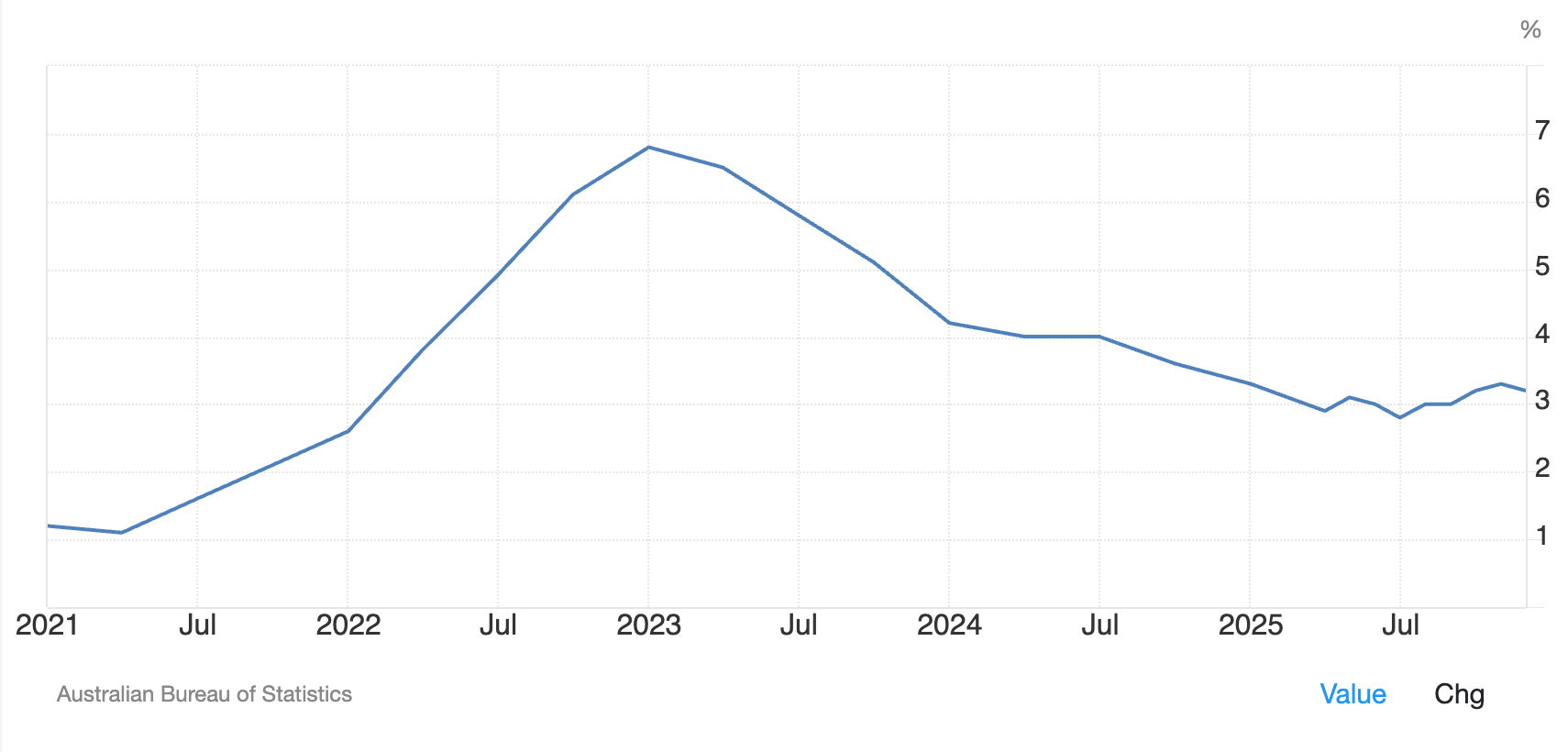

The Australian monthly CPI Index is forecast to show a slight lift in inflation in December. Headline inflation is predicted to rise to 3.6% from 3.4% in November. More importantly, the RBA’s preferred gauge of underlying inflation, the trimmed mean figure, is forecast to lift to 3.3% from 3.2%.

The data shows inflation remains sticky and persistently above the RBA’s 2% to 3% target band. Despite historically modest GDP growth, a pick up in demand, partially on improving household activity, is exacerbating an imbalance in aggregate supply and aggregate demand and putting upward pressure on prices.

(Source: Trading Economics)

Futures point to coin toss RBA rate call in February

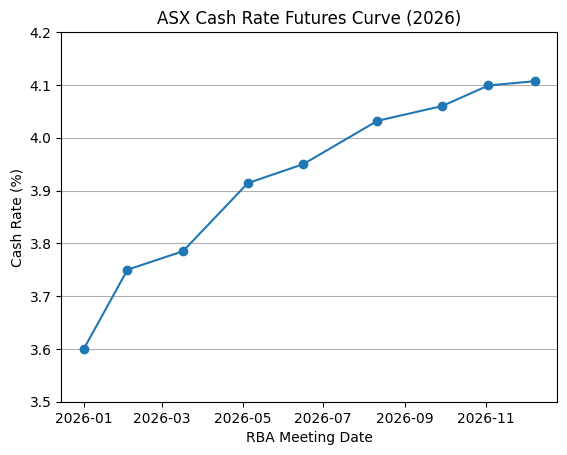

Following much stronger than expected Australian employment data for December – which revealed an unexpected drop in the unemployment rate to 4.1% on a much better than forecast 65,000 employment change – traders are pricing in a better than even chance of a rate hike at this RBA meeting. The markets shifted towards pricing-in that the next move from the RBA would be hiked after inflation accelerated at the end of 2025.

The uncertainty in the markets is about the timing of the next potential rate hike from the central bank. Sticky inflation and evidence of a resilient labour market has pulled forward the timing of the first RBA hike. It has also increased the number of cuts baked into the curve for 2026 to two as the markets grapple with the possibility the central bank over-loosened in 2025.

(Source: Bloomberg, Capital.com)

AUD/USD rises on rate differentials, commodity prices

The rising odds of RBA cuts, a cutting bias in the US, a lift off in global commodity prices, and the so-called “sell America trade” has supported a surge in the AUD/USD to 15 month highs. From a technical perspective, the AUD/USD has tested overbought levels on the weekly RSI for the first time in almost five years. A significant level of resistance appears to be around 0.6940, a break of which could open a run to the 70-handle – a move that could be catalysed by hotter than expected inflation data. Meanwhile, a downside surprise in the price figures could be the spark that leads the AUD/USD to snap back from overbought levels.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)