Featured articles

Why Michael Burry just sold all his tech stocks

Michael Burry has just exited a nearly $100 million position on Nvidia that he opened earlier this year.

14:42, 9 October 2025

Gold forecast: Third-party price targets

Gold (XAU/USD) is currently trading at $3,982.94 (as of 6:12pm UTC, 7 October 2025), after briefly crossing $4,000 per ounce for the first time during the session.

14:43, 9 October 2025

How does Elon Musk impact cryptocurrency prices?

In cryptocurrency markets, few individuals command as much attention as Elon Musk. The CEO of Tesla and SpaceX’s tweets, Tesla and Dogecoin announcements, and public statements can trigger periods of heightened volatility, with shifts in buying and selling pressure across digital assets.

13:29, 30 September 2025

Amazon stock split: what it means for traders

Amazon’s decision to adjust its share structure in 2022 drew attention across the market, not only because of the size of the split but also because of what it signalled about the company’s long-term approach to accessibility and shareholder participation.

3 hours ago

Fortinet stock split: what it means for traders

A stock split changes how shares are priced and how accessible they may appear, but it doesn’t affect a company’s overall market value. Interest in potential future splits often increases when a share price rises significantly or when sector peers adjust their share structures.

3 hours ago

International Business Machines stock split: what it means for traders

IBM has been part of the US market landscape for generations, and its share activity reflects that long history. Stock splits played a recurring role in the company’s earlier decades, offering insight into how IBM has managed its share structure through periods of technological and strategic change.

4 hours ago

BlackRock stock split: what it means for traders

Stock splits can draw attention when reviewing the long-term history of large, publicly traded companies.

4 hours ago

A Week of Divergence: Markets react to BoE, ECB and BoJ as data reshapes the outlook

The latest central bank meetings show a growing divergency in policy directions as the latest data changes the narrative in some economies.

10 hours ago

EU50 forecast: Third-party price targets

EU Stocks 50 (EU50) was trading around 5,721.0 as of 1:59pm (UTC) on 4 December 2025, within an intraday range of 5,687.4–5,729.9 on Capital.com’s platform. Prices remain close to recent Euro area benchmark levels, with related EU50 measures reported near 5,714.0 in early December.

18:14, 15 December 2025

Market Mondays: How Policy and Valuations Are Shaping the Year-End Trade

US equities struggle to capitalise on the dovish FOMC meeting as the AI valuation concerns resurface.

10:54, 15 December 2025

Trading the Dow 30 as it Benefits from Rotation

Rotation out of AI and into value the name of last week’s game helping keep the Dow’s technicals positive, while in sentiment retail traders briefly flirt with majority short bias.

08:11, 15 December 2025

Silver price forecast: Third-party predictions 2025-2030

Silver spot is trading at $52.44 per ounce as of 16:41 UTC on 20 October 2025, within its intraday range of $51.12–$54.43.

14:37, 17 December 2025

XAG/USD latest: Silver’s surge looks increasingly speculative

The recent rally in silver has been impressive but the technical picture shows signs of overexhaustion

10:31, 17 December 2025

Market Mondays: How Policy and Valuations Are Shaping the Year-End Trade

US equities struggle to capitalise on the dovish FOMC meeting as the AI valuation concerns resurface.

10:54, 15 December 2025

Gold is sending a major economic warning

Gold prices have surged since mid August of this year, continuing an historic rally that began towards the end of 2023. Since then, gold prices have more than doubled.

15:50, 11 December 2025

USD/JPY forecast 2026–2030: Third-party price targets

USD/JPY is trading around 155.70 in intraday action on 8 December 2025, close to the top of its session range between 154.41 and 155.71 as of 2:44pm UTC. The pair remains near levels seen over the past week, with external data showing fluctuations between roughly 154.5 and 156.0, suggesting relatively contained day-to-day volatility. Past performance is not a reliable indicator of future results.

9 hours ago

A Week of Divergence: Markets react to BoE, ECB and BoJ as data reshapes the outlook

The latest central bank meetings show a growing divergency in policy directions as the latest data changes the narrative in some economies.

10 hours ago

EUR/CHF forecast: Third-party price targets

EUR/CHF is trading around 0.93384 as of 11.28am UTC on 4 December 2025, within an intraday range of 0.93277–0.93430 on the Capital.com platform. The pair remains close to the levels seen in early December. Past performance is not a reliable indicator of future results.

16:46, 15 December 2025

Market Mondays: How Policy and Valuations Are Shaping the Year-End Trade

US equities struggle to capitalise on the dovish FOMC meeting as the AI valuation concerns resurface.

10:54, 15 December 2025

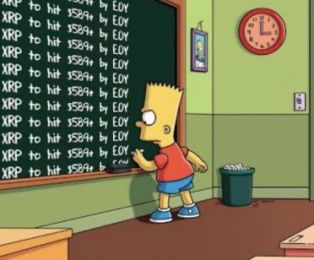

The Simpsons predicted XRP to hit $589: What’s behind the viral claim?

The link between The Simpsons and real-world events often resurfaces when online communities revisit past episodes for possible references or coincidences. XRP has recently been drawn into this discussion, leading some viewers to question whether the show ever hinted at a specific price level.

17:45, 12 December 2025

Bitcoin price prediction: Third-party outlook

Discover Bitcoin price projections 2025–2030 with third-party BTC forecasts, technical trends, price history, and CFD market sentiment.

16:44, 8 December 2025

Discover Newsquawk: your integrated in-platform newsfeed

News moves fast — and so do the markets. With Newsquawk integrated into Capital.com, you can explore real-time headlines, detailed reports and tailored updates directly where you trade.

08:23, 5 December 2025

Top crypto traders to follow by social media popularity in 2025

Influencers, analysts and developers use digital platforms to exchange ideas, interpret market trends and discuss the development of digital assets. As their audiences grow, these voices increasingly shape how information spreads and how trading discussions evolve across communities.

15:11, 1 December 2025