How to use stop losses for trading CFDs

Stop-loss orders are simple and effective tools to minimise the risk of making a loss.

“Rule No.1: Never lose money. Rule No. 2: Never forget rule No.1.” These are the words of Warren Buffet, one of the greatest investors of all time.

Although it is not possible to keep that rule, there are many tools available for investors and traders to protect themselves from market unpredictability. A stop-loss order is one of the most used mechanisms to limit a loss when the market moves in an unfavourable direction.

Trading stop losses are designed to buy or sell a specific asset when its price reaches a certain level. This risk management tool is especially helpful when trading with leverage for contracts for difference (CFD), which increases the risk of a loss.

In this stop-loss trading guide we take a look at how to use stop losses and learn the pros and cons of using stop losses to trade CFDs.

CFD trading versus stock trading

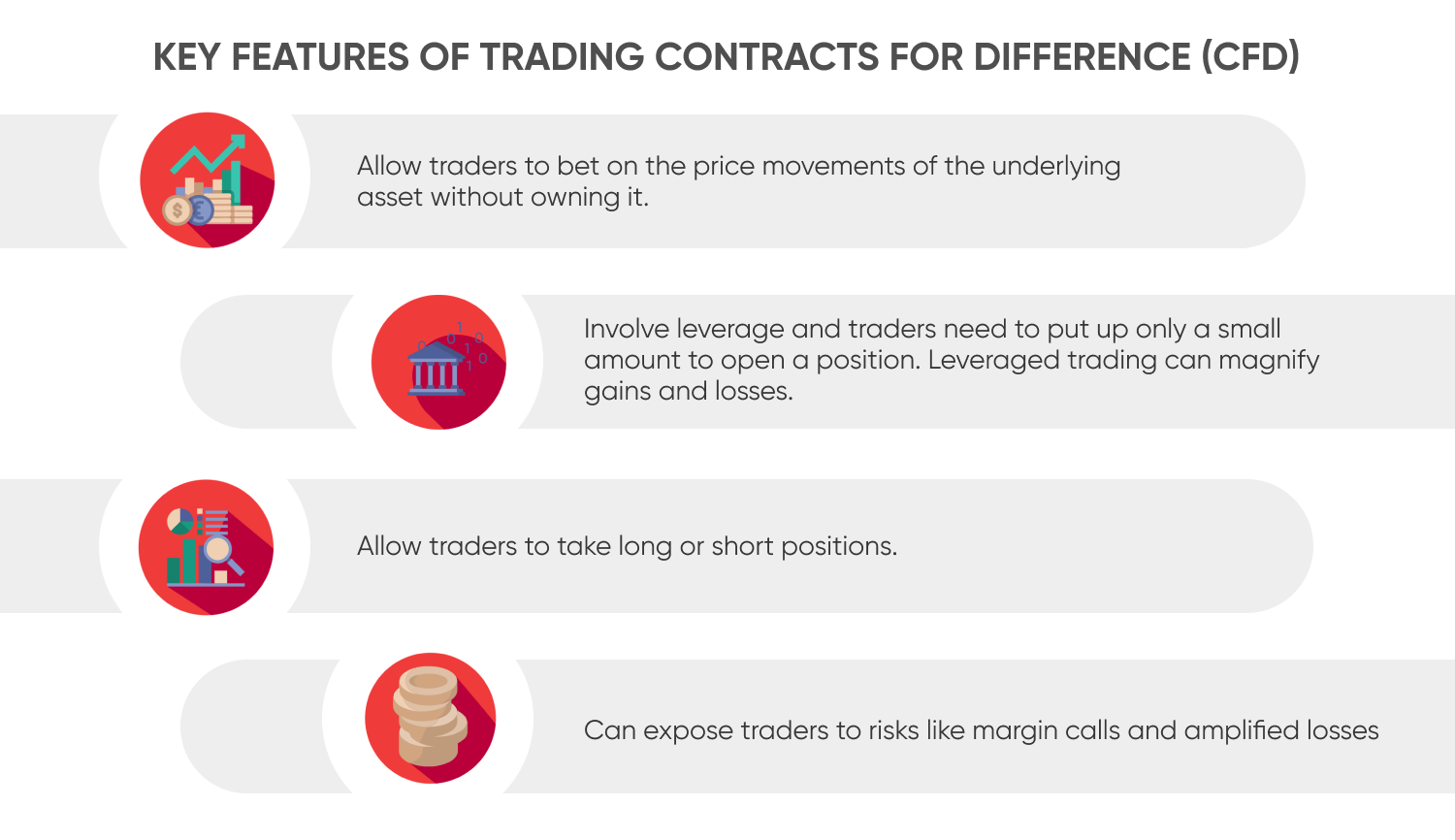

Traders have various financial mechanisms available to them, like futures, options. Brokerages can also offer clients CFDs. These instruments allow trading of securities without having to buy or sell the underlying asset.

A CFD is a contract between a broker and a trader to exchange the difference in value of an underlying security between the beginning and the end of the contract.

Unlike trading underlying securities, a CFD is a leveraged financial product. This means that traders with CFDs or margin accounts need to put down only a fraction of the total capital required to open a leveraged trading position. The rest of the capital is lent to traders by their brokerage company.

The initial amount required to open a CFD position is known as margin deposit, which is a percentage of the trade’s total value. A trader will also need a minimum amount of capital in their account, known as a maintenance margin, to keep a leveraged trade open.

They may be asked to deposit additional capital in their account to keep positions open, in case their trades start to make a loss. This is known as margin call.

What is a stop loss in CFD trading?

Now that we have read about the basics of CFDs, it’s important to know how to use stop losses to protect yourself and reduce risk.

Due to the use of leverage in CFD trading, they are considered high-risk financial instruments and should be used with caution.

Using leverage can magnify both your profits and losses, which implies higher risk. This is where stop losses come into play.

The main benefit of using a stop loss is that traders can limit their risks on both long and short trades.

Furthermore, stop-loss orders help traders make decisions free of emotional influence, thereby allowing execution of planned trades in line with the trading plan in place.

Stop-loss example in CFD trading

Let’s assume that gold is trading at $1,800 an ounce. A trader studies the macro environment and concludes that the risk-off sentiment in the equity markets could result in capital inflows to gold, which is considered a safe-haven asset.

The trader expects gold prices to rise to $1,850 an ounce and opens a long CFD position by buying a contract for 10 ounces at the current offer price of $1,800. This would represent $18,000 worth of gold. Capital.com offers leverage of 20:1 for gold, which means a client will need a margin of $900 in their account to open the trade. If gold prices trade above the entry price when the trader exits their position, they will make a profit.

However, the trader knows that markets are unpredictable. In order to protect from excessive losses, the trader sets a sell stop-loss order at $1,780 that will automatically exit the position if the price of gold drops below the stop price.

If, on the other hand, the trader perceives that the market sentiment is about to shift to risk-on and the gold price is likely to fall, they could take a short position. In this scenario, the trader is expecting the price will fall – a rise in the gold price would result in a loss.

When taking a short position, the trader would need a buy stop-loss order, which is a stop-loss above the current gold price, for example, at $1,820.

The buy-stop order is essentially a stop loss for a short trade. It is triggered automatically when the asset price rises to a specified level to protect the trader from a potential loss if the asset price rises against the short trade.

Key features of a stop loss

Below are the key tools and techniques you need to know for using stop losses in CFD trading.

-

Guaranteed vs non-guaranteed

Stop-loss orders are executed automatically at the specified price level. However, they are not fool-proof in the times of heightened market volatility.

When the asset price moves significantly below the stop-loss level in a matter of seconds, the order may be triggered lower (or higher in the case of short-trading) than the specified price, which effectively means that your losses will be higher.

There is also an option to set a guaranteed stop-loss, which is a premium type that guarantees to exit the position at the exact price you set, despite the volatility.

Unlike an ordinary stop loss, a guaranteed stop loss typically comes at a fee as it is more efficient at capping losses and reducing risk. At Capital.com, for example, a guaranteed stop loss is charged as a percentage on the open volume for the client, and is shown in the realised profit or loss of the position, but also is broken down in the client transactions.

-

Trailing stop losses

One of the limitations of a stop loss is that it doesn’t move up with the price of an asset.

For example, if you trade gold with a stop loss at $1,780, and the price moves much higher than you expected to $1,900, your original stop loss could become ineffective as you may want to exit the trade at a higher level to maximise profits.

In this scenario, you may want to look into trailing stop-loss orders, which are set at a specific percentage or absolute amount above or below the asset’s current market price.

“As the price of the security moves in a favourable direction the trailing stop price adjusts or ‘trails’ the market price of the security by the specified amount,” explained the US Securities and Exchange Commission (SEC) in a blog post.

“However, if the security’s price moves in an unfavourable direction the trailing stop price remains fixed, and the order will be triggered if the security’s price reaches the trailing stop price,” the SEC added.

-

Bid-ask spreads

Another important factor to keep in mind when trading CFDs is the bid-ask spread, which is the difference between the highest bid price a buyer is willing to pay for a security and its lowest selling price, known as the ask price.

A security’s supply and demand dynamics will determine the spread. Highly liquid assets tend to have narrow spreads.

Spreads may be insignificant to individuals who do not trade frequently, however wider spreads result in higher costs for traders making numerous and large volume trades.

Wider spreads are considered riskier trades compared to trades with narrow spreads, therefore a trader can plan their stop-loss strategy accordingly. It should be noted that asset prices need to rise or fall further than the price of the spread to result in a profitable long or short CFD trade.

-

Risk-reward ratio

The risk-reward ratio represents the prospect of reward for every $1 an investor is willing to risk. Risk-reward ratios are generally used to compare expected returns on various investments.

For example, a trading position with a risk-reward ratio of 1:5 indicates that an investor can earn $5 at the risk of losing $1. A trading position with a risk-reward ratio of 1:2 indicates a return of $2 if the investor is willing to risk $1.

Investors can manage their stop-loss orders according to their preferred risk-reward ratio. Let’s say Apple shares are trading at $100. A trader is bullish on the stock and expects AAPL to rise to $120. They open a long CFD position by buying a contract for 100 shares and place a stop loss at $95 to ensure that losses do not exceed $500.

In this case the trader is willing to risk $5 a share to make potential returns of $20 a share. The risk-reward ratio for this trade is 1:4. If the trader has a higher appetite for risk and prefers to seek a risk-reward ratio of 1:6, they can modify the stop-loss order accordingly.

Pros and cons of using stop losses in CFD trading

Using stop-loss orders in CFD trading has advantages and disadvantages. Traders need to be aware of how stop-loss orders work and how to use them effectively.

While stop-loss orders offer an avenue to limit losses, it is not a fool-proof method and has its limitations. Below are the pros and cons of stop-loss orders traders need to be aware of.

Pros of using stop-loss orders

-

A stop-loss order is free of cost to implement. It should be noted that guaranteed and trailing stop-loss orders may come at an extra fee depending on your brokerage. At Capital.com, for example, a guaranteed stop loss is charged as a percentage on the open volume for the client.

-

Stop-loss orders do not need to be monitored constantly and executed automatically when the stop price strikes.

-

Stop-loss orders help traders execute planned decisions away from emotional bias.

-

Stop-loss orders can be used in line with other tools such as risk-reward ratio, technical indicators and more.

-

Trailing stop losses allow traders to “trail” asset prices thereby protecting the profits when the price rises.

Cons of using stop-loss orders

-

A short-term fluctuation can trigger a stop-loss order resulting in exiting the position due to temporary volatility.

-

A stop loss is not always guaranteed. It may exit the position at a price worse than the specified stop price during times of heightened volatility. A guaranteed stop loss, on the other hand, may come with a price tag.

-

A stop loss is not always trailing, which may result in losing out on profits should the price rise. Trailing stop losses may help, but come at with a fee.

To sum up, stop-loss orders are useful tools in a trader’s arsenal and while guaranteed and trailing stop losses may come with a fee, ordinary stop losses are free. A stop loss is a simple and effective device that can benefit your trading strategy.