Featured articles

Why Michael Burry just sold all his tech stocks

Michael Burry has just exited a nearly $100 million position on Nvidia that he opened earlier this year.

14:42, 9 October 2025

Gold forecast: Third-party price targets

Gold (XAU/USD) is currently trading at $3,982.94 (as of 6:12pm UTC, 7 October 2025), after briefly crossing $4,000 per ounce for the first time during the session.

14:43, 9 October 2025

How does Elon Musk impact cryptocurrency prices?

In cryptocurrency markets, few individuals command as much attention as Elon Musk. The CEO of Tesla and SpaceX’s tweets, Tesla and Dogecoin announcements, and public statements can trigger periods of heightened volatility, with shifts in buying and selling pressure across digital assets.

13:29, 30 September 2025

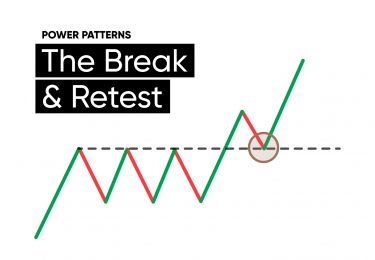

How to trade the break and retest pattern

Welcome to our guide on the break and retest pattern – a structured approach to identifying and managing breakout trades.

11 hours ago

Trading the Nasdaq 100 on Reopening Progress

Optimistic start for markets following the fundamental updates, though the technical overview remains unchanged in both time frames while trader sentiment is majority long.

08:08, 10 November 2025

Best AI stocks for traders in 2025

From leading innovators to emerging firms shaping new opportunities – this overview highlights key top AI companies and artificial intelligence stocks influencing global markets.

13:37, 7 November 2025

AMD stock forecast: Third-party price targets

Advanced Micro Devices (AMD) is quoted at $255.88 as of 4:21pm UTC on 31 October 2025, trading within an intraday range of $255.45–$263.21 USD, based on Capital.com’s platform feed.

11:55, 7 November 2025

Markets rally on rising Fed cut bets, Europe leads the gains

Global stocks trade higher as optimism around the possible end of the US government shutdown improves sentiment, alongside greater odds of rate cuts from the Federal Reserve

14 hours ago

Market Mondays: Shutdown relief drives sentiment higher

Market sentiment improves, lifting equities and weighing on the dollar, as a deal aimed at ending the US government shutdown has passed the Senate

10:50, 10 November 2025

Trading the Nasdaq 100 on Reopening Progress

Optimistic start for markets following the fundamental updates, though the technical overview remains unchanged in both time frames while trader sentiment is majority long.

08:08, 10 November 2025

This has only happened twice: Market concentration at historic highs

The stock market is more concentrated than it's ever been. The top 10 biggest US companies now make up nearly a quarter of the entire global equity market.

16:07, 6 November 2025

Market Mondays: Shutdown relief drives sentiment higher

Market sentiment improves, lifting equities and weighing on the dollar, as a deal aimed at ending the US government shutdown has passed the Senate

10:50, 10 November 2025

Gold steadies as safe-haven demand increases

Gold sees renewed safe haven interest as investors become more risk-averse, but several hurdles remain ahead

11:23, 5 November 2025

Gold Mining Stocks: Top Producers, Performance and Industry Outlook

Gold mining stocks provide a way to gain exposure to the precious metals market. For CFD traders, identifying which companies offer strong potential can have a notable impact on performance.

07:57, 5 November 2025

Market Mondays: Balancing cuts, earnings, and a stronger dollar

Markets digest the impact of last week's volatility after a hawkish cut from the FOMC and tech earnings that didn't quite meet the mark

11:14, 3 November 2025

Market Mondays: Shutdown relief drives sentiment higher

Market sentiment improves, lifting equities and weighing on the dollar, as a deal aimed at ending the US government shutdown has passed the Senate

10:50, 10 November 2025

Market Mondays: Balancing cuts, earnings, and a stronger dollar

Markets digest the impact of last week's volatility after a hawkish cut from the FOMC and tech earnings that didn't quite meet the mark

11:14, 3 November 2025

ECB Preview: no action expected as economy settles

The European Central Bank is expected to leave rates unchanged at their meeting this week as the balance of risks remains in favour of moderate growth and inflation

10:59, 29 October 2025

Market Analysis: Gold, Nasdaq 100, GBPUSD

A look into how gold, the Nasdaq 100 and GBPUSD are trading during a busy week of ok key earnings reports and central bank meetings.

09:44, 29 October 2025

What is Terra Luna 2.0? Everything you need to know about Terra’s fork

An arrest warrant remains in effect for Terra co-founder Do Kwon, whose ongoing legal situation continues to cast uncertainty over Terra projects.

7 hours ago

What is shiba inu? What you need to know about SHIB, a memecoin with a loyal fanbase

Shiba Inu (SHIB) trades at around $0.000009–$0.000010 as of 3 November 2025, slightly above its 2022 lows but well below its 2021 peak. The token continues to operate actively within its ecosystem, although overall market interest in memecoins has moderated.

11 hours ago

Celer Network price prediction: Will CELR rise?

Celer Network (CELR) is trading near $0.00526 against the US dollar at 11:19am UTC on 31 October 2025, hovering close to the intraday low of $0.00512 and below the session high of $0.00586.

12:53, 7 November 2025

The Sandbox price prediction: Third-party outlook

The Sandbox (SAND) was last trading at $0.19935 against the US dollar as of 10:59am UTC on 31 October 2025, moving between $0.19054 and $0.21667. Trading data shows prices holding slightly above the session’s recent low, while sentiment indicates a majority of long positions.

11:35, 7 November 2025