Hull moving average strategy: An educational guide

Learn about the Hull moving average (HMA) and its key features, as well as how to apply a Hull moving average trading strategy.

What is the Hull moving average?

The Hull moving average (HMA) is a technical analysis tool that measures the average price of an asset over a period of time. In contrast to traditional moving averages (MA), the indicator aims to minimise the noise and smooth price fluctuations.

Here, we take a look at the indicator’s mechanics and how to design your own Hull moving average strategy.

Highlights

- HMA is a technical analysis tool that measures the average price of an asset over a period of time, aiming to minimise noise and smooth price fluctuations.

- Created by Alan Hull in 2005, HMA has a unique calculation process that combines the benefits of other moving averages like SMA, WMA, and EMA to create a more responsive and smooth indicator.

- When using HMA, it's crucial to select appropriate parameters and timeframes according to your trading style and objectives. Alan Hull recommends a default period of 16.

- HMA can be used for identifying trends, spotting trend reversals, determining support and resistance levels, and combining with other indicators for better trading signals.

- Popular HMA trading strategies include crossover and breakout.

Hull moving average explained

The HMA was created in 2005 by the Australian stock market trader Alan Hull in an attempt to solve the problem of lags in moving averages. As the indicator’s creator put it:

The HMA indicator sets itself apart from other moving average types, such as simple moving average (SMA), weighted moving average (WMA), and exponential moving average (EMA), through its unique calculation process that combines the benefits of other moving averages to create a more responsive and smooth indicator.

Hull moving average calculation

Although HMA is easily accessed on most charting and trading platforms, understanding the mechanism behind it may be helpful to use it more appropriately. To calculate the HMA on their own, traders can follow these steps:

- Choose a number of periods: Suggested by Alan Hull is 16, but traders can use any number suitable for their HMA trading strategy.

- Calculate two weighted moving averages (WMAs):

- One for the entire length of time (Number of periods)

- Another for half its length (Number of periods/2)

- Multiply the shorter-period WMA by two and subtract the first WMA: This result gives you the raw, non-smoothed HMA.

- Find the square root of the number of periods: You can round it up or down to the nearest whole number.

- Calculate a third WMA using the resulting number: This is your final Hull moving average.

In short, the Hull moving average formula is:

HMA= WMA(2*WMA(n/2) − WMA(n)),sqrt(n))

Where:

- WMA = Weighted Moving Average

- n = number of periods

- sqrt = square root

Hull moving average settings for trading

When using the Hull moving average, it's crucial to select the appropriate parameters and timeframes to suit your specific trading style and objectives. The HMA is calculated using a selected period, which determines its responsiveness and smoothness.

Alan Hull, the creator of the HMA indicator, recommends a default period of 16, but traders can experiment to find the best fit for their needs.

To choose the right time frame, consider your trading style and the type of market analysis you wish to perform. For example:

- Day trading: Day traders may prefer shorter time frames, such as 1-minute, 5-minute, or 15-minute charts.

- Swing trading: Swing traders might opt for 4-hour, daily, or even weekly charts.

- Position trading: Position traders may focus on weekly or monthly timeframes to identify longer-term trends.

Remember that selecting the right parameters and timeframes is a trial-and-error process. It's essential to test various settings using historical price data before applying them to live trading.

How to use the Hull moving average in trading

The HMA can be used in various ways, depending on a trader’s strategy. Below are some scenarios where HMA trading can be used.

Identifying trends

The HMA may be particularly useful in trend identification due to its smoothing properties and responsiveness to price changes.

To confirm the trend, you can observe the slope of the HMA line. An upward-sloping HMA signifies a bullish trend, while a downward-sloping HMA points to a bearish trend.

The position of the HMA line in relation to the price is informative too. For example, when the HMA is above price but is upward trending it suggests an uptrend that is likely to face increased resistance. Conversely, when the HMA is below the price but downward trending, it signifies that resistance to the downtrend is likely.

Hull moving average trading strategy

While traders can come up with various ways of using the indicator, some of the popular Hull moving average strategies include crossover and breakout.

Hull moving average crossover strategy

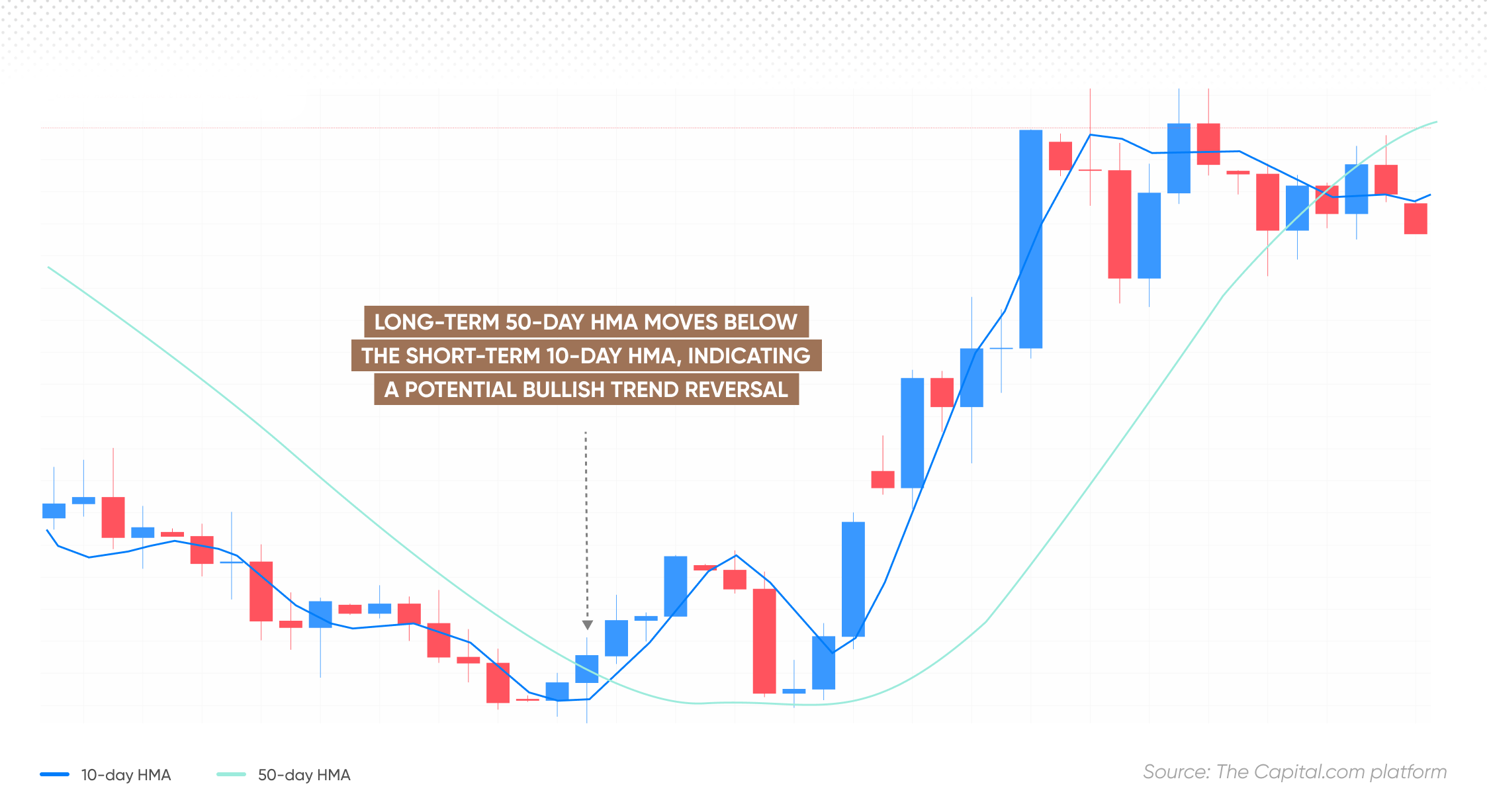

The HMA crossover strategy involves using two different HMA timeframes, a shorter period and a longer period, to generate trading signals when they cross each other.

Traders using this strategy would apply two Hull moving average indicators to their price chart, with one being a shorter period (eg, 10 periods) and the other being a longer period (eg, 50 periods). The shorter period HMA will respond more quickly to price changes, while the longer period HMA will provide a smoother representation of the overall trend.

The primary concept behind the HMA crossover strategy is to identify potential entry and exit points based on the interaction between the two HMA lines. When the shorter period HMA crosses above the longer period HMA, it signals a potential bullish trend. Conversely, when the shorter period HMA crosses below the longer period HMA, it suggests a possible bearish trend.

To enhance the accuracy of the HMA crossover strategy, traders can consider implementing additional rules or filters. For example, they may choose to enter a trade only when the crossover occurs along with a significant increase in trading volume, which may serve as further confirmation of the trend's strength. Additionally, incorporating other technical analysis tools, such as the RSI or MACD, can help confirm the validity of crossover signals.

Hull moving average breakout strategy

The HMA breakout trading strategy focuses on identifying and trading breakouts from established support or resistance levels, which may signal the beginning of a strong trend.

The first step in implementing this HMA strategy is to identify significant support and resistance levels on the price chart. These levels are typically formed when the price reaches a high or low point multiple times, creating a horizontal barrier. The Hull moving average indicator can be applied to the chart to help determine the overall trend direction and gauge the strength of the breakout.

Once the support and resistance levels have been identified, traders can monitor the price's interaction with these levels in conjunction with the HMA. A breakout occurs when the price moves beyond the established support or resistance level, accompanied by a corresponding HMA confirmation.

For instance, if the price breaks above a resistance level and the HMA also moves above the resistance level, it may signal a bullish breakout. Conversely, if the price breaks below a support level and the HMA follows suit, it may suggest a potential bearish breakout.

To increase the reliability of the HMA breakout trading strategy, traders can use additional indicators, such as Bollinger Bands® or the average true range (ATR).

Why choose HMA?

-

Responsiveness: The Hull moving average is designed to be highly responsive to price changes, which may help traders to quickly identify potential trend shifts and market reversals.

-

Smoothness: Despite its responsiveness, the HMA indicator maintains a smooth curve that could potentially minimise market noise and false signals.

-

Versatility: The HMA indicator can be applied to various timeframes, markets, and trading styles, making it a versatile tool for diverse trading objectives.

Risks associated with HMA

-

Lagging nature: Although the HMA is designed to be more responsive than traditional moving averages, it is still a lagging indicator that relies on historical price data, which does not guarantee future returns.

-

False signals: While the HMA's smoothness helps reduce market noise, it can still generate false signals, for example, in choppy or range-bound markets.

-

Parameter selection: Choosing the appropriate parameter or period for the HMA can be challenging, as different market conditions and trading styles may require different settings.

Conclusion

In conclusion, the HMA is a valuable technical analysis tool that provides traders with a responsive and smooth indicator for analysing price action. Developed by Australian stock market trader Alan Hull, the HMA aims to address the inherent issues of lag and potential noise associated with traditional moving averages, such as SMA, WMA, and EMA.

The unique calculation process of the HMA sets it apart from other moving averages by combining the benefits of different moving average types. Choosing the appropriate parameters and timeframes is crucial when using the HMA, and traders are encouraged to experiment with various settings to find the optimal fit for their specific trading style and objectives. Alan Hull recommends a default period of 16, but other period lengths can be explored as well.

HMA's versatility enables it to be used in a variety of trading strategies, including trend identification, trend reversals, support and resistance, and combining with other indicators. Two popular HMA trading strategies are the HMA crossover and breakout strategies. Both approaches seek to capitalise on the HMA's responsiveness and smoothness to detect potential entry and exit points in the market.

Despite its advantages, traders should also be aware of the risks associated with using the HMA. As a lagging indicator, it still relies on historical price data, which cannot guarantee future returns. Furthermore, HMA can generate false signals, for example, in choppy or range-bound markets, and selecting the appropriate parameters can be challenging.

FAQs

What is the best setting for the Hull moving average?

The best setting for the Hull moving average depends on the trader's preferred time frame and trading style. However, the default setting recommended by Alan Hull is a period of 16. Traders may need to experiment with different settings to find the optimal one for their specific market and approach.

How is the Hull moving average different to other moving averages?

The Hull moving average combines the advantages of various moving averages to create a more responsive and smooth indicator. Its unique calculation process, involving multiple weighted moving averages and an additional WMA based on the square root of the period, is aimed to reduce lag and false signals compared to traditional moving averages.

Why is the Hull moving average useful for traders?

The Hull moving average may be useful for traders as it can provide a faster, more accurate representation of price trends, enabling better trend identification, entry and exit signals, and overall enhanced trading experience.