Real GDP vs nominal GDP: what's the difference?

Real GDP vs Nominal GDP

Real GDP and nominal GDP are two key measures of a country's economic performance, both derivatives of the gross domestic product (GDP). While real GDP accounts for inflation, nominal GDP reflects the current market prices. For traders, understanding the differences between these measures remains valuable, as it allows them to accurately assess a country's economic health and make informed trading decisions based on the true growth of the economy.

Here we take a closer look at nominal vs real GDP, how to use both and what is the difference between nominal GDP and real GDP.

Key takeaways

-

Real GDP measures the value of goods and services in an economy, adjusted for inflation or deflation, providing a more accurate representation of economic growth.

-

Nominal GDP measures the value of goods and services in an economy at current market prices, without accounting for inflation or deflation, reflecting the current size of an economy.

-

The main difference between real GDP and nominal GDP is the adjustment for inflation or deflation, making real GDP more suitable for long-term analysis and comparisons.

What is real GDP?

Real GDP, or real gross domestic product, measures the value of all goods and services produced within an economy, adjusted for inflation or deflation. The real GDP formula is calculated by dividing nominal GDP by a GDP deflator, which represents the rate of inflation or deflation.

Using real GDP provides a more accurate representation of economic growth over time, as it accounts for changes in prices. This makes it easier to compare economic performance across different time periods or between countries.

Why use real GDP?

-

Real GDP accounts for inflation: By using a constant base year for prices, real GDP provides a more accurate representation of an economy's growth, as it eliminates the distorting effects of price changes over time.

-

Enables meaningful comparisons: Real GDP allows traders to compare the economic performance of different countries adjusted for inflation, providing a clearer picture of the underlying growth trends.

-

Valuable in fundamental analysis: Real GDP serves as a useful component in fundamental analysis, as it can reveal insights into the underlying economic strength, enabling traders to make well-informed decisions.

What is nominal GDP?

Nominal GDP, in contrast to real GDP, measures the value of all goods and services produced within an economy at current market prices, without accounting for inflation or deflation. The nominal GDP formula is calculated by multiplying the quantity of goods and services by their respective prices and summing up the values:

Nominal GDP is particularly useful for short-term analysis, as it reflects the current size of an economy and helps businesses and investors assess market conditions and investment opportunities.

Why use nominal GDP?

-

Raw economic data: Nominal GDP provides an unadjusted snapshot of an economy's performance, which can be useful for traders when comparing economies or tracking short-term changes.

-

Benchmark for comparing economies: Nominal GDP provides an easy-to-understand metric for comparing the size of different economies, allowing traders to identify countries with potentially larger market opportunities or risks.

-

Straightforward calculation: Nominal GDP is easier to calculate as it only requires the current market prices and doesn't involve adjustments for inflation.

Difference between real and nominal GDP

| Real GDP | Nominal GDP | |

| Definition | GDP adjusted for inflation | GDP in nominal terms |

| Growth representation | Provides a more accurate measure long-term | Provides a more current measure, but can be distorted by inflation |

| How to use | Useful for comparing GDP over long-time periods | More relevant for short-term comparisons and to evaluate the current state of the economy |

The primary difference between real GDP and nominal GDP lies in the fact that real GDP is adjusted for inflation or deflation, whereas nominal GDP is not. This difference can have significant implications when interpreting economic data.

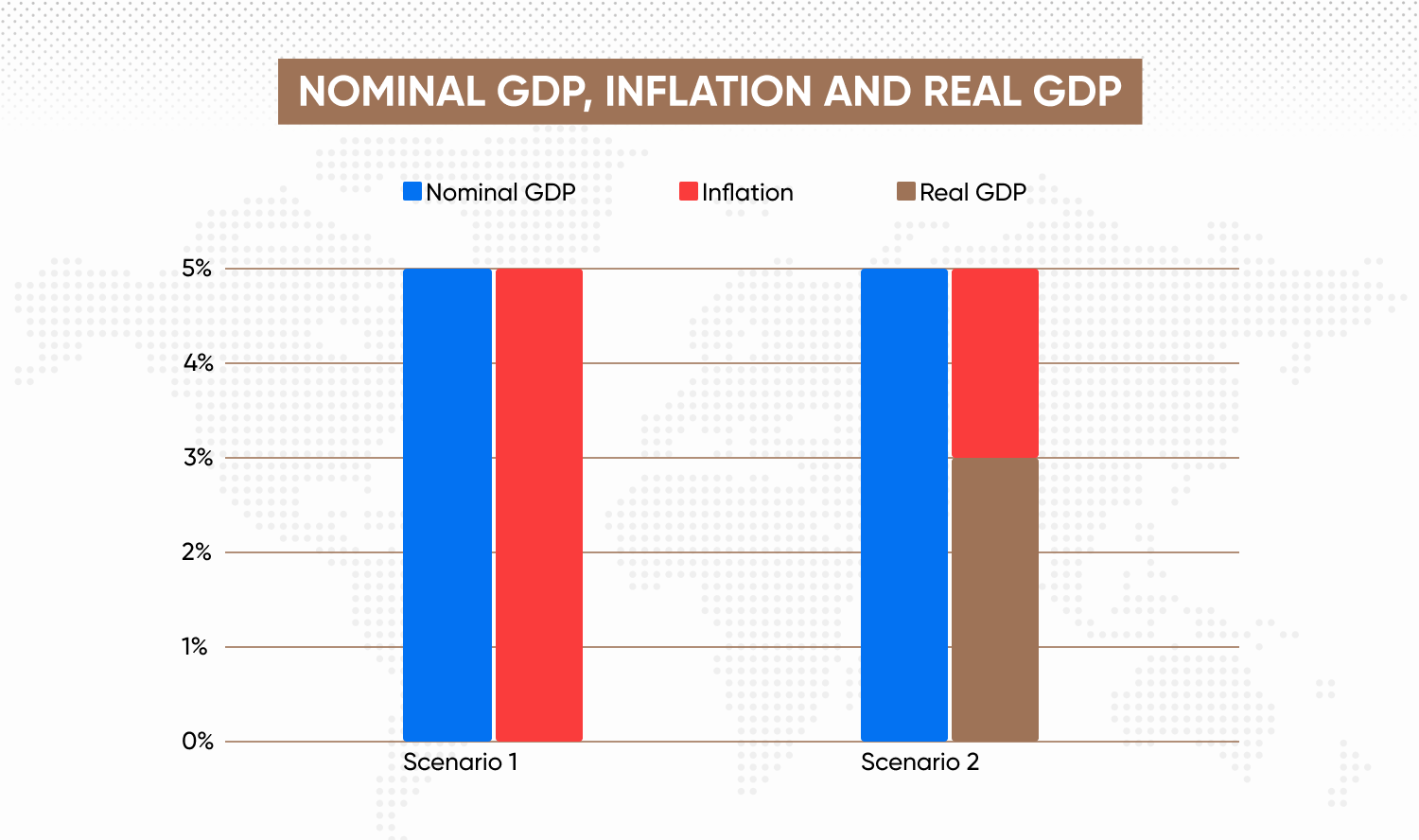

For example, suppose nominal GDP grows by 5% in a given year. If inflation is also 5%, this growth could simply be attributed to price increases, rather than actual economic growth. In this case, the real GDP would remain unchanged. Conversely, if nominal GDP grows by 5% and inflation is only 2%, real GDP would grow by 3%, indicating genuine economic growth.

In different economic contexts, real GDP and nominal GDP can be used for various purposes. Real GDP is often used to assess long-term economic trends and to compare economic performance across countries, while nominal GDP is more relevant for short-term analysis and understanding an economy's current size.

Conclusion

In conclusion, the primary difference between nominal GDP and real GDP is that real GDP is adjusted for inflation or deflation, providing a more accurate measure of economic growth, while nominal GDP measures an economy's size at current market prices. Both measures have their advantages and limitations, and understanding these differences is essential for making informed decisions in economics.

As the global economy continues to evolve, new methods for measuring economic performance may emerge. For now, understanding the real and nominal GDP formulas, and the differences between the two remains valuable for navigating the world of trading.

FAQs

What is the key difference between real GDP and nominal GDP?

The key difference between real GDP and nominal GDP is that real GDP is adjusted for inflation, while nominal GDP is not.

Why is real GDP higher than nominal GDP?

In case of deflation, real GDP would be higher than nominal GDP because deflation would result in lower prices for goods and services, thus increasing the value of real GDP when adjusted for the decrease in price levels. In contrast, if there is inflation, nominal GDP would be higher than real GDP because the increase in price levels would inflate the value of nominal GDP, while real GDP would be adjusted to account for the inflation, showing the actual growth in economic output.

How does inflation affect GDP?

Inflation affects GDP by causing nominal GDP to overstate the actual growth of an economy. Real GDP removes the effects of inflation to provide a more accurate measure of economic growth.