What is automated market-making?

To understand AMM meaning or how automated market-making (AMM) works, it’s essential first to grasp the concept of traditional market making, which is the process of quoting two-sided markets in a security, and providing bids and offers to ensure the liquidity of an asset.

In simpler terms, when you buy a security – let’s say some company stock – and you suddenly want to sell it, there has to be a counterparty willing to buy the asset. The assurance that there will always be a counterparty to complete the transaction on a stock exchange is the primary objective of market-making.

Similar to how a stock exchange operates in a capital market, a decentralised exchange (DEX) follows the same model for cryptocurrencies. Through a DEX, cryptocurrency owners can connect to other holders of crypto money and trade with them without involving any middlemen or intermediary parties.

In the context of DEX, you can define AMM as a protocol-driven computer algorithm that automates the process of providing liquidity on the cryptocurrency trading platforms. By using smart contracts and pre-set mathematical equations, automated market-making ensures the selling side matches the buying side.

Key differences from traditional market making

In the case of traditional stock exchanges, there are set guidelines and benchmarks for entities that facilitate the market-making process. Typically, only reputable companies or high-net-worth individuals can take positions in traditional exchanges.

However, in a DEX, any cryptocurrency owner with an internet connection can fit the bill if it provides the needed liquidity pool through a smart contract. Some examples of automated market-makers are Uniswap (SWAP) and Curve.

Automated market-making explained

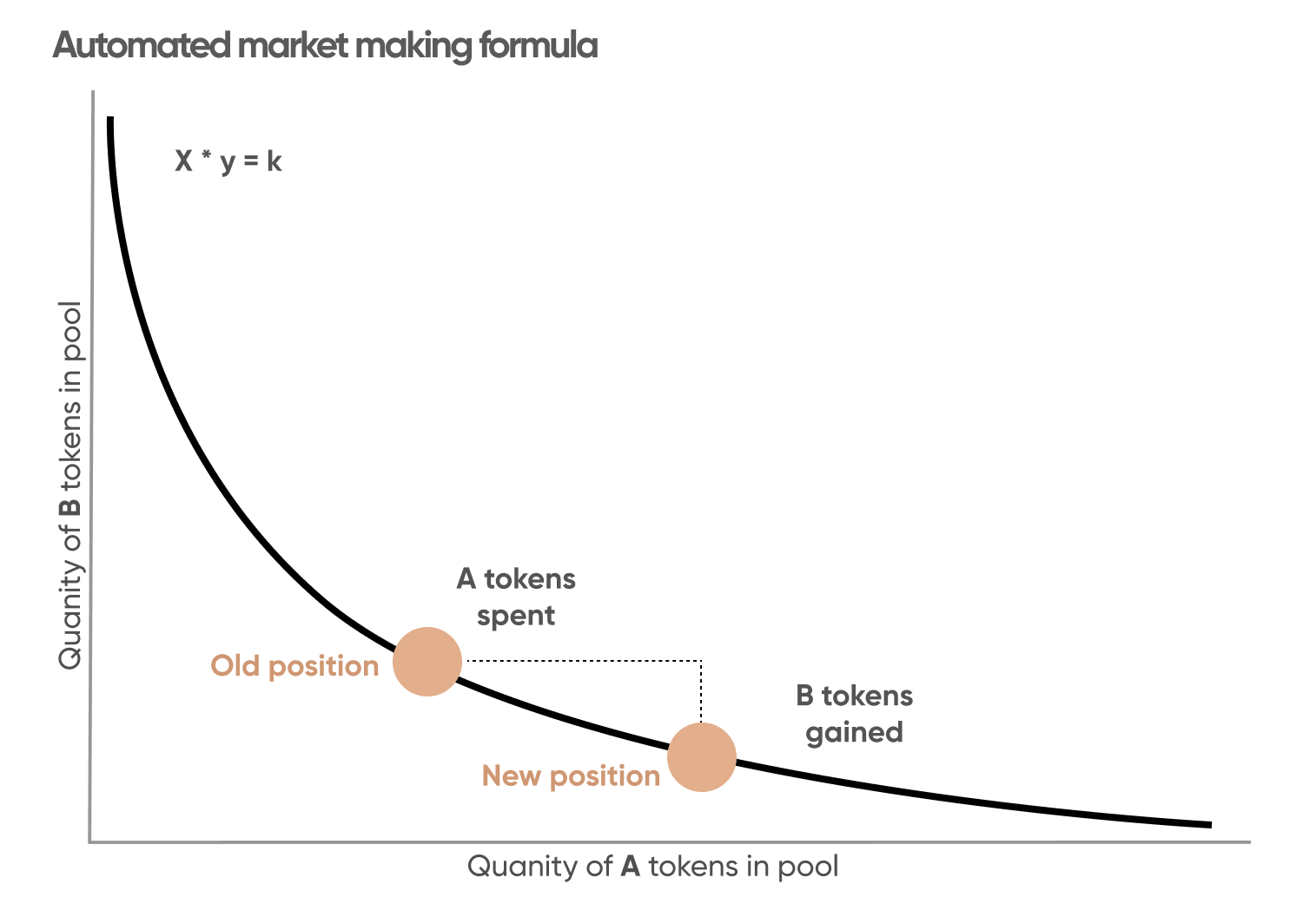

Put forward by Ethereum founder Vitalik Buterin, the automated market-making algorithm is driven by a simple mathematical formula that can be redesigned into different forms. This formula is x*y = k; it is commonly used in the decentralised finance (DeFi) ecosystems.

In this formula, x and y relate to different cryptocurrency tokens A and B, respectively, while k reflects a constant balance of assets that determines the price of tokens in a liquidity pool.

For instance, if token A is being purchased extensively, its price will rise while the quantity of token A will be diminishing. On the other hand, token B’s prices will instinctively keep falling because their quantity will be maintained in the liquidity pool.

However, the overall value of the liquidity pool will remain constant. This formula lays down the basic framework over which different AMMs function to maintain liquidity in decentralised exchanges.