Wall Street and US Dollar drops as US President Trump pushes ahead with tariffs

US stocks and the dollar decline as President Trump imposes new tariffs on key trading partners. Market uncertainty rises, while European equities gain.

Trade Uncertainty and Tariffs Weigh on U.S. Economy, Markets React

The U.S. economy faces increasing pressure as trade uncertainty intensifies, yet President Donald Trump has proceeded with the latest round of tariffs on America’s three largest trading partners. Under the new policy, a broad 25% tariff will be imposed on imports from Canada and Mexico, while tariffs on Chinese goods will increase to 20%. Market participants had previously anticipated a more measured approach following a 30-day delay and commitments from Canada and Mexico to enhance border security. However, the administration’s decision to press ahead has heightened concerns over a potential economic shock, particularly as the Department of Commerce has yet to release a full review of U.S. trade relationships.

The tariff announcement came shortly after weaker-than-expected ISM Manufacturing data, which revealed rising input costs alongside declines in employment and new orders. In response, Wall Street experienced a sharp sell-off, and the U.S. dollar weakened as investors reassessed recession risks. While some of the economic shifts can be attributed to technical factors in GDP calculations, an expanding trade deficit, slowing consumer spending, and weakening business activity have contributed to a significant downturn in growth expectations. The Atlanta Federal Reserve’s GDP Nowcast has revised projections downward to -2.8%, prompting market participants to shift their expectations for the next Federal Reserve rate cut to June, with growing speculation that the May meeting could also see policy adjustments.

(Source: Atlanta Fed)

European Equities Benefit from Geopolitical Developments

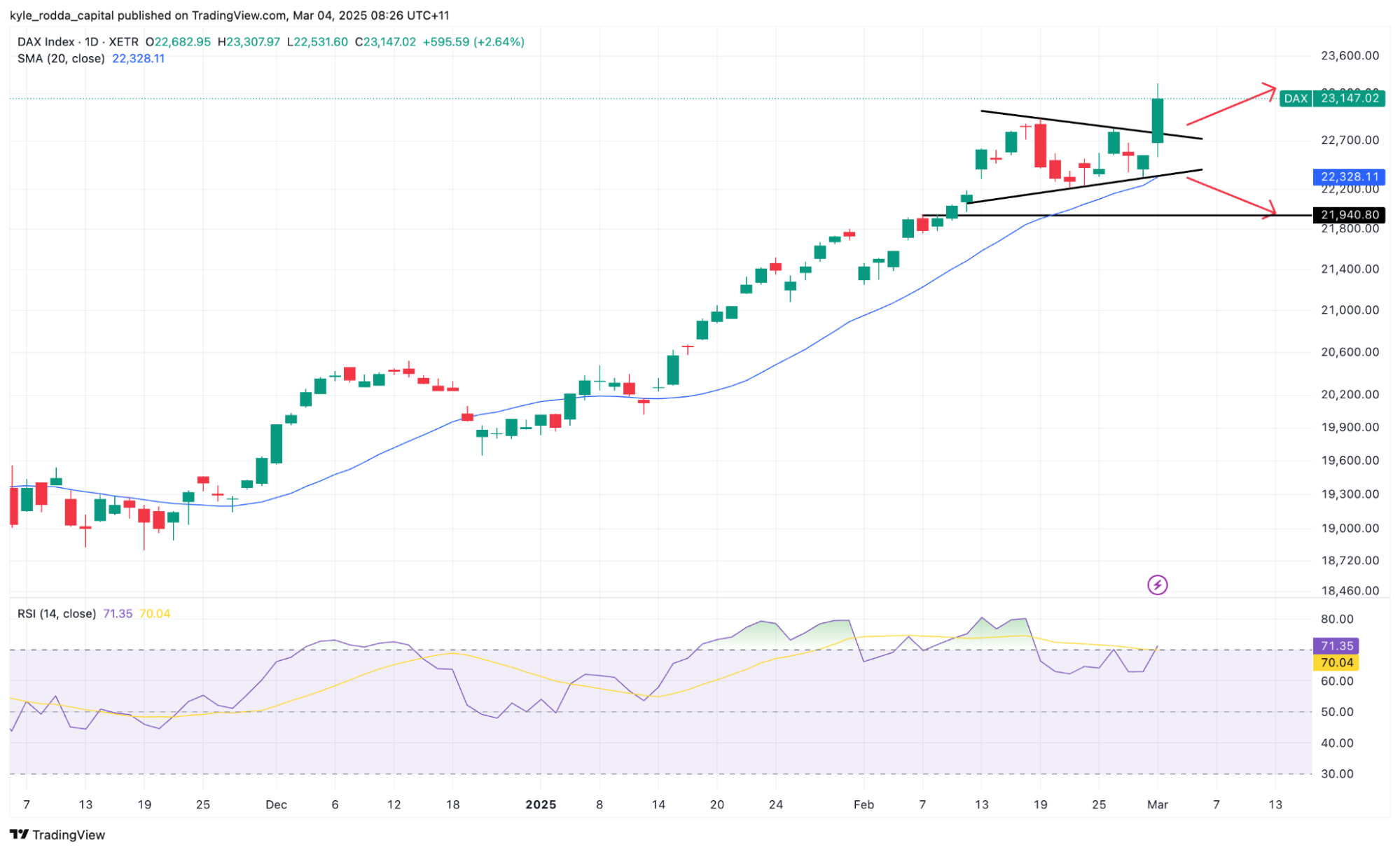

In contrast to U.S. market struggles, European equities outperformed as investors priced in the potential for a resolution between Russia and Ukraine, alongside increased defense spending across the continent. As the Trump administration scales back U.S. security commitments in the region, European governments, particularly Germany, are ramping up defense investments. The German government is proposing a significant increase in defense expenditure, with similar commitments from other major European nations. This shift has fueled a rally in Germany’s stock market, particularly among defense-related equities, while the broader economy stands to benefit from increased fiscal stimulus.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)

Oil Prices Decline Amid Weakening Demand and OPEC’s Supply Response

Oil markets also experienced a sharp decline due to a combination of supply and demand factors. The weakening economic outlook, coupled with tariff-related uncertainty, has dampened demand expectations. At the same time, OPEC has announced plans to proceed with an output increase next month despite the fragile demand environment and oil prices lingering near the lower end of their recent trading range. The decision appears to align with the Trump administration’s broader economic strategy, which prioritizes lower energy prices as a key policy objective.