FOMC expected to cut interest rates, market reaction hinges on guidance and projections

The FOMC is expected to cut interest rates by 25 basis points.

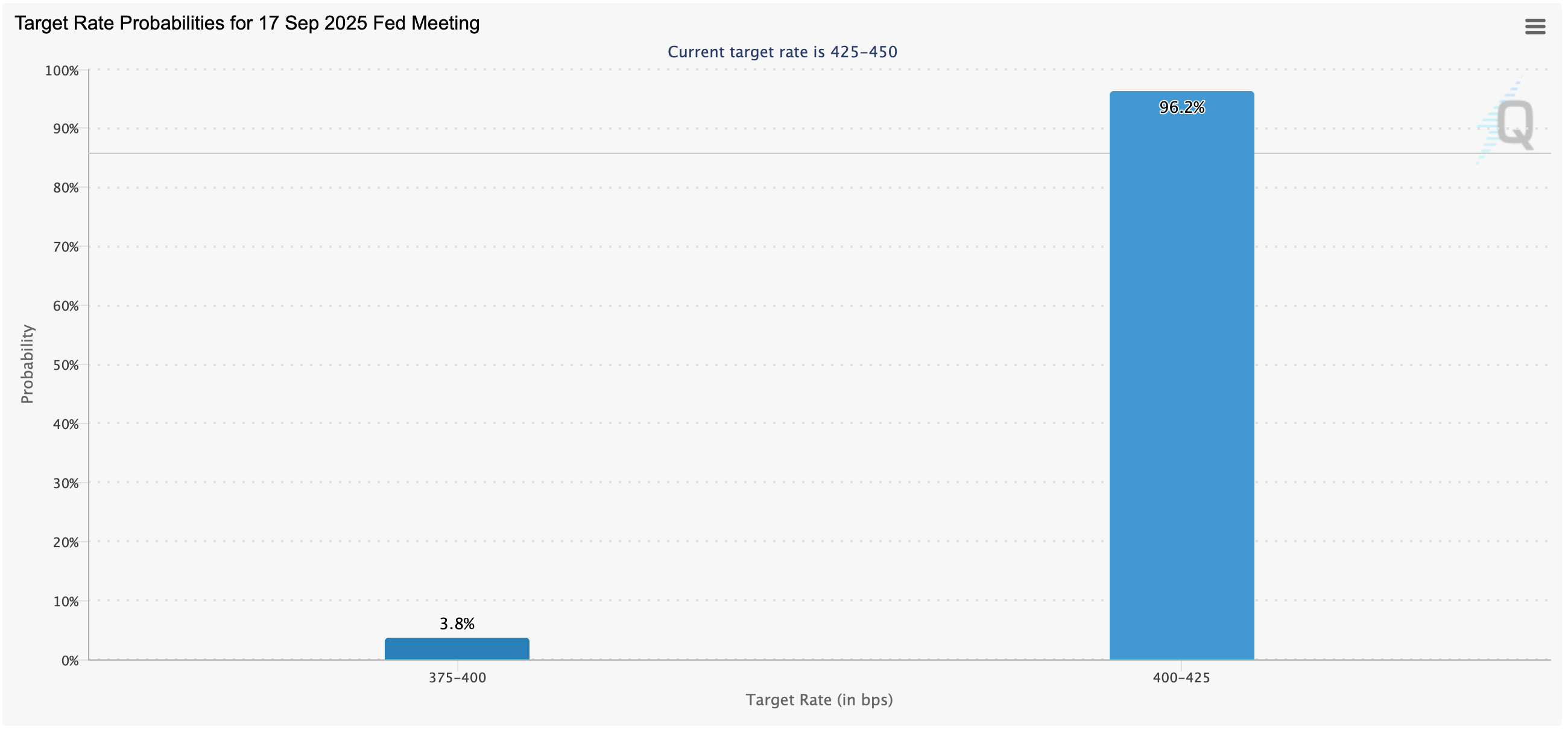

The US Federal Reserve is poised to deliver another interest rate cut this week, as investors await clarity on the central bank’s path into year-end. Consensus points to a 25 basis point reduction, with futures pricing showing that outcome is all but guaranteed.

Policy divide between hawks and doves

The rate cut itself may be a foregone conclusion, but debate within the Federal Open Market Committee (FOMC) has been far from settled. In recent meetings, divisions between doves and hawks have widened, and another split vote looks likely.

On one side are the doves, who have consistently emphasised labour market weakness and advocated for more aggressive easing. Some policymakers even argued for a cut at the Fed’s last meeting, when rates were left unchanged. Christopher Waller, a known dove and potential future chair candidate, has already signalled comfort with deeper easing. Figures like him could push for a 50 basis point move now.

On the other side are the more cautious members, wary of cutting too quickly given inflation’s stubborn persistence. Chair Jerome Powell is expected to side with this camp, preferring a steady, incremental approach. That makes a 25 basis point move and cautious guidance the baseline.

Markets have taken note of the split. Pricing suggests around a 3–4% chance of a 50 basis point cut, reflecting slim but non-negligible odds that doves gain traction. Whatever the outcome, the balance of votes will be scrutinised for signs of the Fed’s internal tilt.

(Source: CME Group)

Softer jobs growth drives dovish calls

Underlying the dovish case is growing evidence of a slowing US labour market. Recent non-farm payrolls figures undershot expectations, with August’s job growth of just 22,000 well below the consensus of 75,000. The unemployment rate ticked up to 4.3%. That figure would have been higher if not for a drop in the participation rate, which has been pressured by immigration restrictions under the Trump administration.

These numbers suggest momentum in hiring has cooled substantially compared with earlier in the year. While the labour market remains far from recessionary collapse, its deterioration has shifted the Fed’s calculus. Protecting employment, particularly against the backdrop of slowing growth and tariff-related headwinds, has become a more urgent priority.

It is this backdrop that has given doves confidence to push harder for easing. Their argument is straightforward: the Fed ought to focus on employment and economic activity. The hawks counter that the labour market, while weaker, is not weak enough to justify risking another inflation flare-up.

Inflation flatlines above target range

If the labour market data underpins the dovish camp, inflation dynamics anchor the hawks’ case. Price growth has slowed dramatically from its peaks but appears stuck above target.

Core inflation remains steady around 3.1%. The Fed’s preferred gauge shows price growth closer to 2.9%, still notably higher than the 2% target. Over the past year, inflation has largely flat-lined in the high-2% range, raising concerns that it may be anchoring at an elevated level.

Several forces explain the stickiness. Services inflation, sustained by resilient demand and loose fiscal conditions, has proven difficult to unwind. Even as overall growth softens, strength in services has propped up activity and kept prices buoyant. Meanwhile, tariffs are feeding through gradually, raising goods prices and adding to short-term pressures.

The Fed has signalled tolerance for these dynamics, treating tariff-related price rises as one-off supply shocks. Still, the persistence of above-target inflation complicates the case for a rapid cutting cycle. Hawks argue that easing too quickly risks embedding inflation at current levels.

Markets await Fed’s new projections

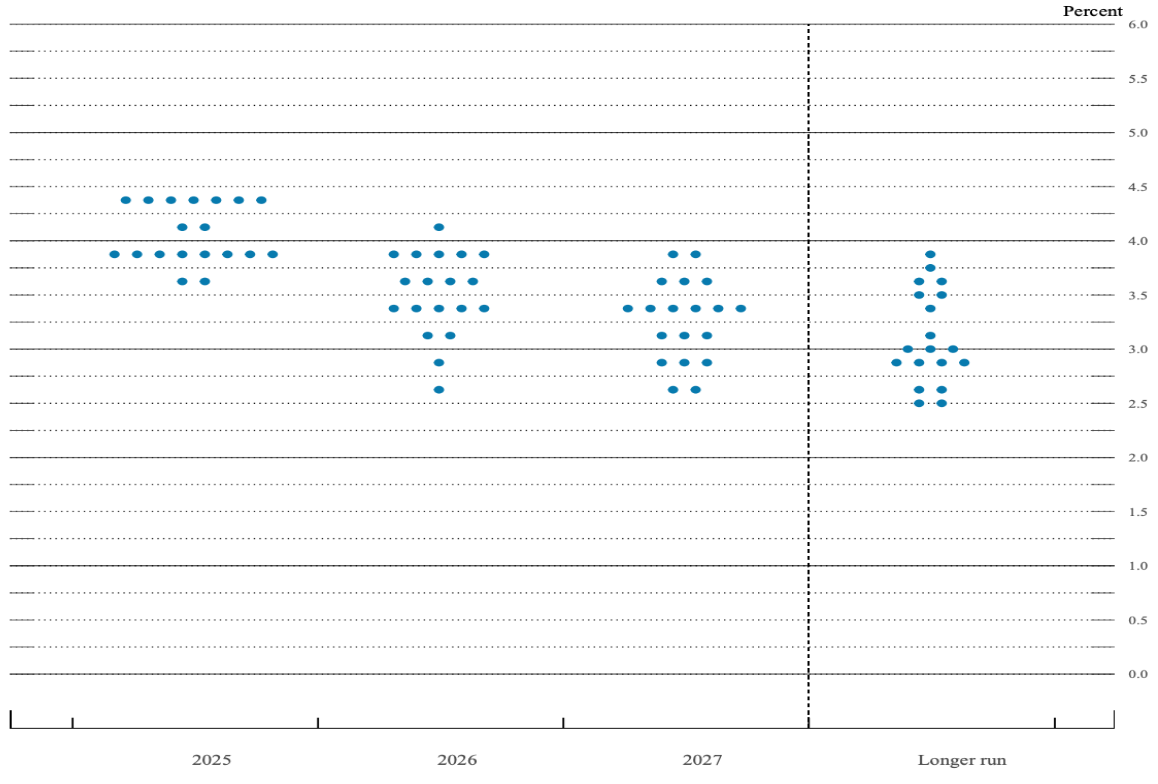

Much of the market’s attention will be on the updated Summary of Economic Projections (SEP), which will reveal how policymakers see the outlook for growth, employment, inflation and, most importantly, interest rates.

At the Fed’s last set of projections, the median view anticipated two cuts before the end of this year, followed by a single cut in 2026. Markets are now expecting that balance to shift. Traders see the Fed projecting around 150 basis points of easing before policy returns to neutral, with as many as two cuts pencilled in for 2026.

(Source: US Federal Reserve)

Yet divisions within the FOMC mean the dispersion of forecasts could widen significantly. Some policymakers are likely to favour a deep cutting cycle to shore up the labour market. Others may see risks in moving too quickly, preferring a cautious glide path. The result could be a scatter plot with a larger spread than usual, underscoring the range of opinion within the Fed.

The SEP therefore has the potential to deliver the biggest surprise of the week. If the dot plot leans more hawkish than expected, markets may need to pare back bets on aggressive easing. Conversely, a dovish tilt could fuel expectations of deeper cuts, especially into 2026.

Market reaction could hinge on tone

The outcome of the Fed’s decision, and particularly its tone, will reverberate quickly through markets. With a 25 basis point cut fully priced in, the bar for a dovish surprise is high, while the bar for a hawkish surprise is low.

If the Fed strikes a cautious note, equity markets could see some of their recent momentum fade. Stocks have rallied to record highs on expectations of a supportive policy backdrop. A hint of restraint from the Fed would challenge that narrative. The US Dollar, meanwhile, could appreciate modestly if the central bank signals less easing than markets currently expect.

Conversely, if the Fed leans dovish — whether through a split vote, an aggressive dot plot, or hints at cuts in October and December — the reaction could be more pronounced. Risk assets, already buoyed by the prospect of easier policy, would likely gain further. Gold, which has rallied on a weaker dollar and easing bets, could extend its run higher.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)