Banks Q3 earnings preview: JP Morgan, Citi, BofA, Goldman Sachs and Morgan Stanley

The Q3 earnings season begins this week in the US, with banks taking centre stage. JPMorgan Chase & Co, Citigroup, BlackRock, and Wells Fargo will kick off the financial sector’s reporting season this Friday, 13 October, before the opening bell. They’ll be followed by Bank of America Corp. and Goldman Sachs on 17 October, and Morgan Stanley on 18 October.

The Q3 earnings season begins this week in the US, with banks taking centre stage. JPMorgan Chase & Co, Citigroup, BlackRock, and Wells Fargo will kick off the financial sector’s reporting season this Friday, 13 October, before the opening bell. They’ll be followed by Bank of America Corp. and Goldman Sachs on 17 October, and Morgan Stanley on 18 October.

In the second quarter, we saw US banks benefitting from higher interest rates – but the outlook became slightly clouded on the back of slower consumer spending and loan growth. The investment banking sector performed relatively well as higher rates and economic uncertainty drove volatility.

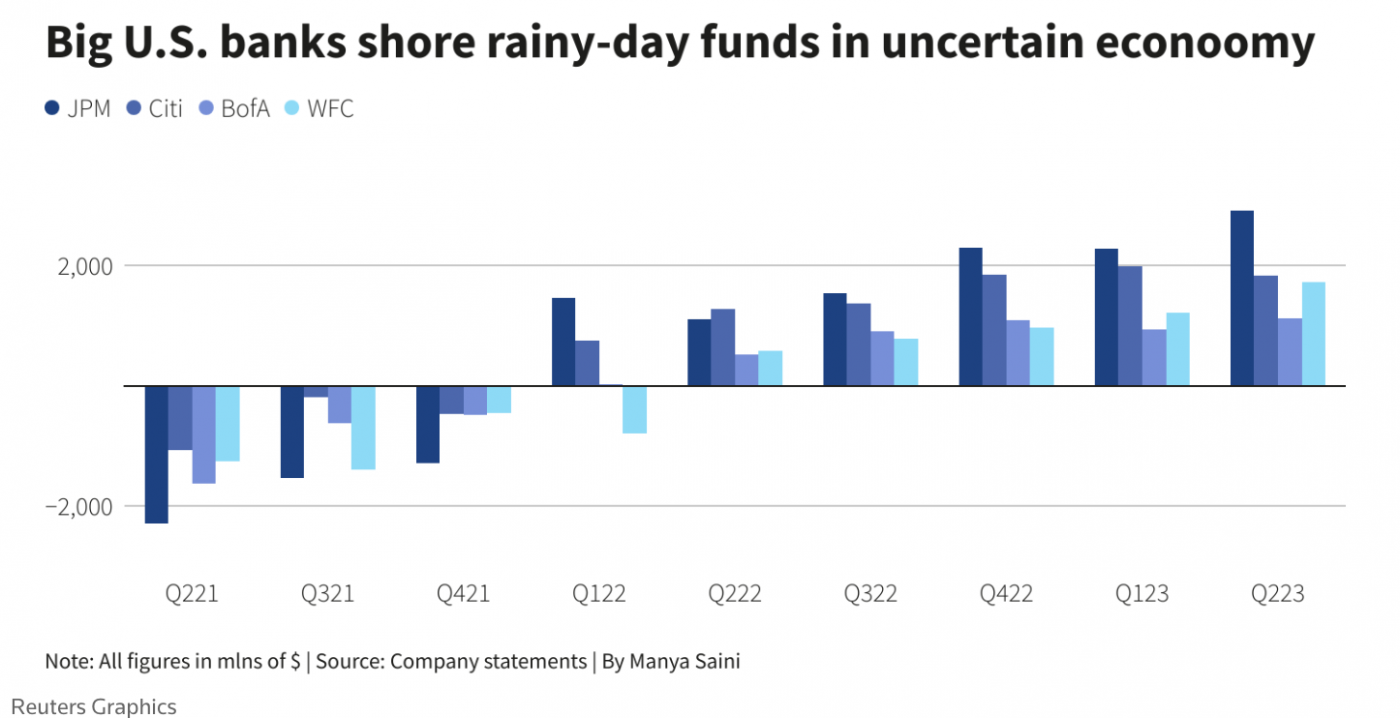

The banking sector continues to face several headwinds, which include higher costs and increased regulatory requirements, as well as the impact of higher bond yields on the value of assets on their balance sheet. It’s also important to consider the challenges consumers will face in the coming years, which has led banks to increase their loan-loss provisions, which will be reflected in their statements. It also evidences that they are bracing for tougher times ahead.

Another strong jobs report last week increased the odds that the Federal Reserve may hike rates one more time, putting further constraints on net interest income growth – and it's also raising the risk of a recession. It’s safe to say the health of balance sheets and forecasts about the economy will be key in the upcoming earnings.

JP Morgan & Chase Co.

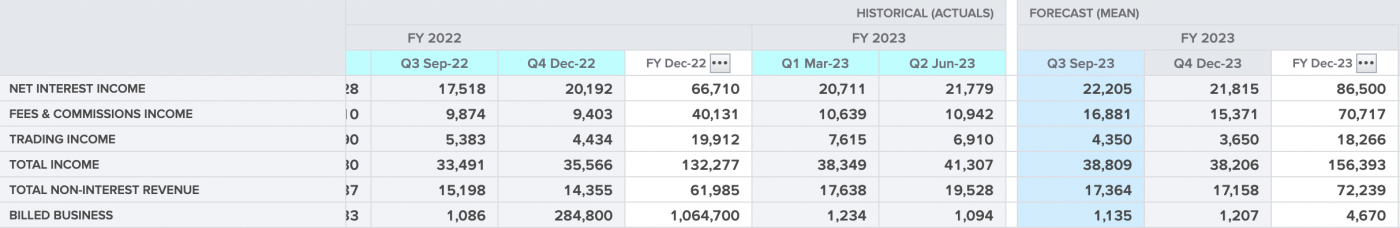

Data compiled by Bloomberg suggests JP Morgan (JPM) is set to show the strongest growth among US investment banks. Net interest income could grow more than 25%, which would offset the likely drop in trading revenues and fees. Markets are likely to focus on whether the bank can beat its full-year net interest income (NII) guidance. Earnings per share (EPS) are forecasted to come in at 3.89 – a drop from 4.98 in the previous quarter, and a 25% rise from the same quarter last year. Loan-loss provisions are forecasted to have dropped 16% in the third quarter. JPM is one of the only large US banks to still be trading above its 2023 opening price, as it led the industry’s efforts to stabilise the market following the banking crisis in March. This has allowed it to grow its loan book and capitalise on higher interest rates. The bias is likely to remain to the upside if earnings live up to their expectations.

Source: Reuters

Citigroup Inc.

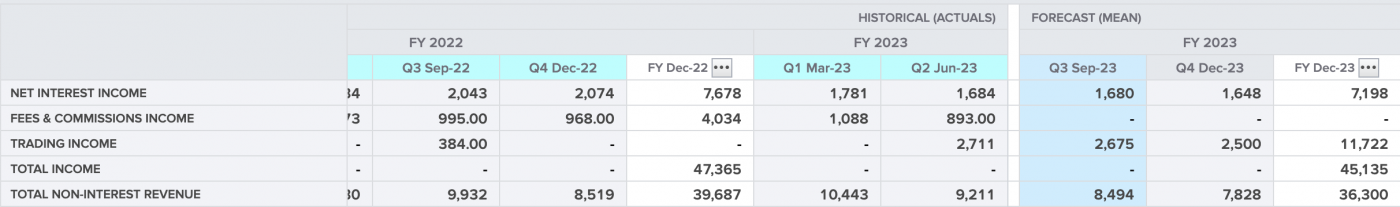

Given the bank's recent restructuring, costs and expenses remain under scrutiny. It’s likely that an increase in its operational costs will outweigh revenue growth and weigh on profitability. As per data from Reuters, EPS is forecasted to come in at 1.18, down from 1.37 in the previous quarter, and a 23% drop from the same quarter last year. Loan-loss provisions are expected to have risen 9% in the third quarter. The stock is currently trading 7% below its 2023 opening price, but is starting to pick up some momentum ahead of the earnings report. The upward trajectory could continue if we see a positive earnings surprise.

Source: Reuters

Bank of America Corp. (BofA)

Given the recent inflationary environment, operating expenses picked up in 2023, and the third quarter is forecasted to show another rise in costs, as per data from Reuters. That said, the bank has been focused more on expanding and upgrading its technology, which could create a bias for a higher share price in the future. For now, EPS is forecasted to come in at 0.80, down from 0.88 in the previous quarter, and a 1% drop from the same quarter last year. Loan-loss provisions are forecasted to have risen 13% in the third quarter. BAC is trading 17% below its 2023 opening price, having been heavily punished in the banking crisis earlier this year. This makes the stock attractive to potential investors ahead of the earnings release.

Source: Reuters

Source: Reuters

Goldman Sachs

Reuters forecasts show an expected rise in revenues, led mostly by its wealth management division. This, alongside a drop in operating expenses, is expected to show EBIT higher than in Q2. Goldman’s earnings are known to be quite volatile from one quarter to another. EPS in Q3 is forecasted at 5.34, up from 3.08 in Q2, but down 36% from the same quarter last year. Loan-loss provisions are expected to have dropped 6% in Q3 – but they grew 260% from Q1 to Q2.

Source: Reuters

Source: Reuters

Morgan Stanley

The spike in bond yields has weighed on its stock, and data from Reuters suggests a drop in revenues from the previous quarter. That said, a drop in operating expenses is expected to offset this, with EPS estimated at 1.28 (up from 1.24 in the previous quarter), but a 15% drop from the same period last year. Loan-loss provisions are expected to have dropped 3.6% from the previous quarter.

Source: Reuters