Bank of Japan Preview

The Bank of Japan will meet on September 20, 2024, with markets anticipating minimal policy changes. However, inflation risks remain, with core CPI at 2.7% and potential for future interest rate hikes.

The Bank of Japan will meet on Friday, 20th of September, 2024, with the market pricing suggesting a trivial risk of a policy change by the central bank. However, there remains upside risks to Japanese interest rates with the markets searching for clues about future BOJ policy.

Authorities see upside risks to Japanese inflation

Japan’s inflation remains above target, with authorities seeing upside risks to prices going forward. The most recent batch of CPI data revealed core inflation at 2.7%, having climbed four successive months as strong wage pressures and relatively robust economic growth underpin upward pressure on prices. The Bank of Japan continues to expect relatively elevated inflation moving forward, with the economic projections released at the central bank’s last meeting indicating core CPI is expected to float around 2% over the next three years. Discussing the policy outlook recently, Bank of Japan Governor Kazuo Ueda stated that the central bank is open to raising interest rates further if economic conditions and inflation align with the BoJ's projections.

(Source: Trading Economics)

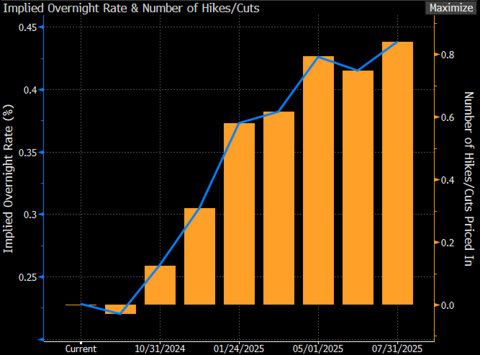

Swaps markets price-in further BOJ hikes

Interest rate swaps markets imply a trivial risk of a rate hike from the Bank of Japan at this meeting. On top of that, after announcing the planned tapering of its asset buying in July and tweaking the yield curve control policy earlier in the year, the markets aren’t expecting any material change to policy at this meeting. However, the markets are priced for further policy tightening, which combined with the existing guidance and rhetoric from the BOJ, means this meeting will be about gauging the possible timing of the next rate hike. Currently, swaps suggest another hike is unlikely before the end of the year but indicate a high probability of a move coming in early 2025.

(Source: Bloomberg)

Market volatility may limit BOJ tightening

Complicating the efforts of authorities to manage inflation is the financial instability risks emerging from tighter monetary policy. Following the meltdown in Japanese and (to a lesser extent) global financial markets in August, which was partially precipitated by a larger than expected BOJ hike, greater market volatility because of tighter BOJ policy may be a self-limiting factor for future rate hikes. Discussing the collapse in Japanese equities in early August, BOJ Deputy Governor Shinichi Uchida said “We won't raise interest rates when financial markets are unstable”. Given the BOJ’s special role in global markets, the dynamic may lower the probability of future hikes from the BOJ. However, given the idiosyncratic circumstances that led to the August meltdown, including very short positioning for the Yen and an extended carry trade, the odds of a similar meltdown are much lower.

Technical analysis: USDJPY and Nikkei

Global markets have been predominantly driven by expectations about US economic growth and monetary policy. The subsequent impact on the Japanese Yen, which has rallied owing to softer global growth expectations and marginal convergence in US Federal Reserve and Bank of Japan policy, has weighed on the Nikkei.

From a technical standpoint, the USD/JPY’s uptrend has broken down, with the move reaffirmed by a failed re-test of upward sloping trendline resistance. 140 looms as a major level, which, if broken, could open a drop towards the 137 support level. Meanwhile, a short-term downward sloping trendline could spark a retracement if broken.

(Past performance is not a reliable indicator of future results)

Meanwhile, the Nikkei is technically still in an uptrend but confronts headwinds from the weaker Yen and slower global growth. A short-term support level appears to be around 35,250, with 33,900 and approximately 30,300 other potential support levels in the long-term. A break of a downward sloping trendline connecting the indices most recent lower-lows could herald a greater reversion to the 20-week MA.

(Past performance is not a reliable indicator of future results)