Beste handelaren, wij beseffen dat veiligheid van het grootste belang is. Sluit u aan bij een broker met een verhandeld volume van meer dan $1 biljoen. Uw geld wordt veilig afgeschermd bij de allerbeste banken.

Erkend en onder toezicht van de Cyprus Securities and Exchange Commission (CySEC)

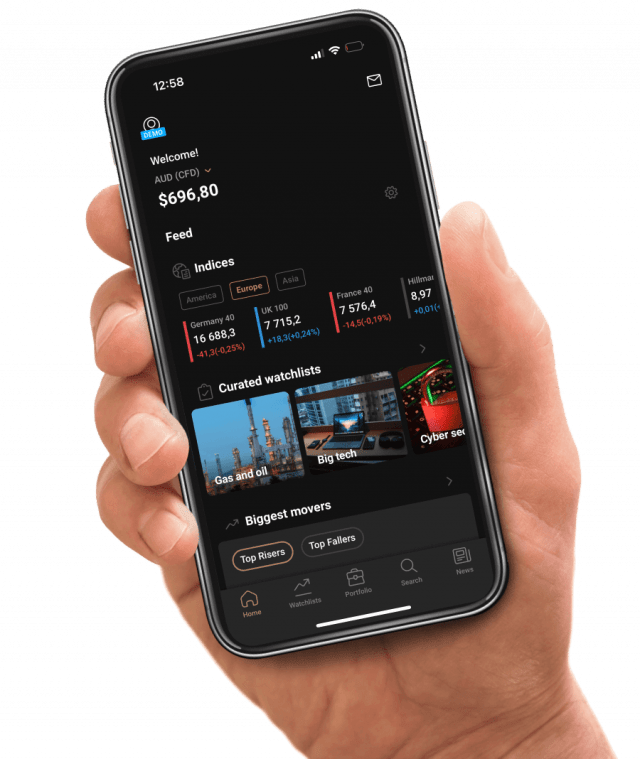

Werkt gemakkelijk en hoop mogelijk heden

Ik gebruik al jaren capital,vooral het onbeperkt gebruik van een demo account vind ik erg nuttig om strategieën te testen daarnaast kan men op een live account met kleine posities handelen om zo ervaring op te doen met live traden, ook de vele instellingen o.a. voor wat betreft de hefboom is handig ,tevens is het laten uitbetalen van je winsten erg rap, gebeurt meestal binnen 4 uur, dan staat het al op je eigen externe wallet ,

Overzichtelijk, snel en duidelijk en de ondersteuning is top.

Overzichtelijk app, duidelijke informaties en goede en snelle service.

Het is leuk en eenvoudig, ik ben een beginnende, maar het is goed duidelijk en veel informatie.

Heb zelf alleen nog een demo account maar wel een fijne app om te oefenen

Ik ben zeer goed en snel geholpen.

Super blij mee, werkt fantastisch samen met tradingview

Dat het vertrouwd is. Tot nu toe is het allemaal perfekt verlopen

Het lukte me niet om geld naar me eigen rekening over te boeken, maar ik ben fantastisch geholpen door de helpdesk! Dezelfde dag was het geld overgemaakt. Echt fantastische klantenservice heel netjes en behulpzaam.

Dit zijn onze 4- & 5-sterrenbeoordelingen. Om te voldoen aan de GDPR-vereisten en de privacy van de gebruikers te waarborgen, zijn hun specifieke gegevens bewust anoniem gemaakt.

De ideale service, instrumenten en hulpbronnen om uw kennis te verruimen.

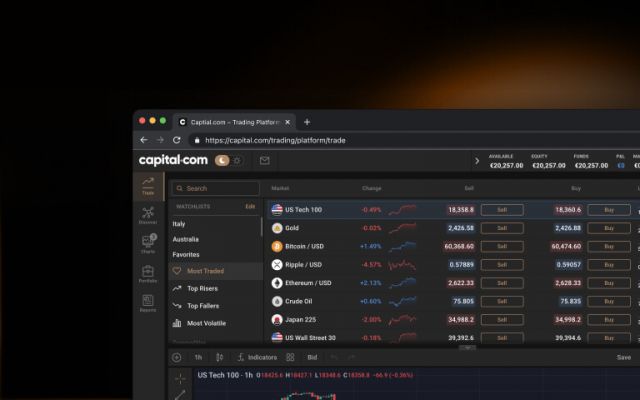

Verfijn uw analyse met een reeks intuïtieve grafieken, tekenfuncties en 75 indicatoren.

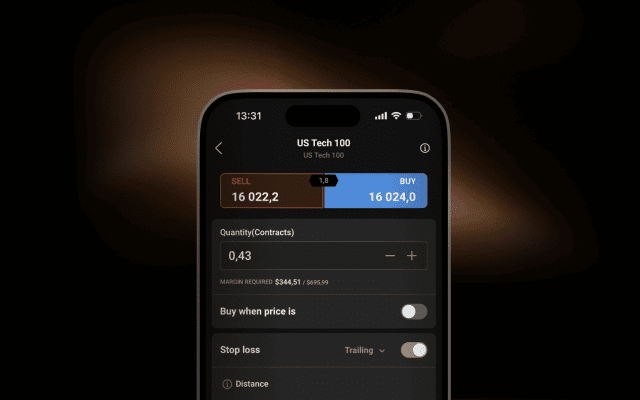

Beheer grotere posities met lage marges op de geselecteerde markten. De hefboomwerking kan zowel uw winsten als verliezen vergroten. Er kunnen beperkingen gelden.

Ons deskundige team is 24 uur per dag beschikbaar.

Bekijk de koersen van uw favoriete activa en bepaal uw strategie.

Op basis van onze interne servergegevens van 2024 wordt 99% van de opnames binnen de 24 uur verwerkt.

Begin uw handelsavontuur bij Capital.com.

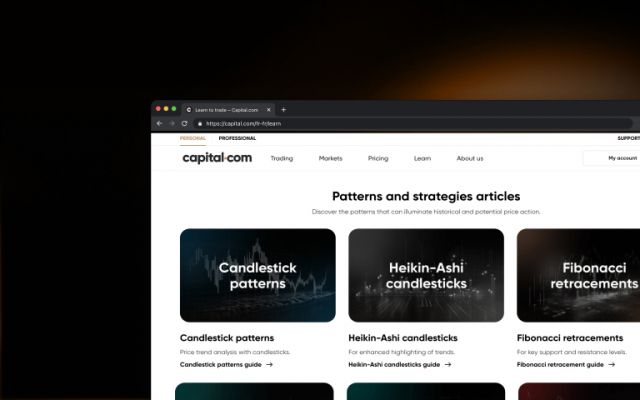

Verruim uw handelskennis zonder risico.

Ontdek de basisprincipes van de effectenhandel in onze toegankelijke cursussen, webinars, quizzen en video's.

Geniet de klok rond van deskundige en persoonlijke ondersteuning.

Houd uw blootstelling onder controle en handel met flexibele positiegroottes.

Gebruik stop-losses3 om uw verlies te beperken, mocht de markt zich tegen u keren.

1 De vermelde informatie heeft betrekking op Capital Com Group.

2 Hefboomwerking vergroot zowel winsten als verliezen.

3 Stop-losses zijn mogelijk niet gegarandeerd.