What is market clearing?

What is market clearing?

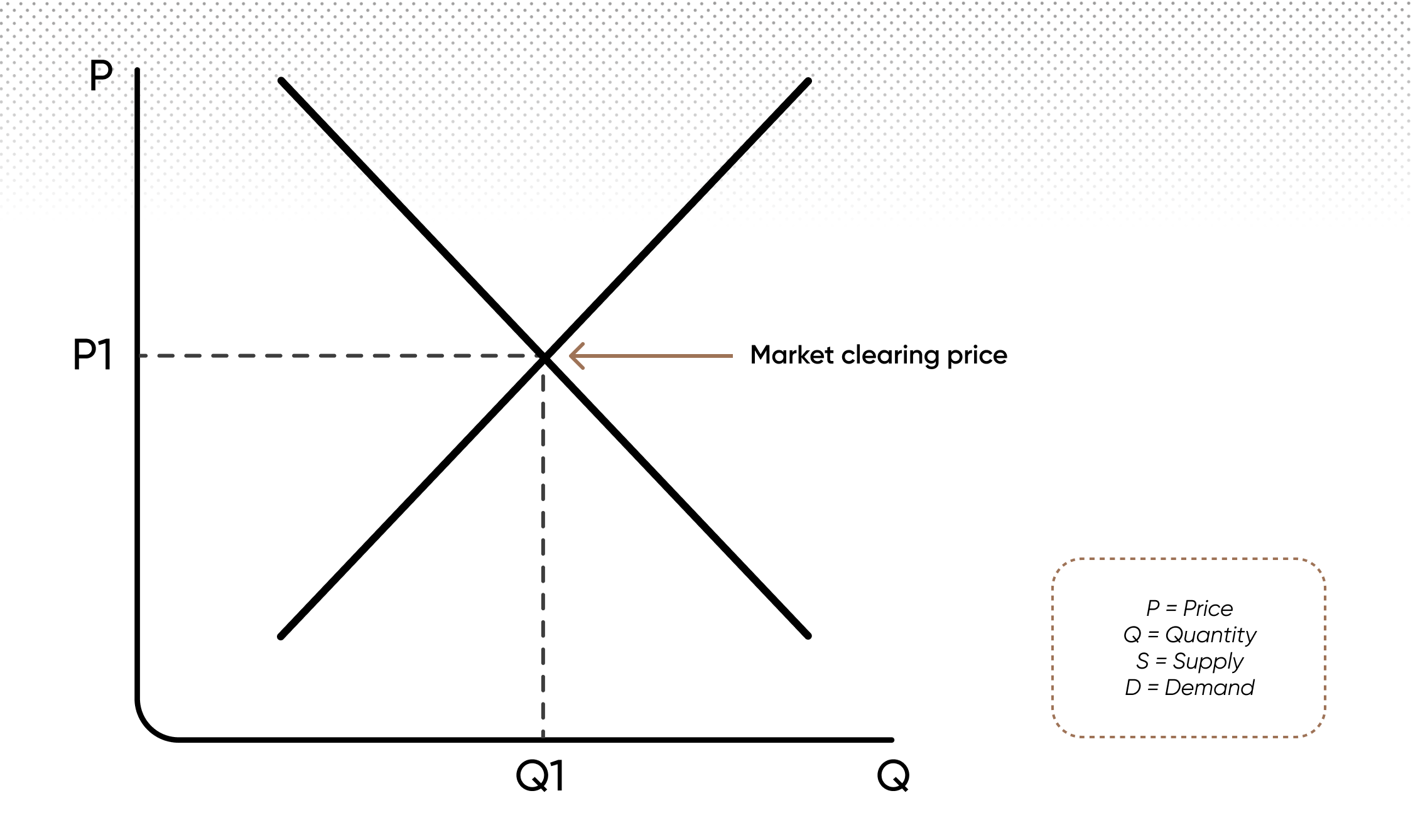

Market clearing is a fundamental concept in economics, a point of equilibrium where the quantity of goods, services or assets aligns perfectly with the demand. It's the sweet spot where supply and demand curves intersect on the economic graph.

In this harmonious balance, every product, service or asset finds a buyer, leaving no surplus or shortage. But remember, in real-world markets, this balance is often elusive due to various market frictions, imperfections and external influences.

Market clearing is pivotal to traders and investors as it directly influences asset prices, which adjust until the market reaches equilibrium. Understanding these dynamics aids in predicting price trends and potential shifts, instrumental for making informed decisions.

Key takeaways

-

Market clearing is the equilibrium point where supply and demand intersect, causing every product, service, or asset to find a buyer, with no surplus or shortage.

-

The market clearing price in trading is where all buy orders can be matched with sell orders, adjusting until equilibrium is achieved. This price can change with shifts in supply and demand.

-

Market clearing occurs in various real-world markets, such as the forex, commodity, and stock markets, where prices fluctuate based on supply and demand.

-

Factors affecting market clearing include supply and demand, market information, competition, economic policies, external shocks, transaction costs, and buyer and seller behaviour.

-

It's essential to remember that market clearing assumes a perfectly competitive and efficient market, which may not always be the case in reality.

Market clearing explained

The market clearing model is grounded in the law of supply and demand. When demand for a certain security outpaces its supply, its price tends to rise. Conversely, if supply outweighs demand, prices usually decrease.

What is the market clearing price?

The market clearing price, also known as the equilibrium price, is the price at which the market forces of supply and demand meet, making it an essential concept in economics and finance. It is the point where the two curves intersect, an equilibrium where all goods, services or assets supplied match those demanded, leaving no surplus or shortage.

In the context of securities trading, the market clearing price would be the price at which all buy orders can be matched with all sell orders. If there's a discrepancy between demand and supply, the price adjusts until equilibrium is reached.

Keep in mind that the model assumes perfect competition and full market efficiency, which are often not completely realised in the real world. The market equilibrium may also vary based on the complexity of the market and the product or service in question.

It's also worth noting that the market clearing price can change due to shifts in supply and demand. For example, a surge in demand or a fall in supply could push the market clearing price up.

Market clearing example

Market clearing is not merely a theoretical construct. Rather, it plays out in real-world markets, shaping price fluctuations.

Take, for instance, the following the foreign exchange (forex) market. Here, currencies are constantly bought and sold across time zones, with prices fluctuating based on shifts in supply and demand.

When economic indicators suggest an upswing in a country's economy, demand for that currency may surge, causing its price to rise. As this higher price attracts more sellers, the market moves toward a new clearing price where demand equals supply.

Factors that affect market clearing

-

Supply and demand: The most fundamental factors affecting market clearing are supply and demand. An increase in supply or decrease in demand typically leads to lower prices, while the opposite conditions result in higher prices.

-

Market information: The level of information available to market participants impacts price discovery. Transparent and accessible information allows for more efficient market clearing.

-

Market competition: Greater competition among sellers and buyers can lead to quicker market clearing. It creates a more dynamic marketplace where prices adjust swiftly to changes in supply and demand.

-

Economic policies: Government policies and regulations can influence market conditions. For example, trade policies can affect the supply of goods, while fiscal and monetary policies can impact overall demand.

-

External shocks: Unexpected events such as natural disasters, political unrest, or sudden technological advancements can abruptly alter supply and demand dynamics, causing significant shifts in the market clearing process.

-

Transaction costs: Costs associated with buying and selling, including brokerage fees and taxes, can impact market clearing. Higher costs might slow down the process, while lower costs could speed it up.

-

Buyer and seller behaviour: Market psychology, driven by emotions like fear and greed, can sometimes override rational economic behaviour, causing market distortions and affecting the speed and efficiency of market clearing.

Market clearing in trading

Understanding the concept of market clearing can play an integral role in trading. It provides valuable insights into the dynamics of supply and demand and the pricing mechanism in various markets.

The process of market clearing reflects the overall investor sentiment and can provide clues about potential market trends and movements. For instance, if there's a sudden surge in demand for a certain asset without an accompanying increase in supply, it can result in rising prices, potentially indicating an upcoming bullish trend.

However, it's crucial to note that market clearing occurs in a perfectly competitive and efficient market with full information, which is often not the case in reality. External factors, like governmental policies and unexpected events, can interfere with market clearing. Moreover, markets can also be affected by behavioural factors, such as investor sentiment and herd mentality, which can lead to price distortions.

While market clearing provides a fundamental understanding of market operations, it should be used alongside other analytical tools and frameworks for a comprehensive analysis. It's also important to constantly monitor market conditions as they can change rapidly, and adapt one's trading strategy accordingly.

Conclusion

Market clearing is a concept that lies at the heart of economics, and refers to a state of balance where supply perfectly matches demand, leaving no surplus or shortage. This equilibrium also defines the market clearing price, which is the price point that satisfies all buyers and sellers in the market.

Yet, achieving market clearing is subject to numerous factors. These range from the fundamentals of supply and demand, the availability of market information, level of market competition, to economic policies and even unexpected external events.

Understanding these influencing factors can provide valuable insights into market dynamics and help traders navigate the shifting landscapes of financial markets. Remember, markets remain volatile, and always conduct due diligence before trading. Testing your strategies using a demo account may prove to be a valuable tool. Finally, never trade more money than you can afford to lose.

FAQs

What is market clearing in simple terms?

Market clearing is an economic state where the supply of goods or services perfectly matches demand, meaning there's no surplus or shortage.

Why is market clearing important?

Market clearing is a key concept in economics because it influences prices of goods, services and assets, aiding in predicting price trends and potential shifts.

What is an example of market clearing?

An example is the forex market, where currency prices fluctuate based on shifts in supply and demand, leading to a new market clearing price where demand equals supply.

What are market clearing models?

Market clearing models are economic models grounded in the law of supply and demand. They explain how prices adjust to attain a balance where all goods supplied match those demanded.

What is a market clearing price?

The market clearing price, or equilibrium price, is the price point at which market forces of supply and demand meet, leaving no surplus or shortage.

How do you find the market clearing price?

You find the market clearing price by setting the quantity demanded equal to the quantity supplied and then solving for the price. Note that this process assumes perfect competition and full market efficiency.