US earnings seasons off to a solid start as focus shifts to tech giants

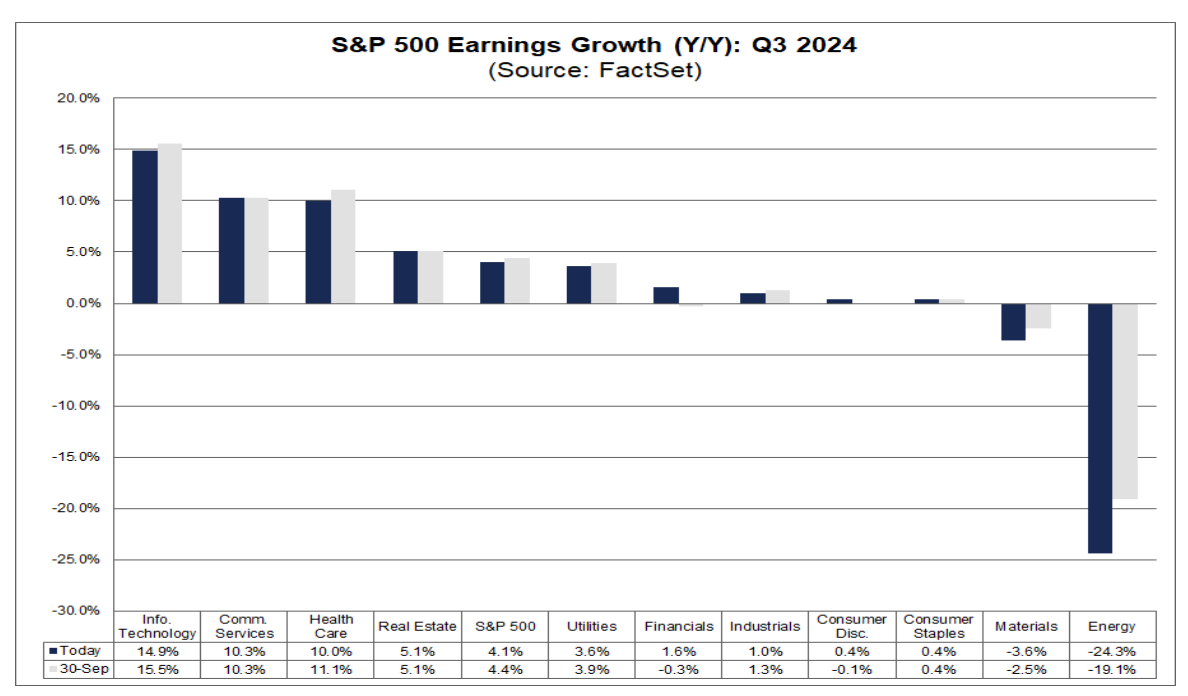

The US earnings season has started on a positive note, with major banks exceeding expectations and boosting market sentiment.Key themes for the sector include investments in artificial intelligence, capital expenditure returns, and consumer trends in advertising and e-commerce.

Despite downward revisions for aggregate earnings growth for the S&P 500 for the quarter, the week’s corporate results boosted market sentiment. The banks soundly beat market expectations, with main street banks, such as Wells Fargo, showing resilient net interest income and only moderate provisions for bad debts. Meanwhile, the investment banks, such as Goldman Sachs and Morgan Stanley, revealed strong activity across their investment banking and trading divisions.

Investors will shift their focus to the results of some of Wall Street’s biggest tech companies, with several of the “Magnificent 7” reporting. The major themes for the sector this quarter will be the scale of investments in artificial intelligence; whether previous capital expenditure in the technology is beginning to deliver returns; and the strength of consumer activity, especially as it relates to advertising spending and e-commerce.

Source: FactSet

Key companies to watch in the week ahead

Friday, October 18

- Procter & Gamble Company (PG), Est. EPS $1.90

- American Express Company (AXP), Est. EPS $3.27

Tuesday, October 22

Alphabet Inc. (GOOG), Est. EPS $1.83

Wednesday, October 23

Tesla, Inc (TSLA), Est. EPS $0.46

Thursday, October 24

- Amazon.com Inc (AMZN), Est. EPS $1.14

- Mastercard Incorporated (MA), Est. EPS $3.69

S&P 500 tests new record highs, supported by the earnings story

The S&P 500 continues to scale fresh record highs, primarily due to data showing resilient economic growth, the prospect of progressive interest rate cuts, and the higher odds of a Donald Trump victory in the Presidential election and subsequent deficit funded tax cuts. The earnings story is also contributing marginally to positive sentiment amid expectations of strong earnings growth in upcoming quarters.

From a technical perspective, the S&P 500 remains in an uptrend, with the index probing fresh record highs this week. The most immediate level of resistance will be the markets recent all time high at 5860. Meanwhile, on the down side, 5800 is a psychologically significant level, with another short-term support/resistance level at 5766.

Source: Trading View

Past performance is not a reliable indicator of future results