RBA expected to cut rates to 3.85% as inflation trends lower and downside risks increase

Markets are increasingly confident that the Reserve Bank of Australia (RBA) will cut interest rates at its 20 May policy meeting, with cash rates futures pricing as of May 19th suggesting a 96% chance of a 25 basis point reduction.

Labour market data signals resilience

The key tension for the RBA lies in the economic data, which continues to show signs of strength. The April employment report delivered a significant upside surprise, with 89,000 jobs added — a figure more than triple the consensus forecast. The unemployment rate held steady at 4.1%, but only because the participation rate ticked higher, drawing more Australians into the labour force.

Adding to the hawkish case was wage growth, which accelerated to 3.4% year-on-year — above expectations and above what many would consider consistent with the RBA’s inflation target. By traditional standards, the labour market is running hot. In fact, the RBA could reasonably argue that it has met its full employment mandate.

However, while the jobs data shows strength, other areas of the economy are slowing. Household consumption remains soft, productivity growth is weak, and business investment is patchy. These broader signs of slack will likely inform the RBA’s bias to cut rates preemptively.

Inflation continues to trend in right direction

On the price front, the data is more supportive of a rate cut. The trimmed mean CPI — the RBA’s preferred measure of underlying inflation — fell to 2.9% in the March quarter. This marked the first time in four years that inflation was comfortably within the RBA’s 2–3% target band.

While headline inflation remains sticky, the underlying trend is encouraging. The RBA has forecast that trimmed mean CPI will decline further to around 2.7% by the end of the June quarter, despite some recent surprises to the upside. That trajectory, if sustained, will reinforce the case for further easing as inflation returns to target.

RBA reaction function: Pre-emptive and data-insensitive?

The RBA’s policy approach in 2025 has been defined by preemption rather than reactivity. The February rate cut — from 4.35% to 4.10% — was justified on the basis that inflation was “likely” to return to target, not that it already had. This speaks volumes about the RBA’s reaction function: it’s forward-looking and willing to cut on the basis of its inflation forecasts.

That mindset is unlikely to have changed, particularly as global risks mount. Although the local labour market looks strong, the external environment is deteriorating — trade tensions are rising, global growth is uneven, and the impact of US tariffs and potential retaliatory measures could spill over into Australia’s open economy.

These downside risks — rather than current data — may compel the RBA to pull the trigger again this month, as it attempts to insulate the domestic economy from global headwinds.

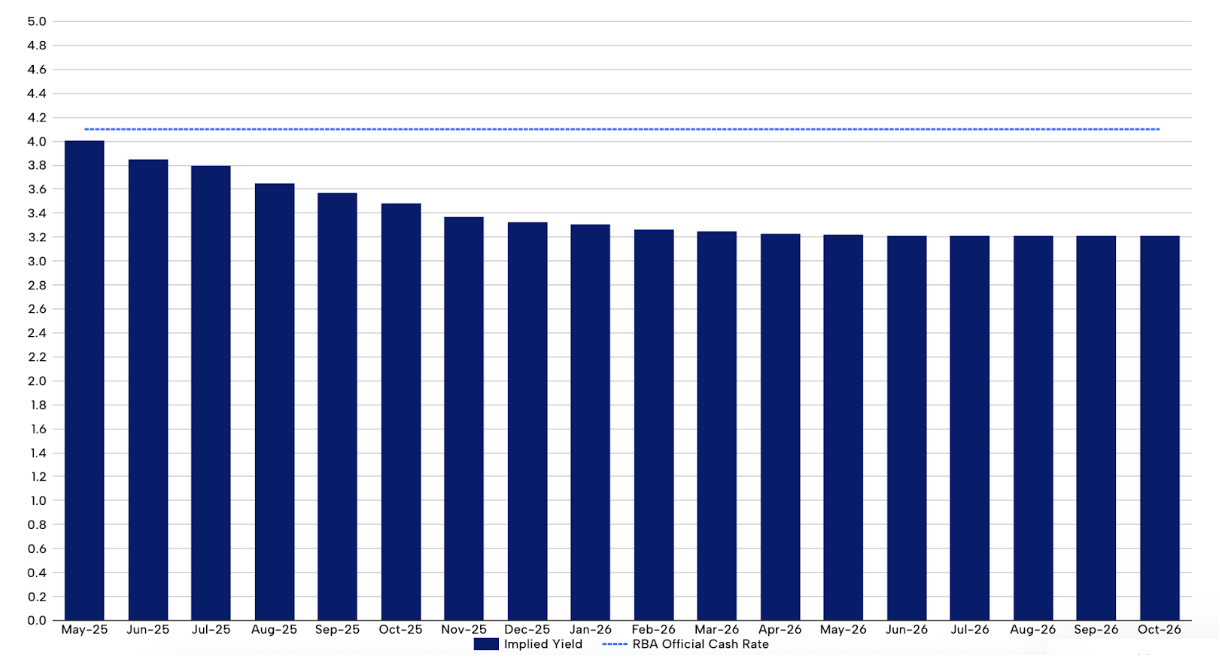

Market pricing: Dovish expectations baked in

Markets have moved aggressively to price in further cuts. As of this week, traders are implying three to four 25bp cuts in 2025, bringing the cash rate below 3.5% over the next 12 months. That’s a meaningful shift in expectations and leaves the market highly sensitive to the RBA’s forward guidance.

A cut next week is mostly priced in. But guidance will drive the reaction in equities, bonds, and the Australian dollar. If the RBA reaffirms the easing bias, risk assets may rally further, while the AUD could drift lower. But if the central bank sounds more neutral or cautious, the market could be forced to pare back some of its aggressive bets on further easing.

(Source: ASX)

Forward guidance: Optionality over pre-commitment?

One of the RBA’s key challenges will be managing expectations without locking itself into a rigid easing cycle. The global outlook remains highly uncertain, and inflation risks from tariffs or supply chain disruptions could quickly reassert themselves. In that context, the RBA may prefer to adopt a “wait and see” approach, keeping the door open to further cuts without promising anything.

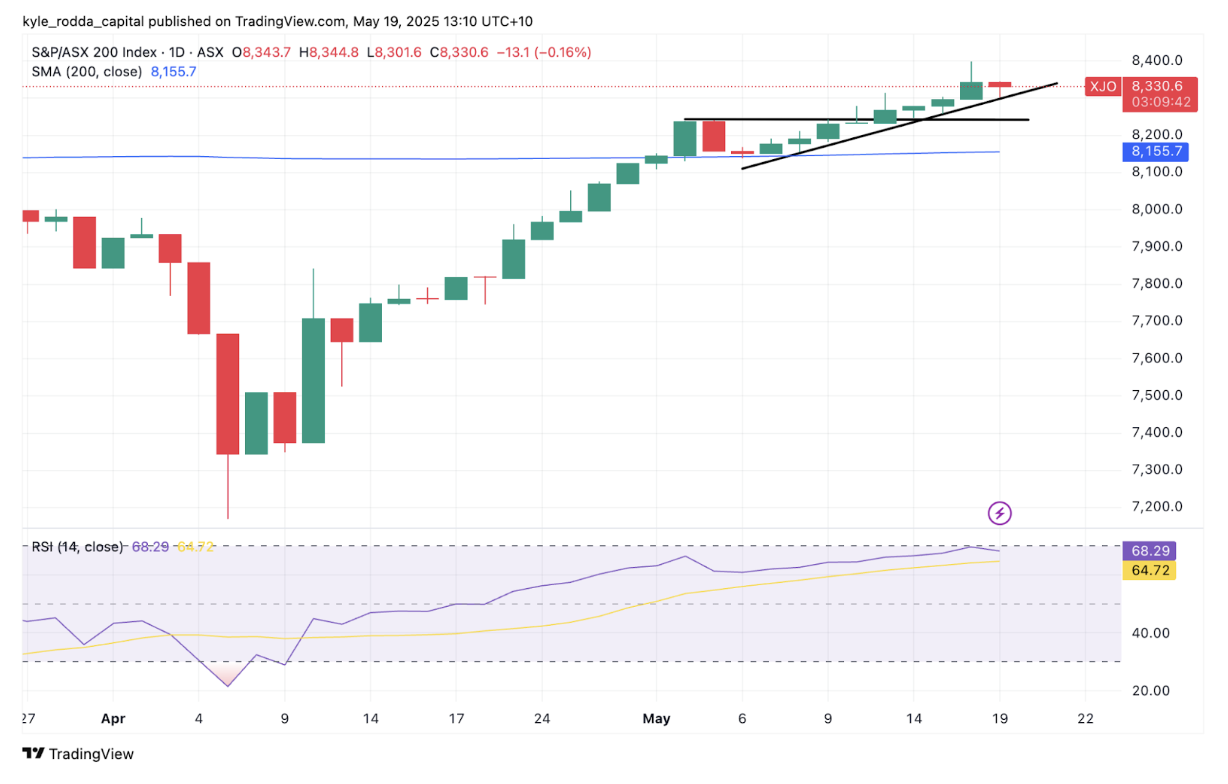

This may frustrate equity markets hoping for a full-blown dovish pivot, and it could trigger some short-term volatility in local bond yields and the currency. After a robust recovery following the Trump administration’s backflip on trade policy, short-term momentum is slowing for the ASX200. A break over upward sloping trend-line support could spark a bigger pull back, while short-term resistance sits at 8400.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)