FOMC Decision Review: Rates unchanged as central bank raises inflation and interest rate forecasts

The FOMC left Federal Funds Rate unchanged at a target range of 5.25 to 5.50%.

The FOMC left Federal Funds Rate unchanged at a target range of 5.25 to 5.50%.

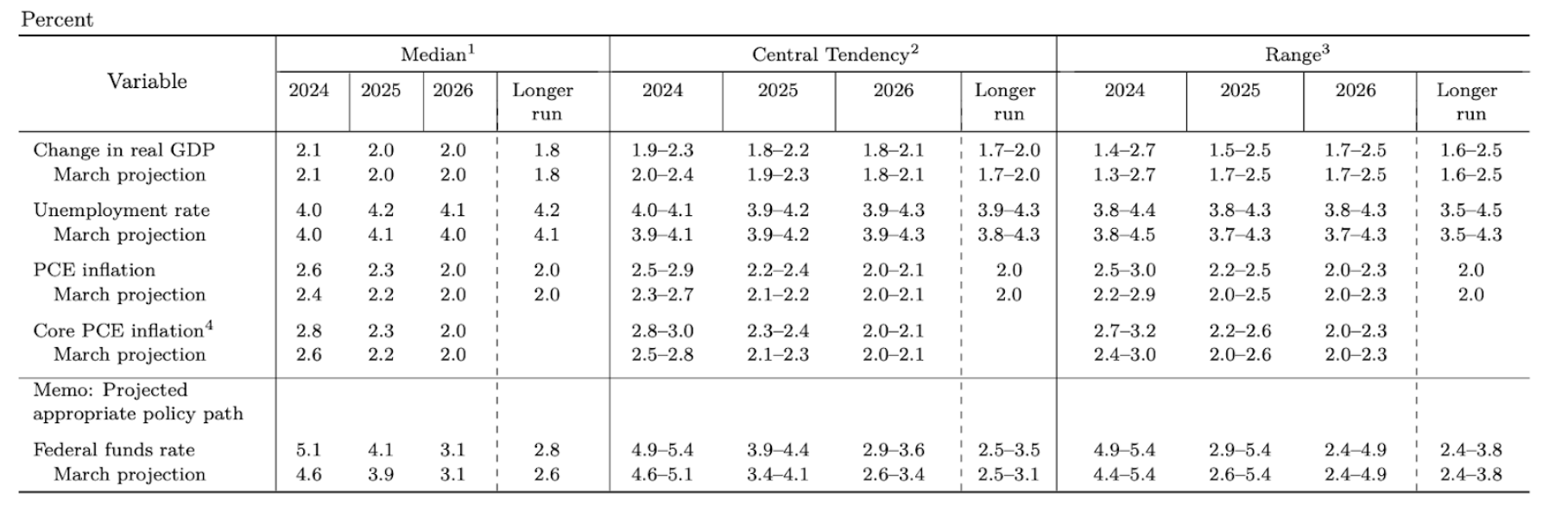

FOMC raises forecasts for the PCE Index and Federal Funds Rate

Given that no charge to the Federal Funds Rate was all but certain going into this FOMC decision, market participants focused on the Summary of Economic Projections. The central bank lifted its forecast for both headline and core PCE in 2024 and 2025 - the projection for core PCE this year moved from 2.6% to 2.8%. As a result, the Fed shifted its median dot in its dot plots to imply just one rate cut from this year, down from three in the March SEP, although a large minority forecasted two cuts. The adjustment in inflation forecasts and the Federal Funds Rate came despite no change in GDP forecasts and the unemployment rate for 2024. The central bank revised its projections for the unemployment rate slightly higher for 2025 and 2026.

Table 1. Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, under their individual assumptions of projected appropriate monetary policy, June 2024

(Source: US Federal Reserve)

How much did CPI data factor into the FOMC’s forecasts?

Although the changes to the Summary of Economic Projections were mostly priced into the market before the FOMC decision, the forecasts raised some questions amongst market participants. The most pressing was whether the CPI data released earlier in the day, which revealed a larger-than-expected drop in core inflation to 3.4%, had been reflected in the FOMC’s forecasts. Fed Chair Powell strongly suggested that it largely was, stating the SEP “does reflect the data we got… to the extent you reflect it in one day”. The next question was how is it possible the Fed could start lowering interest rates from here if growth continues above its long-run average this year, the unemployment doesn’t budge, and inflation remains practically exactly where it is now. Arguably, Chair Powell’s answer did little to clarify the dynamic, ultimately falling back on the view that the Fed believes current policy is restrictive. He also said the revised forecasts were in part due to base effects from low readings last year.

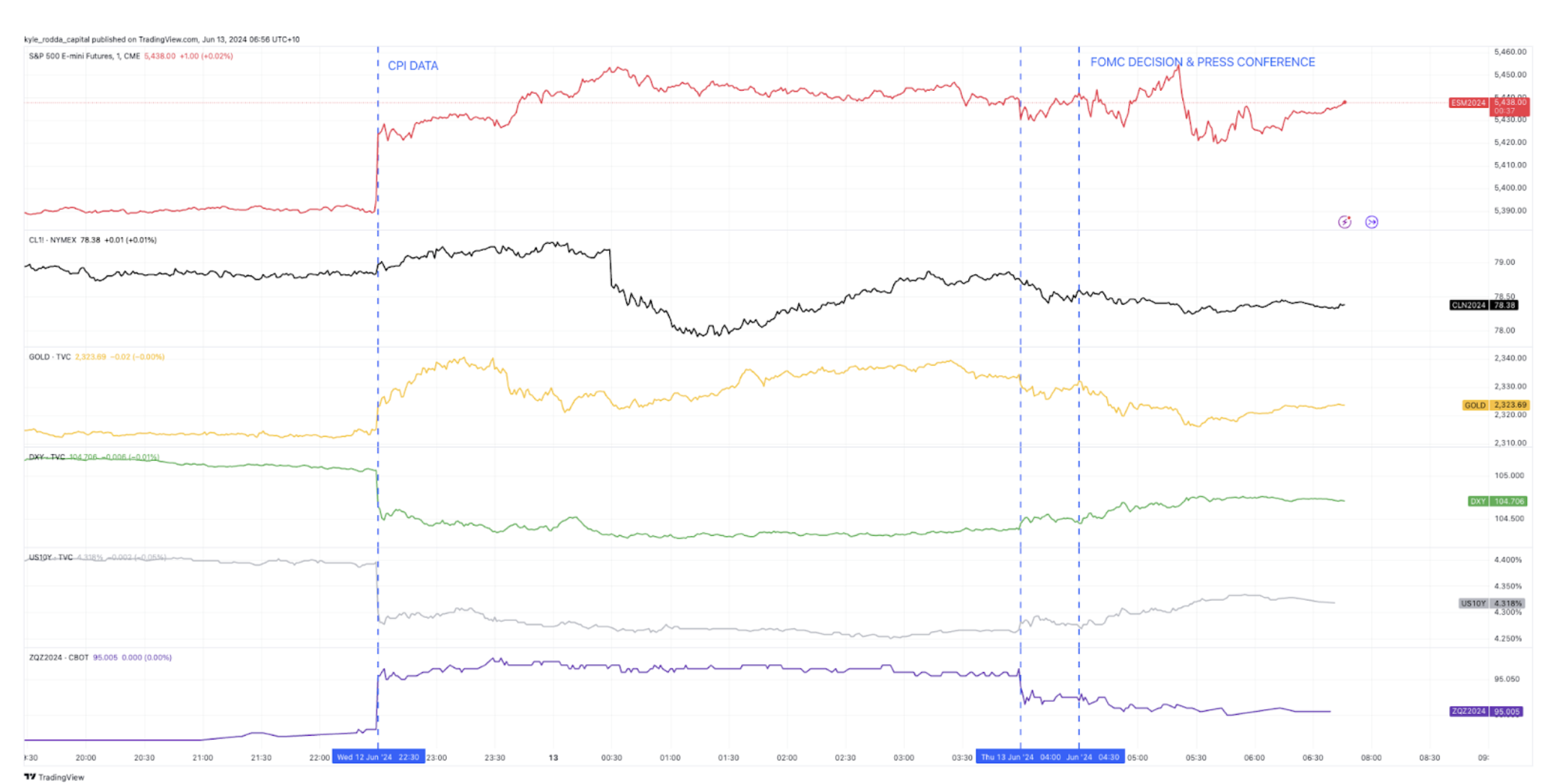

CPI data fuelled risk-appetite, FOMC waters it down

The softer-than-expected CPI report fuelled risk appetite before the FOMC watered down the moves. Stocks closed higher for the day but finished off the session’s highs. Yields pared back a double-digit drop. The US Dollar recovered from its intraday lows. As of the US close, futures imply roughly one and three-quarter cuts before the end of the year, slightly higher than yesterday, but lower than the two cuts that the market had flirted with after the release of the inflation figures. Given the “dot-plots” pointed to an almost even split between members who forecast one cut and two cuts, the pricing effectively splits the difference between the two.

(Source: Trading View)