Central Banks: which one will cut first?

Central banks dominate the calendar in March and markets try to anticipate which one will be the first one to cut

After months of speculation, traders turn their attention to the central banks to try and figure out which will be the first one to cut. Before the year started, many thought all the major banks would have started cutting by now, or at least suggested that the first rate cut would come in March. Futures markets were pricing in up to 150 basis points of cuts from the Federal Reserve, the European Central Bank and the Bank of England in 2024 – but soon they realised that was too optimistic. Current pricing stands at around 80bps of cuts, but that is likely to continue dropping for some of them.

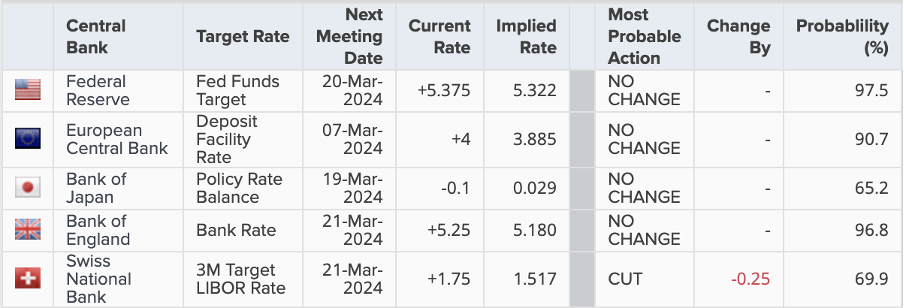

The fact is that none of these three central banks are expected to cut rates in March. Data from Reuters is currently assigning between 90% and 98% chance of policy remaining unchanged at their respective meetings during the month. There has been a lot of speculation about which bank will take the first step, and whilst the Federal Reserve seems the best positioned to continue holding rates for longer, the ECB and BoE have both given very little away in terms of forward guidance. But, in the shadows of the major central banks, there is one contender that could kick off the cutting season. Markets are currently assigning a 70% chance that the Swiss National Bank (SNB) could cut rates by 25bps at their meeting on 21 March.

Market-implied rate expectations for the March meetings

Source: refinitiv

Speculation about the rate cut has arisen mostly from lower-than-expected inflation. Swiss CPI dropped to 1.3% in January when markets were anticipating it to stay unchanged at the 1.7% reported in December, given prices are more regulated in the country. The surprise fall evidenced that prices are undershooting the SNB’s inflation forecasts for Q1, which prompted the expectation of a rate cut in March. However, there is still doubt that the SNB will cut this month as it may want to make sure domestic price pressures no longer pose a threat. Economists at UBS believe the SNB will hold until June, at which point it will cut 25bps, followed by another two 25bps cuts, one in September and one in December. This would take the rate at the end of the year to 1%.

Meanwhile, the Federal Reserve is expected to start cutting rates in June based on current pricing from Reuters, but the timeline could easily change. Minutes from the January meeting showed the FOMC is still wary about cutting rates, as the central bank wants to avoid having to hike again if it cuts too soon. The Fed also expressed cautious optimism about the path of inflation as CPI remains above 3% after coming in higher than anticipated in January. The February reading will be released on 12 March, and the central bank has expressed on various occasions that it needs to be convinced that the rate will return to the 2% target in the medium term before considering cutting rates.

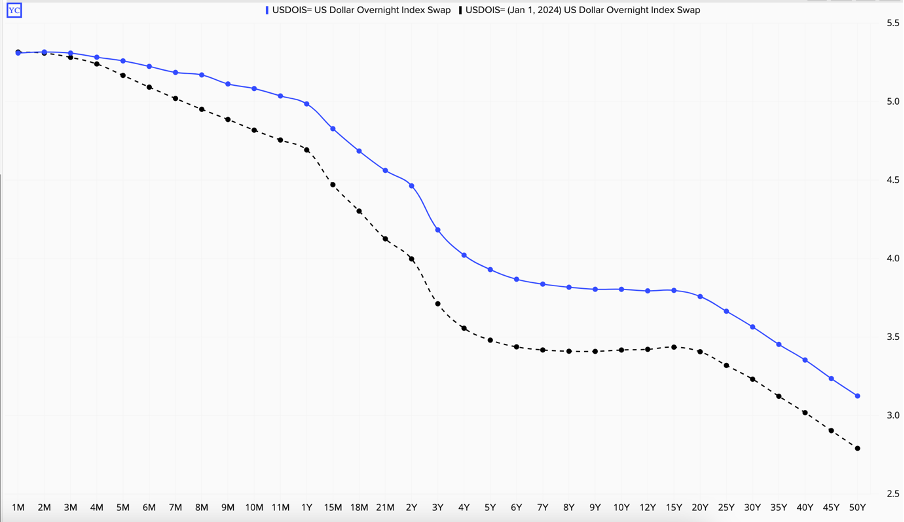

Another important factor for the Fed is the labour market. The unemployment rate remains abnormally low, having been unchanged since November at 3.7% despite repeated forecasts for it to rise. Meanwhile, average hourly earnings have been coming in higher than expected in the past few months, rising unexpectedly to 4.5% in January, the highest level in almost a year. The Fed has also pointed out that it would like to see some of the tightness in the jobs market unwind before cutting rates, as higher wages pose a threat to domestic inflation. Growth has also been surprisingly strong in the past two quarters, with GDP coming in at 4.9% and 3.2% in Q3 and Q4 respectively, suggesting a soft landing has been successfully achieved in the US, pushing back the need for the Fed to cut rates to safeguard the economy. As the chart below shows, current pricing (blue line) sees rates being higher over the coming months compared to what was originally priced at the beginning of the year (black line).

US overnight index swaps (OIS) – current vs 1 January (equally spaced out)

Source: refinitiv

For the eurozone and the UK, things are slightly different. Growth has stagnated in both regions with the UK having entered a technical recession after two consecutive quarters of negative growth, whilst the eurozone has just narrowly avoided it after coming in at 0% in the preliminary readings for Q4 GDP. The weakness in economic growth puts greater pressure on the central banks to start lowering rates as they would want to avoid deepening the rout.

Inflation-wise, the eurozone is in a better position than the UK, with the preliminary CPI reading released on Friday morning showing prices rose 2.6% in the year to February, slightly above expectations of 2.5% but close enough to the 2% long-term target. In the UK, the latest reading showed prices rose 4% in the year to January, double the long-term target. A combination of persistently elevated inflation and stagnant growth is considered stagflation, a tricky situation to navigate and one that central banks likely wish to avoid.

Policy-wise, the higher CPI reading in the eurozone may enable Lagarde and her team at the ECB to continue keeping policy restrictive and avoid giving any further details on when to expect rate cuts to start. As per data from Reuters, futures markets are currently pricing in the first cut to happen in June, with a total of 90 basis points of cuts priced in for 2024.

For the Bank of England, the higher CPI is causing markets to price in the first cut in August, suggesting it will be the last one of the three majors. But, with a weakening economy, the central bank may have to consider lessening the tightness in monetary policy before then, that is if inflation allows it to do so.

So, when it comes to a timeline of cuts, right now it seems that the Swiss National Bank could take the lead in March, but may wait until June, which would coincide with the forecasts for the ECB and the Federal Reserve. The latter seems the least likely of the three to cut in June; the Fed could wait until the end of July. This might coincide with the Bank of England, which may have to start cutting sooner if growth is a concern, albeit this is somewhat unlikely.