A hawkish Fed cut sparks fresh volatility

Discover how the Federal Reserve's hawkish stance, revised SEP, and delayed inflation targets triggered market volatility, with stocks tumbling, bond yields surging, and a stronger US Dollar reshaping investor outlooks.

A lone dissenter on FOMC and revised SEP sparks volatility

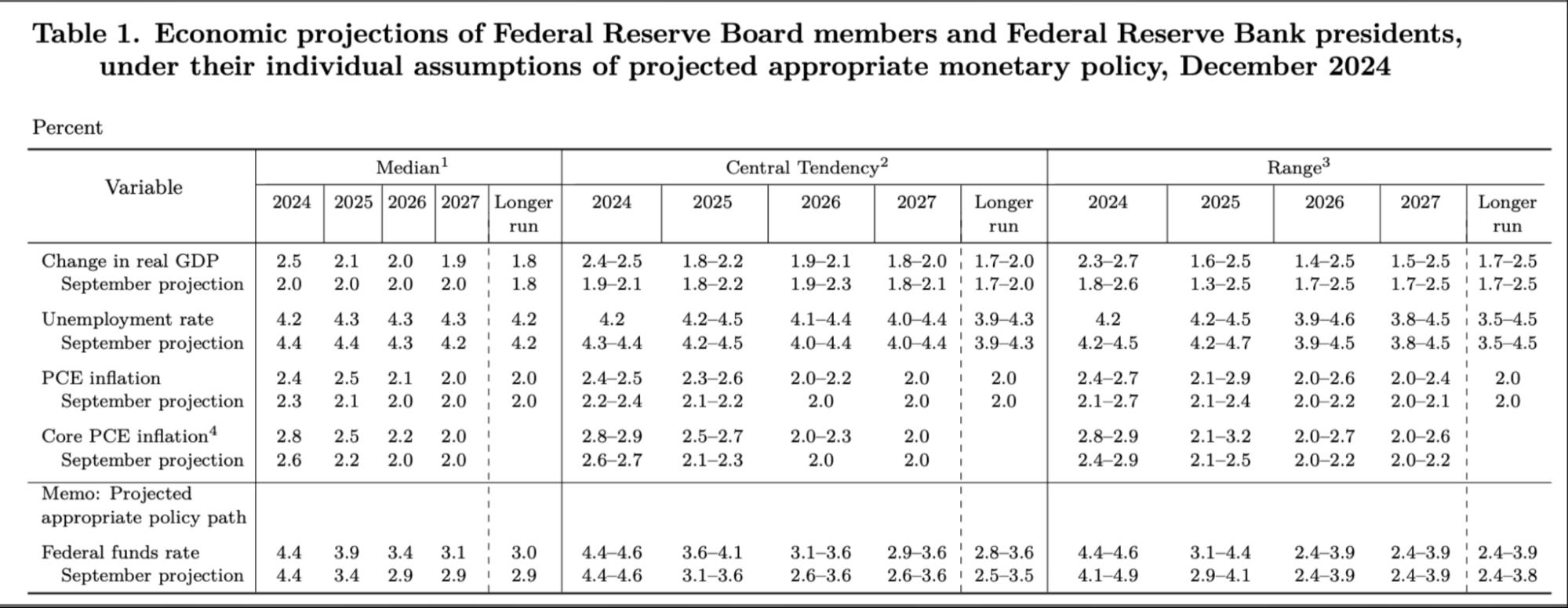

The Federal Reserve's latest policy statement and summary of economic projections signaled a more hawkish stance than anticipated, prompting a significant market reaction. Equities experienced their largest post-FOMC same-day decline since March 2020, reflecting heightened uncertainty about the future policy path. Key indicators contributing to this response included a dissenting vote favoring no change to policy rates and an upward revision in the dot plot, indicating higher interest rates over the medium term. The Fed also delayed its expected timeline for reaching its inflation target, while raising growth projections and lowering unemployment forecasts. The median dot increase was expected, with the projection of only two rate cuts in 2025 aligning the Fed’s outlook with market expectations, which have long assumed a higher neutral rate. However, the emphasis on persistent inflation risks, the possibility of a prolonged pause in rate cuts, and a "higher-for-longer" policy outlook unsettled investors, triggering a broad risk-off sentiment.

(Source: FOMC)

Powell strikes positive tone but markets see shift in balance of risks

The most impactful information and market movements emerged during the Federal Reserve Chairperson's press conference, which largely reinforced the tone and substance of the initial policy statement and Summary of Economic Projections. While expressing confidence in the economic outlook and indicating that rate cuts could continue as inflationary pressures ease, there was a noticeable shift in the perceived balance of economic risks. Concerns appeared to move away from slower growth and labor market deterioration toward persistent inflation risks. This reassessment seems influenced not only by strong economic data but also by expectations of more expansionary fiscal policies under a Trump administration, which could introduce additional procyclical stimulus in an already robust economic environment.

Stocks tumble and Dollar surges as markets reprice rate outlook

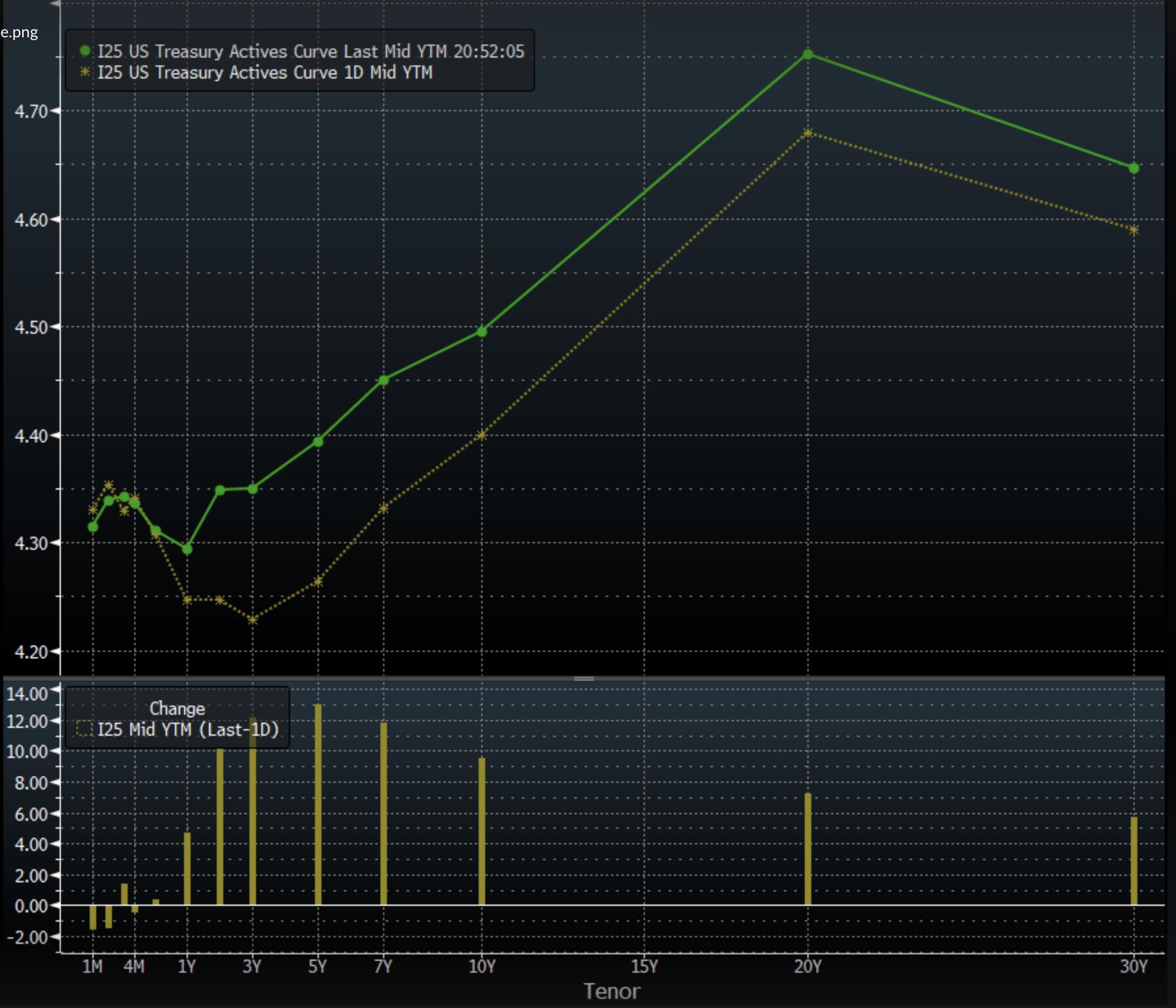

The Federal Reserve’s hawkish stance triggered a predictable bearish reaction across financial markets. Market uncertainty surged, as reflected by the VIX approaching 20. Equities declined sharply, with tech stocks leading the drop, though small-cap stocks performed even worse. Bond yields spiked significantly, echoing the scale of the 2014 taper tantrum. The US Dollar strengthened notably, pushing AUD/USD down to the 0.62 range amid concerns about weaker domestic and Chinese economic growth. Rising Treasury yields and a stronger dollar also pressured gold and Bitcoin lower. A key market response was the shifting yield curve, which steepened around the middle as investors priced in the possibility of structurally higher interest rates. Expectations for the next rate cut have now been delayed until the second half of next year.

(Source: Bloomberg)