差价合约 (CFD) 是一种复杂的金融工具,利用杠杆交易虽然可能放大收益,但同样也会加剧亏损风险,导致资金快速流失。数据显示,81.7% 的散户投资者在使用该提供商服务进行差价合约交易时出现账户亏损。在进行交易之前,请确保您充分了解差价合约的运作机制,并仔细评估自己是否有能力承担资金亏损的高风险。

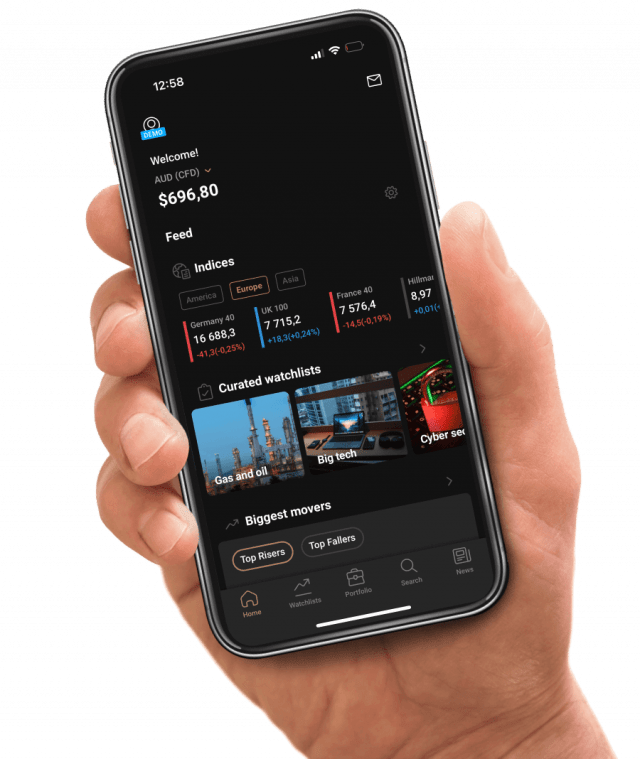

对黄金、香港50、USD/JPY 等多种资产进行差价合约 (CFD) 交易。开户便捷高效,$20美金即可交易。

本平台由巴哈马证券委员会 (SCB) 授权并监管

展示我们的 4 星和 5 星好评。为遵守 GDPR 要求并保护用户隐私,用户的具体信息已被匿名处理

全面且完善的服务、专业工具与优质资源,助您持续提升交易技能。

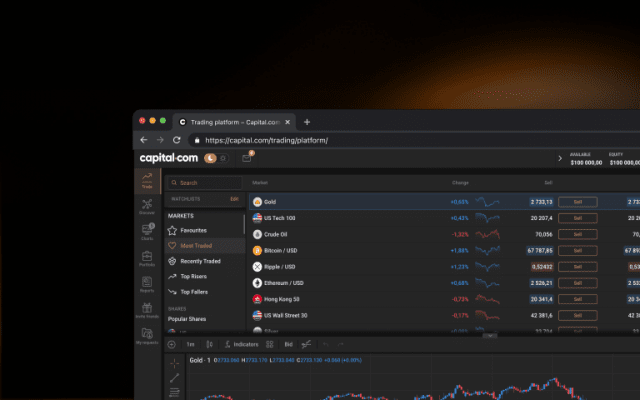

利用 100++ 种技术指标、直观图表和绘图工具,助力市场分析。

在精选市场以低保证金掌控更大交易头寸。杠杆不仅能提升盈利潜力,也会加大亏损风险。可能存在杠杆限制

我们的专业团队提供全天候支持服务,随时为您答疑解惑

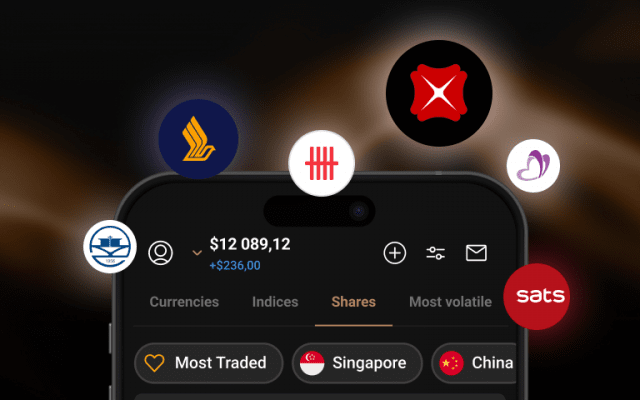

时刻关注您最爱资产的价格走势,把握市场机遇,优化交易策略

根据我们 2024 年的内部服务器数据,99% 的提款请求在 24 小时内处理完毕。

选择 Capital.com,开启您的交易之旅。

零风险体验交易,轻松积累实战经验。

享受专业且友好的全天候客户支持服务。

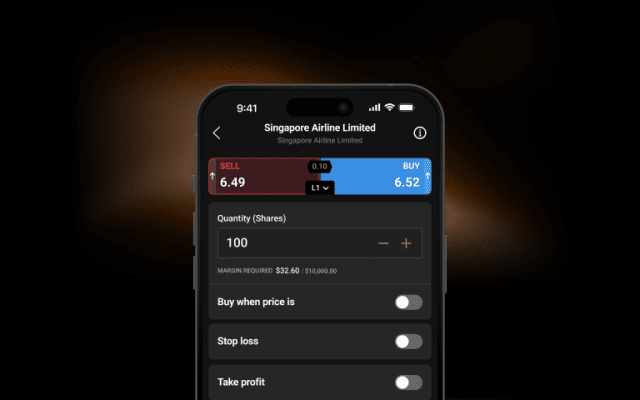

灵活设置交易规模,优化资金管理,稳健掌控风险。

使用止损单1在市场走势对您不利时及时止损。

1止损可能无法保证执行