US elections: Trump leads the polls, but tariff talk spooks investors

As the US elections get closer we look at how Trump’s tariff plans could affect markets.

All price and forecast data in this article is sourced from Bloomberg, The Times

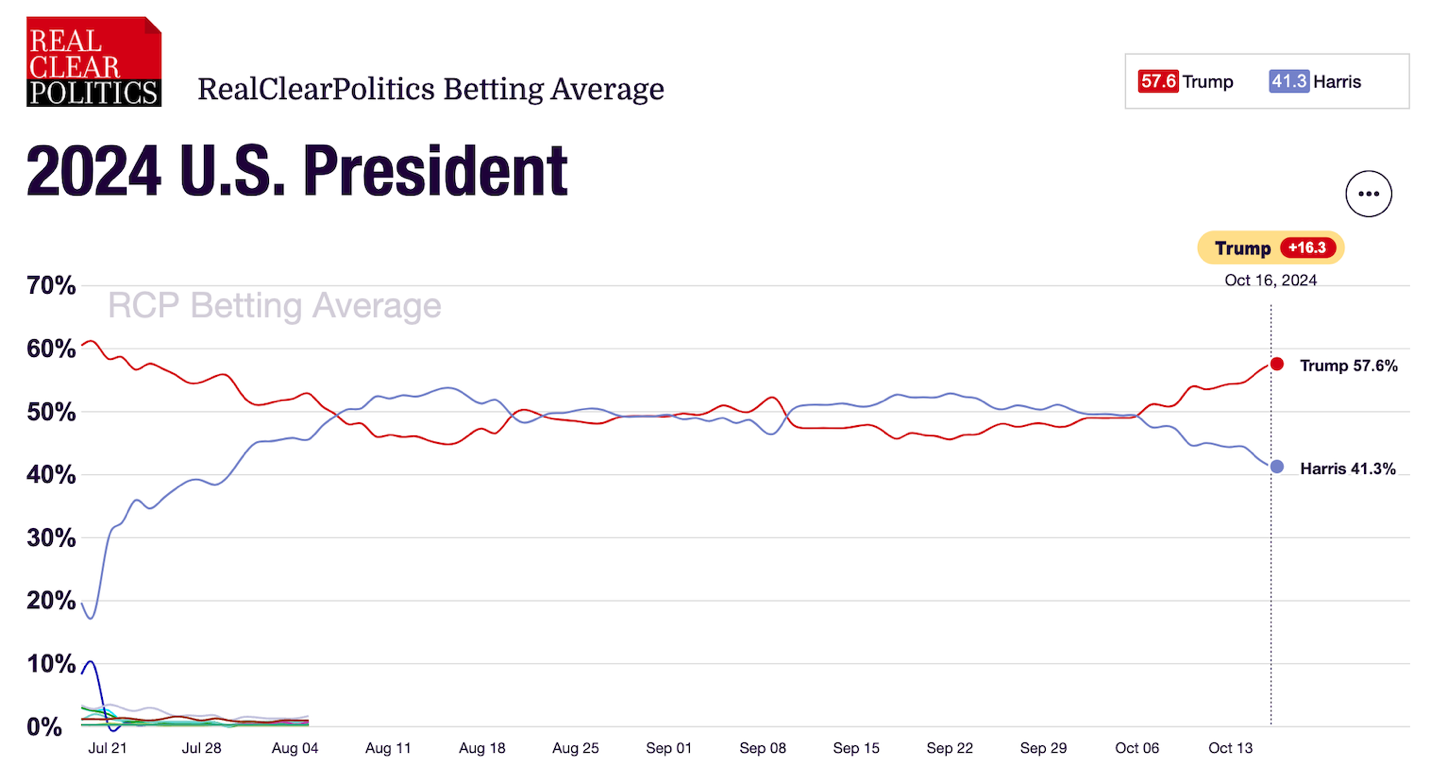

The latest odds seem to be leaning in favour of Donald Trump winning the US election once again. Polling markets now show the former president is ahead of the current vice-president Kamala Harris and is gaining ground as the days go. Last month it seemed like it was going to be a very tight race with Harris marginally sneaking ahead of Trump, but with less than three weeks to go the gap has widened in favour of the republicans, with an average of 57% of the votes, versus 41% for the democrats.

Source: realclearpolling.com

The truth is that polls are often given a lot of attention leading up to the election day, but they are not a clear indication of how the result will go. That said, they do work to set up market expectations heading into the event, which can result in market volatility. One of the key standouts of a Trump win would be his tariff strategy, which could shock markets. The former president has been making headlines this week by launching his all-American bid which would see high tariffs placed on all imports to boost domestic manufacturing. The initial proposal sees a 10% blanket tariff on all goods, with tariffs as high as 60% for China. His plan is that it would force companies to relocate and consider building manufacturing plants in the US to revive depleted industries.

The tariff claims may be seen somewhat as a bluff within his election campaign, but some political analysts are suggesting this may not be the case. After all, he needs a lot of money to go through with his other election promise of cutting taxes. Brendan Duke, a left-leaning economist at the Center for American Progress who has studied the potential economic impact of Trump’s tariff plans says “there's actually a logic to the tariffs for his other policy goals”.

But what impact could these tariffs have on US consumers? First, they are likely to see a big increase in inflation. Just because Trump attempts to limit the access of foreign products into the US does not mean US consumers will stop buying these products. But it will make them more expensive. It could also impact growth negatively to the point of a potential recession from a massive fall in imports and widespread disruption in manufacturing.

It is important to consider the fact that the election is less than a month away and will take place before the November 7 Federal Reserve meeting. Considering Powell and his team have only been able to deliver 50 bps of cuts so far, the impact on rate expectations could be significant, especially as Trump believes he should have a say in whether rates should rise or fall. A Trump tariff strategy could limit how much the Fed is able to cut rates over the coming year.

With regards to markets, one area where the Trump trade has started to show impact is the US dollar, which has been moving higher. Trump’s agenda is seen as inflationary which is positive for the US currency and negative for bonds. Positive economic data and geopolitical tensions have also been keeping the dollar supported. Funnily enough, Trump has been pretty clear in the past that he believes the dollar is overvalued and that affects the US competitiveness in international trade, with some reports of potential measures to try and devalue the currency if he becomes president.

As for stocks, the impact of a Trump victory seems to be slightly unclear. His bid to deregulate the market and lower taxes should be positive for stocks in the short-term, especially for traditional sectors like heavy industries and fossil fuels. That said, if his measures are seen to have a negative impact on growth and a rise in borrowing costs then investors may get spooked and move away from US equities.

US dollar index (DXY) daily chart

Past performance is not a reliable indicator of future results.

All price and forecast data in this article is sourced from Bloomberg, The Times