PCE Index Preview: Forecasts point to no change in headline or core inflation from a month earlier

The markets continue to look for signals of disinflation in the United States. The latest PCE Index data, the US Federal Reserve’s preferred inflation gauge, is released on May 31, 2024.

The markets continue to look for signals of disinflation in the United States. The latest PCE Index data, the US Federal Reserve’s preferred inflation gauge, is released on May 31, 2024.

Headline and core PCE deflator tipped to remain steady

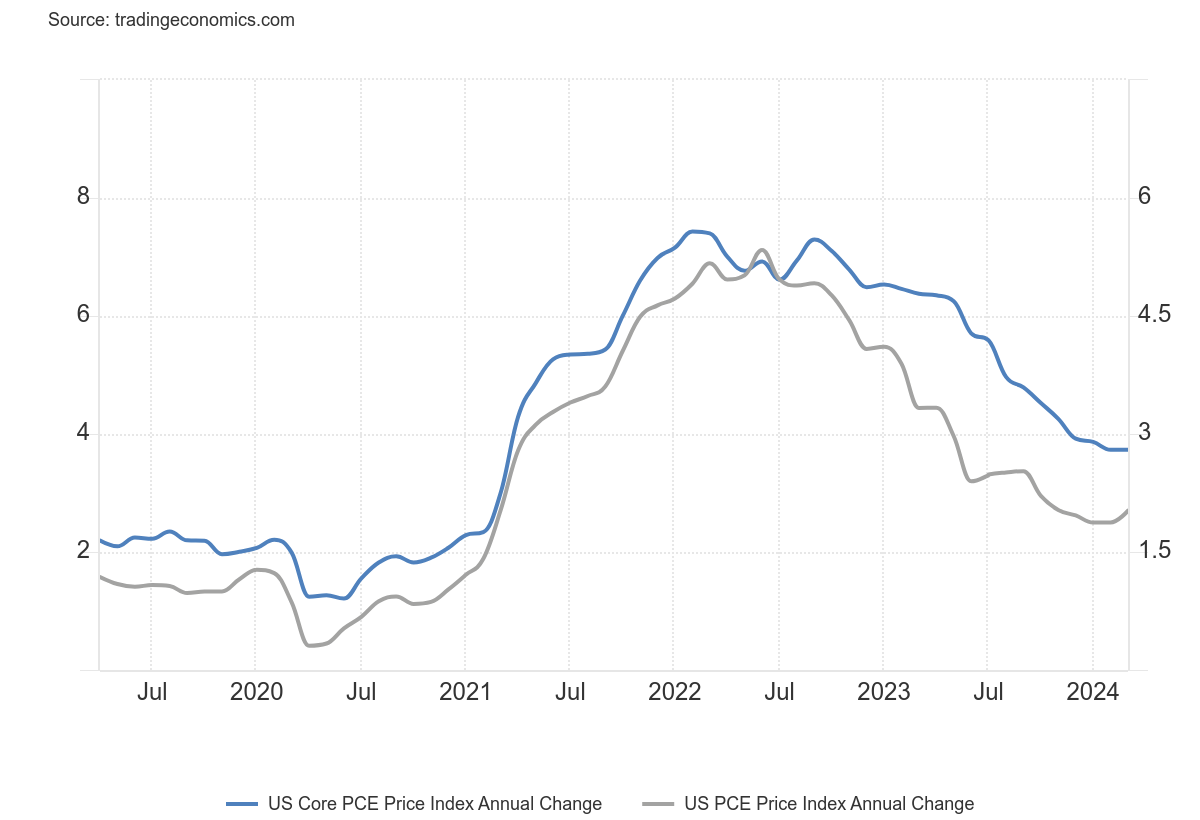

Following signs of softening price pressures in the recent CPI survey, the markets are turning attention to the PCE Index release, the US Federal Reserve’s chosen inflation gauge, to confirm the process of disinflation in the US economy is ongoing. According to data from Bloomberg, economists forecast the price growth was unchanged in April compared to a month earlier. Headline PCE is projected to remain at 2.7%, while the more significant core figure is estimated to remain at 2.8%. The forecasts suggest ongoing stickiness in US prices, supporting the claim that inflation has re-anchored above the Fed’s target and potentially re-accelerating.

(Source: Trading Economics)

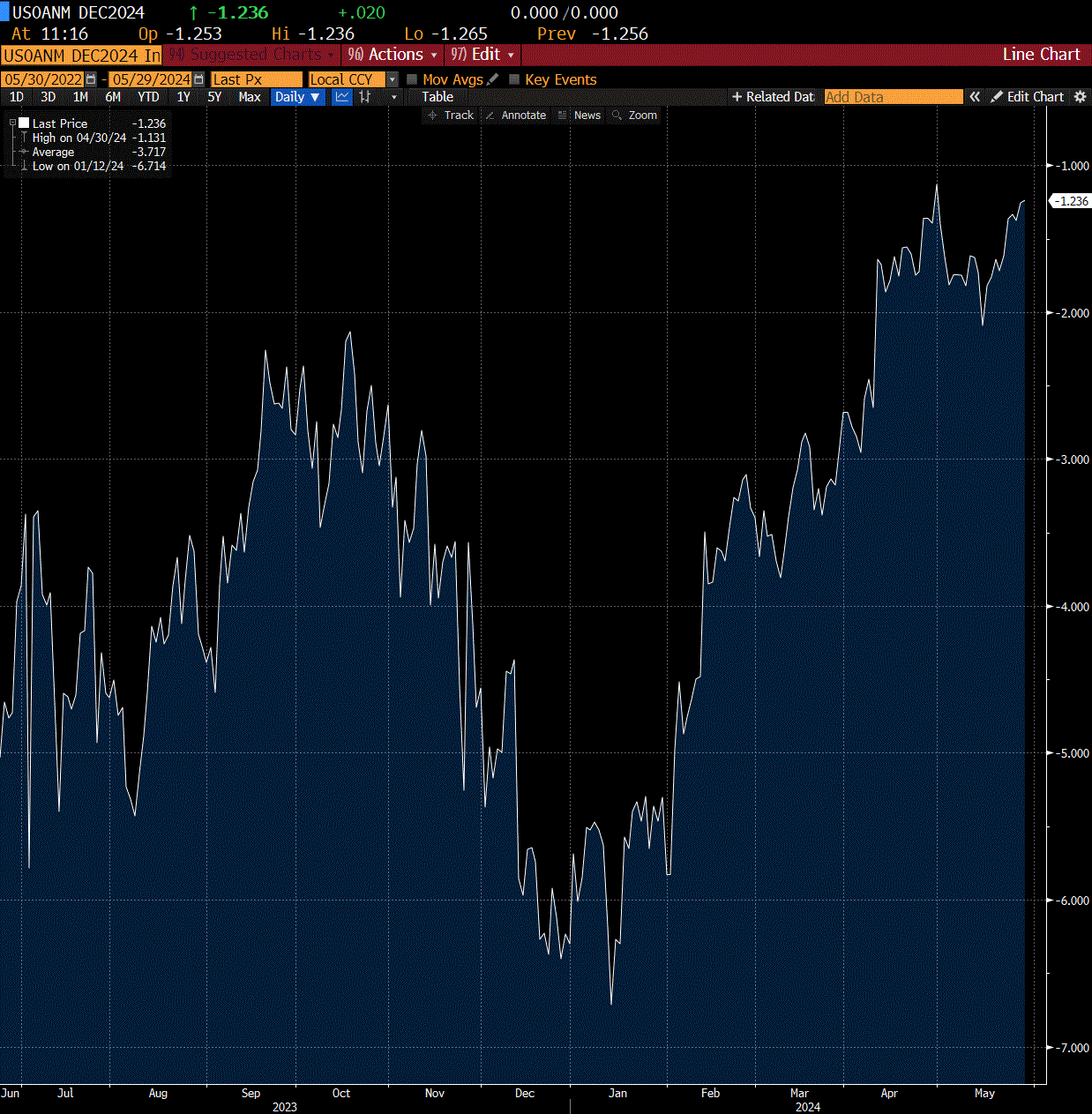

Following the last FOMC meeting, at which the Fed pushed back on the need for further policy tightening and suggested rate cuts this year were still possible, US interest rate futures have shifted to imply a delayed start to the Fed’s next cutting cycle and fewer cuts by the end of 2024. The markets have deferred the timing of the first rate cut to December, with the December futures (below) contract implying less than a 25% chance of two cuts this year.

(Source: Bloomberg)

Unlike the CPI release, which came in at expectations but showed core prices fell to a three-year low, a lower-than-expected result from the PCE data is (more than likely) required to excite bullish sentiment. Meanwhile, signs of a pick-up in prices last month could reignite fears of stubborn or potentially reaccelerating inflation and drive further pricing out of rate cuts this year—a move that would be negative for market sentiment.

Technical analysis: GBP/USD

Although the markets have reduced expectations for Fed rate cuts this year, the GBP/USD has been in a short-term uptrend due to higher-than-expected UK inflation data and dialling back of Bank of England cuts. The pair’s technicals suggested a slowing upside moment, with an ascending wedge suggesting a possible reversal. The GBP/USD recently rejected resistance around 1.2800, marking that as a critical level. Meanwhile, 1.2700 is a level of previous resistance that may act as support if the pair’s uptrend breaks down.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)