Cineworld share price forecast: What lies ahead for CINE as the chain seeks buyers for its assets?

What lies ahead for Cineworld's share price following reports of the company seeking buyers for its assets in the US and Europe?

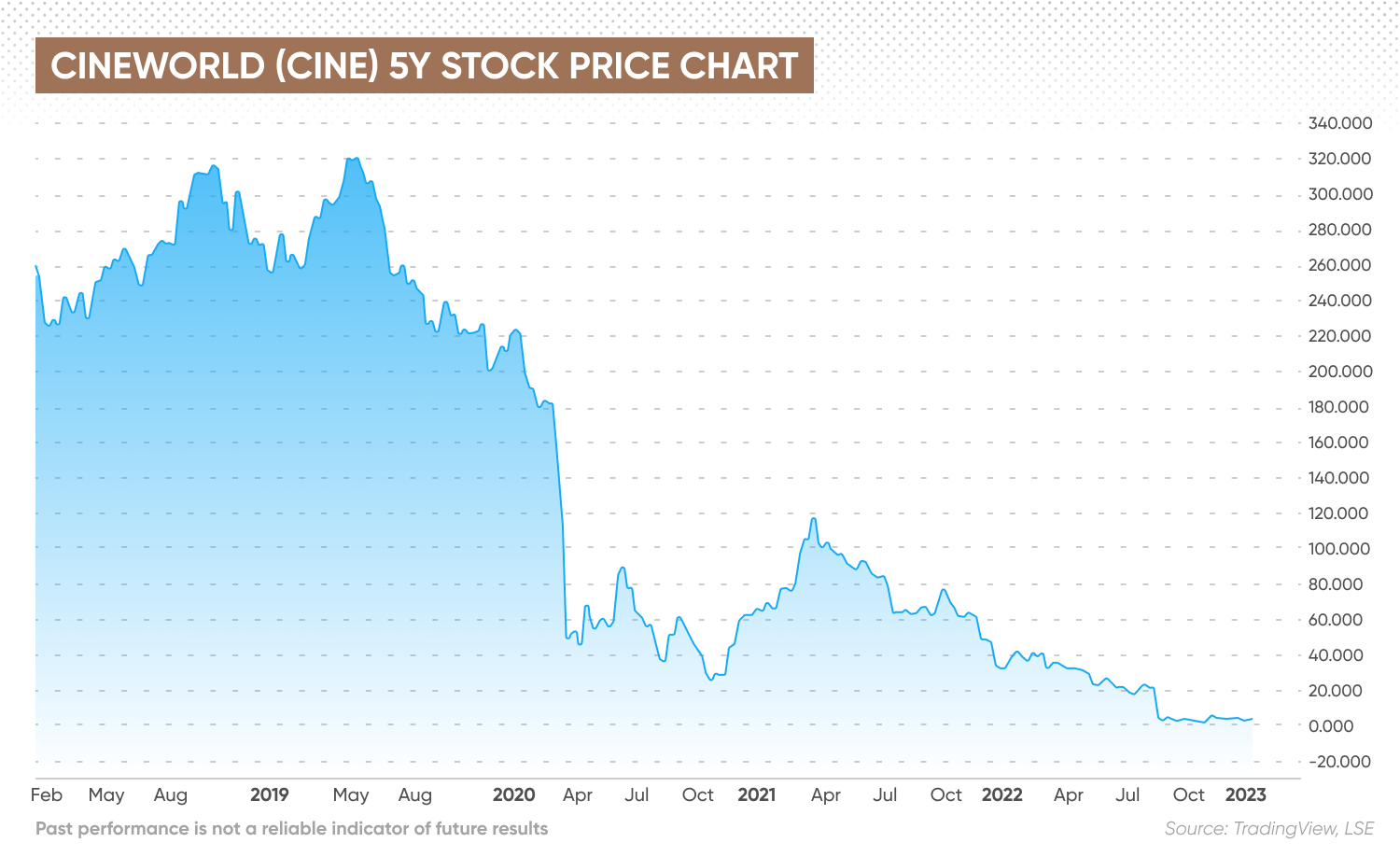

Customers have returned to Cineworld Group (CINE) theatres since the lifting of Covid-19 restrictions, but the British cinema operator's share price has nosedived over the past few years.

Cineworld filed for Chapter 11 bankruptcy in the US on 7 September 2022. It has been saddled by a growing debt load and slow recovery from pandemic lockdowns that severely disrupted the global cinema business.

Recently, the company denied that some of its lenders were in talks with rival AMC Entertainment Holdings (AMC) to acquire its cinemas in the US and Europe.

One of the world's largest cinema chains saw its share price fall to 3.67p on 4 January 2022, from the highs of above 300p in 2018 during the pre-pandemic period.

Will Cineworld’s share price recover? Read on for a Cineworld stock analysis and analysts' views on the Cineworld share price forecast.

What is Cineworld?

British Cineworld Group (CINE) was founded in 1995 by American Steve Wiener, whose first job was as a cinema usher. Wiener served as CEO of the company for 18 years before stepping down in 2013.

The acquisition of Regal Entertainment Group in March 2018 made Cineworld the world’s second-largest cinema chain after AMC Theatres.

The London-based company now operates 751 cinemas with a total of 9,189 screens in the UK, Ireland, Poland, the Czech Republic, Slovakia, Hungary, Bulgaria, Romania, Israel and the US. The US is Cineworld’s biggest market, contributing 68% of its revenue.

Cineworld, which originated as a private company, listed its shares on the London Stock Exchange on May 2, 2007.

Cineworld stock price analysis over the years

Like all its peers in the cinema business, CINE's share price was hit by theatre closures and a shift to streaming services to curb the Covid-19 pandemic.

The share fell to 36.47p at the end of March 2020 as countries began lockdowns and restricted public activities to stop the disease from spreading. The price then gradually recovered, hitting 122p on 15 March 2021 as Covid-19 restrictions eased on the widespread vaccine roll-out.

However, Cineworld’s share price has continued going downhill since the March 2021 recovery. The share was trading at around 32p by the end of 2021 after it reported an operating loss of $208.9m in H1 2021 and net debt of $8.4bn, highlighting the company's risky position.

CINE's share price dropped throughout 2022, hitting 2.9p on 22 August on news that the company was considering bankruptcy. It briefly recovered to 5.8p on 31 October, before gradually dropping to 3.4p as of 4 January. CINE's share price has fallen by more than 88% year-to-date (YTD).

Cineworld earnings: Admission recover but below expectations

Cineworld’s financial performance has recovered as moviegoers returned to cinemas with the easing of the remaining Covid-19 restriction.

In the six months to 30 June 2022, the group’s revenue rose to 1.51bn, compared to $292.8m in the same period in 2021, as the company’s cinemas fully reopened in all territories, the company announced in an interim report released in September 2022.

CINE booked an operating profit of $57.3m from January to June 2022, recovering from an operating loss of $208.9m in the first half of 2021 on a steady increase in admissions. Its gross profit surged to $424.5m in the first half of 2022, compared to $9.6m year-on-year (YoY).

Admissions from January to June 2022 stood at 85 million, a 487% increase from 14.1 million in the same period in 2021 on the reopening of cinemas. However, the company said monthly admission levels remained below both pre-pandemic levels and the group's original forecast for 2022.

Admissions are a key performance indicator in the movie theatre industry, affected by the frequency, popularity and timing of the films shown.

The company's overall admissions rose to 95 million in 2021 from 54 million in 2020. However, it remained below 275 million in 2019 and 308.4 million in 2018 as a result of theatre closures and the dearth of blockbuster movie releases since the outbreak's start.

As for admission outlook, the company expected admission to stay below the pre-pandemic levels in 2023 and 2024 on a lower volume of theatrical releases.

Why did Cineworld’s shares tank?

Cineworld’s piling debt has dragged the company’s stock down and capped recovery opportunities.

Net debt is calculated by comparing a company's total debt to its cash on hand and in the bank. The company reported net debt of $8.8bn in the first half of 2022, rising 14.58% from $7.68bn at the end of 2019.

In the first hearing of the Chapter 11 bankruptcy petition, the Southern District of Texas, where Cineworld filed the petition, granted immediate access to $785m out of a $1.94bn financing facility (DIP Facility) that helped the company meet short-term liquidity.

In recent news, AMC Theatres on 21 December 2022 said in a filing that it had held talks with certain Cineworld lenders about a potential strategic acquisition. The talks focused on the acquisition of Cineworld’s cinemas in the US and Europe.

Cineworld dismissed AMC’s statement on the acquisition discussion. In a filing on 3 January 2023, the company said it nor its advisers nor the lenders had participated in the discussion with AMC Entertainment Holdings.

Russ Mould, Investment Director at AJ Bell, said in a note on 3 January:

“Shareholders have been told on numerous occasions that their investment could be significantly diluted upon any restructuring or sale of the business, so the situation is more about getting back pennies in the pound rather than waiting for a big payday.”

Cineworld share price forecast: Target for 2023 and beyond

According to MarketBeat, the consensus analyst rating was 'hold'. The analysts’ forecasts suggested a 12-month share price target of 40p with the low and the high prices at the same level. The average price target, issued by analysts from Jefferies, JPMorgan Chase and Berenberg Bank, represents a potential 91.54% increase compared to the share price as of early November.

MarketScreener polled two analysts, and the stock's consensus rating was also 'hold'. The analysts’ predictions offered a 12-month share price target of 68.50p with a low price target of 24p and a high price of 115p, as of 4 January.

Wallet Investor's CINE share price forecast was pessimistic, citing the company's recent bearish cycle.

“Our AI stock analyst implies that there will be a negative trend in the future and the CINE shares are not a good investment for making money,” according to the algorithm-based price prediction which typically offers five-year price forecasts for stocks, as of 4 January 2023.

According to Wallet Investor’s Cineworld share price forecast for 2023, the price could crash to 0.000001p by the end of that year, from an estimated 3.379p on 5 January 2023. The service’s Cineworld share price forecast for 2025 saw CINE remaining a penny stock up until until 2027.

When looking for Cineworld share price predictions, keep in mind that analyst forecasts and price targets are not always accurate. Many variables will influence the movement of the CINE share price, including the outcome of its bankruptcy filing and potential acquisition.

Analysts' CINE share price forecast should not be used in place of your research. Before investing, always conduct due diligence by conducting fundamental and technical analyses of the stock's performance. Past results are no guarantee of future outcomes. And never invest money you can't afford to lose.

FAQs

Is Cineworld a good share to buy?

Analysts polled by MarketScreener and MarketBeat rated the stock a 'hold'. Cineworld’s share price has dropped nearly 99% in the past five years. Always remember to do your own research and analysis before reaching a trading or investment decision. And never trade or invest more than you can afford to lose.

Will Cineworld shares go up or down?

Analysts were divided on Cineworld's share price prediction. Analyst forecasts compiled by MarketBeat and MarketScreener indicated that the stock price could rise over the next year. Meanwhile, Wallet Investor projected that CINE could collapse to a penny stock by 2023 and beyond.

It should be noted that analyst and algorithm-based price prediction service forecasts for Cineworld's share price can be incorrect. We encourage you to conduct your research to determine whether the stock price will rise or fall in the future.

Should I invest in Cineworld shares?

Your decision to invest in Cineworld Group (CINE) shares should be based on your risk tolerance, investment objectives, portfolio composition and experience in the markets. Remember to do your own research before trading or investing. Never trade or invest money that you can't afford to lose.