Boohoo share price forecast: Can it make a fashionable comeback?

Can the British online fashion retailer survive among competitors like ASOS and Shein?

Boohoo has contributed almost £2bn ($2.4bn) to the UK economy in Gross Value Added (GVA) since 2009. According to the company’s website, in 2020 to 2021 it spent over £300m in British businesses, which, in turn, supported nearly 5,000 jobs.

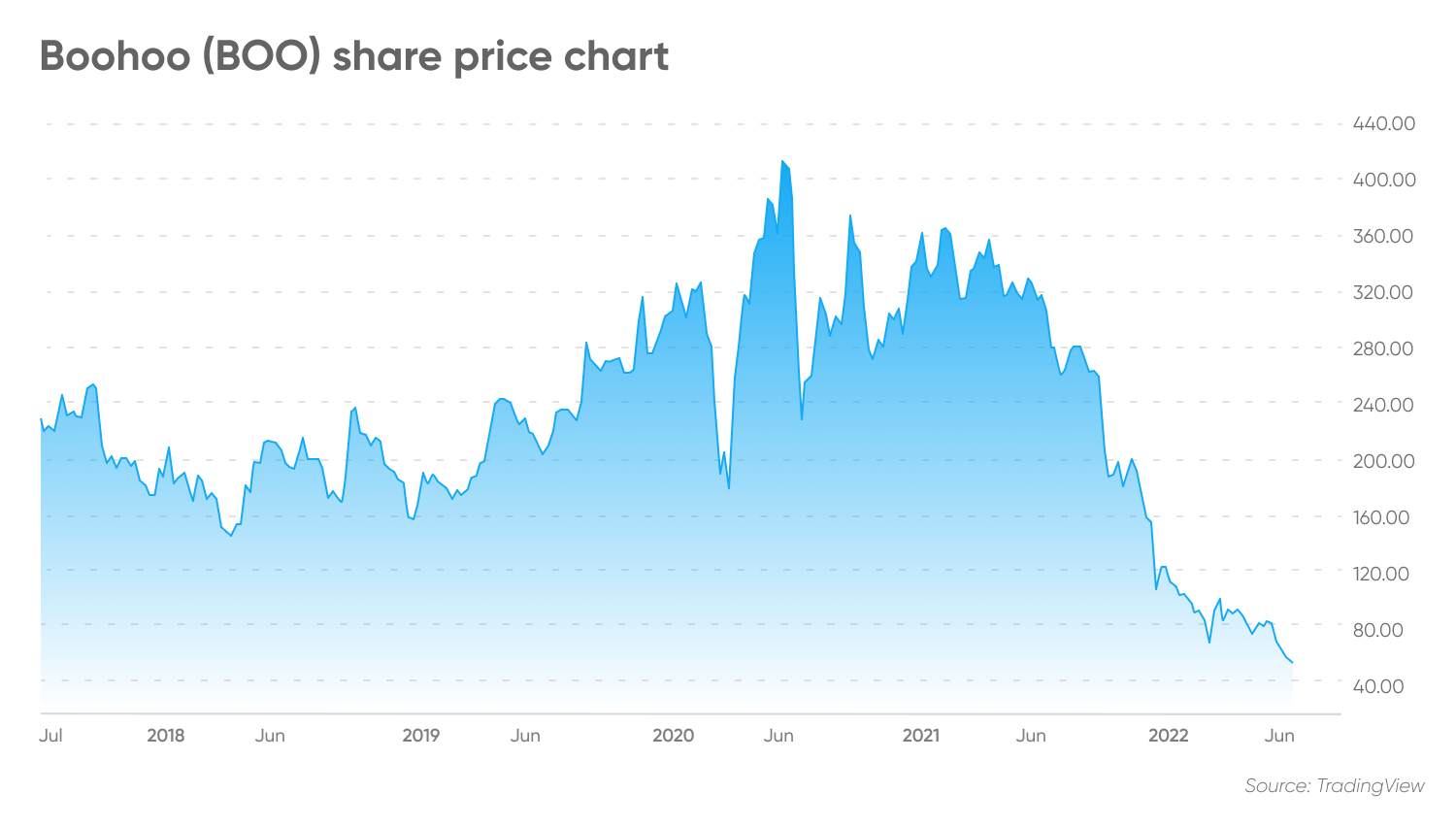

In 2020, Covid-19 induced global lockdowns saw many consumers switch to online shopping, leading to a boom for e-commerce retailers. On 19 June 2020, the BOO share price reached an all-time high of 413p. However, since then the price has corrected over 85% and last closed at 56.78p on 28 June 2022.

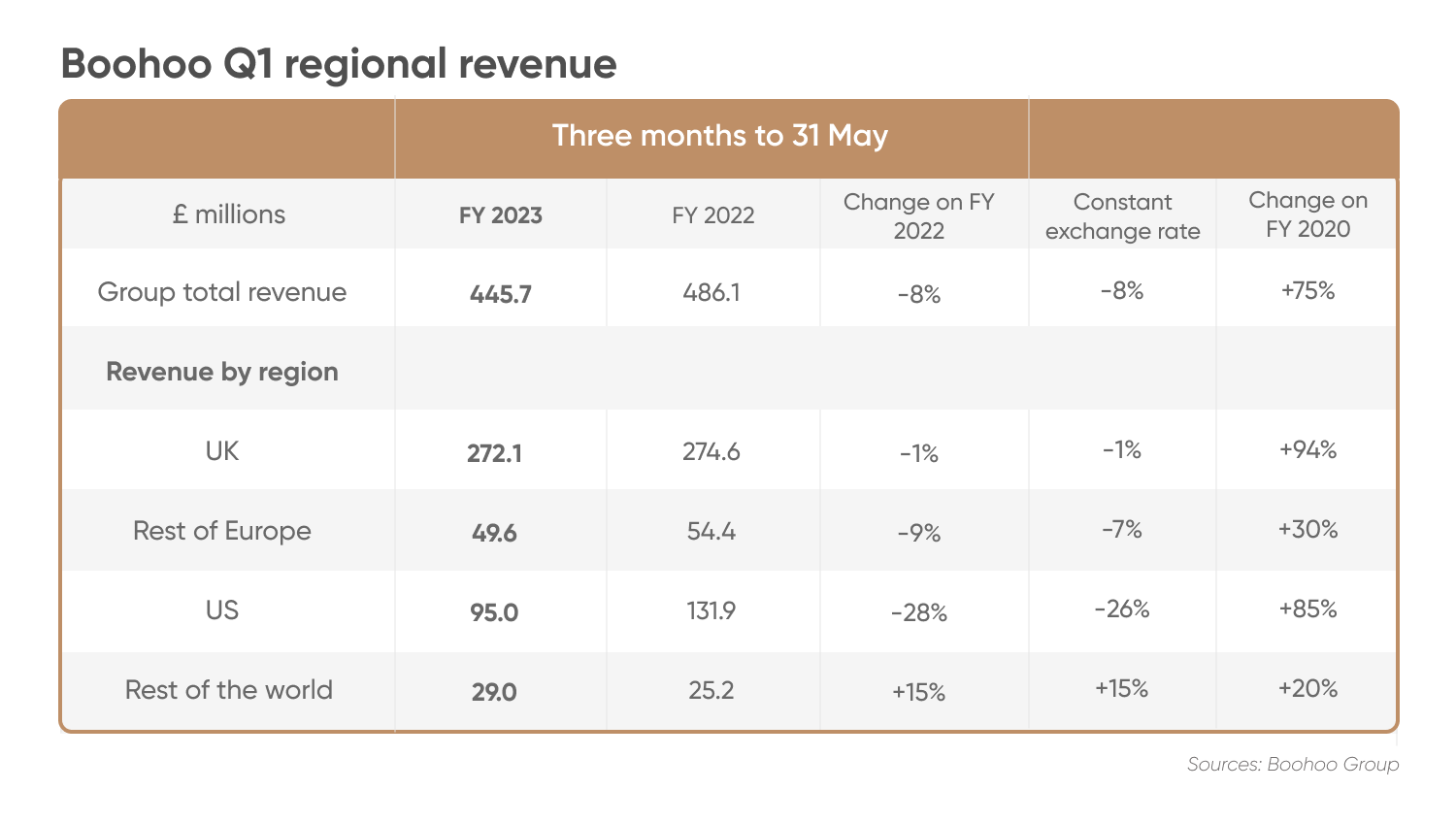

On 16 June, Boohoo released its Q1 trading statement for the three months ending 31 May 2022. Reporting a £445.7m in total revenues, the top-line reflected an 8% year-over-year (YOY) decrease.

Against the backdrop of a tough macroeconomic environment, what does the future of this fashion company look like? Join us as we dig into the company’s latest financial results, gather analyst insights on Boohoo share price predictions and outline a plausible Boohoo share price forecast.

Boohoo Q1 revenues

For the quarter ending 31 May, the top-line was reported at £445.7m, compared to £486.1m for the same period in last year. This reflected a fall of 8.31%. The company cited global supply chain issues and customer product returns amid rising inflation as reasons for the decline. However, while its performance has been adversely affected it continues to be in line with previous guidance.

The three-year pre-pandemic period suggests a 75% increase in revenues. This is primarily driven by the multi-year market share gains across Boohoo’s platform.

A closer look at the company’s revenues by region shows that the biggest losses were experienced in its US business. US revenues fell from £131.9m in Q1 FY 2022 to £95m in Q1 FY 2023, making for a 28% pullback.

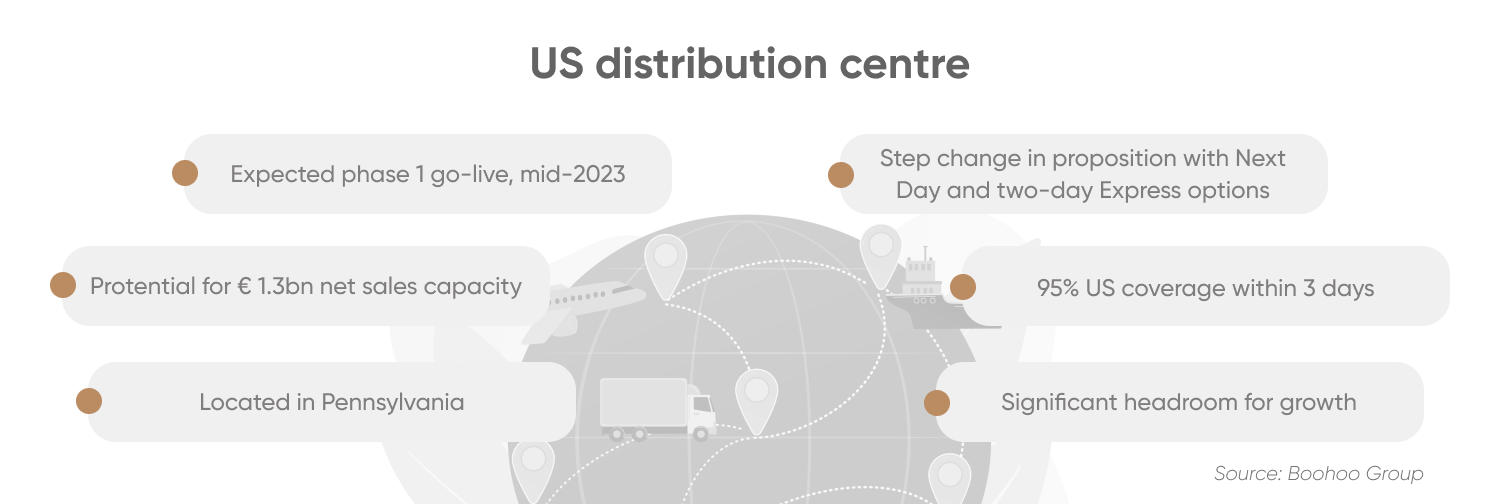

Owing to logistics challenges, deliveries have been severely affected, taking significantly longer than in pre-pandemic times. However, with Boohoo’s first distribution facility in Pennsylvania going live mid-2023, the company aims to launch a one-day delivery proposition in key areas of the US market.

Despite a 1% fall in UK revenue, Boohoo reported month-on-month increases. As a result of efficient product pricing, underlying gross demand continued to be upwards of 21%.

A 15% quarterly revenue increase was seen in the company’s rest of the world segment. Wholesale partnerships that Boohoo has developed over the years have boosted increased sales in this area.

Boohoo makes progress toward its strategic priorities

In its final results for the year ended 28 February 2022, Boohoo set a series of strategic priorities to bounce back in the post-pandemic market. During its earnings call for the Q1 trading update, CEO John Lyttle said the company was continuing to make progress toward optimising its operations and having a meaningful impact on the group.

Reporting a 10% YOY increase in the short-lead time product mix, Boohoo continues to increase sourcing from the near-shore markets to reduce its exposure to elevated inbound freight costs.

With conscious efforts made to tightly control inventory, lower stock levels have been observed. Boohoo’s automation project at its Sheffield distribution centre is set to go live in the second half of the financial year.

Boohoo guidance for FY 2023

In its guidance for the year ending 28 February 2023, Boohoo made no changes to its previous outlook. With improved growth rates anticipated in alignment with normalising consumer demand, the company expected its overall revenue growth to be in low-single digits.

By accounting for high-inflationary conditions, international competition and supply chain issues; Boohoo expects the adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) margins for the year to lie within the range of 4% to 7%.

Commenting further on the company’s future prospects, Lyttle said:

Boohoo partners with CottonConnect

Boohoo recently announced its partnership with CottonConnect in Pakistan, working with Responsible Environment Enhanced Livelihoods (REEL) cotton to leave a lighter carbon footprint.

The company plans to launch a sustainable range powered by 2,500 trained farmers through CottonConnect’s value chain management. With better education to farmers regarding the benefits of sustainable production methods, they expected higher yields and enhanced net income which would further elevate their quality of lives.

Director of Responsible Sourcing & Product Operations, Andrew Reaney said:

Boohoo share price forecasts and analyst insights

Factoring in the competition by other fast fashion groups, Third Bridge senior analyst Harry Barnick said:

Milan Vaishnav, CMT, MSTA, a consulting technical analyst at Gemstone Equity Research & Advisory Services, shared his technical opinion on BOO share price forecast:

As of 29 June, algorithm-based forecasting service Wallet Investor was bearish on the stock. In its Boohoo share price forecast for 2022, the service anticipated the BOO share price to close at 0.000000066 by December. Beyond that, it expects the price to be 0.000001, restricting the ability to provide a credible Boohoo share price forecast 2025.

In a Boohoo share price prediction by Tip Ranks, four out of 13 analysts rated the BOO stock a ‘buy’, seven suggested to ‘hold’ and two recommended a ‘sell’ Their consensus 12-month price target was 89.92p, with a possible low of 45p to a high of 140p. The current analyst price target consensus had an upside of 58.37% from the last price of 56.78p as of 29 June.

When looking at analysts’ BOO share price forecast keep in mind that these predictions could be wrong. Your decision to invest or not should be based on your attitude to risk, your expertise in this market, the spread of your portfolio and how comfortable you feel about losing money. There are no guarantees. Markets are volatile. You should conduct your own analysis, taking in such things as the environment in which it trades and your risk tolerance. And never invest money that you cannot afford to lose.

FAQs

Is Boohoo a good stock to buy?

In its Q1 trading update for FY 2023, Boohoo reported an 8% year-over-year (YOY) fall in its revenues. However, with continued investments in improving its supply chain logistics and controlling overheads, the company anticipated growth improvements by H2 FY 2023.

Whether these factors make BOO a good investment for you or not will depend on your portfolio composition, investment goals and risk profile, among other factors. Different trading strategies will suit different investment goals with short or long-term focus. You should do your own research. And never invest money you cannot afford to lose.

Will the Boohoo share price go up?

As of 29 June, algorithm forecasting service Wallet Investor was bearish in its Boohoo share price forecast, anticipating it could close at 0.000000066 by December 2022. Tip Ranks had a 12-month price target of 89.92p for the stock.

Note that analysts’ forecasts can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.

Should I invest in Boohoo stock?

Whether Boohoo stock is a suitable investment depends on your own investment objectives. You should conduct your own research and then make a decision regarding Boohoo stock buy, sell or hold. It’s important to reach your own conclusion on a company’s prospects and the likelihood of achieving analysts’ targets. And never invest money you cannot afford to lose.