How to manage risk when trading

Risk management is a central concept that governs your attitude to the assets you trade and how you go about it. Learn the types of risk to consider, along with common risk management techniques, effective risk management tools, and more.

What is risk management?

Risk management in trading refers to the methods used to protect capital and minimise losses, and is undertaken both before and during management of positions. Risk management strategies in CFD trading take many forms, from market risk and credit risk to liquidity risk, and all of them pose potential threats to your capital and market activities.

Whether using a stop-loss, considering your position size in line with volatility conditions, or weighing up how much risk you’re willing to take on in general, having a keen understanding of the various factors that make up a comprehensive risk management plan is a must for serious traders.

What are risks in trading?

It’s not only the risk of losing capital when a trade goes against you that should concern you. From liquidity risk to operational risk, here’s a comprehensive list of the risk types out there with margin trading, how they are defined, and how to understand them.

Market risk: market risk, also known as systematic risk, refers to the risk of losses resulting from adverse movements in asset prices. Fundamental factors such as changes in interest rates, economic indicators, geopolitical events, and overall market sentiment are examples of the type of events that can influence price moves. Market risk affects all securities and cannot be diversified away.

Liquidity risk: this is the risk of being unable to buy or sell an asset quickly at its current market price due to insufficient trading volume. While illiquid assets – such as certain agricultural products, lesser-known metals, or exotic currency pairs – often have wider bid-ask spreads and higher transaction costs, even liquid markets can experience price slippage during periods of high volatility. Slippage occurs when trades are executed at a different price than expected due to market fluctuations. To mitigate this, you may consider using guaranteed stops to ensure your position closes at your chosen price. However, activating a guaranteed stop incurs a fee for this protection.

Credit risk: credit risk, also known as counterparty risk, arises when the other party involved in a trade fails to fulfil their contractual obligations. It’s possible that counterparties may default on their obligations, leading to financial losses for the trader, making it crucial to minimise this risk by choosing a broker wisely.

Operational risk: operational risk comes from internal processes, systems, or human error within trading operations. This includes errors in order execution, technological failures, cybersecurity breaches, and compliance issues. Operational risk can disrupt trading activities and result in financial losses. Again, ensuring your broker has a reputation for reliable execution and solid operational processes will be useful.

Model risk: model risk arises when trading decisions are based on flawed or inaccurate models, algorithms, or quantitative strategies. Traders rely on various models for risk assessment, forecasting, and trading strategies, and errors in these models can lead to unexpected losses.

Regulatory risk: regulatory risk refers to the risk of adverse changes in regulations or compliance requirements that affect trading activities. Regulatory changes may impact market structure, trading rules, margin requirements, and reporting obligations, influencing trading strategies and the availability of derivative products.

Event risk: event risk encompasses unexpected events or developments that can significantly impact financial markets, such as natural disasters, terrorist attacks, political upheavals, or corporate scandals. These events can cause market volatility and disrupt trading strategies.

Country risk: also known as sovereign risk, this risk type is associated with trading assets denominated in foreign currencies or issued by foreign governments. Factors such as political instability, economic downturns, and currency fluctuations can affect the value of these assets.

Concentration risk: concentration risk arises from having a large portion of trading capital invested in a single asset, sector, or market. Lack of diversification increases vulnerability to adverse price movements in specific assets or market segments. Hence, it’s always advisable to spread your trading across diverse instruments with different risk profiles, in order to minimise the impact of extreme price fluctuations across single assets.

Psychological risk: psychological risk refers to the emotional and cognitive biases that can influence trading decisions. Fear, greed, overconfidence, and herd behaviour can lead traders to deviate from their rational trading strategies, resulting in poor decision-making and increased risk exposure. It’s always worth it to factor psychological risk into your trading plan, and to consider ways to ensure you’re trading in the right frame of mind when it matters most.

Why is risk management important in trading?

Risk management is important in trading because applying it effectively can help preserve funds and prolong your trading career. Trading is risky and markets can be volatile, meaning conditions can vary wildly across assets and market conditions. Managing risk well means maintaining consistency in your trading performance, helping you in your trading strategy and giving you the best chance to achieve your financial goals.

How can I manage my risk when trading?

You can manage your risk when trading in various ways depending on the risk presented. Perhaps the most common way will be to apply carefully-thought-out stop-losses to mitigate market risk, but other risk management strategies include hedging, backtesting and maintaining a consistent emotional state to minimise impulsive decision-making. You can practise your trading risk-free with us by opening a demo account.

Here are some ideas for risk management across the range of risk types.

| Type of risk | Potential risk management solution |

|---|---|

| Market risk | Apply a stop-loss to limit the downside of a trade. |

| Liquidity risk | Diversify your portfolio across risk-on and risk-off assets. |

| Credit risk, operational risk | Trade with reputable brokers with strong credentials across compliance and trading operations. |

| Model risk | Validate and backtest trading models rigorously before deployment, and regularly reassess and adjust them to account for changing market conditions. |

| Regulatory risk | Stay informed about regulatory changes in the jurisdictions where you operate and ensure compliance with all relevant regulations. |

| Event risk | Use hedging strategies to protect against unexpected events that could impact markets. |

| Country risk | Diversify your investments across different countries to reduce exposure to any single country's economic or political risks. |

| Concentration risk | Avoid overexposure to any single asset or sector by diversifying your portfolio. |

| Psychological risk | Practise disciplined trading strategies, maintain emotional control, and consider using techniques like meditation or journalling to manage stress and emotions during trading. Additionally, setting predefined trading rules and sticking to them can help mitigate impulsive decision-making. |

What are risk management strategies?

Risk management strategies refer to plans to manage all types of risk. Your strategy will need to identify any applicable risk to your trading activity, such as those outlined in the section above, and then evaluate their likelihood in various scenarios by drawing up a comprehensive assessment.

With that written down, you’ll be in a position to better avoid and reduce risks when they present themselves. It’s important to monitor your risk management strategy and adjust as needed based on market conditions, your own risk tolerance, and other factors.

Find out more on trading strategies with our technical analysis guides as well as our general trading strategy guides, incorporating timeframe analysis, fundamental analysis, trading vs investing, and more.

Implementing effective risk management techniques, such as hedging strategies, is crucial for traders aiming to mitigate potential losses.

What are risk management tools?

Risk management tools can be defined as technical instruments like stop-loss orders crucial in derivatives trading to protect against significant losses. Here are some common risk management tools used in CFD trading:

Standard stop-loss orders

Stop-losses automatically close a trade when the market moves against you by a specified amount, helping to limit potential losses. However, in fast-moving or volatile markets, the execution price may differ from your specified stop level due to slippage. Stop-losses can be fixed in place or trailing (see below).

Take-profit orders

These close a trade when the market moves in your favour by a specified amount, securing profits before the market can reverse.

Guaranteed stop-loss orders (GSLOs)

This is a more secure version of the stop-loss order, guaranteeing to close the trade at the specified price, regardless of market volatility or gaps. GSLOs are subject to a fee if activated. For more information, please see the fees and charges page.

Trailing stops

Trailing stops adjust the stop-loss level as the market price moves in your favour (IE, up for a long trade, and down for a short trade), locking in profits while still protecting against adverse price movements.

Leverage and margin control

Managing the amount of leverage used in trading can help ensure it stays within a comfortable risk level, reducing the likelihood of margin calls and forced position closures.

With us, you can adjust your leverage settings for different asset classes by clicking the ‘Live’ button in the top right of the platform screen. Then, select ‘My accounts’ and you’ll find the leverage toggle under the ‘Trading options’ icon for each live account you hold.

However, any changes to leverage will only apply to new positions – existing open positions will remain unaffected.

Hedging

Hedging refers to opening new positions to offset potential losses from existing positions. This can help manage risk exposure in volatile markets.

Position sizing

This refers to determining the appropriate amount of capital to allocate to each trade to ensure that no single trade can significantly impact the overall portfolio.

Diversification

Diversification entails spreading investments across various assets or markets to reduce exposure to any single asset or market risk.

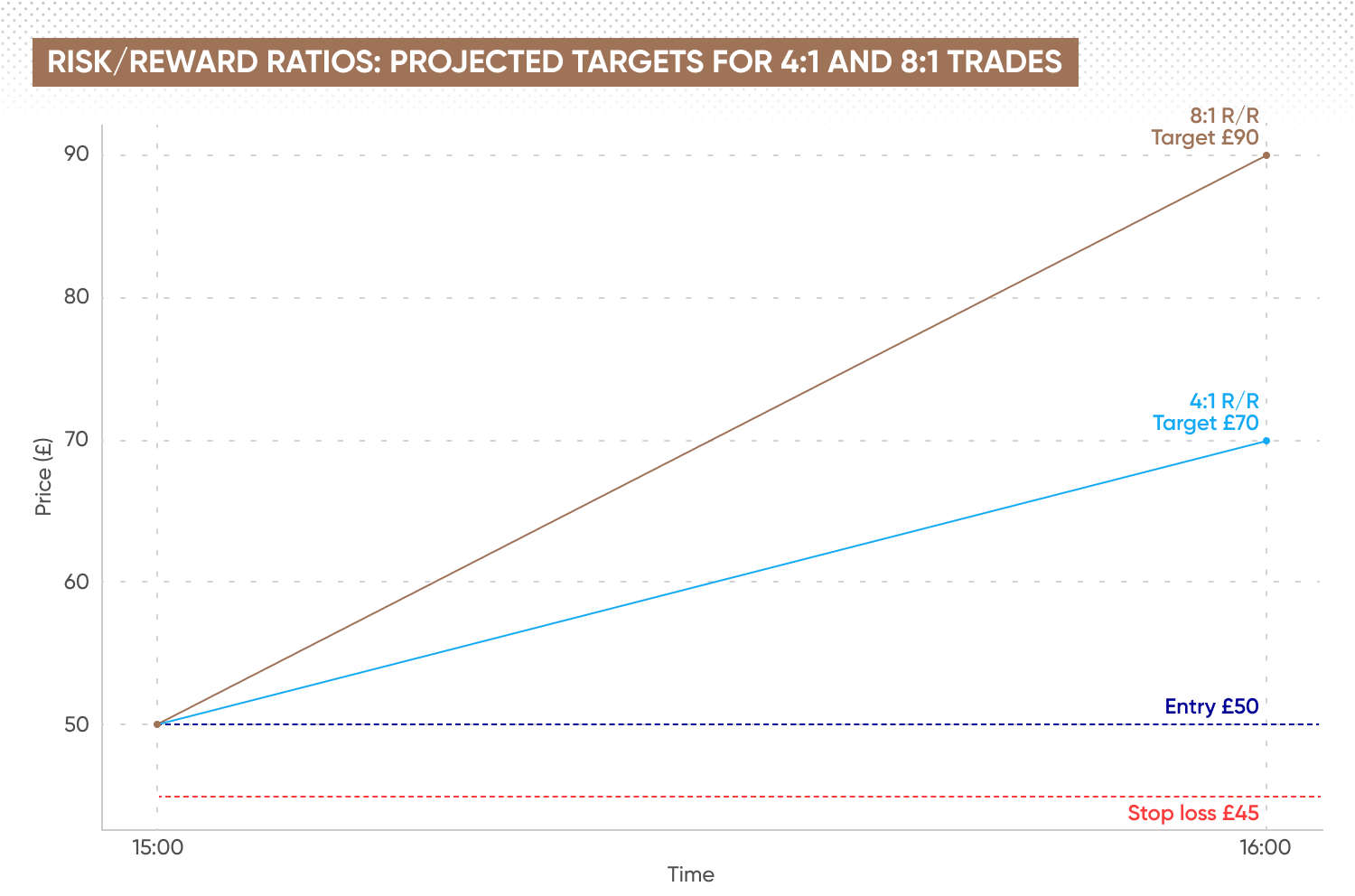

Risk-reward ratio analysis

Assessing the potential risk versus the expected reward for each trade to ensure it meets predetermined risk management criteria. For more information, take a look at our risk-reward ratio page.

Regular monitoring and analysis

Continuously monitoring market conditions and reviewing trading strategies and positions to adjust risk management techniques as necessary.

Market alerts and notifications

Setting up alerts to notify traders of significant market movements or conditions that could affect their positions, allowing them to take timely action.

Trading plan and discipline

Having a comprehensive trading plan that includes risk management strategies and adhering to it strictly to avoid emotional decision-making.

Using these tools effectively helps CFD traders manage their risk exposure and improve their chances of long-term success in the markets.

FAQs

What is risk management in trading?

Risk management in trading refers to the process of identifying and minimising the risks that present themselves while holding a leveraged derivative position – which is an inherently risky endeavour. In short, it aims to protect capital and minimise losses. Risks range from market risk (price fluctuations) through to systemic risk (market-wide events), and assessing the impact of those risk on holding specific positions. From there, setting risk tolerance, applying practices such as stop-losses and careful sizing, and diversification are all key components to the risk management process.

How do I calculate risk in trading?

In trading, risk is calculated by establishing your position size as well as the potential entry and exit points for a risk per trade and risk/reward ratio. The ratio you go for is dependent on the level of your stop-loss, so considering how far you are willing to ride losing trades before closing them is also an important part of calculating risk. Risk profiles can change, so it’s important to be flexible in calculating risk as variables such as position size and stop placement move depending on asset, market conditions and general risk tolerance.

What are risk management tools?

Risk management tools are used to identify and mitigate risk in trading. The most common examples include stop-loss orders, but other tools that help manage risk include volatility indicators, risk assessment models, and position-sizing calculators, all of which can help understand risk profiles in diverse ways. Using a range of these tools can broaden your knowledge of risk and potentially inform your risk management strategy.

What is the 1% rule in risk management?

The 1% rule in risk management refers to only risking a maximum of 1% of your trading capital on any single trade. By understanding what this figure is and sticking to it, you may be in a better position to manage your risk and protect your capital. However, some traders are comfortable with risking more than this, while others may be even more conservative. It’s important to take into account market conditions, volatility of the asset, liquidity and other factors to come to a figure that’s right for you.